Can I Claim Tax Back On Company Car Fuel Technical guidance Overview As an employer providing company cars and fuel to your employees you have certain National Insurance and reporting obligations You ll usually need to report

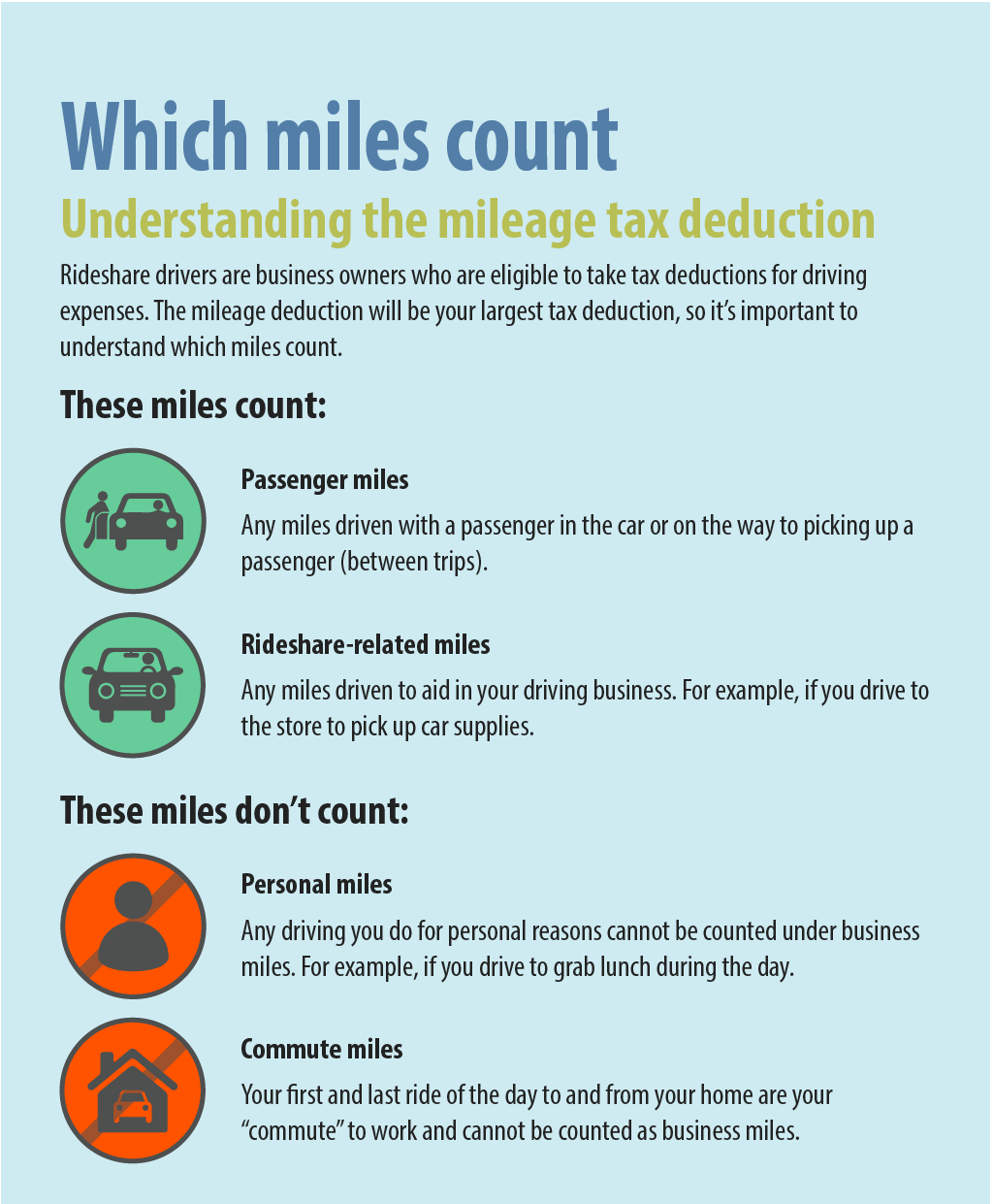

The fuel benefit charge is normally the only tax charge for the provision of fuel for private use by an employee or members of their family or household in a company vehicle As an employee you can only claim mileage allowance tax relief if you use your own vehicle for company business If you have a car provided by your company you are able to claim back mileage for your business travel to cover the cost of fuel where you pay for the fuel

Can I Claim Tax Back On Company Car Fuel

Can I Claim Tax Back On Company Car Fuel

https://cdn.images.express.co.uk/img/dynamic/24/590x/secondary/Road-tax-refund-DVLA-sold-car-2416290.jpg?r=1586945753674

Road Tax Refund How Do I Claim Road Tax Back When I Sell My Car

https://cdn.images.express.co.uk/img/dynamic/24/750x445/1269177.jpg

How Do I Claim TAX Back Write On Sticky Notes Isolated On Wooden Table

https://thumbs.dreamstime.com/z/how-do-i-claim-tax-back-write-sticky-notes-isolated-wooden-table-business-concept-205362752.jpg

If you earn less than the personal tax allowance and therefore do not pay tax you will not qualify for tax relief Additionally If you use a company car and your employer does not reimburse you with the full Advisory Fuel Rates AFR you can claim MAR on your fuel costs for business trips If you are an employer and you pay for your fleet s fuel during personal times you will not only have to pay for the full cost of the fuel but you ll have to contribute a significant amount of National Insurance This is because you re giving out a taxable company benefit

If your employer isn t stumping up the full amount to reimburse you you can claim back the difference from HMRC When you ve got a company car you can t use the AMAP rates to claim back tax This is basically because those rates are Employees can only claim mileage allowance tax relief where their own vehicle is used for business purposes If the employee is provided with a company car a mileage claim can be made for business travel to cover the cost of fuel where this is paid for by the employee

Download Can I Claim Tax Back On Company Car Fuel

More picture related to Can I Claim Tax Back On Company Car Fuel

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/thumb/9/97/Claim-Tax-Back-Step-4-Version-2.jpg/aid9412652-v4-728px-Claim-Tax-Back-Step-4-Version-2.jpg

How Do I Claim A Tax Back Written On Memo Stock Image Image Of Claim

https://thumbs.dreamstime.com/z/how-do-i-claim-tax-back-written-memo-152600027.jpg

Advisory Fuel Rates For Company Cars Hawsons

https://www.hawsons.co.uk/wp-content/uploads/2022/08/advisory-company-car-fuel-rates-e1661520604291.jpg

Can I claim tax back on company car fuel With a company car you can claim back the mileage you re doing but not the tax Approved Mileage Allowance Payments AMAP allow you to cover the cost of your fuel your Vehicle Excise Duty VED and the upkeep of your company car The rate is the same for all cars irrespective of engine size and if you re paid a lower mileage rate you can claim tax relief on the difference For instance if the company pays 40p per mile up to 10 000 miles you can claim back five pence per mile from the government

If you are reimbursed for your petrol or diesel by your employer and the mileage paid to you is not taxed the amount has to be taken away from the total tax relief on fuel you can claim Use the mileage tax relief calculator The mileage tax relief calculator can help you work out how much tax back on your petrol you could be owed All you The maximum relief for NIC is always 45p per business mile The claims for reimbursement of NIC effectively provide for a mirroring of the tax relief enjoyed by the driver This is done by reducing the amount of NIC charged on the cash allowances or fuel card expenses if any paid by the company

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/thumb/9/9f/Claim-Tax-Back-Step-10-Version-2.jpg/aid9412652-v4-728px-Claim-Tax-Back-Step-10-Version-2.jpg

How To Claim Back Tax On PPI YouTube

https://i.ytimg.com/vi/Jfc_3j0q9aY/maxresdefault.jpg

https://www. gov.uk /expenses-and-benefits-company-cars

Technical guidance Overview As an employer providing company cars and fuel to your employees you have certain National Insurance and reporting obligations You ll usually need to report

https://www. gov.uk /guidance/taxable-fuel-provided...

The fuel benefit charge is normally the only tax charge for the provision of fuel for private use by an employee or members of their family or household in a company vehicle

What s The Importance Of A Vehicle Logbook GOFAR

3 Ways To Claim Tax Back WikiHow

What Can I Claim Tax Back On In Ireland

How Much Tax Will I Pay On Car Allowance Car Retro

Can I Buy A Personal Car Under A Company And Claim Tax Deduction Feb

24 Vehicle Lease Mileage Tracker Sample Excel Templates

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Do You Want To Claim PPI Tax Back Here s How It Works Gowing Law

How To Claim Tax Back On PPI Interest Refund EasyFinance4u

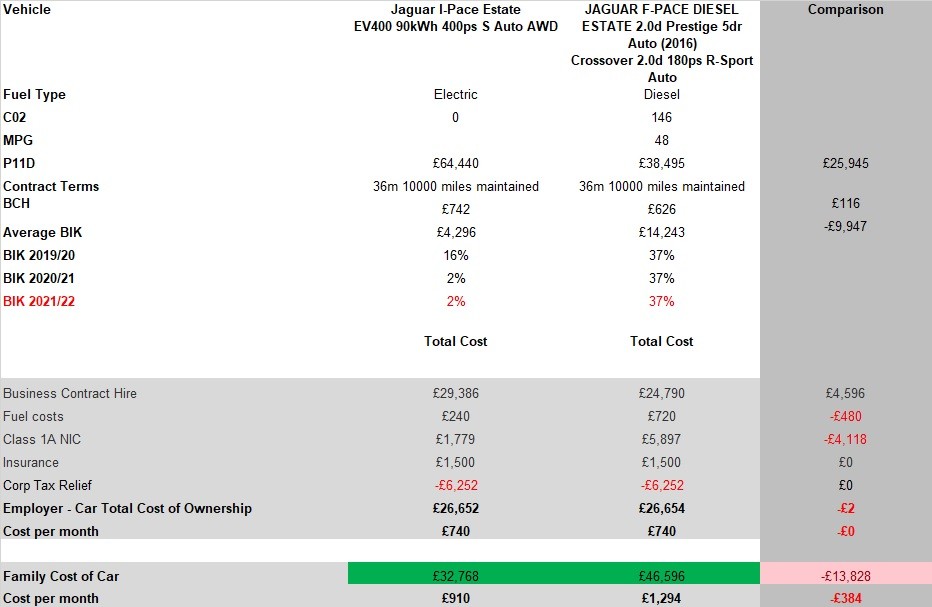

Company Car Tax BIK Rates And Bands 2019 20 Covase Fleet Management

Can I Claim Tax Back On Company Car Fuel - Car allowance in the UK is paid out with regular income and as such it is taxed Company car allowance tax is applied at the same rate as your income tax but the allowance doesn t form a part of your salary for bonuses