Who Pays Wine Equalisation Tax Wine equalisation tax WET is a tax imposed on wine made imported or sold by wholesale in Australia It is applied at 29 of the wholesale value of wine

Verkko 31 hein 228 k 2023 nbsp 0183 32 Wine equalisation tax or WET is levied at 29 of the wine s wholesale value and in the majority of cases you will only have to pay WET if you Verkko 10 hein 228 k 2019 nbsp 0183 32 When you have to pay WET Explains at what stage you pay wine equalisation tax WET and who doesn t have to pay WET Last updated 10 July

Who Pays Wine Equalisation Tax

Who Pays Wine Equalisation Tax

https://insights.taxinstitute.com.au/hs-fs/hubfs/Imported_Blog_Media/Wineequalisationtax-1024x683.jpg?width=1600&height=1065&name=Wineequalisationtax-1024x683.jpg

Wine Equalisation Tax Understanding The Changes Winetitles

https://winetitles.com.au/wp-content/uploads/2018/07/droplet-drop-liquid-wine-glass-bar-851217-pxhere.com-2.jpg

What s The Wine Equalisation Tax WET Lawpath

https://images.lawpath.com/2019/08/stencil.new-blog-image-2019-08-08T165134.639.jpg

Verkko Contact Us Wine Equalisation Tax WET is a tax on wine levied at 29 of the taxable value of wine The taxing point is the last wholesale sale or a retail sale or application Verkko 3 huhtik 2017 nbsp 0183 32 If you make wine import wine into Australia or sell it by wholesale you ll generally have to account for wine equalisation tax WET WET is a tax of 29 of

Verkko The Wine Equalisation Tax WET legislation changes were agreed by the Australian Parliament on 17 August 2017 and are now law known as the Treasury Laws Amendment 2017 Measure No 4 Act 2017 Verkko Wine equalisation tax WET is a tax based on the value of wine You calculate the amount of WET due and you report and pay that amount through your BAS If you re

Download Who Pays Wine Equalisation Tax

More picture related to Who Pays Wine Equalisation Tax

Is Australian Premium Wine Being Taxed Beyond Return Newcastle

https://butlers.net.au/wp-content/uploads/2018/09/winery.jpg

Wine Equalisation Tax WET For Wine Distributors Accounting Software

https://i.pinimg.com/originals/0a/6e/dc/0a6edcfea3257cc4d25017cbd76e9d46.jpg

Royale Chardonnay Vin De Pays Wine Grape Juice Champagne From The

https://www.kosherwine.co.uk/images/royale-chardonnay-vin-de-pays-p3615-10305_image.jpg

Verkko Wine Equalisation Tax WET is calculated as follows final line CVAL final line Duty line T amp I x WET rate currently 29 WET can be calculated for Nature 10 amp 30 Full Verkko Last updated 7 April 2021 Print or Download On this page Claiming credits Over claimed credits When you are and aren t entitled to a wine equalisation tax WET credit

Verkko 6 toukok 2019 nbsp 0183 32 Since the inception of the Goods amp Services Tax GST in 2000 the government introduced the Wine Equalisation Tax WET to abolish a previous sales Verkko 10 toukok 2023 nbsp 0183 32 Who pays the wine equalisation tax The WET is paid by wine producers who are responsible for calculating and collecting the tax for the ATO

Business Activity Statements What They Are How To Lodge

https://locmansadvisors.com/wp-content/uploads/2021/06/Business-Activity-Statements:-What-They-Are-&-How-To-Lodge.jpg

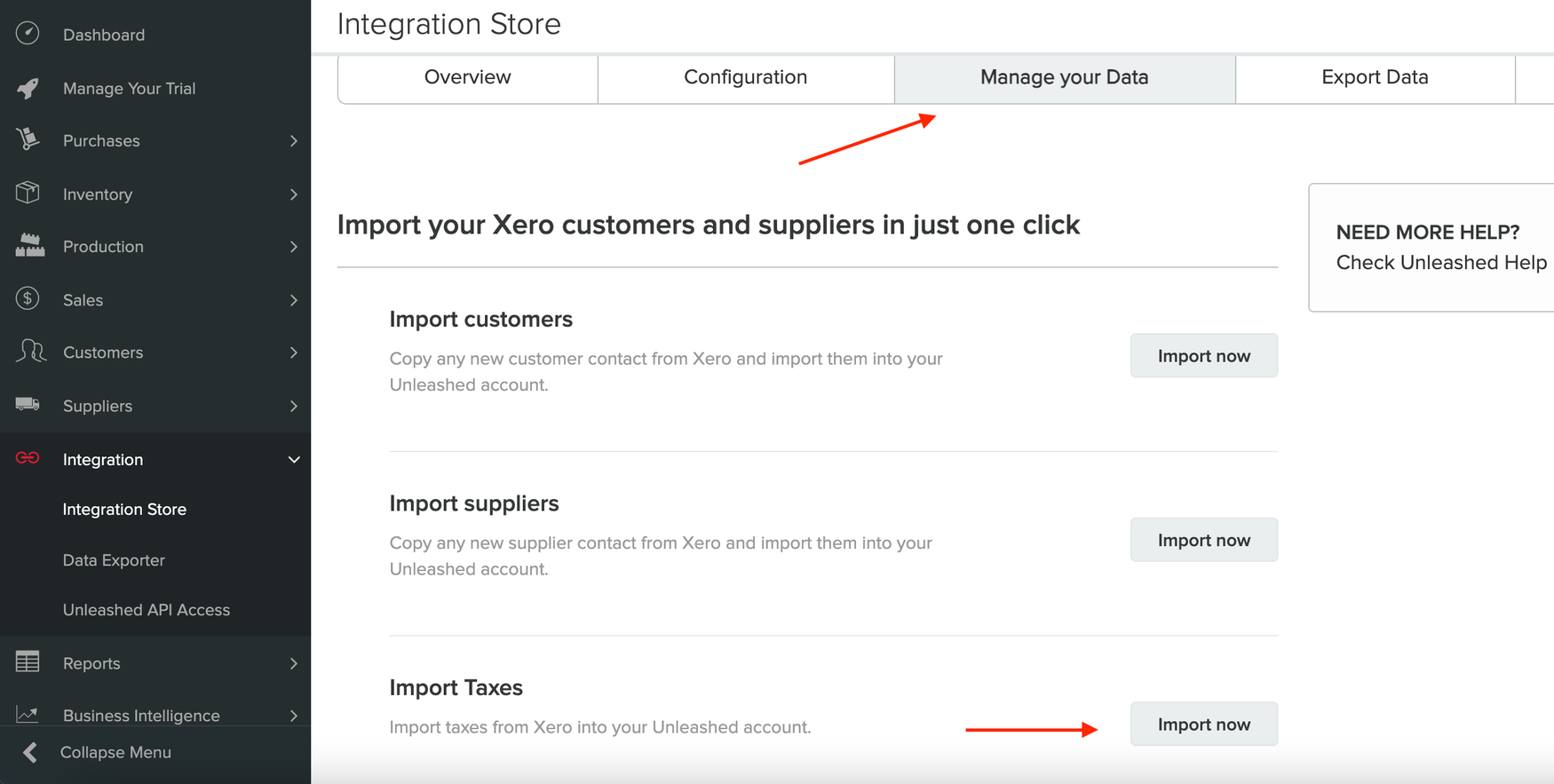

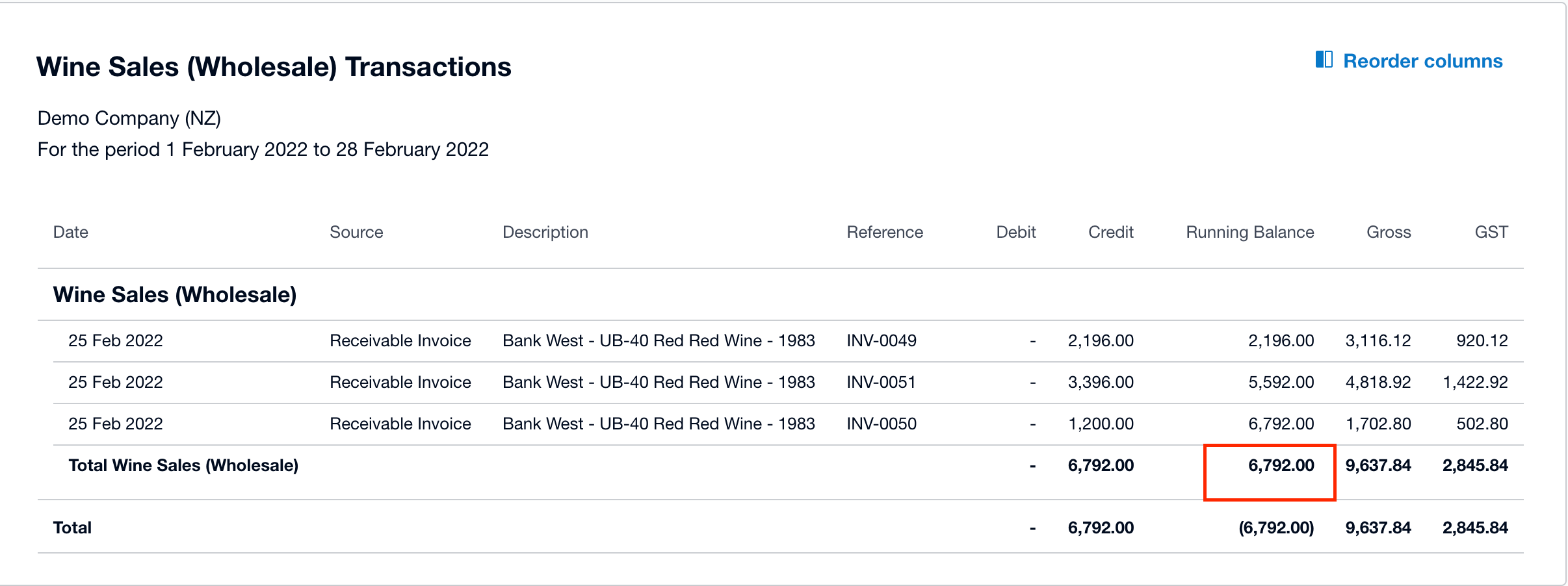

Wine Equalisation Tax WET Unleashed Support

https://support.unleashedsoftware.com/hc/article_attachments/4421011638169/blobid5.png

https://en.wikipedia.org/wiki/Wine_equalisation_tax

Wine equalisation tax WET is a tax imposed on wine made imported or sold by wholesale in Australia It is applied at 29 of the wholesale value of wine

https://cleartax.com.au/tax/specific-taxes-and-levies/wine-tax

Verkko 31 hein 228 k 2023 nbsp 0183 32 Wine equalisation tax or WET is levied at 29 of the wine s wholesale value and in the majority of cases you will only have to pay WET if you

Wine Equalisation Tax WET Unleashed Support

Business Activity Statements What They Are How To Lodge

Wine Equalisation Tax WET Unleashed Support

Vin De Pays Wine Labels And Packaging On Behance Curated By Packaging

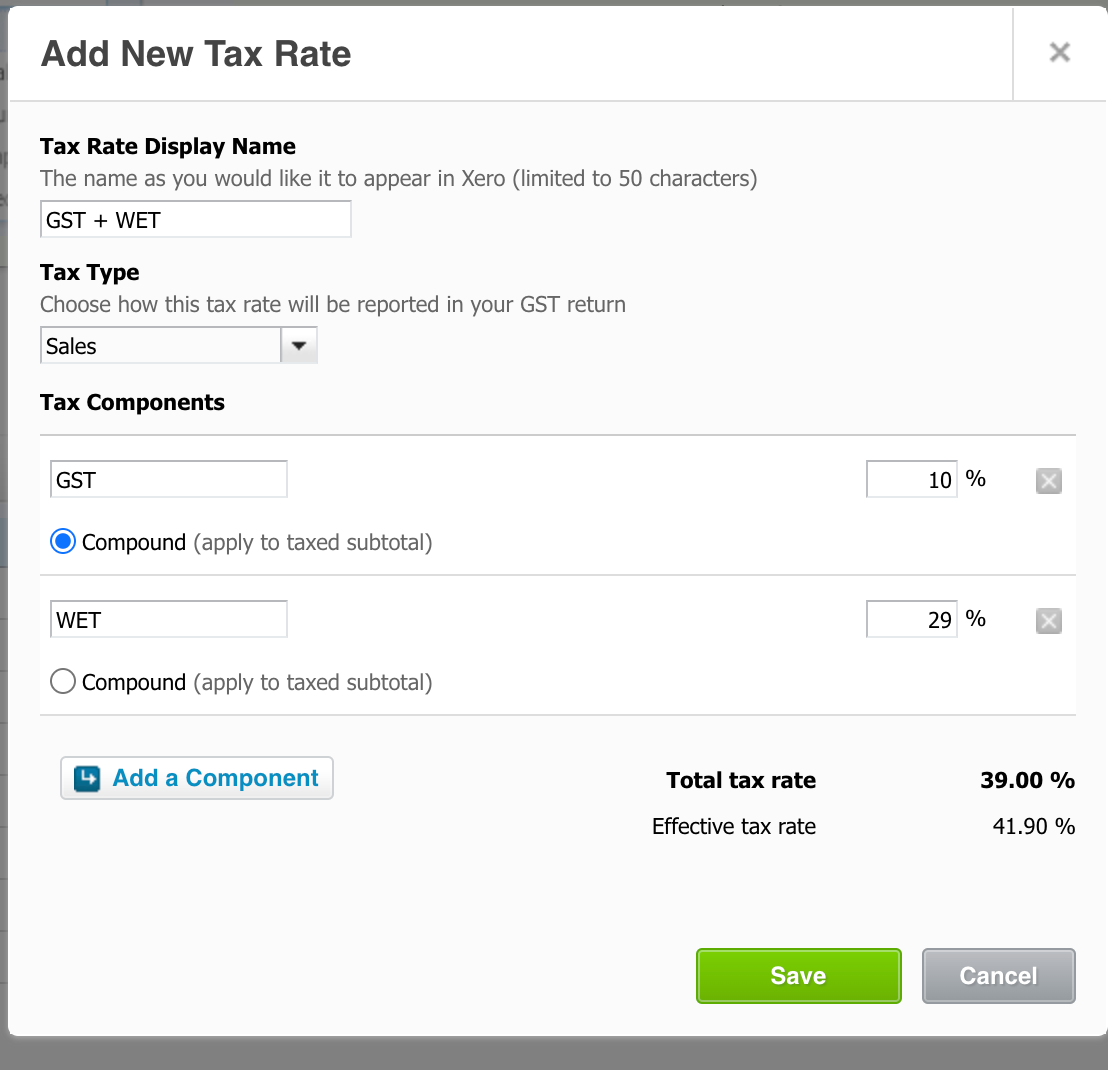

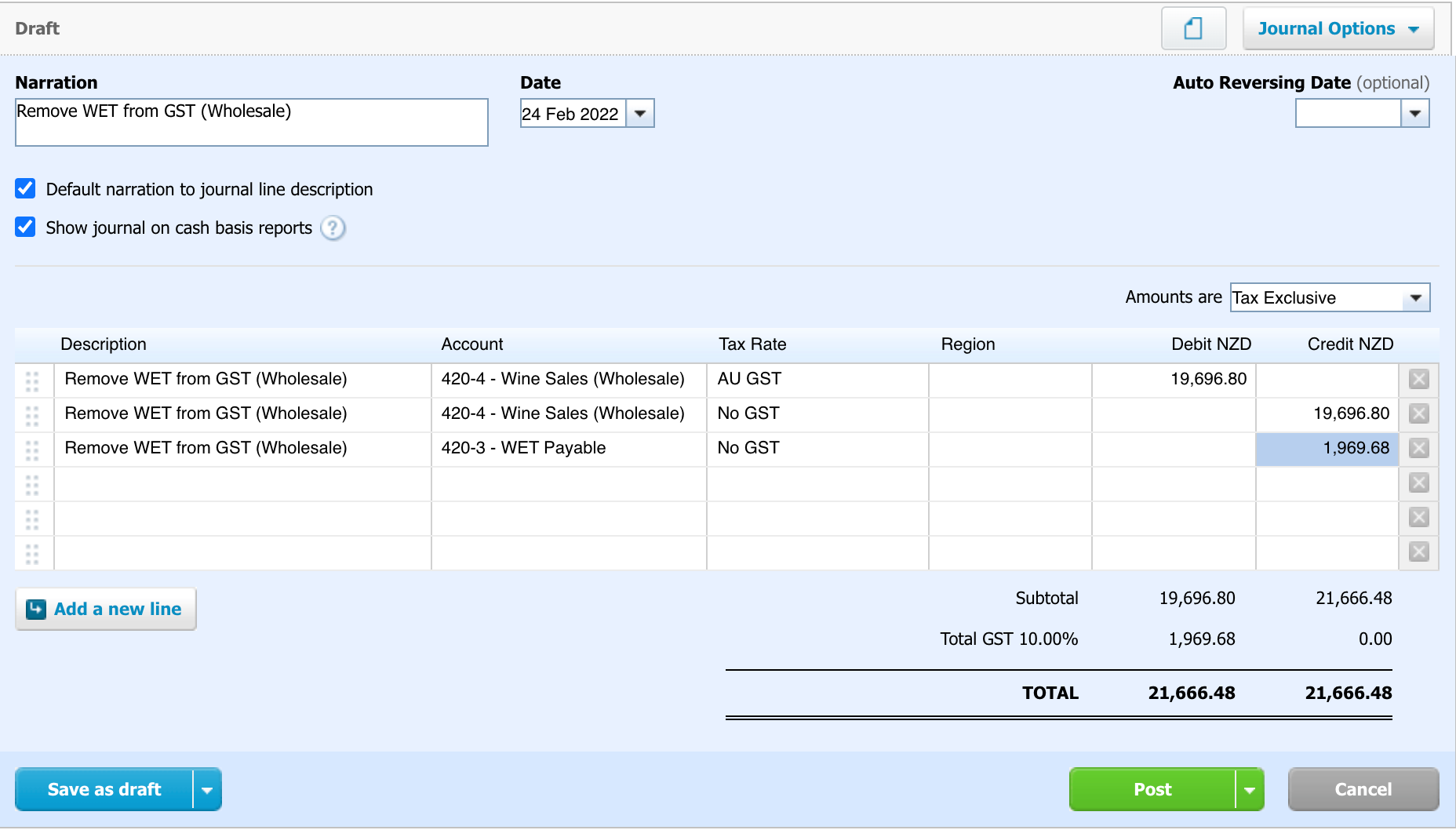

Understanding Tax How To Setup Australian Wine Equalisation Tax Using

6 Google Tax Will Hurt Indian Startups MyOnlineCA

6 Google Tax Will Hurt Indian Startups MyOnlineCA

Royale Merlot Vin De Pays Wine Grape Juice Champagne From The

Wine Equalisation Tax WET Unleashed Support

The Boudas Blog Who Pays The Most Tax In The EU

Who Pays Wine Equalisation Tax - Verkko Description You will generally be required to pay Wine Equalisation Tax WET if you make wine or import wine for consumption in Australia sell wine by wholesale WET