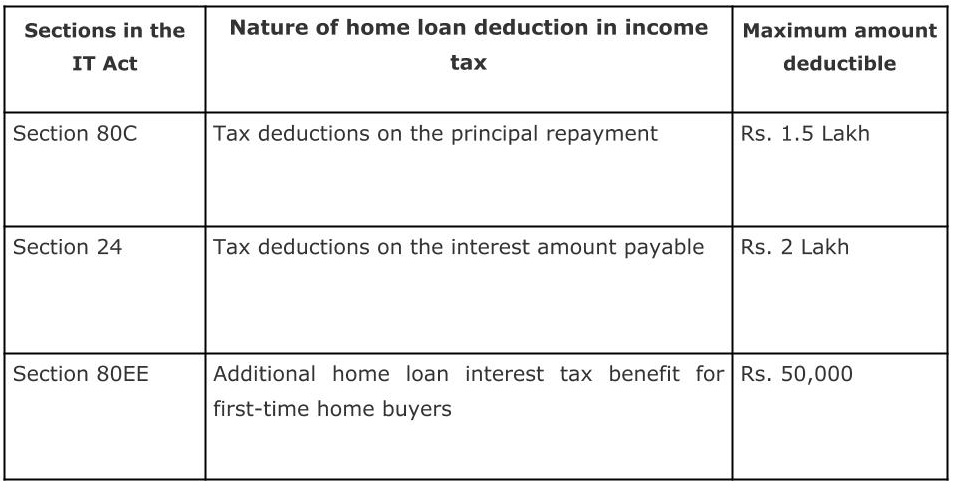

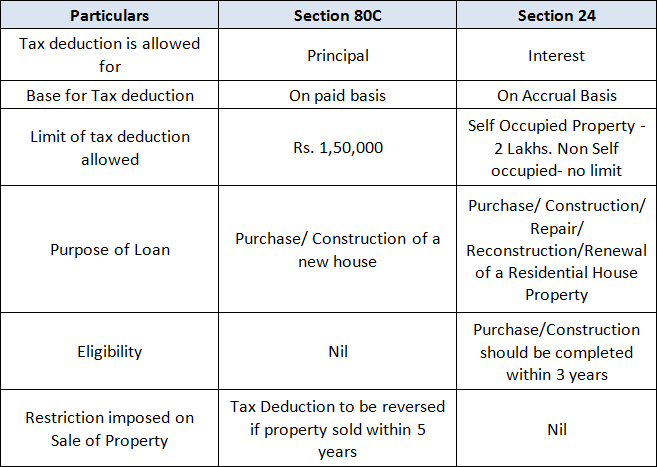

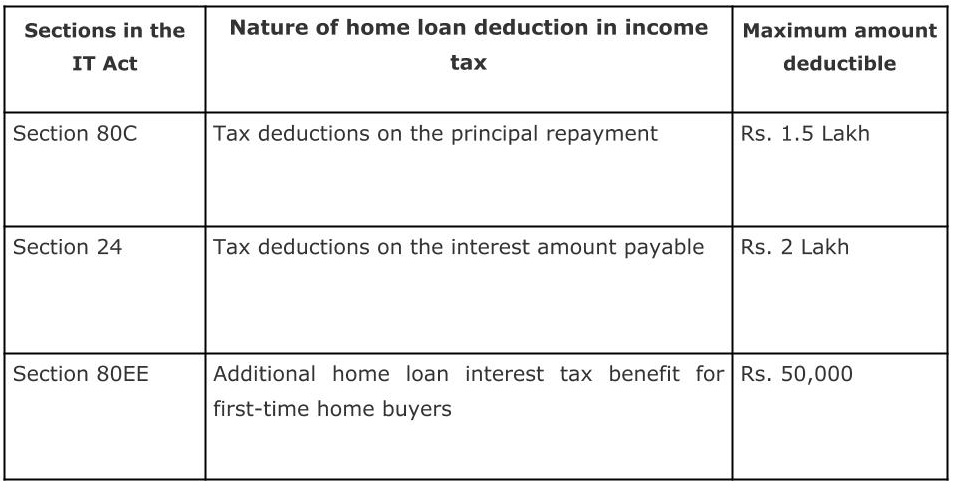

Tax Rebate On Interest Paid On Home Loan Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 4 janv 2023 nbsp 0183 32 A mortgage calculator can help you determine how much interest you paid each month last year You can claim a tax deduction for the interest on the first Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Tax Rebate On Interest Paid On Home Loan

Tax Rebate On Interest Paid On Home Loan

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

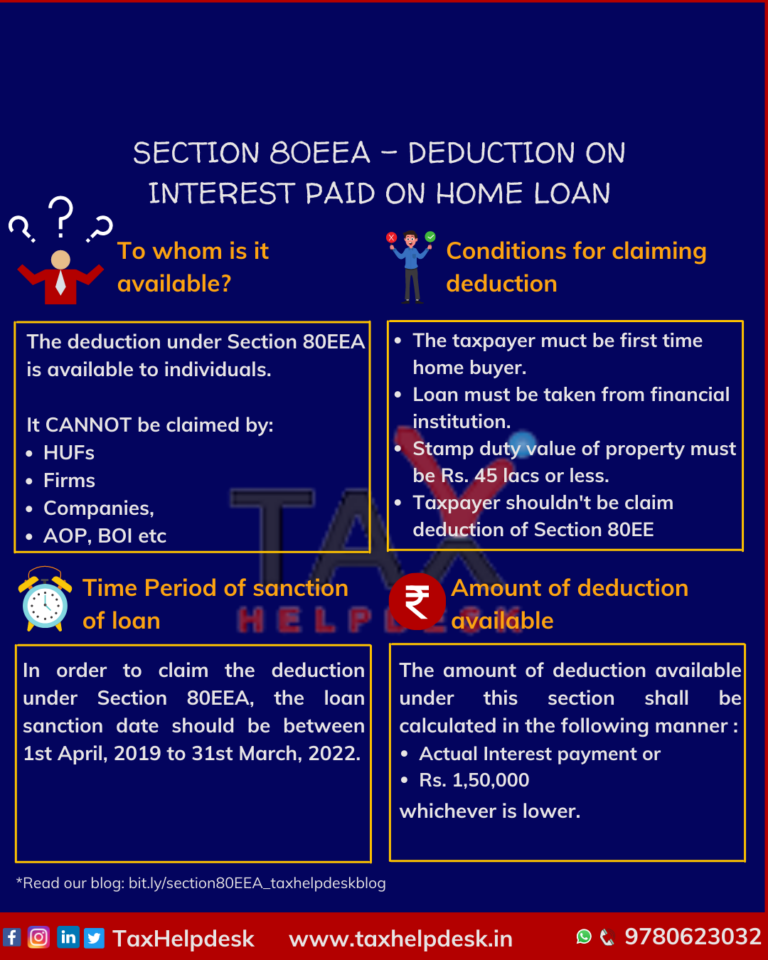

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Section-80EEA-Deduction-on-interest-paid-on-home-loan-768x960.png

Web 13 janv 2023 nbsp 0183 32 As noted in general you can deduct the mortgage interest you paid during the tax year on the first 750 000 375 000 if married filing separately of your mortgage debt for your primary Web 21 f 233 vr 2023 nbsp 0183 32 Therefore taxpayers can claim a total deduction of Rs 3 5 lakh for interest on a home loan if they meet the conditions of section 80EEA As we have seen here this can bring significant tax savings

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

Download Tax Rebate On Interest Paid On Home Loan

More picture related to Tax Rebate On Interest Paid On Home Loan

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

https://images.moneycontrol.com/static-mcnews/2022/08/home-loan-700X700.jpg

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Web 1 f 233 vr 2021 nbsp 0183 32 So if you have a big home loan and are repaying more than Rs 1 5 lakh of home loan principal then your home loan principal repayment tax benefit will be still Web Tax Benefits under Section 80EE Allows you to avail tax benefits of up to Rs 1 5 lakh on the interest component paid on a home loan The benefit can be availed over and

Top 10 Tax Saving Tips For FY 2021 Rurash Blog

https://rurash-blog.s3.ap-south-1.amazonaws.com/rurash/wp-content/uploads/2021/01/14125405/o.jpg

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.thebalancemoney.com/home-mortgage-interest-tax-deductio…

Web 4 janv 2023 nbsp 0183 32 A mortgage calculator can help you determine how much interest you paid each month last year You can claim a tax deduction for the interest on the first

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Top 10 Tax Saving Tips For FY 2021 Rurash Blog

54 FORM FOR HOME MORTGAGE INTEREST DEDUCTION DEDUCTION HOME MORTGAGE

What Is The Apr On A Home Loan

Form 12BB New Form To Claim Income Tax Benefits Rebate

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Home Loan Interest Exemption In Income Tax Home Sweet Home

Review Of Fido Loans Apk Ideas Rivergambiaexpedition

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Tax Rebate On Interest Paid On Home Loan - Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to