Can I Deduct Mileage Driving To Work On My Taxes Driving your vehicle a lot of work can mean a lot of extra miles and added costs Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the mileage deduction can add up to significant tax savings

If you drive 36 000 miles a year with 18 000 miles dedicated to business use you can deduct 50 of your actual expenses If you qualify you can claim this deduction as an employee business expense using Form 2106 And if a mileage reimbursement is treated as taxable income can you claim a tax deduction for it That s a separate question that depends on the type of job you hold In most cases the answer is no but a deduction is available for certain workers

Can I Deduct Mileage Driving To Work On My Taxes

Can I Deduct Mileage Driving To Work On My Taxes

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

Can I Deduct My Gas And Mileage Driving To Work YouTube

https://i.ytimg.com/vi/r_weed6DsPA/maxresdefault.jpg

Can I Deduct Health Insurance Premiums If I m Self Employed The

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=1200%2C800&ssl=1

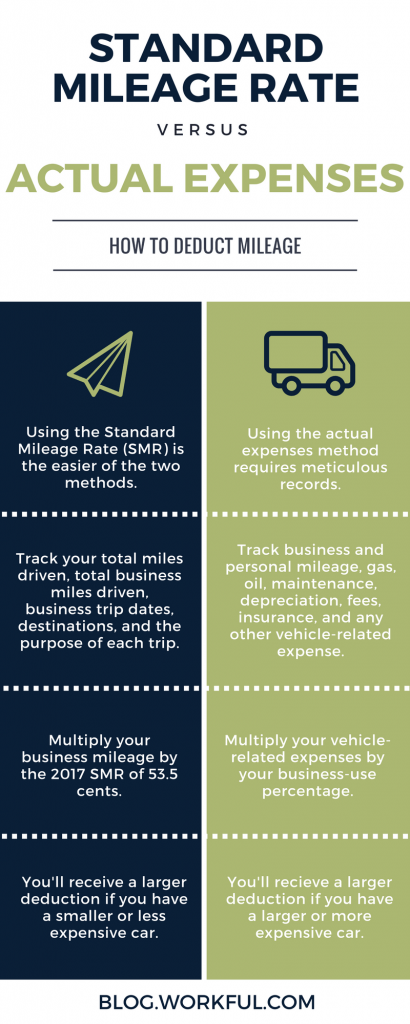

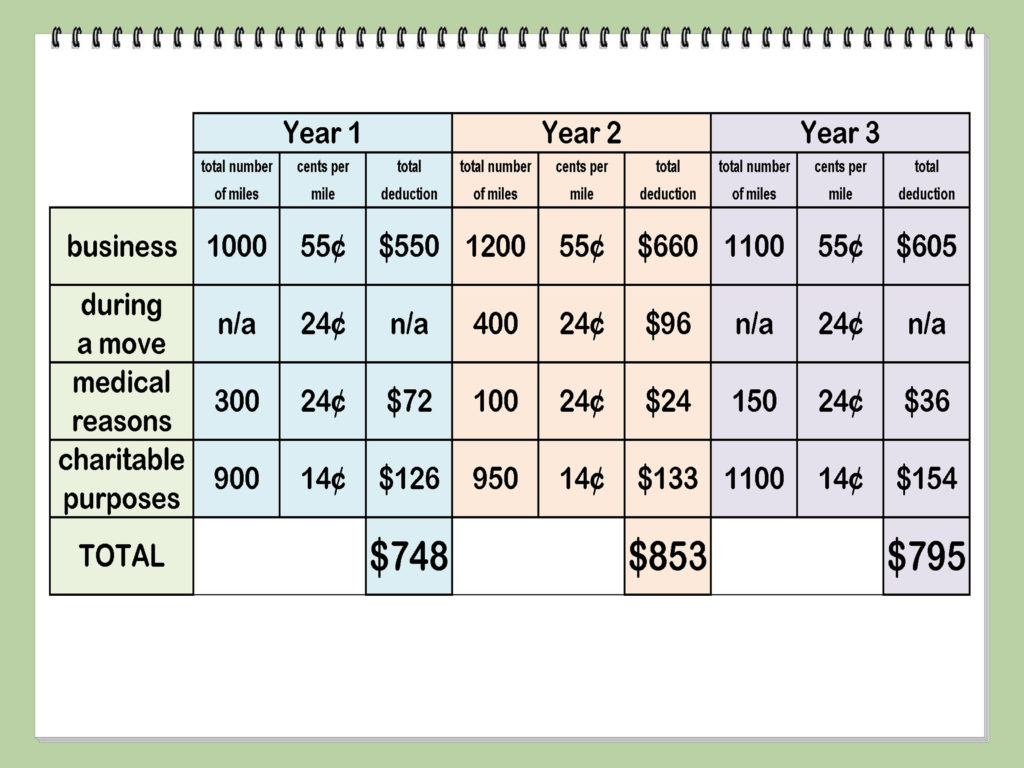

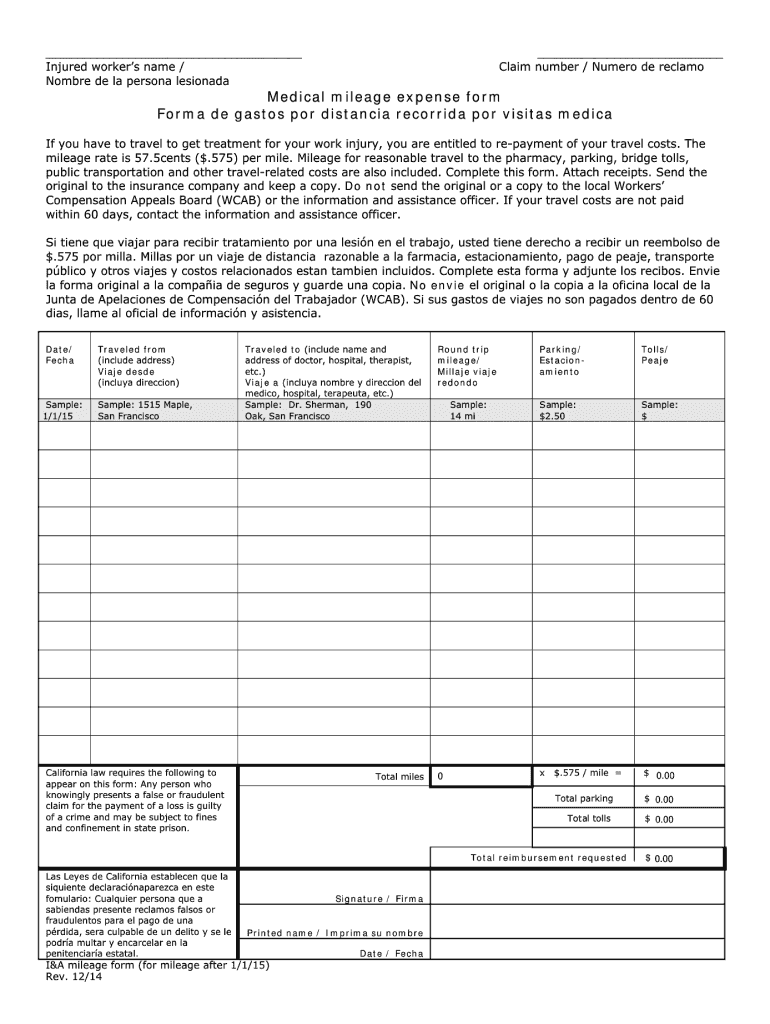

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also allowed Mileage is an allowable deduction if you re self employed or own your own business You can choose between the standard mileage rate or the actual cost method where you keep track of what you paid for gas and maintenance

You can t deduct the costs of taking a bus trolley subway or taxi or of driving a car between your home and your main or regular place of work These costs are personal commuting expenses You can t deduct commuting expenses no matter how far your home is from your regular place of work If you use your own vehicle or vehicles for work you may be able to claim tax relief on the approved mileage rate This covers the cost of owning and running your vehicle You

Download Can I Deduct Mileage Driving To Work On My Taxes

More picture related to Can I Deduct Mileage Driving To Work On My Taxes

When Can You Deduct Mileage Peavy And Associates PC

https://peavyandassociates.com/wp-content/uploads/2022/07/car-773360_640.jpg

Can I Deduct Mileage To And From Work YouTube

https://i.ytimg.com/vi/9zpy0BVnPUw/maxresdefault.jpg

How To Deduct Your Car And Rent On Your Tax Return YouTube

https://i.ytimg.com/vi/4KE5i7T_7-8/maxresdefault.jpg

Deductible travel expenses include Travel by airplane train bus or car between your home and your business destination Fares for taxis or other types of transportation between an airport or train station and a hotel or from a hotel to a work location Certain taxpayers can deduct mileage from vehicle use related to business charity medical or moving purposes To take the deduction taxpayers must meet use requirements and may

Both taxes are based on the net profit of your business which can be reduced by taking a deduction for the use of your car for your business The IRS offers two ways of calculating the cost of using your vehicle in your business The actual expenses method or Standard mileage rate method You can claim a deduction for as many miles as you drive for business purposes without an upper limit as long as they are legitimate business expenses

Business Mileage Deduction 101 How To Calculate For Taxes

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Mileage Deduction Standard Mileage Rate Workful Blog

https://workful.com/blog/wp-content/uploads/2017/12/Mileage-Deduction-410x1024.png

https://www.hrblock.com/tax-center/filing/...

Driving your vehicle a lot of work can mean a lot of extra miles and added costs Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the mileage deduction can add up to significant tax savings

https://www.thebalancemoney.com/mileage-deduction...

If you drive 36 000 miles a year with 18 000 miles dedicated to business use you can deduct 50 of your actual expenses If you qualify you can claim this deduction as an employee business expense using Form 2106

Solved How Much Can She Deduct Were You Being A Tax Professional

Business Mileage Deduction 101 How To Calculate For Taxes

The Deductions You Can Claim Hra Tax Vrogue

Government Mileage Calculator IRS Mileage Rate 2021

Can I Deduct Tolls Mileage For My Job On My Taxes Sapling

Can I Deduct My Tax prep Fees Fox Business

Can I Deduct My Tax prep Fees Fox Business

When Can I Deduct Mileage On My Taxes Sapling

Mileage Form 2021 IRS Mileage Rate 2021

Can I Deduct Mileage As An Employee On My Taxes Foxxfinance

Can I Deduct Mileage Driving To Work On My Taxes - If you use your own vehicle or vehicles for work you may be able to claim tax relief on the approved mileage rate This covers the cost of owning and running your vehicle You