Wine Equalisation Tax Rebate Web 11 mai 2021 nbsp 0183 32 there are two methods you could use to calculate the wine equalisation tax payable the average wholesale price method and the half price retail method and you could qualify to claim a 350 00 wine

Web from 1 July 2017 reduce the WET rebate cap from 500 000 to 350 000 and from 1 July 2018 to 290 000 and from 1 July 2019 apply tightened eligibility criteria where a wine Web What is the wine equalisation tax rebate The wine equalisation tax rebate the rebate enables eligible producers to offset their wine equalisation tax liability The intention of

Wine Equalisation Tax Rebate

Wine Equalisation Tax Rebate

https://www.sellercommunity.com/t5/image/serverpage/image-id/34185iF14723C83D55CB24?v=v2

Wine Equalisation Tax Rebate Cut To Hit Tasmania s Small Producers

https://content.api.news/v3/images/bin/e808bb330aaf8a5ec6a23da5f38fef54?width=1280

Wine Equalisation Tax Gap 2018 19 Australian Taxation Office

https://sig.ato.gov.au/uploadedImages/Content/CR/Images/Tax_Gap/2018-2019/WET_gap_graphs_Fig3.png?n=4660

Web WET credits When you are and aren t entitled to a wine equalisation tax WET credit paid WET in error or overpaid WET for example a wholesaler sells wine and pays Web Policy amp Issues Selling Wine in the Domestic Market WET Seminars amp Webinars Record Keeping Requirements Contractual Arrangements Trademarks What is WET WET is

Web 1 Executive Summary On 5 May 2015 the Assistant Treasurer announced the release of a discussion paper on the wine equalisation tax rebate WET rebate This discussion Web In this section Chapter 2 Wine equalisation tax rebate 2 1 This chapter considers the impact and application of the wine equalisation tax rebate on grape and wine industry

Download Wine Equalisation Tax Rebate

More picture related to Wine Equalisation Tax Rebate

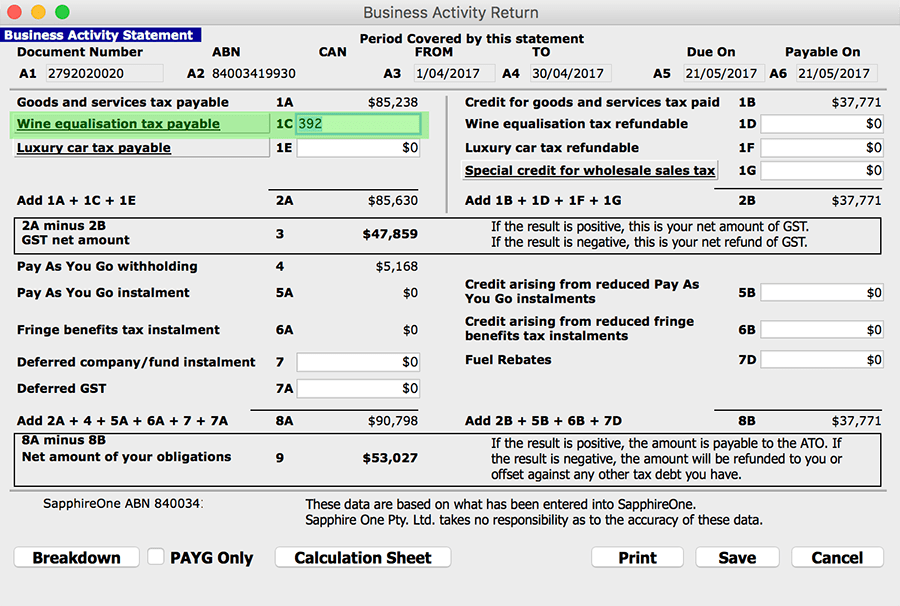

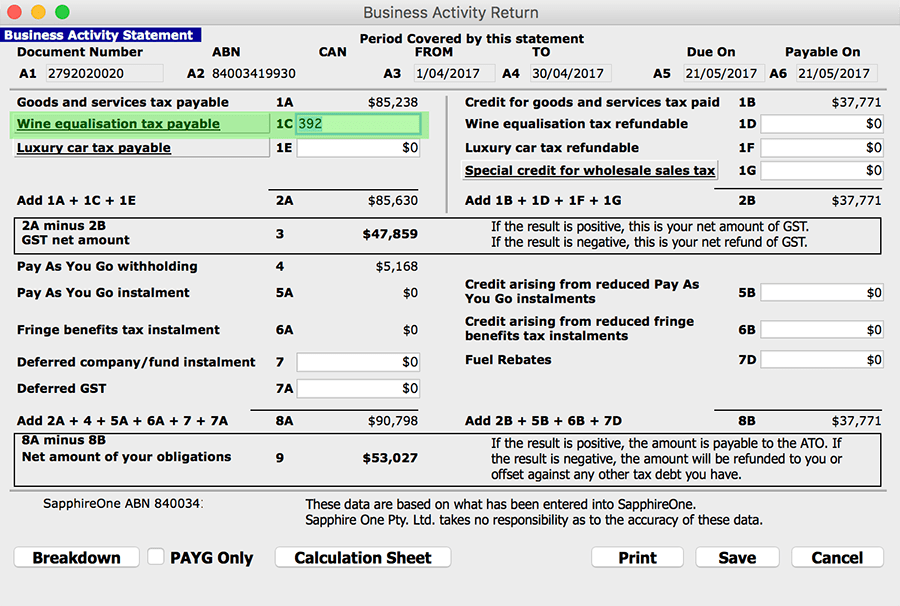

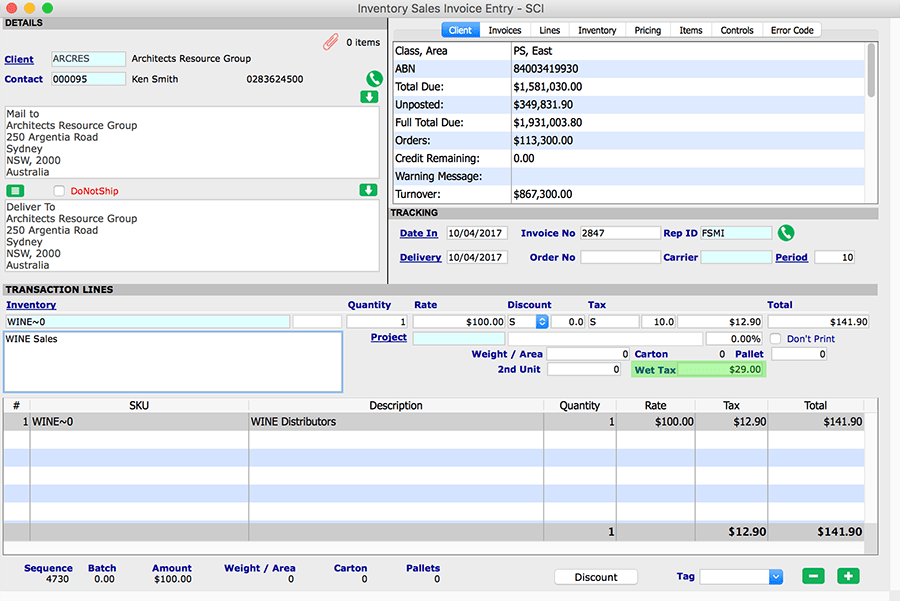

Wine Equalisation Tax WET Unleashed Support

https://support.unleashedsoftware.com/hc/article_attachments/4834051447833/blobid0.png

Wine Equalisation Tax WET Unleashed Support

https://support.unleashedsoftware.com/hc/article_attachments/4834171914137/blobid3.png

Wine Equalisation Tax WET Unleashed Support

https://support.unleashedsoftware.com/hc/article_attachments/4421011638169/blobid5.png

Web The Government has released exposure draft legislation and associated explanatory material that would amend the A New Tax System Wine Equalisation Tax Act 1999 to Web Policy amp Issues Wine Equalisation Tax WET Information The Wine Equalisation Tax WET legislation changes were agreed by the Australian Parliament on 17 August 2017

Web This form is to be used by New Zealand wine producers in applying for the Wine Equalisation Tax WET rebate NAT 14199 How to apply How to complete your Web 10 mai 2023 nbsp 0183 32 A rebate is available for eligible Australian wine producers WET is collected by the ATO to create a level playing field for wine producers ensuring that all imported

Wine Equalisation Tax WET For Wine Distributors Accounting Software

https://blog.sapphireone.com/wp-content/uploads/2017/04/Business-activity-statement-calculation-for-WET.png

Wine Equalisation Tax WET For Wine Distributors Accounting Software

https://i.pinimg.com/originals/b6/06/71/b60671c549c74d8b7f0c3f02d25aaa41.png

https://boxas.com.au/small-business-handboo…

Web 11 mai 2021 nbsp 0183 32 there are two methods you could use to calculate the wine equalisation tax payable the average wholesale price method and the half price retail method and you could qualify to claim a 350 00 wine

https://treasury.gov.au/.../C2016-027_WET-Rebate-Impleme…

Web from 1 July 2017 reduce the WET rebate cap from 500 000 to 350 000 and from 1 July 2018 to 290 000 and from 1 July 2019 apply tightened eligibility criteria where a wine

Concern Over Wine Tax Delay Queensland Country Life QLD

Wine Equalisation Tax WET For Wine Distributors Accounting Software

Wine Equalisation Tax WET Unleashed Support

Wine Equalisation Tax Loopholes To Be Closed The Australian

What Future The Wine Equalisation Tax ABC News

Wine Equalisation Tax Rorting Set To End With New Legislation Good

Wine Equalisation Tax Rorting Set To End With New Legislation Good

Wine Equalisation Tax Rebate Widely Rorted Treasury Says

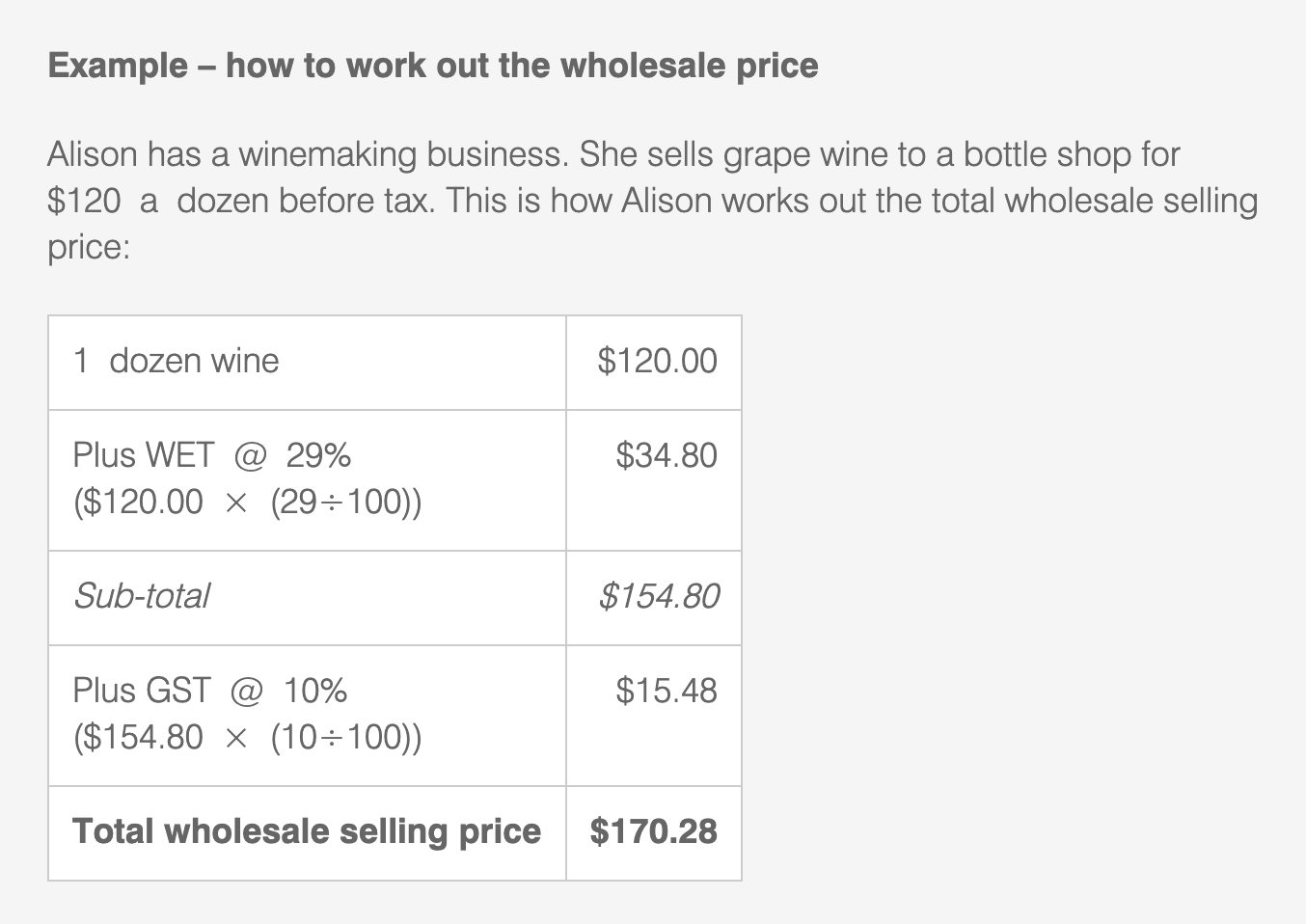

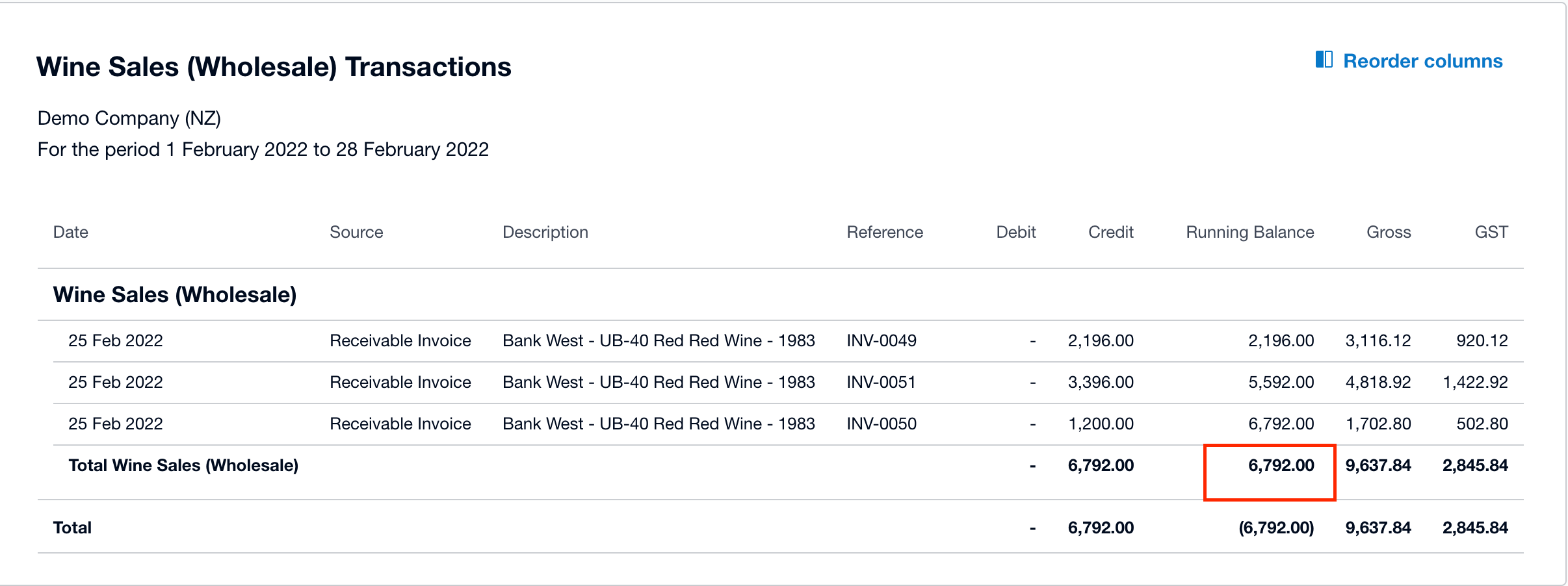

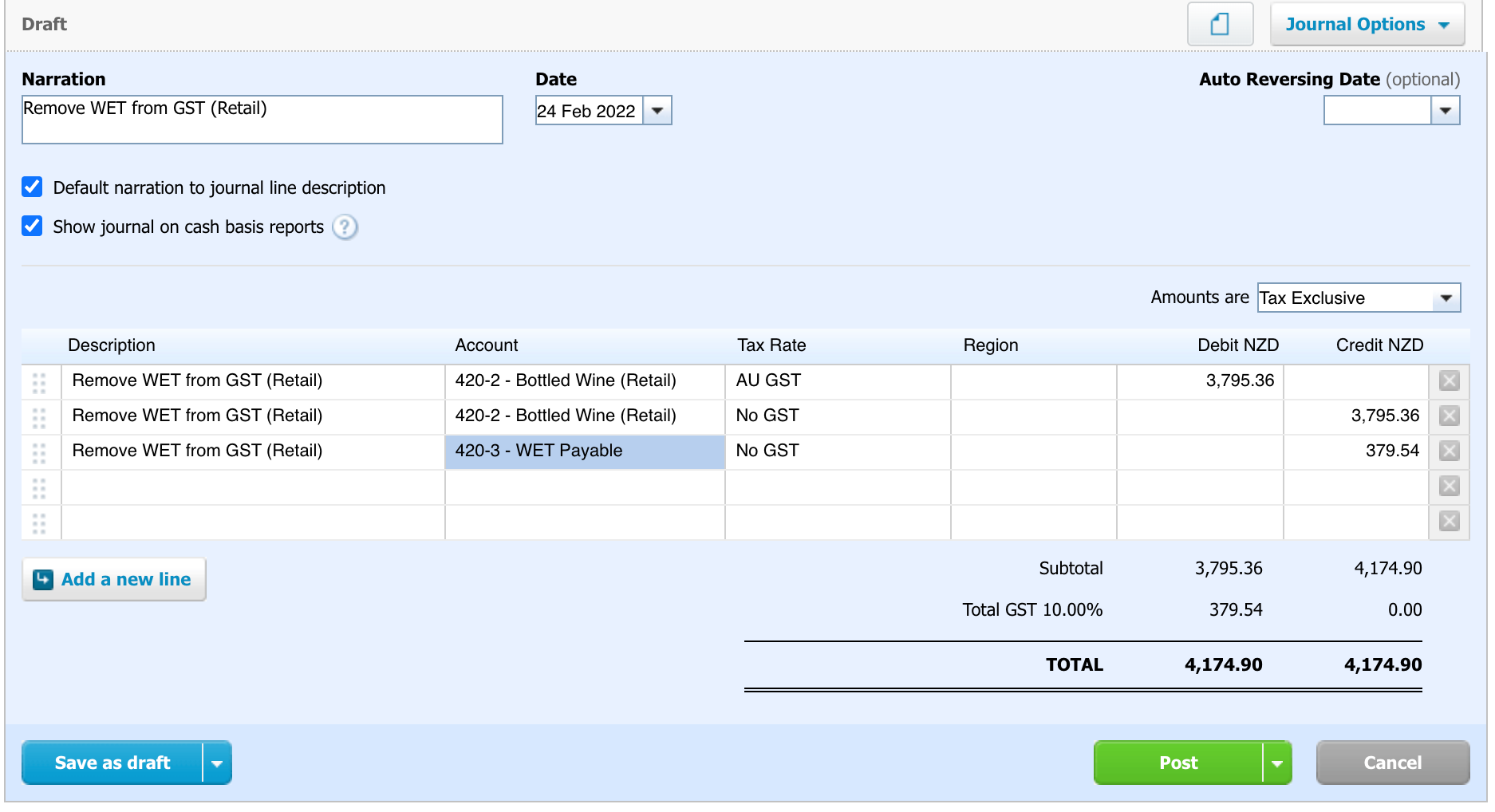

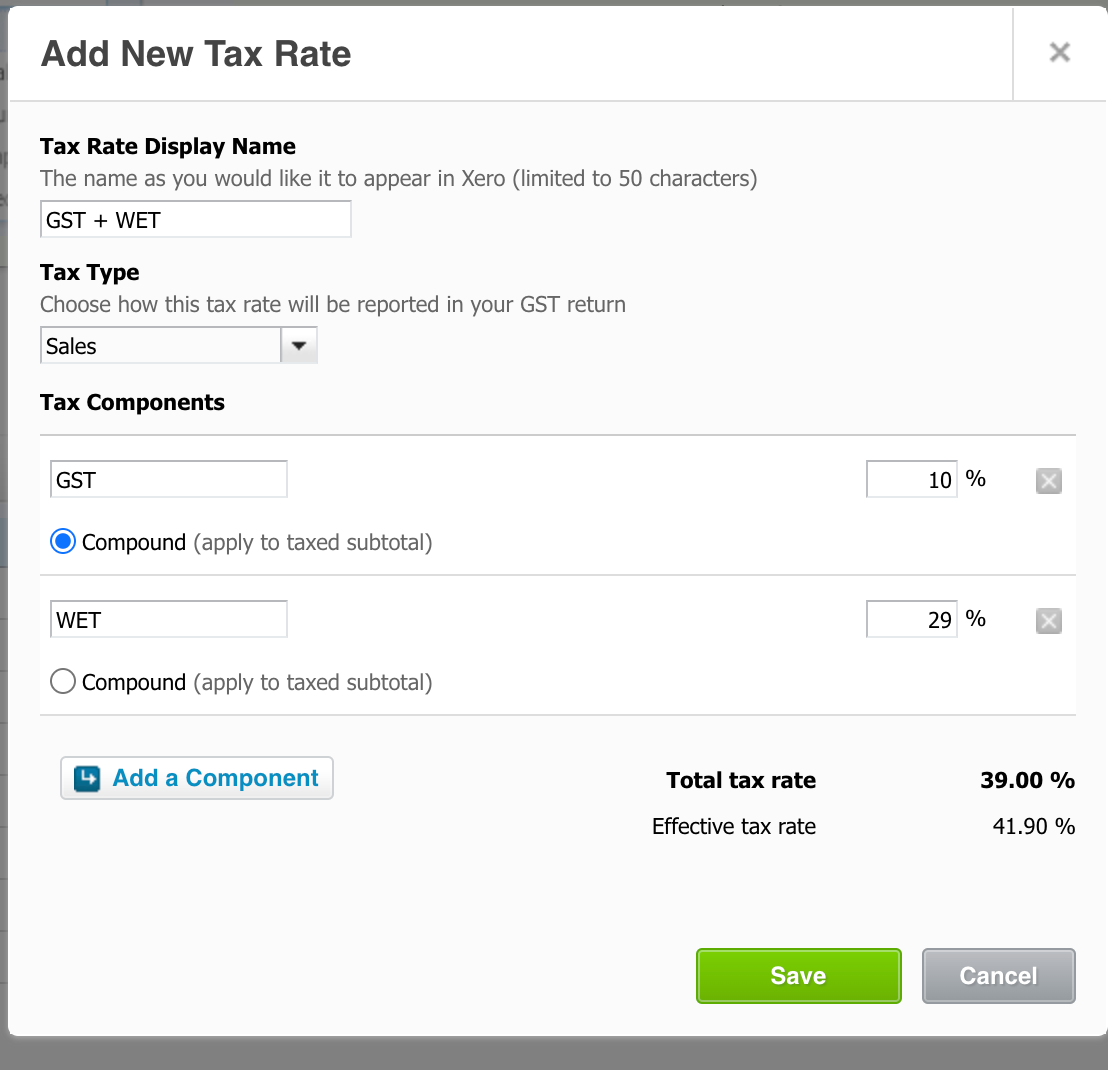

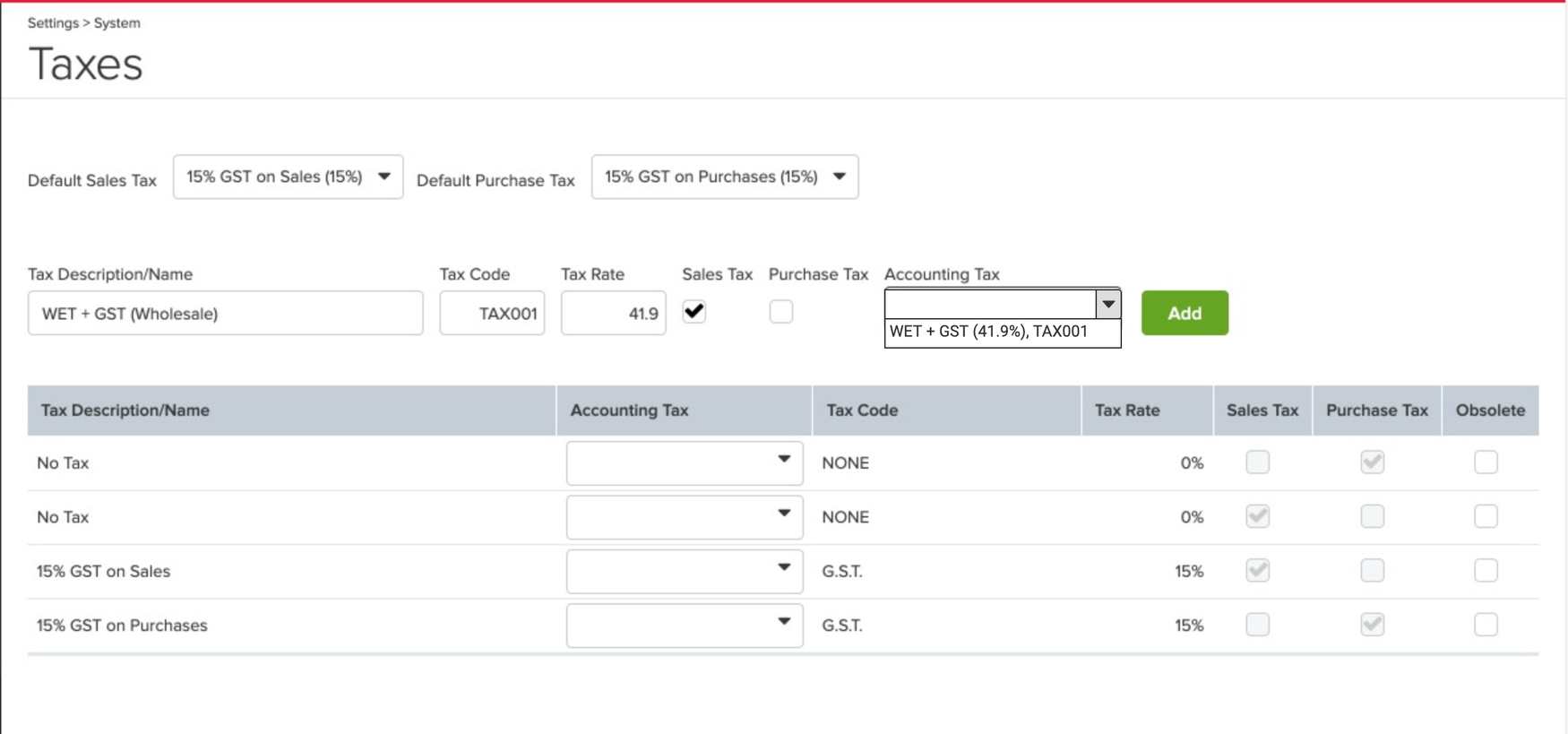

Accounting For Wine Equalisation Tax WET Xero DEAR DEAR Support

Wine Equalisation Tax WET For Wine Distributors Accounting Software

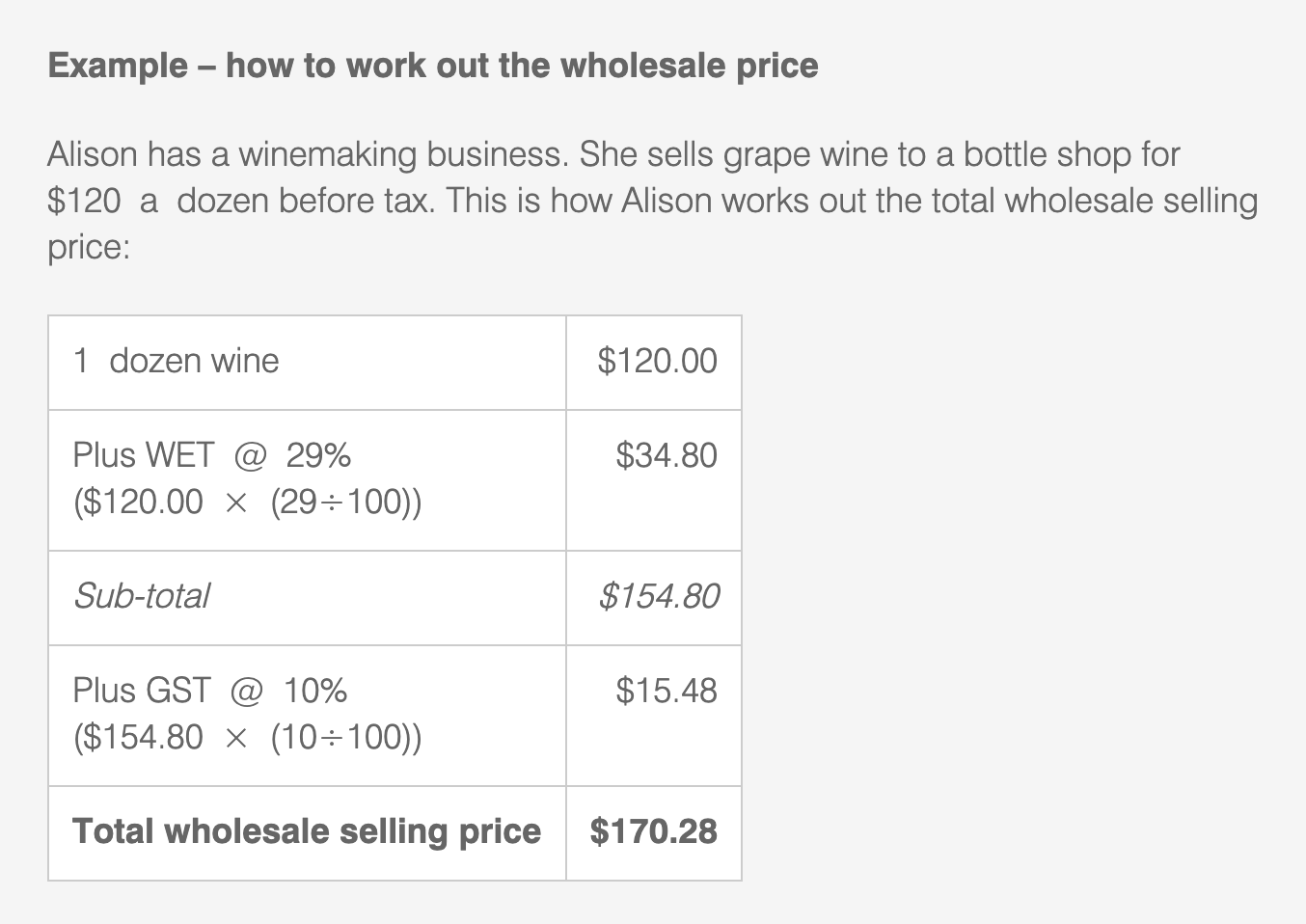

Wine Equalisation Tax Rebate - Web Wine is taxed differently to other alcoholic beverages in Australia It has its own tax the Wine Equalisation Tax WET The WET is imposed at the rate of 29 per cent on the