Federal Rebate Checks 2023 Web 1 ao 251 t 2023 nbsp 0183 32 The department will begin taking applications for the 2022 tax rebate on August 15 2023 and claims must be filed by October 1 2023 Separate claims need to

Web 5 juil 2023 nbsp 0183 32 July 5 2023 Ottawa Ontario Department of Finance Canada Today the Deputy Prime Minister and Minister of Finance the Honourable Chrystia Freeland Web 1 mai 2023 nbsp 0183 32 The state s revenue department will send checks out automatically either via mail or through direct deposit Residents can expect the payments beginning in July and

Federal Rebate Checks 2023

Federal Rebate Checks 2023

https://www.californiarebates.net/wp-content/uploads/2023/04/state-of-new-mexico-rebate-checks-2023-printable-rebate-form.jpg

Blue Cross Blue Shield Rebate Checks 2023 Nc RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/blue-cross-blue-shield-customers-overpaid-refunds-due-reform-austin.jpg?resize=1536%2C803&ssl=1

Renters Rebate Checks In The Mail Yet 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/renters-rebate-checks-in-the-mail-stratford-crier.png

Web 22 nov 2022 nbsp 0183 32 CAI payments for 2023 24 will be disbursed as follows Residents of Alberta Manitoba Ontario and Saskatchewan will receive four equal quarterly payments April Web 12 f 233 vr 2023 nbsp 0183 32 Star Rebate Checks 2023 Schedule February 12 2023 by tamble Star Rebate Checks 2023 Schedule Rebate check can be a good option to cut down on

Web 1 juil 2023 nbsp 0183 32 Taxpayers who apply for the rebate could receive up to 500 but will need to complete an application online or via mail between August 15 and October 1 Web 17 avr 2023 nbsp 0183 32 COLORADO Colorado Governor Jared Polis signed a law in May 2022 giving Coloradans a tax rebate of 750 for individual filers and 1 500 for joint filers The

Download Federal Rebate Checks 2023

More picture related to Federal Rebate Checks 2023

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Federal-Tax-Rebate-2023.jpg?ssl=1

Americans Will Receive New One time Rebate 4th Stimulus Check Update

https://i.ytimg.com/vi/KjIsHVsvSoo/maxresdefault.jpg

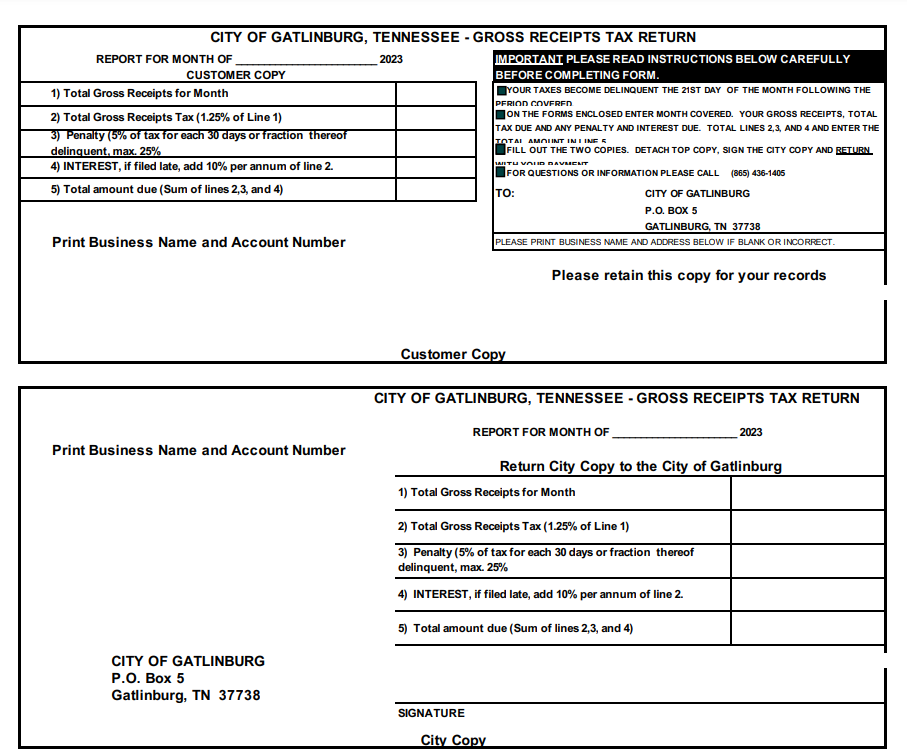

Tennessee Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Tennessee-Tax-Rebate-2023.png

Web 5 sept 2023 nbsp 0183 32 NEW For the 2023 tax year the IRS has announced that most state rebate payments won t be taxable on your federal return However there could be some Web 23 ao 251 t 2023 nbsp 0183 32 Federal stimulus payments that were sent to U S households in the wake of the COVID 19 pandemic have ended but some states still offer financial relief in the form

Web il y a 9 minutes nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have Web 23 ao 251 t 2023 nbsp 0183 32 Taxpayers can claim the 2022 property tax rebate online through the agency s TransAction Portal or by paper form beginning Aug 15 2023 The claim must

IRS Deadline Nears For 1 5 Billion In Tax Refunds

https://d.newsweek.com/en/full/2253652/irs-tax-refund.jpg?w=790&f=86bc1b5e52335635f107dca81b97ac38

North Carolina Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/North-Carolina-Renters-Rebate-2023-768x690.jpg

https://www.newsweek.com/stimulus-check-august-2023-update-people...

Web 1 ao 251 t 2023 nbsp 0183 32 The department will begin taking applications for the 2022 tax rebate on August 15 2023 and claims must be filed by October 1 2023 Separate claims need to

https://www.canada.ca/en/department-finance/news/2023/07/government...

Web 5 juil 2023 nbsp 0183 32 July 5 2023 Ottawa Ontario Department of Finance Canada Today the Deputy Prime Minister and Minister of Finance the Honourable Chrystia Freeland

Nys Property Tax Rebate Checks 2023 Eligibility Application Process

IRS Deadline Nears For 1 5 Billion In Tax Refunds

2023 Federal EV Charging Infrastructure Rebates Part 1 Incentive

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

2023 Elanco Interceptor Rebate Save On Flea Tick Treatment For Your

Star Rebate Checks 2023 Schedule RebateCheck

Star Rebate Checks 2023 Schedule RebateCheck

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/U25JEJJPRNBFRK4TGMNYA4T3TE.jpg)

Stimulus Checks 2023 In California What Are The Payment Dates And

Ny Property Tax Rebate Checks 2023 RebateCheck

Simple US 2022 Federal Income Tax 2023 Tax Rebate Check Calculator 2022

Federal Rebate Checks 2023 - Web Il y a 12 heures nbsp 0183 32 Minnesota approved the one time rebate check this spring as part of a 3 billion tax package Individuals with an AGI adjusted gross income of up to 75 000 in