Can I Claim Tax Relief On Home Office Furniture If you have dedicated office space in a room even if sharing it with private household users or a separate office in an adapted room where private use is incidental the tax saving

You can claim expenses for rent for business premises business and water rates utility bills property insurance security using your home as an office only the part that s You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time you work from

Can I Claim Tax Relief On Home Office Furniture

Can I Claim Tax Relief On Home Office Furniture

https://www.income-tax.co.uk/wp-content/uploads/2022/04/how-can-i-claim-tax-working-from-home-scaled.jpeg

Work From Home Tax Relief Amount And How To Claim It Marca

https://phantom-marca.unidadeditorial.es/901044baf3c0b051252a326a6ff71d9a/crop/0x0/1300x730/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/30/16408614090996.jpg

How To Claim Tax Relief A Freelancer s Guide I24 Blog

https://lh6.googleusercontent.com/ABlmZjBFbp86bWomXmNWG6sFh0qh-SHwqVMQjjgopXkaQawk-FCZiYnyKFKZpK1zZm5Y3K7FDNgvt9iHSBIyO3Mkrn1CJDVa1Exi1rQY9Tjk-ZF-3f_nWUSabb7pxJMa-V49Z0yC

Any office furniture or equipment you purchase must be new and unused You cannot make a claim for refurbished or second hand office furniture A claim can April 26 2019 One of the benefits of being self employed is working from home Make sure you understand the HRMC use of home as office tax deduction rules though How do I

The scheme states that you can claim for office furniture ink stationary and more to help you work from home it starts at 6 a week or 26 a month though you can claim for more In some cases it s even possible to claim expenses for working from home furniture and office equipment as a tax deductible home office expense We ll show you what to look out for when

Download Can I Claim Tax Relief On Home Office Furniture

More picture related to Can I Claim Tax Relief On Home Office Furniture

How To Claim Tax Relief For Your Home Office Bright Ideas Accountancy

https://biaccountancy.com/wp-content/uploads/2017/03/454.jpg

Claiming For Working From Home Expenses In 2021 22

https://rfm-more.co.uk/wp-content/uploads/2021/09/Working-from-home-expenses.jpg

Claiming For Working From Home Expenses In 2021 22

https://rfm-more.co.uk/wp-content/uploads/2021/09/Working-from-home-expenses-S.jpg

If your employer does not reimburse you for the costs of your office furniture do not fear you are still able to claim tax relief The steps you will need to To qualify for the deduction you need to meet four tests You can deduct the expenses related to your home office if your use is Exclusive Regular For your business and

You can claim the deduction whether you re a homeowner or a renter and you can use the deduction for any type of home where you reside a single family home an apartment a condo or a How to claim What you can claim on You can claim capital allowances on items that you keep to use in your business these are known as plant and machinery In most cases

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

https://www.accaglobal.com/gb/en/technical...

If you have dedicated office space in a room even if sharing it with private household users or a separate office in an adapted room where private use is incidental the tax saving

https://www.gov.uk/expenses-if-youre-self-employed/office-property

You can claim expenses for rent for business premises business and water rates utility bills property insurance security using your home as an office only the part that s

Claiming Tax Relief On Personal Contributions

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Claim Tax Relief For Your Job Expenses Full Claiming Guide

Here S Who Can Claim The Home Office Tax Deduction This Year

Claim Tax Relief For Additional Costs Of Working From Home

Claiming Tax Relief On Your Garden Office Ridgefield Consulting

Claiming Tax Relief On Your Garden Office Ridgefield Consulting

Hecht Group Does Pennymac Pay Property Taxes

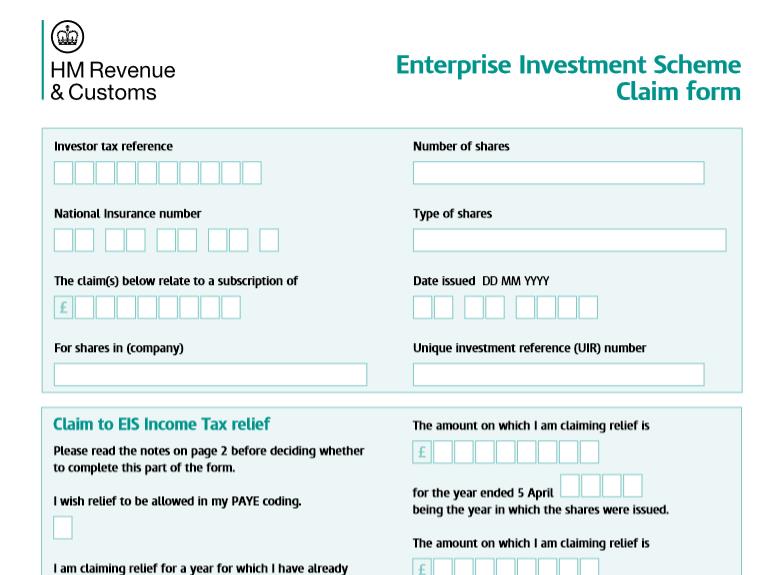

Here s How To Claim EIS Tax Reliefs This Tax Year

How Can I Reduce My Tax Bill The Accountancy Partnership

Can I Claim Tax Relief On Home Office Furniture - If you re a regular employee working from home you can t deduct any of your related expenses on your tax return In the past you could claim an itemized deduction