Electricity Rebate 2024 Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Electricity Rebate 2024

Electricity Rebate 2024

https://assets.theedgemarkets.com/Belanjawan2024-malaysia-madani_parliment-3_20231013160301_theedgemalaysia.jpg

Electricity Rebate Form NSW 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/09/Electricity-Rebate-Form-NSW-2021.png

Electricity Rebate Connolly Associates

https://connollysbs.com.au/wp-content/uploads/2021/07/business-electrical-rebate.jpg

Energy Efficiency and Electrification Rebates for 2024 Update Per the latest guidance from the US Department of Energy the home electrification rebates listed below are expected to be available in some areas in the second half of 2024 and available in most areas by early 2025 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

The Inflation Reduction Act of 2022 has a bunch of incentives aimed at helping you make your home more energy efficient This year and next a few more incentives will roll out Kara Saul Rinaldi 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022

Download Electricity Rebate 2024

More picture related to Electricity Rebate 2024

You Could Be Getting A 150 Electricity Rebate From The Alberta Government News

https://images.dailyhive.com/20220401114803/jason-kenney-electricity-rebate-e1648838943285.jpg

Electricity Bill Rebate Plan Gets The Green Light From Agency Radio Sweden Sveriges Radio

https://static-cdn.sr.se/images/2054/f802b4c6-765d-4557-99d2-45dce86fb126.jpg?preset=1024x576

500 Electricity Rebate Ination And Application 500 Electricity Rebate Ination And Application

https://www.pdffiller.com/preview/486/456/486456786/large.png

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings The CEC expects rebates will become available in 2024 Expand All Request for Information Home Efficiency Rebates HOMES Program Home Electrification and Appliance Rebates HEEHRA Training for Residential Energy Contractors TREC Expected Timeline for California IRA Residential Energy Rebates Legislation Upcoming Events

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 Jan 9 2023 Getting a substantial instant discount would simplify electrification for homeowners and widen its appeal But that means a system must be put in place for a contractor a state

Kenney Says Province Will Keep open Mind To Electricity Rebate Montreal Gazette

https://smartcdn.gprod.postmedia.digital/calgaryherald/wp-content/uploads/2019/10/1017-power-line.jpg

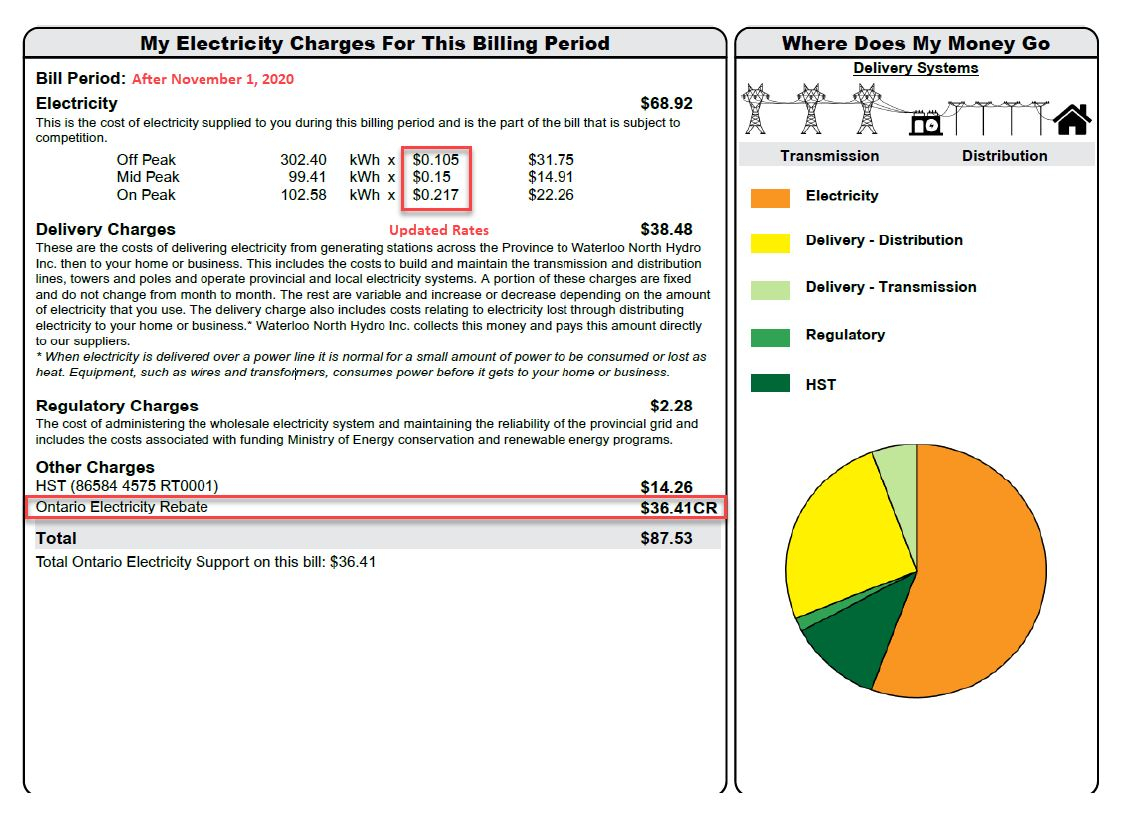

Ontario Electricity Rebate November 2022 ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/ontario-electricity-rebate-waterloo-north-hydro.jpg

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

175 Queensland Energy Rebate Can You Get It I Finder

Kenney Says Province Will Keep open Mind To Electricity Rebate Montreal Gazette

Mobil One Offical Rebate Printable Form Printable Forms Free Online

With Electricity Rebate Legislators Could Spend More Than 75 Of The 2022 Budget Surplus THE

2024 YouTube

Lensrebates Alcon Com

Lensrebates Alcon Com

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/LRVCBAALVRGB5KHXFQR3HEHF4M.jpg)

Electricity Customers To Get 89 Rebate Next Year Due To A Reduction In PSO Levy The Irish Times

Calls For All SA Households To Get A One off Electricity Rebate To Help With Cost Of Living

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Electricity Rebate 2024 - The Inflation Reduction Act of 2022 has a bunch of incentives aimed at helping you make your home more energy efficient This year and next a few more incentives will roll out Kara Saul Rinaldi