Interest Rebate In Income Tax Web 17 juil 2019 nbsp 0183 32 What is section 80TTA Section 80TTA of the Income Tax Act 1961 provides a deduction on the interest earned on your savings

Web 10 sept 2023 nbsp 0183 32 Soaring interest rates have rekindled Americans penchant for fixed income investments like bonds and money market funds but experts warn that they should be Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue

Interest Rebate In Income Tax

Interest Rebate In Income Tax

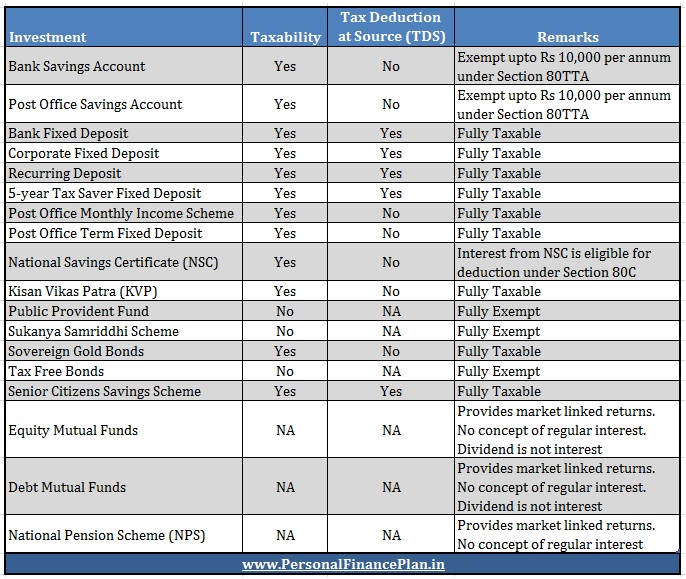

http://www.personalfinanceplan.in/wp-content/uploads/2017/04/20170420-Taxation-of-interest-income-tax.jpg

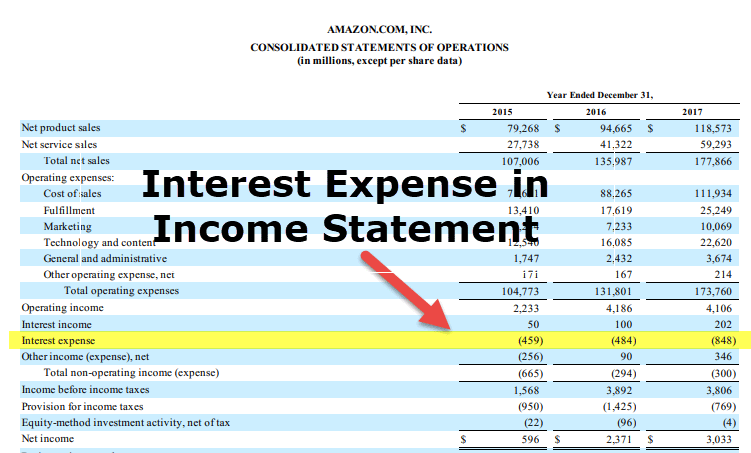

Interest Expense In Income Statement Meaning Journal Entries

https://www.wallstreetmojo.com/wp-content/uploads/2019/01/Interest-Expense-Income-Statement.png

How To Show Interest On NSC In Income Tax Return

https://myinvestmentideas.com/wp-content/uploads/2016/04/how-to-show-nsc-interest-in-income-tax-return-method-1.jpg

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on Web Il y a 1 jour nbsp 0183 32 New Income Tax Act of 2023 replaced the 1984 Ordinance in June It s been praised but there are concerns among finance professionals about compliance The

Download Interest Rebate In Income Tax

More picture related to Interest Rebate In Income Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

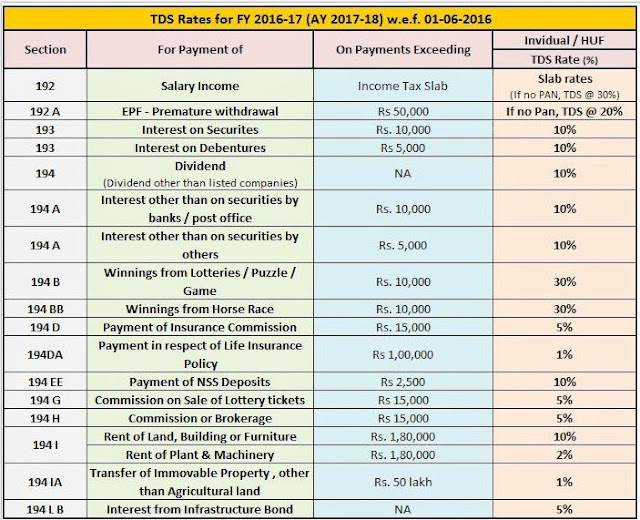

TDS Rates For The Assessment Year 2017 18 FY 2016 17

https://2.bp.blogspot.com/-GIy5mVfJLKg/WHkEOebzrJI/AAAAAAAAFyM/S0xaGkRvXa4QICePG8-h3p7bdvg99XnAgCLcB/s640/Tax-Deducted-at-Source-latest-new-TDS-Rates-Chart-for-FY-2016-17-AY-2017-18-pic.jpg

Web Il y a 1 jour nbsp 0183 32 Let s say individual A is currently in the 24 tax bracket but due to their expense needs in retirement and the amount of taxable income they expect to produce Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Web 22 f 233 vr 2023 nbsp 0183 32 Interest Exemptions Interest from a South African source earned by any natural person is exempt per annum up to an amount of 22 February 2023 No Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

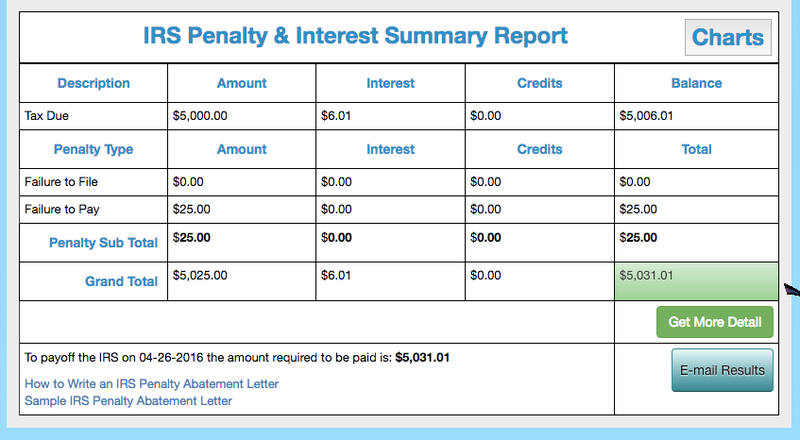

How Do You Calculate The Late Payment Penalty And The Interest On IRS

https://i.kinja-img.com/gawker-media/image/upload/s--pfHNlFAR--/c_scale,fl_progressive,q_80,w_800/ctogci84hf7w8pmrnscy.png

https://tax2win.in/guide/section-80tta

Web 17 juil 2019 nbsp 0183 32 What is section 80TTA Section 80TTA of the Income Tax Act 1961 provides a deduction on the interest earned on your savings

https://www.usatoday.com/story/money/personalfinance/2023/09/10/high...

Web 10 sept 2023 nbsp 0183 32 Soaring interest rates have rekindled Americans penchant for fixed income investments like bonds and money market funds but experts warn that they should be

Tax Rebate For Individual Deductions For Individuals reliefs

2007 Tax Rebate Tax Deduction Rebates

IDR 2020 Interest Rates Standard Deductions And Income Tax Brackets

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

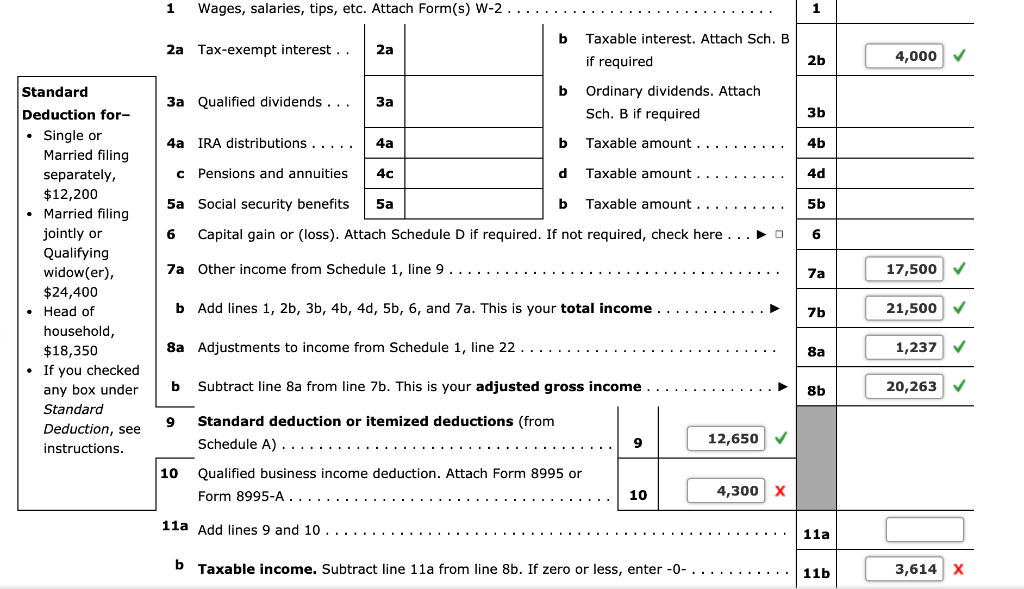

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Interest Rebate In Income Tax - Web Il y a 2 jours nbsp 0183 32 Yet savers in that income group were most likely to be getting higher rates Only 19 of savers with incomes between 80 000 and 99 999 were earning 3 or