Federal Tax Credit Vs Rebate Web One of the biggest differences between tax credits and rebates is the frequency with which they occur Every year the tax code contains several credits that taxpayers can

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Federal Tax Credit Vs Rebate

Federal Tax Credit Vs Rebate

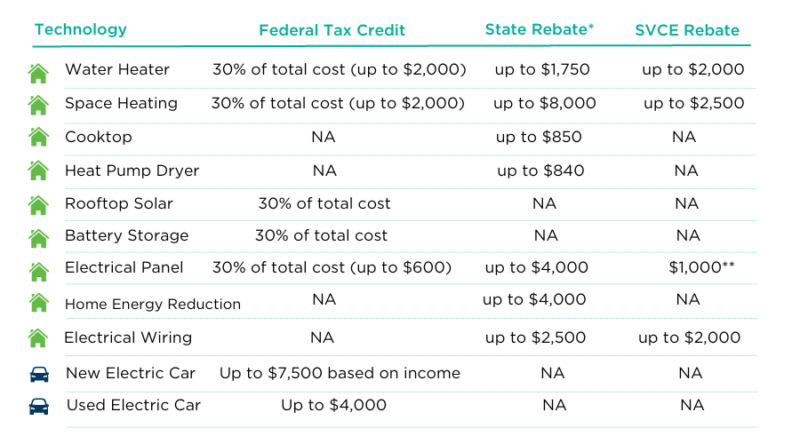

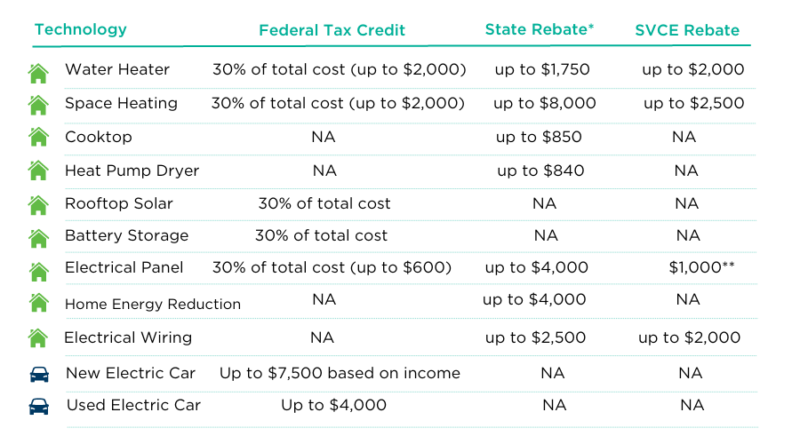

https://svcleanenergy.org/wp-content/uploads/IRA-Webpage-Rebates-3-800x444.png

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/taking-advantage-of-hvac-rebates-federal-tax-credits-with-an-1.png

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-federal-tax-credits-taxuni-12.jpg?fit=1024%2C576&ssl=1

Web 31 janv 2023 nbsp 0183 32 A tax credit valued at 1 000 for instance lowers your tax bill by the corresponding 1 000 Tax deductions on the other hand reduce how much of your income is subject to taxes Web 12 f 233 vr 2023 nbsp 0183 32 Key Takeaways A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions because

Web 8 mai 2022 nbsp 0183 32 EV Rebate vs Tax Credit What s the Difference Between EV Incentives Credits and rebates and discounts oh my Learn all about EV incentives in 2022 the Web If you owe 1 500 in 2023 federal income taxes and claimed a 1 200 federal tax credit for energy efficiency equipment you would now owe 300 in federal income taxes REBATE A rebate is an upfront

Download Federal Tax Credit Vs Rebate

More picture related to Federal Tax Credit Vs Rebate

Cu l Es La Diferencia Entre Una Transcripci n Del IRS 1040 Y Una W 2

https://img.cs-finance.com/img/the-basics/tax-credit-vs.-rebate.png

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-federal-tax-credits-taxuni.jpg?w=1200&ssl=1

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Web 12 nov 2021 nbsp 0183 32 Federal tax credit vs rebate Hi trying to get clarification on the proposed EV incentives that president Biden signed It is still a tax credit right You claim the Web 5 mai 2023 nbsp 0183 32 Claim Federal Tax Credits and Deductions Claim certain credits and deductions on your tax return and you may be able to get a larger refund while others

Web 19 ao 251 t 2022 nbsp 0183 32 From 2023 a 1 200 annual tax credit limit will replace the old 500 lifetime limit The tax credit will be equal to 30 of the costs for all eligible home improvements Web 1 d 233 c 2022 nbsp 0183 32 What is a tax rebate Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more

Tax Credits Vs Deductions In 2023 Definitions And Examples Benzinga

https://cdnwp-s3.benzinga.com/wp-content/uploads/2018/12/11164543/Screen-Shot-2018-12-11-at-11.45.27-AM.png

How To Get A Tax Rebate On Energy Efficient Appliances Learn How To

https://i2.wp.com/www.learnhow-to.com/wp-content/uploads/2016/11/federal_tax_credit.jpg

https://www.sapling.com/7884940/tax-credit-vs-rebate

Web One of the biggest differences between tax credits and rebates is the frequency with which they occur Every year the tax code contains several credits that taxpayers can

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

2020 HVAC Rebates Federal Tax Credits DTC Air Conditioning Heating

Tax Credits Vs Deductions In 2023 Definitions And Examples Benzinga

Federal Tax Rebate Program Benson s Heating Air

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Education Expenses Tax Deduction Bdesignsnow

How To Find Federal Tax Credits Rebates For HVAC Upgrades

How To Find Federal Tax Credits Rebates For HVAC Upgrades

EV Tax Credit Support Climate Nexus May 2019

Federal Solar Tax Credits For Businesses Department Of Energy

Baker Heating Cooling 2023 Home Energy Federal Tax Credits Rebates

Federal Tax Credit Vs Rebate - Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial