Ira Energy Rebates 2024 On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit The IRA s up front electrification rebates and electrification tax credits can all be used by renters Many of these upgrades including window unit heat pumps which should qualify by 2024 2025 electric stoves cooktops and heat pump clothes dryers are portable so renters can bring them to their next homes and won t have to leave

Ira Energy Rebates 2024

Ira Energy Rebates 2024

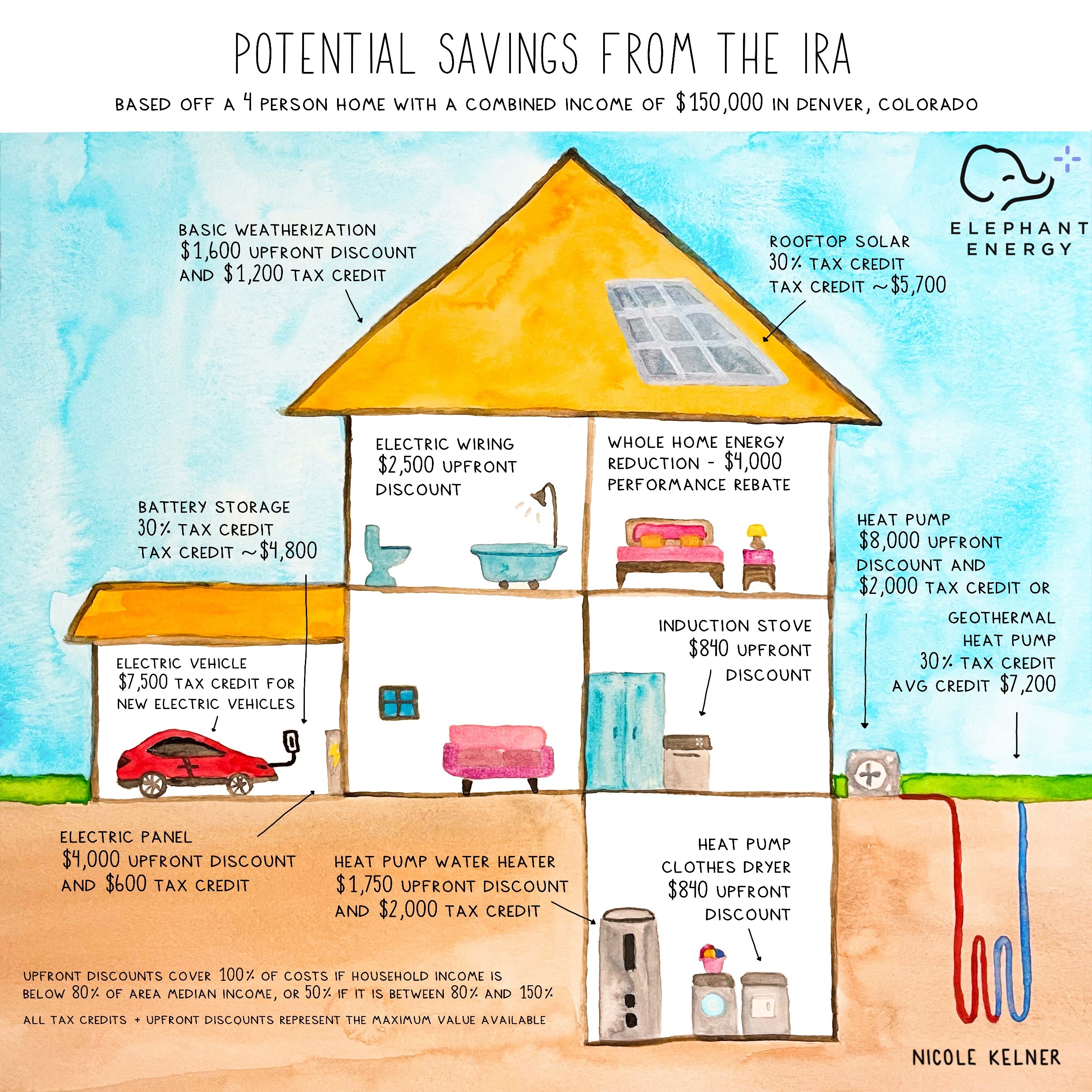

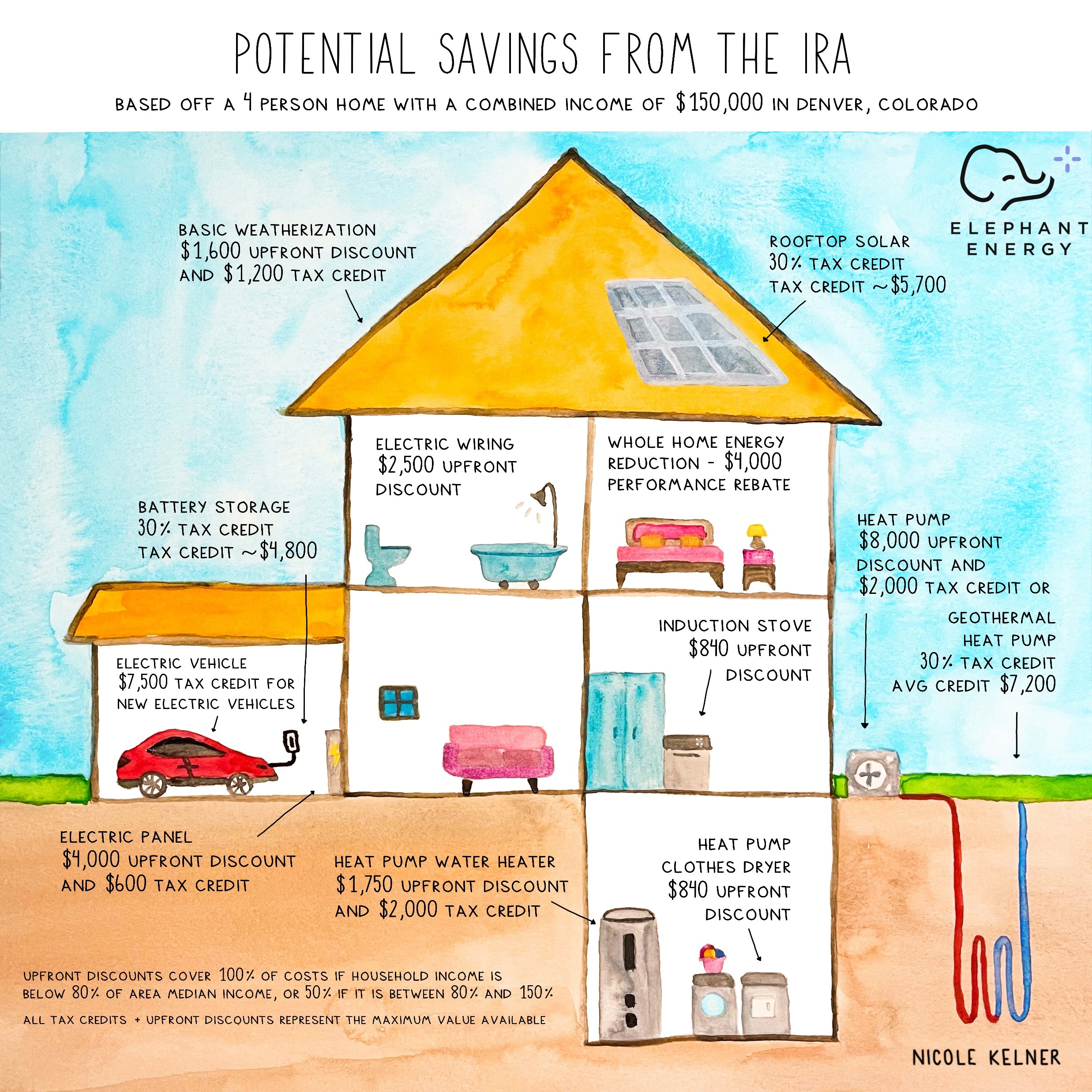

https://elephantenergy.com/wp-content/uploads/2022/09/IRA-Summary-Image-by-Nicole-Kelner-Made-Exclusively-for-Elephant-Energy.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Home Energy Rebates And The IRA Recommendations For Equity And Environmental Justice Just

https://justsolutionscollective.org/wp-content/uploads/2023/04/Home-Energy-Rebates-and-the-IRA-Recommendations-for-Equity-and-Environmental-Justice-1536x980.jpeg

What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 The goals of HOMES and HEEHRA which comprise the IRA s Home Energy Rebate Programs are to help households save money on energy bills improve energy efficiency reduce greenhouse gas GHG emissions and improve indoor air quality

Energy gov scep Background The 8 8 billion Home Energy Rebates HER program provides an unprecedented opportunity for states territories and Tribes to make American homes more comfortable while reducing energy costs and greenhouse gas emissions Given the complexity and expertise required to plan design and execute these programs Greg Siedschlag the Department of Energy s chief communications strategist for the home energy rebates said the hope is to have the first rebate programs go live in the spring of 2024 with the majority of states and territories issuing rebates by the end of 2024

Download Ira Energy Rebates 2024

More picture related to Ira Energy Rebates 2024

About

https://iraenergy.com/images/team/01.jpg

Knowledge

https://iraenergy.com/images/LOGO/ira-logo-4.png

How Much Different Households May Save With Inflation Reduction Act Rebates CLEAResult

https://www.clearesult.com/sites/default/files/inline-images/0822-DEVELOP-CORPCOMM-3175098-IRA Household Blog - Home Energy Rebates-NEW.jpg

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit The Office of State and Community Energy Programs SCEP is working to distribute these funds so that households across the country can soon access these benefits The Inflation Reduction Act of 2022 includes two provisions authorizing 8 8 billion in rebates for Home Efficiency Rebates and Home Electrification and Appliance Rebates

Washington expects to receive IRA funding for home energy improvement rebates in early 2024 and will begin to make these available no earlier than mid 2024 The Washington State Legislature also appropriated additional funding to support investments in high efficiency electric appliances for households and small businesses That the process is already in place to obtain a rebate Unfortunately that is not the case Under the best of circumstances Kansas will not see the rebate funding and make it available to citizens until mid to late 2025 Here s how it works The IRA Home Energy Rebate program is divided into two categories The Home Efficiency Rebate

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500 Electrek

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

Public Roundtable The Inflation Reduction Act IRA Residential Energy Rebates And Contractor

https://atlasbuildingshub.com/wp-content/uploads/2022/06/US-DOE.png

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Energy Communities Guidance For IRA Bonus Tax Credits

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500 Electrek

IRA Energy And Climate Tax Credits Crowe LLP

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

About

NJ Clean Energy Rebates Incentives In 2024

NJ Clean Energy Rebates Incentives In 2024

When Can You Get An IRA Rebate For A New Heat Pump Or Induction Stove

IRA Rebates And Tax Credits For New Jersey Homeowners

2023 Residential Clean Energy Credit Guide ReVision Energy

Ira Energy Rebates 2024 - What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5