Wine Equalisation Tax Producer Rebate Web 7 lignes nbsp 0183 32 Calculate and claim your rebate You calculate your wine producer rebate

Web 1 juil 2018 nbsp 0183 32 the producer rebate cap for each financial year is 350 000 reduced from 500 000 tightened eligibility criteria for the producer rebate apply to all wines there Web WET is a value based tax which generally applies to the last wholesale sale of wine in Australia If an entity makes or imports wine for consumption in Australia or sells wine

Wine Equalisation Tax Producer Rebate

Wine Equalisation Tax Producer Rebate

https://www.goodfruitandvegetables.com.au/images/transform/v1/crop/frm/DQPpmhQKY4q83RFKYAWNAF/599890e5-972d-4a8b-a125-e3691caa6cde.JPG/r0_117_2288_1404_w1200_h678_fmax.jpg

Wine Equalisation Tax Issue The Seller Community

https://www.sellercommunity.com/t5/image/serverpage/image-id/34185iF14723C83D55CB24?v=v2

Wine Equalisation Tax Rebate Reform Boon For Local Producers The

https://content.api.news/v3/images/bin/665da7f81f3f297425716d7b6be1cd03

Web from 1 July 2017 reduce the WET rebate cap from 500 000 to 350 000 and from 1 July 2018 to 290 000 and from 1 July 2019 apply tightened eligibility criteria where a wine Web Wine Equalisation Tax WET Information The Wine Equalisation Tax WET legislation changes were agreed by the Australian Parliament on 17 August 2017 and are now law known as the Treasury Laws Amendment

Web products subject to wine equalisation tax WET whether they are sold by wholesale retail or wine applied to own use such as wine used for tastings or promotions The rebate is Web the producer rebate is for wine produced in New Zealand and which is subject to a dealing in australia on which wet is paid the producer rebate scheme entitles you to a rebate of

Download Wine Equalisation Tax Producer Rebate

More picture related to Wine Equalisation Tax Producer Rebate

Wine Equalisation Tax Rebate Loophole to Be Closed Tony Pasin

https://content.api.news/v3/images/bin/6b9c132d05375236968bca29f7bb52f9

Wine Equalisation Tax Rebate A Rort

https://media.licdn.com/dms/image/C4E12AQEaFIdm5ziT3g/article-cover_image-shrink_600_2000/0/1520058131087?e=2147483647&v=beta&t=JgG8WcCZedwyAHLChP3clXj64yUiY0nFDRUSesS3Y14

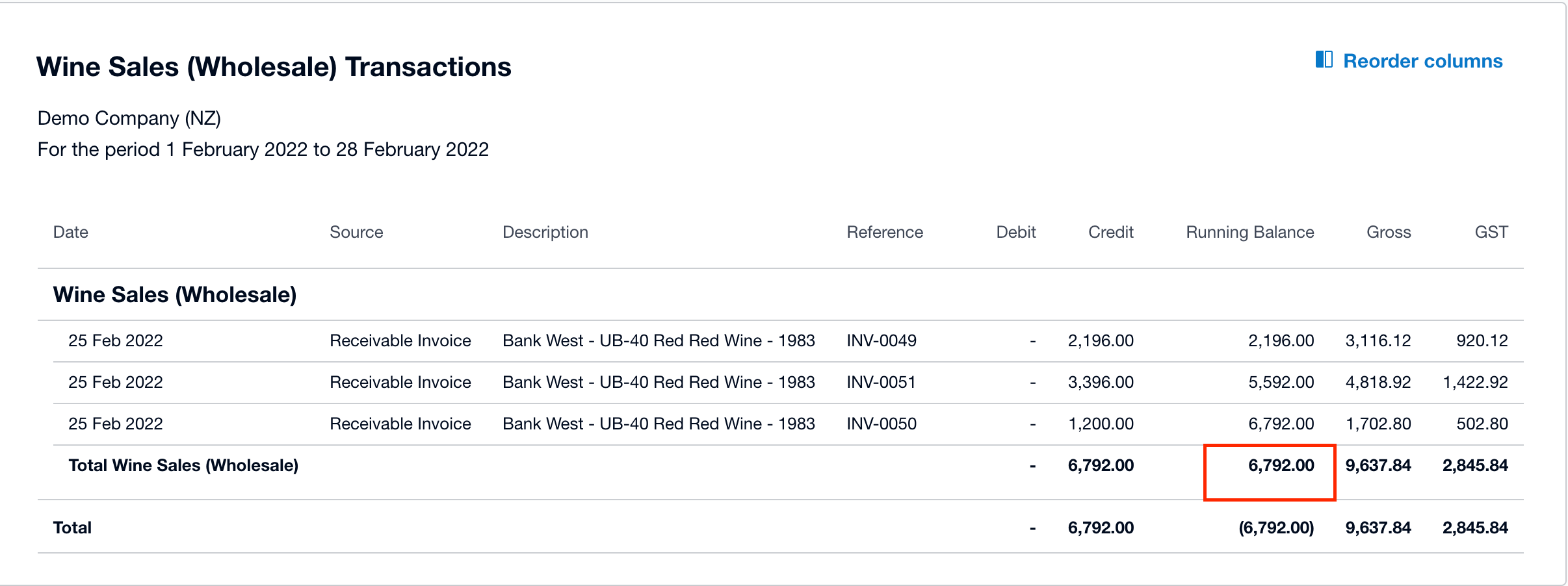

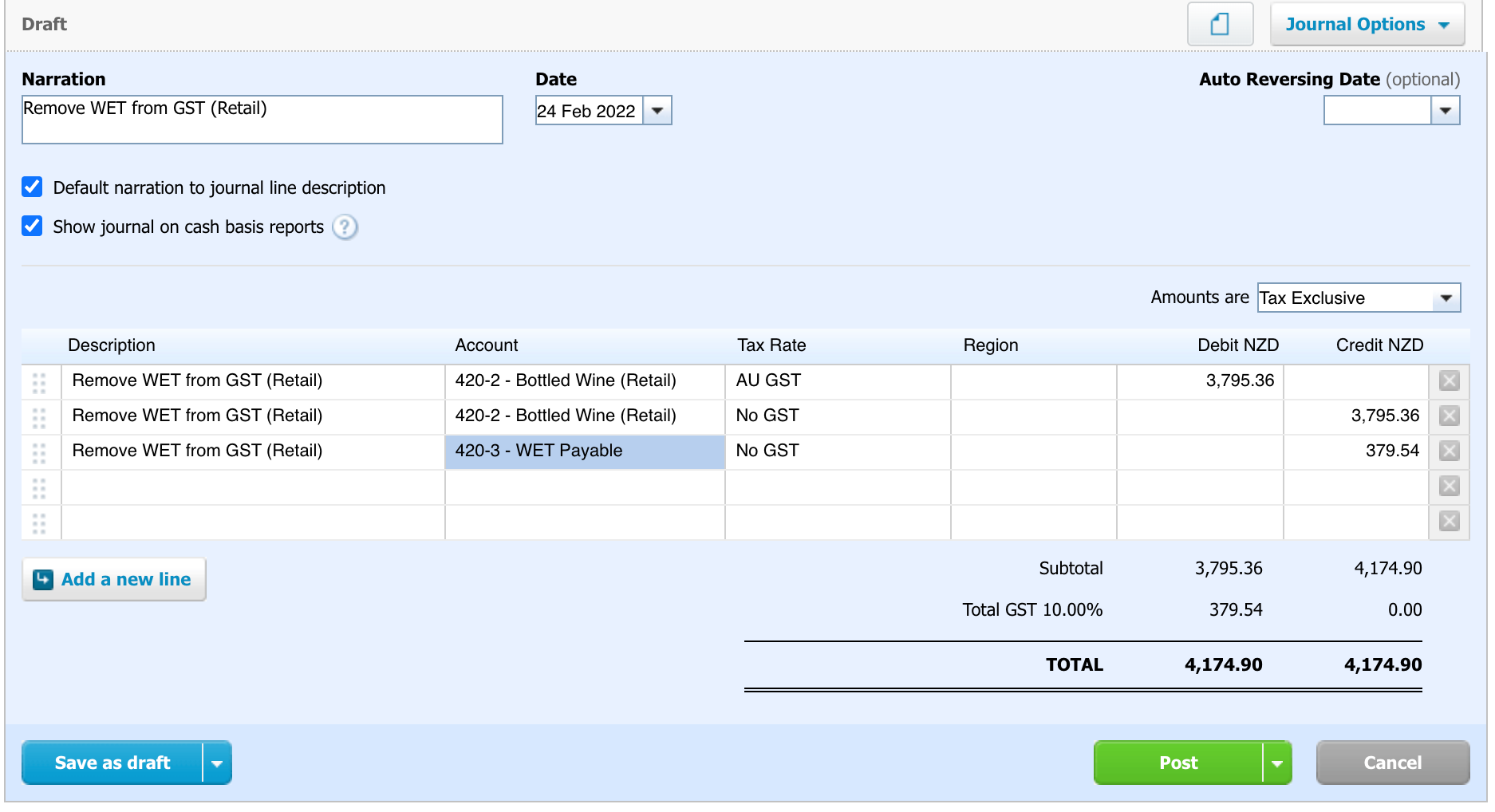

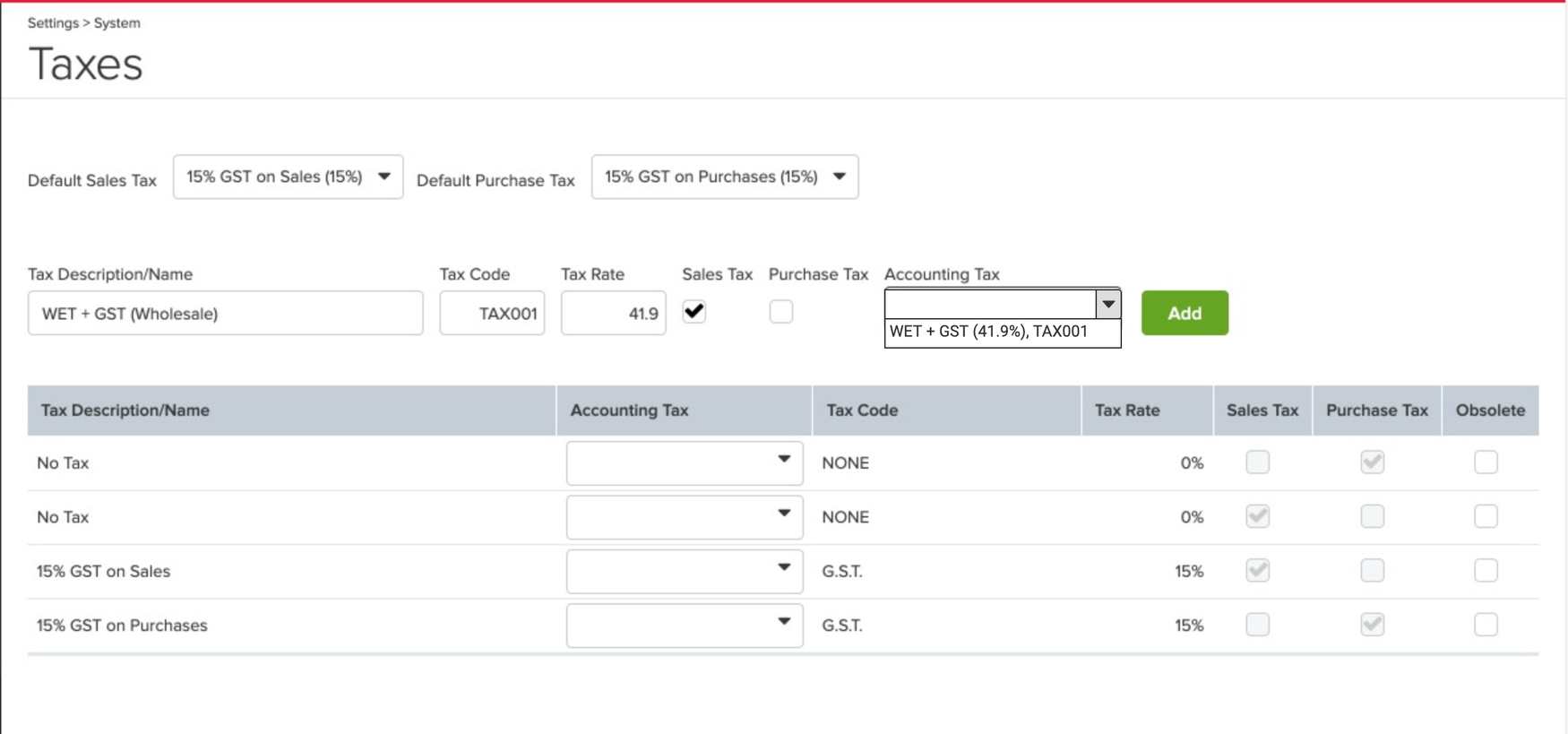

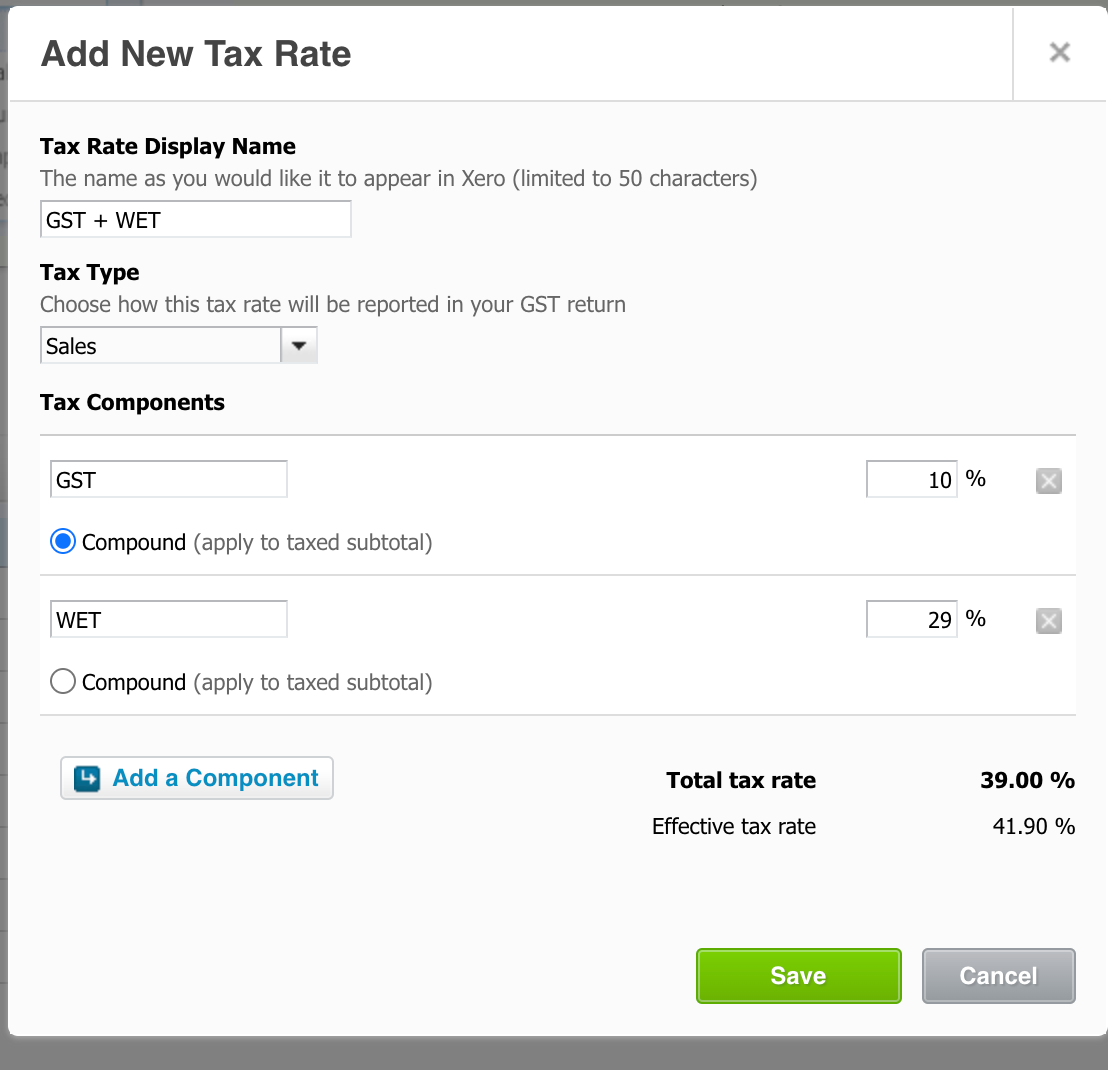

Wine Equalisation Tax WET Unleashed Support

https://support.unleashedsoftware.com/hc/article_attachments/4834051447833/blobid0.png

Web by the cap reduction as around nine out of 10 wine equalisation tax credit claimants claim less than 350 000 per year How do the changes better target support to small wine Web are entitled to the wine producer rebate You are not entitled to claim a WET credit for wine you have bought for a price that includes WET unless you have a WET liability for a

Web 11 mai 2021 nbsp 0183 32 The ATO allows wine producers to claim a wine equalisation tax rebate or tax credit on the amount they have paid on a wine dealing or the amount of WET they would have paid on the Web 1 Executive Summary On 5 May 2015 the Assistant Treasurer announced the release of a discussion paper on the wine equalisation tax rebate WET rebate This discussion

Wine Equalisation Tax Gap 2018 19 Australian Taxation Office

https://sig.ato.gov.au/uploadedImages/Content/CR/Images/Tax_Gap/2018-2019/WET_gap_graphs_Fig3.png?n=4660

Wine Equalisation Tax Rebate Reform Boon For Local Producers The

https://content.api.news/v3/images/bin/afa95e6b3483611c1bc582834fca2ca1

https://www.ato.gov.au/Business/Wine-equalisation-tax/Producer-rebat…

Web 7 lignes nbsp 0183 32 Calculate and claim your rebate You calculate your wine producer rebate

https://www.ato.gov.au/Business/Wine-equalisation-tax

Web 1 juil 2018 nbsp 0183 32 the producer rebate cap for each financial year is 350 000 reduced from 500 000 tightened eligibility criteria for the producer rebate apply to all wines there

Tackling WET Concerns Stock Journal South Australia

Wine Equalisation Tax Gap 2018 19 Australian Taxation Office

Wine Equalisation Tax WET Unleashed Support

Wine Equalisation Tax Rebate Concern On Rise As Survey Finds Growing

Wine Equalisation Tax WET Unleashed Support

Wine Equalisation Tax Rebate Reform Boon For Local Producers The

Wine Equalisation Tax Rebate Reform Boon For Local Producers The

Wine Equalisation Tax Loopholes To Be Closed The Australian

Wine Equalisation Tax WET Unleashed Support

WET Wine Equalisation Tax Explained Knowledge Base Cashflow Manager

Wine Equalisation Tax Producer Rebate - Web products subject to wine equalisation tax WET whether they are sold by wholesale retail or wine applied to own use such as wine used for tastings or promotions The rebate is