Can I Claim Work From Home Expenses Without T2200 To claim the actual expenses you paid for working from your home you must meet all of the following conditions One of the following applies Your employer

The T2200 is not submitted with your return but you re required to keep it in case the CRA asks to see it later You can claim a variety of home office expenses No need to track expenses or obtain Form T2200 Consistent with 2020 employees who use the temporary flat rate method do not need to track expenses perform workspace

Can I Claim Work From Home Expenses Without T2200

Can I Claim Work From Home Expenses Without T2200

https://www.familyfriendlyworking.co.uk/wp-content/uploads/2014/02/Regus_Infographic_Working-from-home.jpg

CRA Updates Form T2200 Eliminates Temporary Flat Rate Method For Home

https://www.talentcanada.ca/wp-content/uploads/2023/01/AdobeStock_370876383_Editorial_Use_Only-2048x1365.jpeg

How To Claim Work From Home Expenses On Your Taxes CB

https://canadianbusiness.com/wp-content/uploads/2022/03/WorkFromHomeTaxes2021-1024x683.png

UPDATE This year CRA is allowing employers to reimburse employees for up to 500 worth of expenses including home office furniture tax free and without Claim home office expenses only and no other employment expenses were not fully reimbursed by their employer for all of their home office expenses The temporary flat

For employees seeking to claim expenses in addition to work from home expenses such as motor vehicle expenses or who are normally required to work from home under their Employees who are required to pay for employment expenses for which they are not reimbursed including home office expenses may be able to claim a deduction

Download Can I Claim Work From Home Expenses Without T2200

More picture related to Can I Claim Work From Home Expenses Without T2200

What Expenses Can I Claim In My Buy To Let BTL Business YouTube

https://i.ytimg.com/vi/6ifyT9Ggx5I/maxresdefault.jpg

CC T2200 And Work from Home Tax Relief YouTube

https://i.ytimg.com/vi/XjPu6qeU8pY/maxresdefault.jpg

Can I Claim Work Pants On Tax A Guide To Deducting Work Clothing

https://shunvogue.com/images/resources/can-i-claim-work-pants-on-tax_20230913002109.webp

A T2200 is a Declaration of Conditions of Employment It is the CRA document that must be signed by your employer that gives you authority to write off any work expense associated with working from If you re an employee who works from home and not due to COVID 19 and hope to deduct work expenses you ll absolutely need your employer to provide Form

If you work from home your employer should provide you with a T2200 that lists expenses both reimbursed to you as taxable and nontaxable as well as any According to the CRA Employees who worked at home in 2023 and meet certain conditions will be eligible to deduct home office expenses including work space in the

T2200 Form 2023 Printable Forms Free Online

https://canadianpayrollservices.com/wp-content/uploads/2022/06/t-2200-snip-new.webp

Expense Claim Form Template Excel Printable Word Searches

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

https://www.canada.ca/en/revenue-agency/services/...

To claim the actual expenses you paid for working from your home you must meet all of the following conditions One of the following applies Your employer

https://financialpost.com/personal-finance/taxes/...

The T2200 is not submitted with your return but you re required to keep it in case the CRA asks to see it later You can claim a variety of home office expenses

Working From Home Tax Deductions In 2022 Wattle Accountants

T2200 Form 2023 Printable Forms Free Online

Capex CPA Online Accounting And Tax Services For Peace Of Mind

Cobb Amos Estate Agents As A Landlord What Expenses Can I Claim

Can I Claim A Workers Compensation Injury If I Work From Home

What Business Expenses Can I Claim As A Limited Company A

What Business Expenses Can I Claim As A Limited Company A

Work From Home Tax Deductions Your Complete FY23 Guide

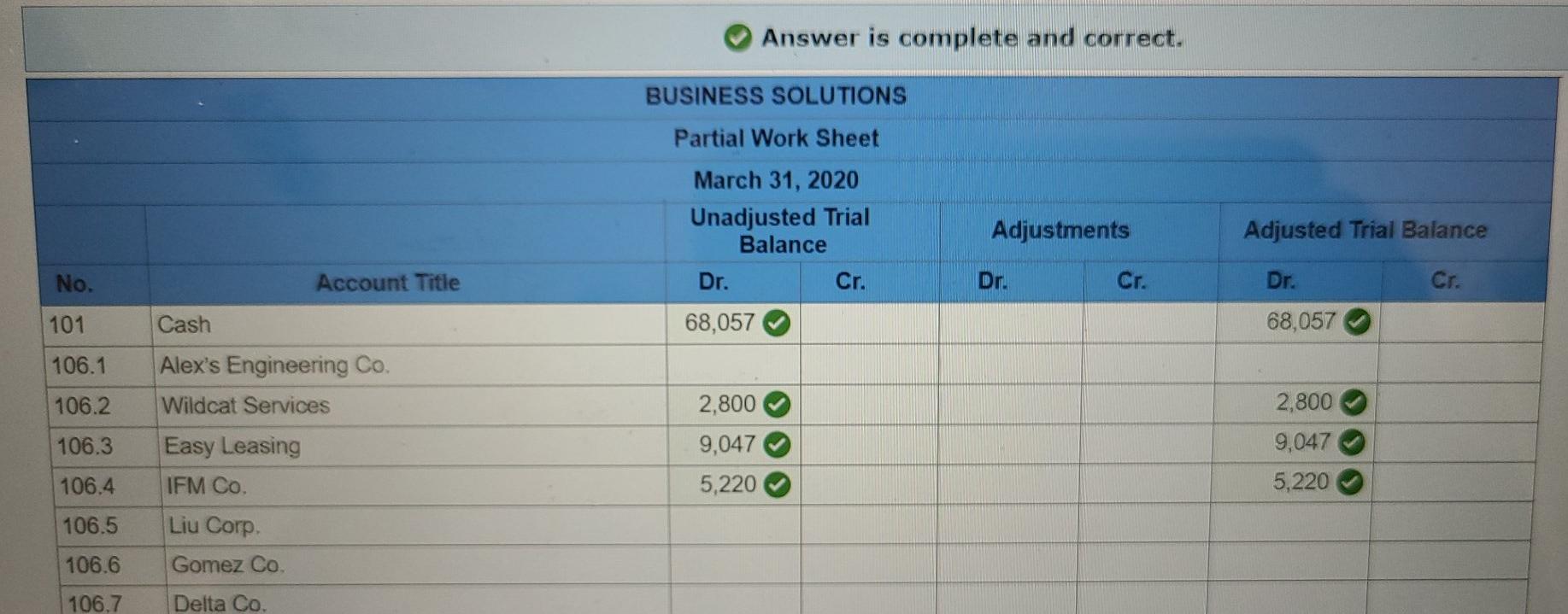

Solved 4 Prepare An Income Statement from The Adjusted Chegg

Steps To Claiming Work From Home Expenses

Can I Claim Work From Home Expenses Without T2200 - If your employees work from home use their cars or otherwise pay for other unreimbursed expenses regularly as part of their job duties If yes then they may be able to deduct