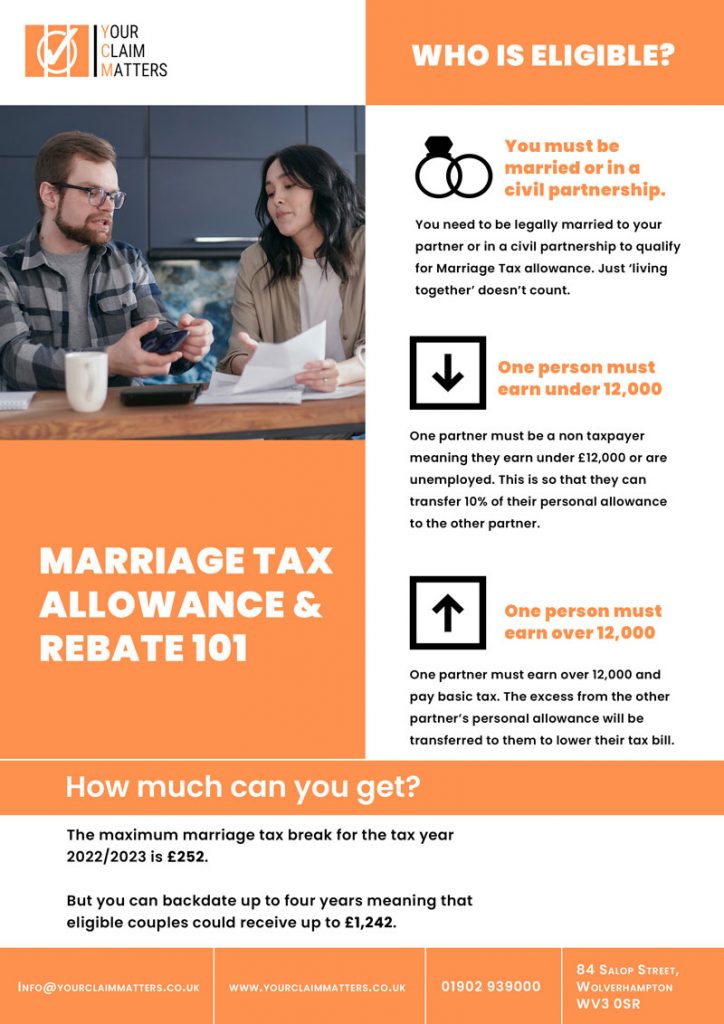

Marriage Allowance Tax Rebate Scotland Web Your partner s income must be between 163 12 571 and 163 50 270 163 43 662 in Scotland for you to be eligible You can backdate your claim to include any tax year since 5 April 2019

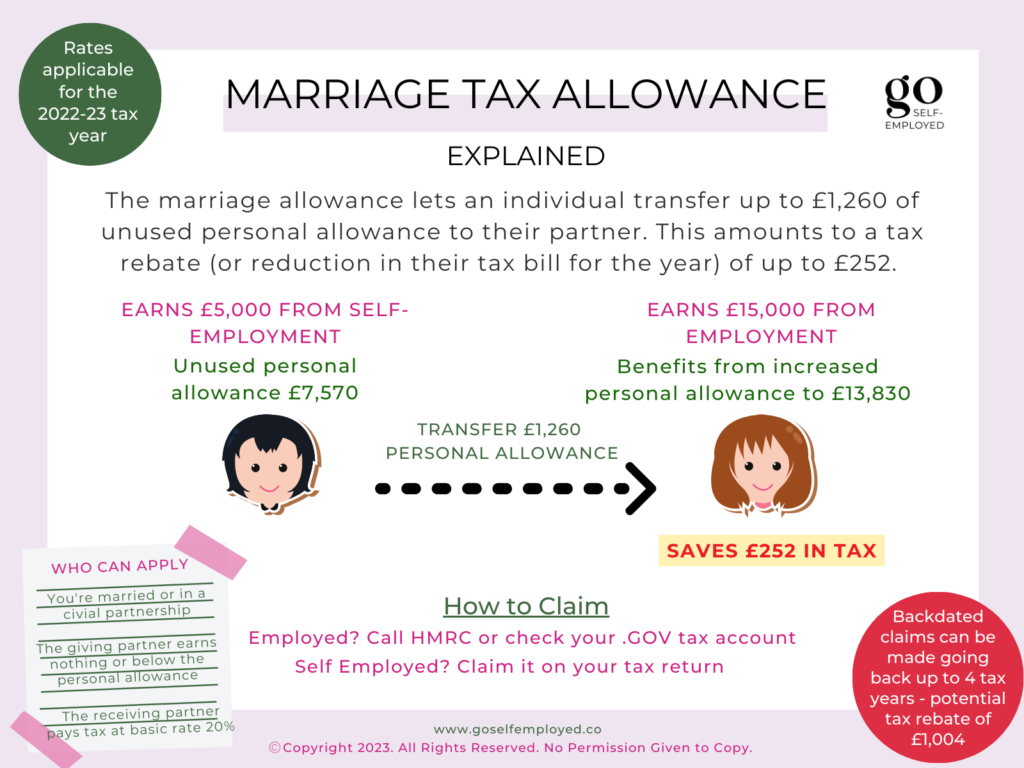

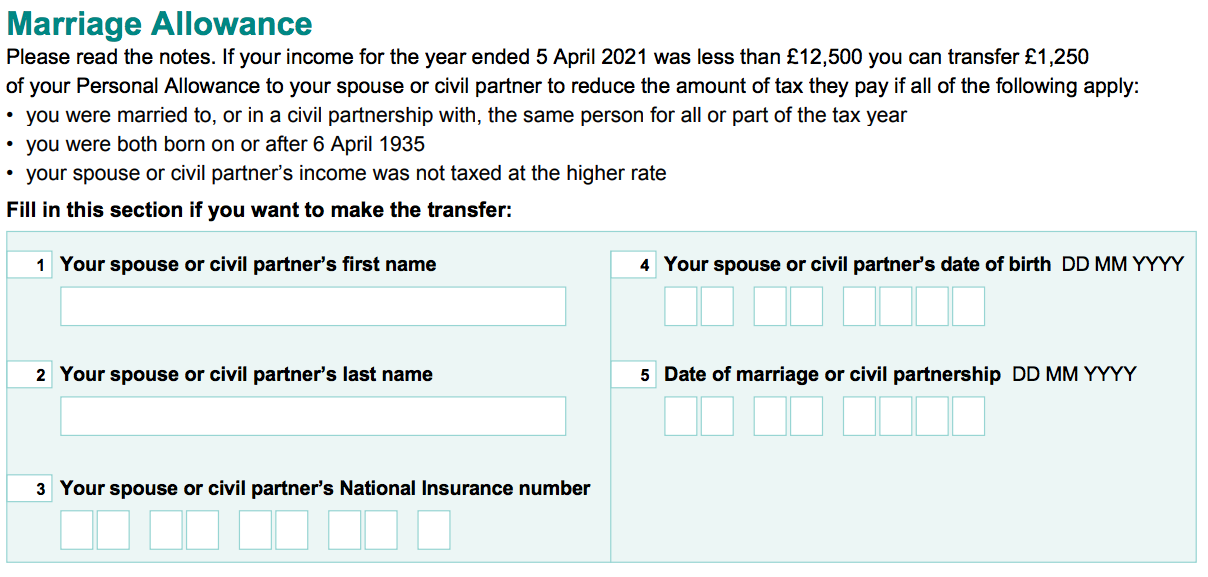

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web How to claim Further information What you ll get Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the 2023 to

Marriage Allowance Tax Rebate Scotland

Marriage Allowance Tax Rebate Scotland

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Marriage Allowance Tax Rebate YouTube

https://i.ytimg.com/vi/mag2FK0B478/maxresdefault.jpg

Web Family Marriage tax allowance Get a tax break worth up to 163 1 250 Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a Web If you re in Scotland your partner must pay the starter basic or intermediate rate which usually means their income is between 163 12 571 and 163 43 662 How to claim Marriage Tax Allowance The non taxpayer

Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should Web 12 janv 2018 nbsp 0183 32 It currently means married couples and those in civil partnerships can reduce their tax bill by up to 163 230 a year which will increase to 163 260 from April this

Download Marriage Allowance Tax Rebate Scotland

More picture related to Marriage Allowance Tax Rebate Scotland

Claim The 220 Transferrable Marriage Allowance Today

https://lewissmith.com/wp-content/uploads/transferrable-marriage-allowance.png

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance.jpeg

Marriage Allowance Transfers Bradley Accounting

https://bradleyaccountingplus.co.uk/wp-content/uploads/2021/09/Marriage-Allowance-768x644.jpg

Web If you re in Scotland your partner must pay the starter basic or intermediate rate which usually means their income is between 163 12 571 and 163 43 662 Marriage Allowance Web Overview Married Couple s Allowance could reduce your tax bill by between 163 401 and 163 1 037 50 a year You can claim Married Couple s Allowance if all the following apply

Web 11 sept 2023 nbsp 0183 32 Money Tax Income tax Updated 13 Apr 2023 Marriage allowance explained Find out about marriage tax allowance what it is how it works and whether Web 8 avr 2021 nbsp 0183 32 It benefits the couple as the person who is earning less than 163 12 500 can transfer 10 of their Personal Allowance to their partner Thus the partner benefits by

Marriage Allowance Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/09/header-2-1024x288.png

Marriage Allowance Are You Paying Too Much Tax Wallis Payroll

https://www.wallispayroll.co.uk/wp-content/uploads/2021/08/Marriage-Register-768x485.jpg

https://www.gov.uk/apply-marriage-allowance

Web Your partner s income must be between 163 12 571 and 163 50 270 163 43 662 in Scotland for you to be eligible You can backdate your claim to include any tax year since 5 April 2019

https://www.litrg.org.uk/.../how-do-i-claim-mar…

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Allowance Tax Rebate In UK EmployeeTax

Marriage Allowance And How You Can Save On Your Tax Bill Joshua Leigh

What Is An SA100 Form Goselfemployed co

Raising Awareness Of Marriage Allowance Tim Loughton MP

Draw Your Signature Marriage Tax Allowance Rebate

Draw Your Signature Marriage Tax Allowance Rebate

Marriage Allowance Tax Advantages For Married Couples

Marriage Tax Allowance Rebate My Tax Ltd

Marriage Allowance Claim Your 252 Tax Rebate

Marriage Allowance Tax Rebate Scotland - Web 6 avr 2023 nbsp 0183 32 Married Couple s Allowance Blind Person s Allowance previous tax years your Personal Allowance if you were born before 6 April 1948 your Personal