Can I Claim Vat Back On Mileage February 8 2024 Travel in business is common and HMRC recognises the VAT you pay on business travel is subject to a possible refund

The date of the trip The start and end destinations with full addresses The mileage traveled A brief description of the reason for the journey You should also enclose who is Claiming VAT on mileage payments to employees Shared from Tax Insider Claiming VAT on mileage payments to employees

Can I Claim Vat Back On Mileage

Can I Claim Vat Back On Mileage

https://gg.myggsa.co.za/how-far-back-can-you-claim-vat-in-south-africa-.jpg

Can You Claim Vat On Petrol In South Africa Greater Good SA

https://gg.myggsa.co.za/can-you-claim-vat-on-petrol-in-south-africa-.jpg

Who Can Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/who-can-claim-vat-in-south-africa-.jpg

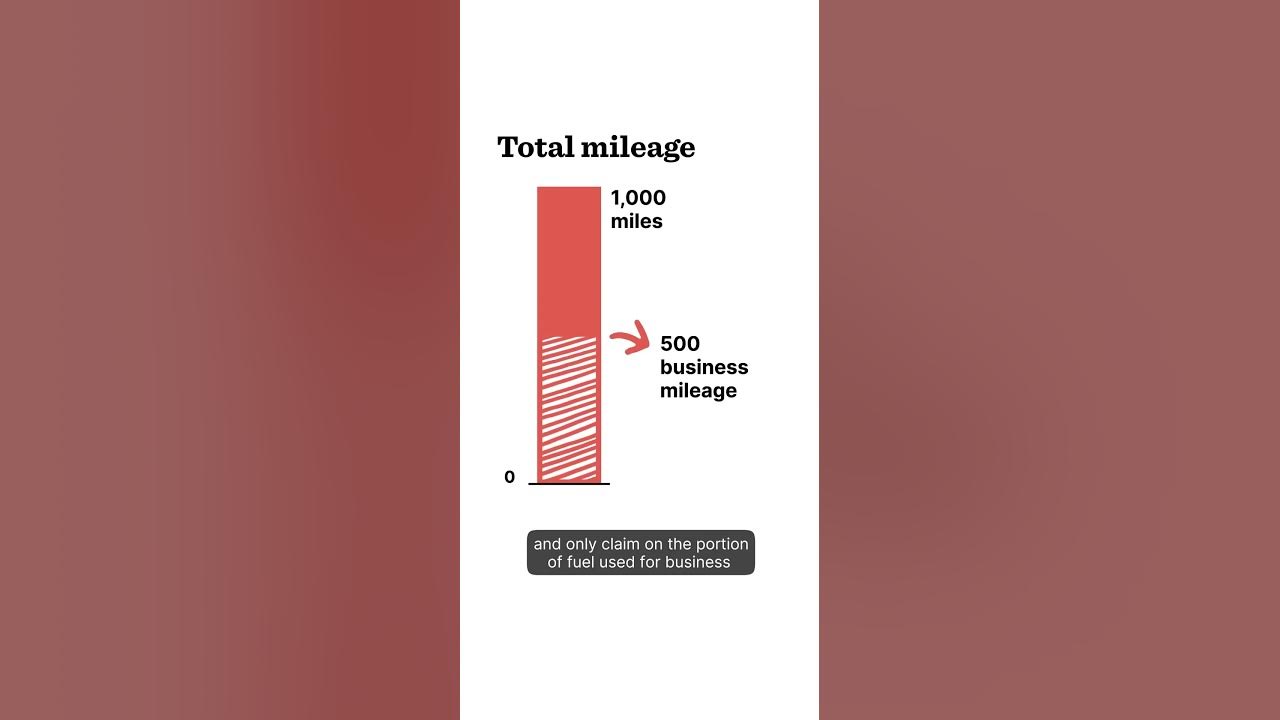

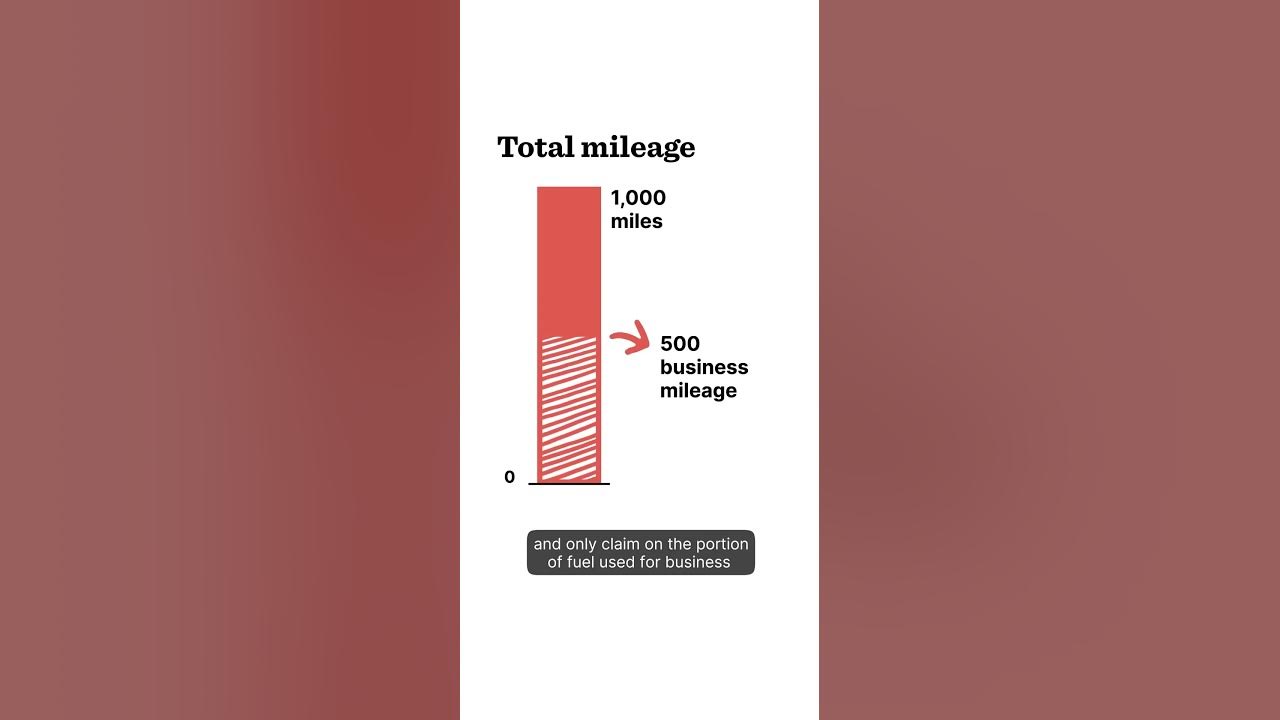

Employees using personal vehicles for work journeys can claim back costs inc VAT of fuel and mileage from their employer or get a tax deduction for the same amount from 1 Who Can Claim VAT on Mileage 2 How to Claim VAT on Mileage Claims 2 1 Advisory Fuel Rates v Mileage Allowance Rates 3 How to Calculate VAT on Fuel 3 1 Example of Claiming VAT Back on

If you are working for yourself in any capacity then we can help you with your accountancy and tax needs Contact us August 2 2023 VAT on Mileage Claims Eligibility Rates and How to Calculate Your Claim Despite changes in recent years to the way we work a great deal of business in

Download Can I Claim Vat Back On Mileage

More picture related to Can I Claim Vat Back On Mileage

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

Jon Jenkins October 4 2022 Can I Claim VAT on Mileage If you are not claiming VAT on mileage payments you need to double check your processes If you are not The first 10 000 miles for vans and cars can claim up to 0 45 per mile and then it s 0 25 per mile after that This 45p is split into two parts fuel and wear and tear The fuel part is

The easiest way is to use the Advisory Fuel Rates published by HMRC HMRC Advisory Fuel Rates The Advisory Fuel Rates are defined by HMRC as the How to take money out of your company Dividend tax rates Limited company expenses corporation tax Annual accounts and deadlines Get a free accounting consultation to

Can You Claim VAT Back On Fuel YouTube

https://i.ytimg.com/vi/749I1hBjINc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4HgAKAD4oCDAgAEAEYfyA3KDUwDw==&rs=AOn4CLDi0gj9PvsXVLxYspSIj3mVyqob1g

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

https://www.freshbooks.com/en-gb/hub/taxes/vat-on-mileage

February 8 2024 Travel in business is common and HMRC recognises the VAT you pay on business travel is subject to a possible refund

https://www.rac.co.uk/.../claiming-vat-on-mileage

The date of the trip The start and end destinations with full addresses The mileage traveled A brief description of the reason for the journey You should also enclose who is

Can I Claim VAT Back On My Mileage

Can You Claim VAT Back On Fuel YouTube

Can I Claim VAT On Mileage incl 45p Allowance VAT Reclaims

How To Claim A VAT Refund Everything You Need To Know

Can I Claim VAT On Mileage incl 45p Allowance VAT Reclaims

How To Claim VAT Back On Expenses Goselfemployed co

How To Claim VAT Back On Expenses Goselfemployed co

Can I Claim Back VAT Small Business UK

VAT On Leased Cars Can You Claim Back VAT On Car Leasing

VAT On Mileage Claims

Can I Claim Vat Back On Mileage - How do you adjust the VAT return to reclaim VAT from mileage payments glennc Level 2 posted February 07 2019 03 18 AM last updated February 06 2019