Can I Claim Tax On Car Purchase You can claim capital allowances on cars you buy and use in your business This means you can deduct part of the value from your profits before you pay tax Use writing down allowances to

Buying vehicles If you use traditional accounting and buy a vehicle for your business you can claim this as a capital allowance If you use cash basis accounting and buy a car for You can enter the sales tax you paid for the car you purchased in 2023 by going to Federal Deductions and Credits Estimates and Other Taxes Paid Sales Tax You will be asked if you paid sales tax on a major purchase and you will be able to enter the sales tax you paid for your new vehicle Sales tax is an itemized deduction

Can I Claim Tax On Car Purchase

Can I Claim Tax On Car Purchase

https://blog.carvana.com/wp-content/uploads/2020/02/022120-How-to-qualify-for-the-vehicle-sales-tax-deduction_Blog4.png

FAQ Can I Claim Tax On Vacant Property YouTube

https://i.ytimg.com/vi/WO7reRsOF_g/maxresdefault.jpg

Save 51 On Any Car Using Taxation Laws Wisely Government Tax On CAR

https://i.ytimg.com/vi/IpcAcpCyWjI/maxresdefault.jpg

The cut off for having your asset in use and eligible to be claimed for the 2021 22 financial year is 11 59pm on 30 June 2022 and yes that s a hard deadline That means even if you ve pre paid for your car it can t be included in your tax return until it s actually in use so beware of delivery delays There is a general sales tax deduction available if you itemize your deductions You will have to choose between taking a deduction for sales tax or for your state and local income tax You can deduct sales tax on a vehicle purchase

Section 179 deduction Mileage deduction Depreciation deduction Sales tax deduction Frequently asked questions The final verdict Personal Use Non Deductible Expenses When purchasing a car solely for personal use the cost of There is a 10 000 limit 5 000 if MFS on the amount of sales tax you can claim from 2018 to 2025 Depending on your choice it applies to the total amount a person could claim for real property taxes personal property taxes local and state income taxes or general sales tax

Download Can I Claim Tax On Car Purchase

More picture related to Can I Claim Tax On Car Purchase

HMRC Company Car Tax Rates 2020 21 Explained

https://blog-media.vimcar.com/uk-blog/uploads/2021/04/21142208/Optimized-210419_car-taxes-1024x683.jpg

Can I Claim Back Tax Paid In The US

https://static.wixstatic.com/media/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg/v1/fill/w_1000,h_667,al_c,q_90,usm_0.66_1.00_0.01/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

Is there such a thing as a car purchase tax deduction While new cars aren t fully tax deductible you can write off some of the cost Learn how and what other car expenses you can deduct for a lower tax bill You can deduct the sales tax you pay on a new vehicle if you buy it between February 17 and December 31 2009 And you get this tax break even if you claim the standard deduction as most taxpayers do rather than itemizing deductions on your tax return

How do I claim car expenses on my tax return Whether you are using tax software or printed CRA materials not recommended there are several forms and declarations you will need to fill out to claim motor vehicle expenses This will help you calculate the amount eligible to deduct If you buy a car October 1 onwards you can only claim 7 5 depreciation on it since the taxman treats it like half a year How does it work Here is how it translates into real money saving Let s talk about two self employed professionals Sheena and Rita

Can I Claim GST On Car Insurance PolicyBachat

https://www.policybachat.com/FAQsImages/can-i-claim-gst-on-car-insurance-5727.jpg

What Happens If You Don t File A Tax Return Tax Time Tax Refund

https://i.pinimg.com/originals/1c/5d/43/1c5d43cf691b7dda6440f821e65c2fa9.jpg

https://www.gov.uk/capital-allowances/business-cars

You can claim capital allowances on cars you buy and use in your business This means you can deduct part of the value from your profits before you pay tax Use writing down allowances to

https://www.gov.uk/expenses-if-youre-self-employed/travel

Buying vehicles If you use traditional accounting and buy a vehicle for your business you can claim this as a capital allowance If you use cash basis accounting and buy a car for

I Have Coeliac Disease Can I Claim Tax On Food Expenses Liam Croke

Can I Claim GST On Car Insurance PolicyBachat

Can I Claim A Car Loan On My Tax Return

Can You File Your Taxes With Your Last Pay Stub This Is What To Know

Sales Tax On Car Purchase Tax Deductible Car Sale And Rentals

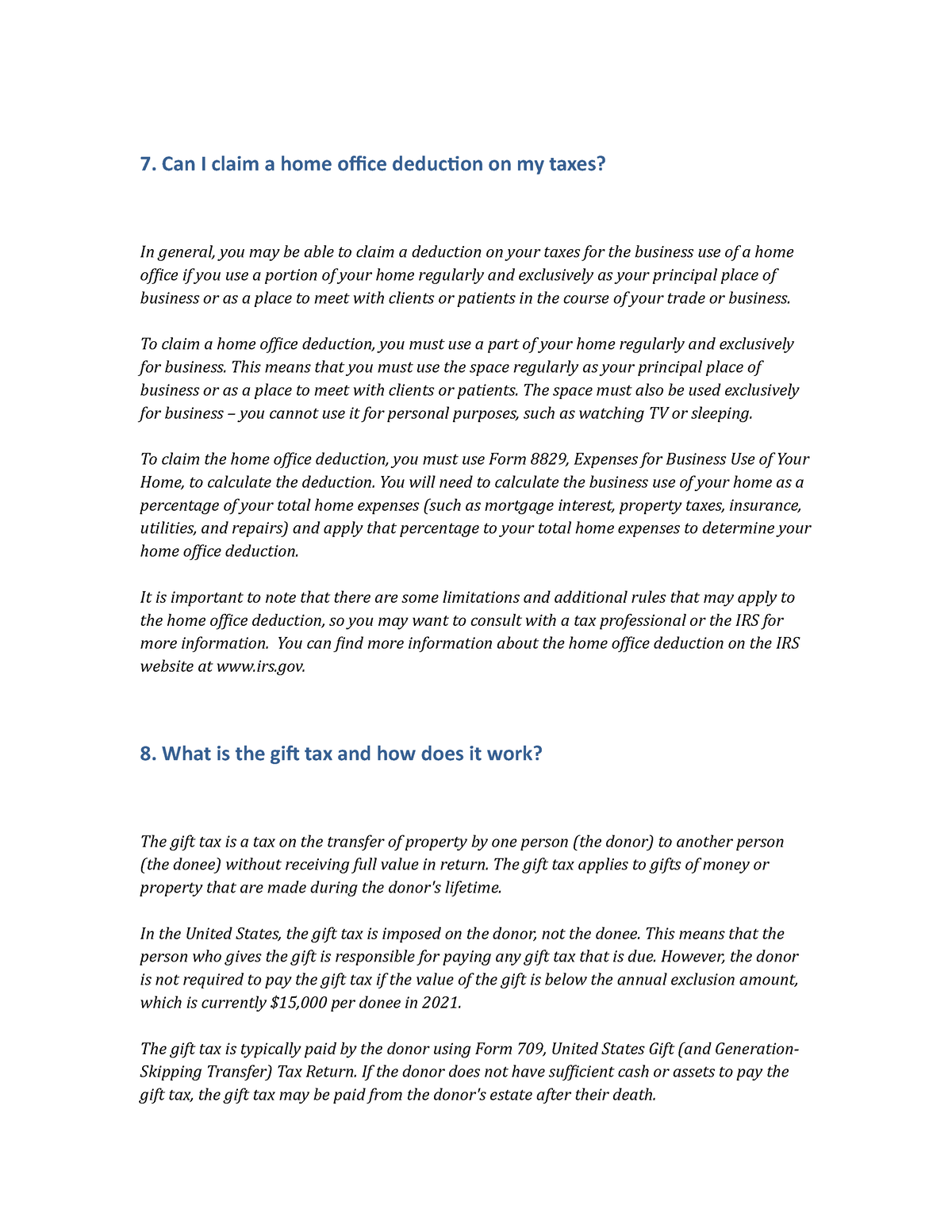

Tax Law2 This Document Contains Course About Tax Law 7 Can I Claim

Tax Law2 This Document Contains Course About Tax Law 7 Can I Claim

How Much Fuel Can I Claim On Taxes Leia Aqui Is It Better To Claim

Car Buying Template

Can I Claim Employment Allowance For My Business Accountants Tax

Can I Claim Tax On Car Purchase - There is a 10 000 limit 5 000 if MFS on the amount of sales tax you can claim from 2018 to 2025 Depending on your choice it applies to the total amount a person could claim for real property taxes personal property taxes local and state income taxes or general sales tax