Can I Claim Tax Credits For A Child At University Verkko Courses are not approved if paid for by an employer or advanced for example a university degree or BTEC Higher National Certificate Your child must be accepted

Verkko 13 tammik 2014 nbsp 0183 32 Child benefit appears to continue until 31st August so is it the same for child tax credits Or do they end as soon as college is finished Also housing Verkko You will only be able to claim working tax credit if you already get child tax credit or vice versa If you want to get working tax credit you will need to do paid work in addition to your studies Any time spent

Can I Claim Tax Credits For A Child At University

Can I Claim Tax Credits For A Child At University

https://www.the-sun.com/wp-content/uploads/sites/6/2022/06/kc-child-tax-credits-comp-1.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

.jpg)

What Are Working For Families Tax Credits CareforKids co nz

https://www.careforkids.co.nz/articles/assets/2018-04-10-10-47-28-shutterstock_357403964-(1).jpg

State Income Tax Credits For Child Or Dependent Care Expenses Wolters

https://assets.contenthub.wolterskluwer.com/api/public/content/d4ca91087ac84d8fa74e048f6b617f46?v=7c187506

Verkko 26 toukok 2022 nbsp 0183 32 Learn how having a child in college can affect your taxes and review the credits and deductions the Canada Revenue Agency offers students Find out Verkko 24 marrask 2019 nbsp 0183 32 While available to any taxpayer there are some tax credits that typically fit the student lifestyle Consider these deductions and non refundable credits when you complete your child s return

Verkko 15 marrask 2023 nbsp 0183 32 The American Opportunity Tax Credit is based on 100 of the first 2 000 of qualifying college expenses and 25 of the Verkko 24 toukok 2023 nbsp 0183 32 Funding your children through university Many parents plan to provide their child with an income so that they will not need to work or to minimise the need for them to take out a loan whilst

Download Can I Claim Tax Credits For A Child At University

More picture related to Can I Claim Tax Credits For A Child At University

Can I Claim Tax Credits Low Incomes Tax Reform Group

https://www.litrg.org.uk/sites/default/files/styles/img_basic_page/public/Disabled people and carers 245 Can I claim tax credits.png?itok=qu1zYN1X

How Do You File Taxes With An Individual Taxpayer Identification Number

https://acastcdn.com/32b66820/https/45f079/www.taxoutreach.org/wp-content/uploads/immigrant-family-1168x390.jpg?theia_smart_thumbnails_file_version=5

TaxTips ca Canadian Non refundable Personal Tax Credits

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

Verkko 14 helmik 2013 nbsp 0183 32 You can t claim child tax credits for children at university or if they are claiming benefits such as income support or income based jobseeker s allowance Verkko 20 marrask 2023 nbsp 0183 32 Help with higher education The idea of combining studying with family life and surviving financially while you do this can be daunting for single

Verkko 21 helmik 2023 nbsp 0183 32 Claiming the tuition credit from your child is a two step process The first step is for your child to claim the tuition amount by completing federal Schedule 11 and the corresponding provincial Verkko Note For universal credit UC once a child reaches age 16 they become a qualifying young person and can be included in a UC claim up to but not including the 1st

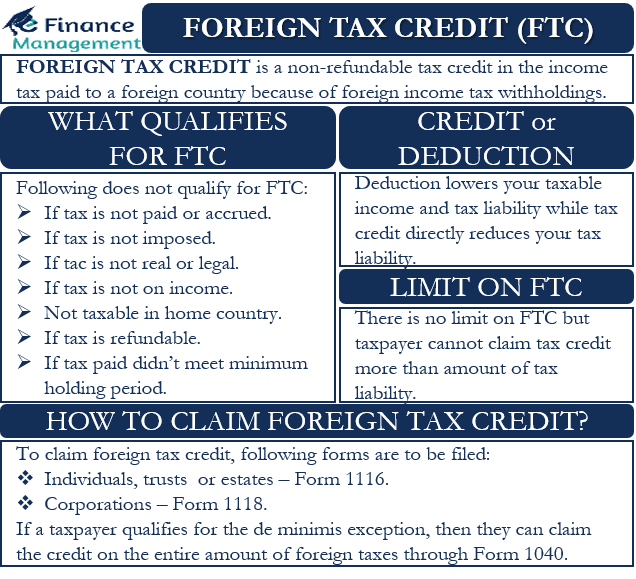

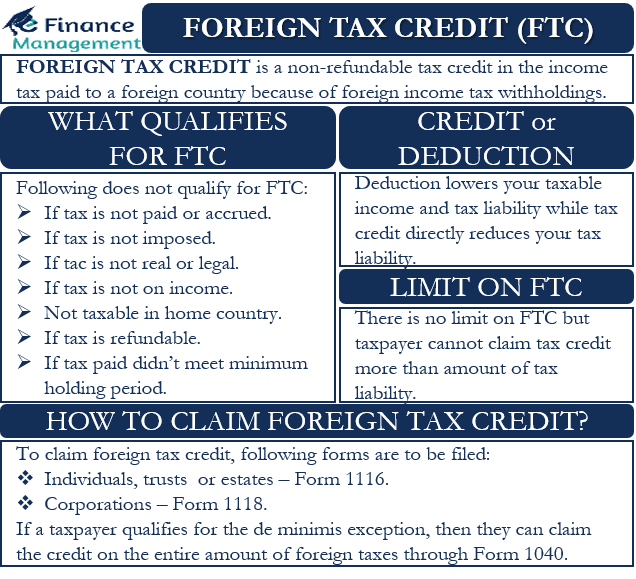

How Do I Claim Tax Credits Leia Aqui How Do Tax Credits Work On Taxes

https://efinancemanagement.com/wp-content/uploads/2021/05/Foreign-Tax-Credit.png

Tax Credits My Tax Refunds

https://mytaxrefunds.ie/wp-content/uploads/2023/12/tc-Example-1.webp

https://www.gov.uk/child-tax-credit-when-child-reaches-16

Verkko Courses are not approved if paid for by an employer or advanced for example a university degree or BTEC Higher National Certificate Your child must be accepted

.jpg?w=186)

https://forums.moneysavingexpert.com/discussion/4867511/child-go…

Verkko 13 tammik 2014 nbsp 0183 32 Child benefit appears to continue until 31st August so is it the same for child tax credits Or do they end as soon as college is finished Also housing

Going Green And Saving Money Unveiling The Benefits Of Tax Credits For

How Do I Claim Tax Credits Leia Aqui How Do Tax Credits Work On Taxes

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

How Tax Credits Work File And Claim Tax Credits On Your Return

Ordering Movie Credits With Graph Theory

EV Charger Tax Credit Jamar Power Systems

EV Charger Tax Credit Jamar Power Systems

New Child Tax Credit Could Raise Issues For Divorced Parents

Tax Credits My Tax Refunds

How To Claim Tax Breaks For Dependents King5

Can I Claim Tax Credits For A Child At University - Verkko 24 toukok 2023 nbsp 0183 32 Funding your children through university Many parents plan to provide their child with an income so that they will not need to work or to minimise the need for them to take out a loan whilst