Can I Claim Tax Relief On Mortgage Interest As per my understanding the finance cost mortgage interest expense can claim a tax relief It can be claim 20 of the financal cost e g 7 668 was the interest i

Support for Mortgage Interest SMI helps homeowners on certain benefits pay interest on loans or mortgages what you ll get eligibility and how to claim From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income All of the rental income you earn will be taxable and you ll instead receive

Can I Claim Tax Relief On Mortgage Interest

Can I Claim Tax Relief On Mortgage Interest

https://temasek-cdn.moneysmart.sg/wp-content/uploads/2018/03/Screen-Shot-2018-03-30-at-3.04.43-PM-1024x712.png

Can I Claim Tax Relief On Mortgage Interest UK

https://www.hamiltoninternationalestates.com/admin/uploads/news/Can i claim tax relief on mortgage interest UK88-881604917834.jpg

![]()

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/claim-1-icon-1536x1536.png

Tax relief is available for interest on loans where the borrowed money is used for certain specific purposes You can also claim relief for alternative finance You can claim the mortgage interest tax credit by making an income tax return for 2023 using Revenue s MyAccount or ROS services There is a mortgage interest tax credit

Learn how mortgage interest tax relief works for private and individual landlords in the UK since April 2020 Find out how to claim tax relief or how to switch Before 2017 The interest for your mortgage was 100 deductible Since most individual landlords have interest only mortgages you could basically claim all mortgage repayments That s because you

Download Can I Claim Tax Relief On Mortgage Interest

More picture related to Can I Claim Tax Relief On Mortgage Interest

Government Responds To Mortgage Interest Tax Relief Petition

https://www.carterjonas.co.uk/-/media/images/news-images-t08/residential/2018-resi-mortgage-interest-tax-relief-petition.ashx

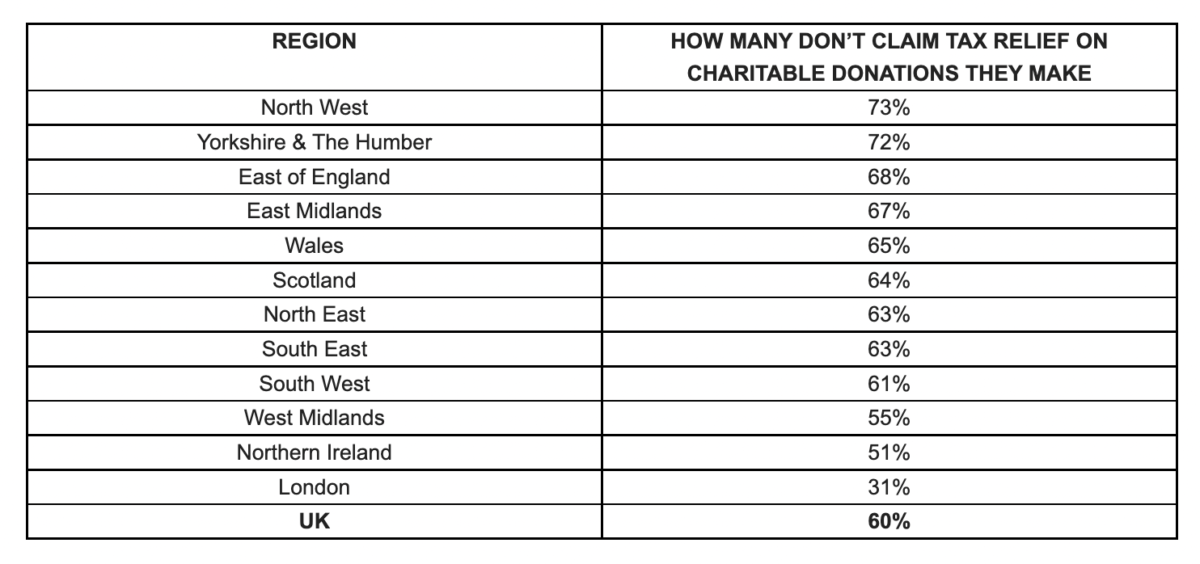

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

List Of Personal Tax Relief And Incentives In Malaysia 2024

https://iqiglobal.com/blog/wp-content/uploads/2023/01/tax-relief.jpg

Mortgage interest tax relief Landlords can claim a tax credit based on 20 of their mortgage interest payments This change no longer allows higher or additional rate taxpayers to claim buy to let tax relief Tax credits which came into full effect from April 2020 mean that landlords can no longer deduct any of their mortgage interest from their rental income when calculating their taxable profit Instead

Can he claim mortgage interest on that borrowing Yes of course he has introduced an asset to his brand new property business venture worth 230 000 and subject to a The new mortgage interest tax relief rules mean landlords have to pay more tax on buy to let income Here are 3 calculations so you know what to expect

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

https://community.hmrc.gov.uk/customerforums/sa/...

As per my understanding the finance cost mortgage interest expense can claim a tax relief It can be claim 20 of the financal cost e g 7 668 was the interest i

https://www.gov.uk/support-for-mortgage-interest

Support for Mortgage Interest SMI helps homeowners on certain benefits pay interest on loans or mortgages what you ll get eligibility and how to claim

Personal Tax Relief 2022 L Co Accountants

Hecht Group Does Pennymac Pay Property Taxes

When Can You Claim The Federal Tax Credit For Electric Cars OsVehicle

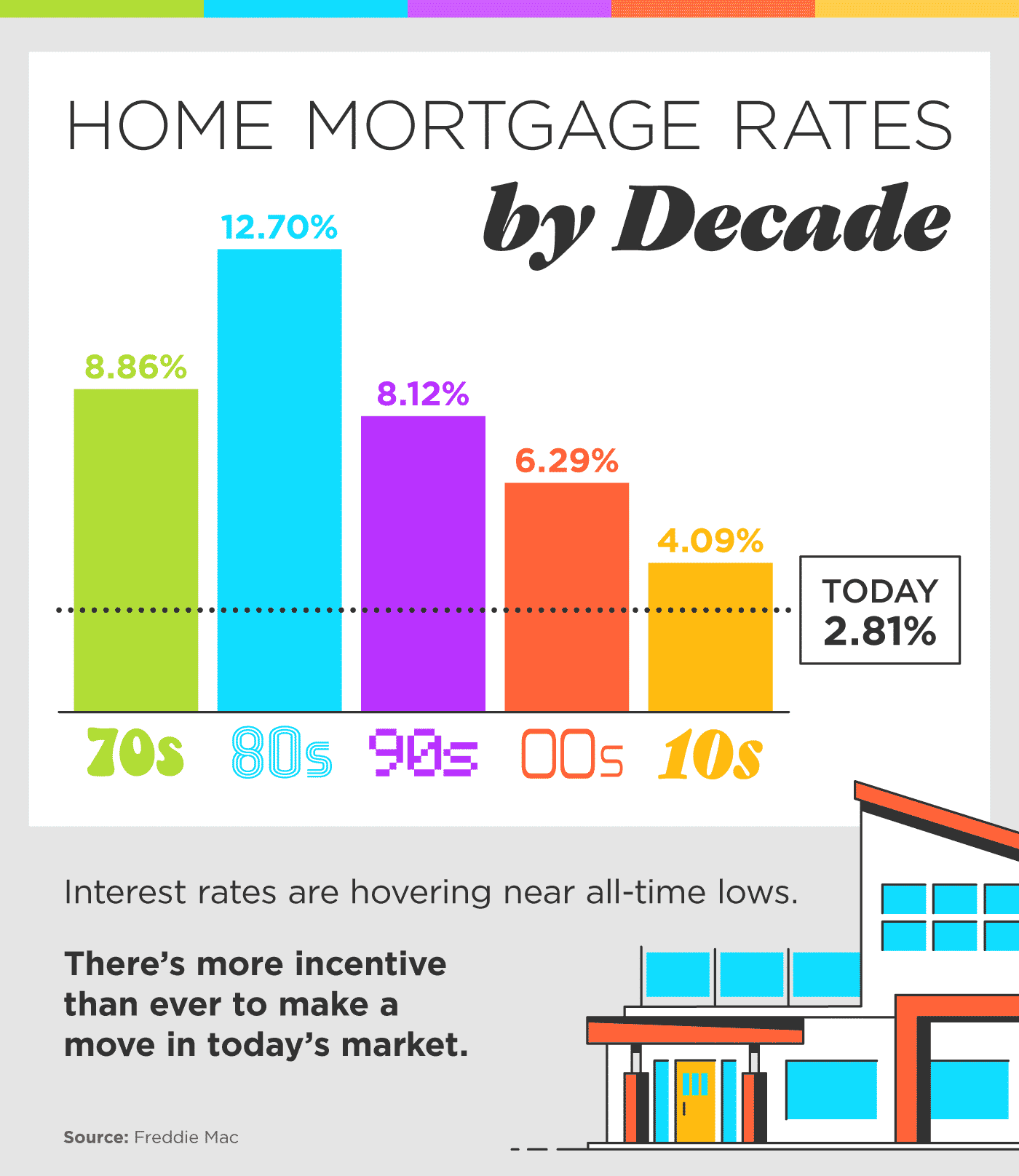

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

Cobb Amos Estate Agents As A Landlord What Expenses Can I Claim

Can I Claim Tax Relief On Pension Contributions Chapman Robinson

Can I Claim Tax Relief On Pension Contributions Chapman Robinson

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Tax Accounting Enews February 2020 Edwards Of Gwynedd Accounting

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Can I Claim Tax Relief On Mortgage Interest - To make the tax system fairer the government will restrict the amount of Income Tax relief landlords can get on residential property finance costs such as