Can I Deduct Private School Tuition Paid For My Child Withdrawals made for private school tuition are tax free on a federal level but you should note that states actually oversee 529 plans

Have you been asking yourself is private school tuition tax deductible The good news is that it may be possible to lower education costs by using tuition tax breaks Even if the money comes out of your pocket at first Private school tuition payments cannot be deducted from your federal taxes The federal government does not provide a tax credit for parents who pay for private school tuition Tax credits are important because they reduce your tax liability

Can I Deduct Private School Tuition Paid For My Child

Can I Deduct Private School Tuition Paid For My Child

https://amynorthardcpa.com/wp-content/uploads/2023/10/Can-I-Deduct-Preschool-Tuition-FB.png

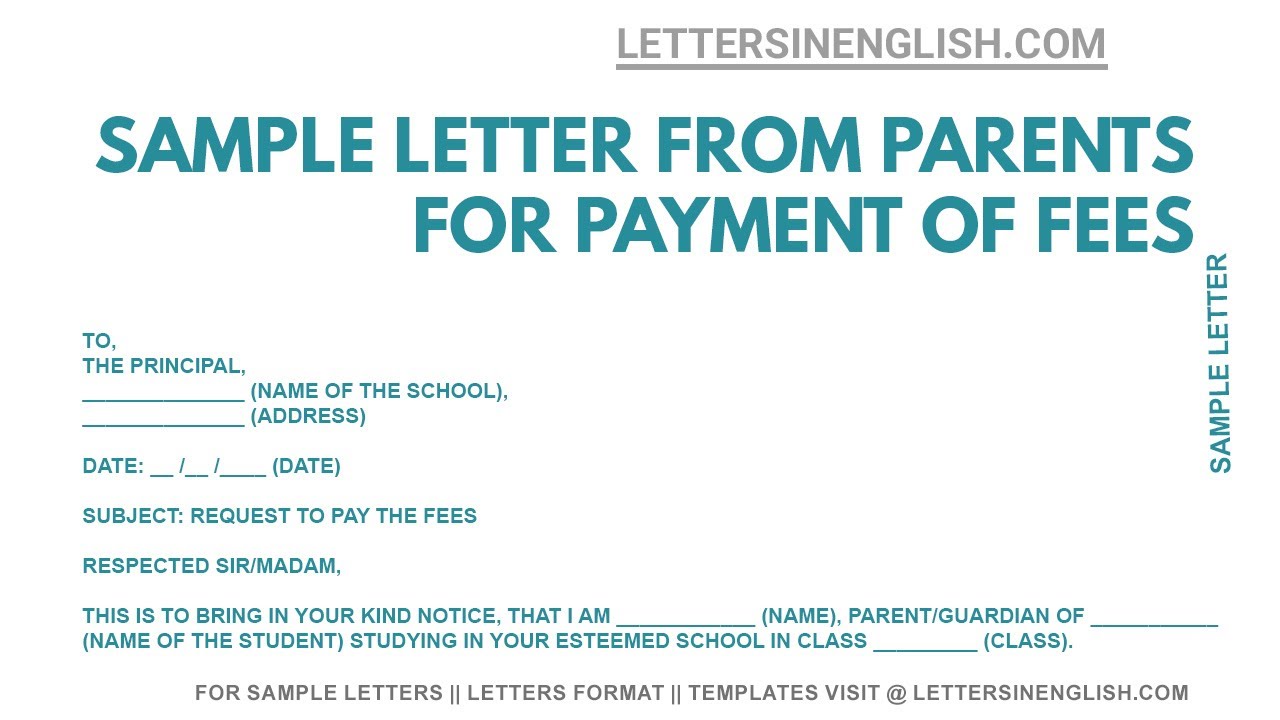

Request Letter From Parents For Payment Of Fees School Fees Payment

https://i.ytimg.com/vi/MZI_MAmpzbc/maxresdefault.jpg

Teachers Paying For School Supplies Out Of Pocket Could Deduct More

https://www.gannett-cdn.com/presto/2022/07/14/USAT/ee71d84a-4e25-4c7c-b6fa-ca3aac1d23e1-classroom.jpg?crop=5999,3374,x0,y305&width=3200&height=1800&format=pjpg&auto=webp

If your child attends a K 12 private school there is no federal tax deduction or credit you qualify for that will help pay for tuition not even school uniforms However once your child graduates and attends a college you re paying for If your child is attending a private K 12 school because they have special education needs you may be able to get a tax break on the tuition The deduction requires a

Private school tuition is not deductible for federal income tax purposes tax breaks for private and parochial school may be available on a state by state basis While private school tuition for children in kindergarten or above is not deductible under the childcare tax credit before and after school programs qualify regardless of grade level Know that special needs private school

Download Can I Deduct Private School Tuition Paid For My Child

More picture related to Can I Deduct Private School Tuition Paid For My Child

What Is The Hardest Private School To Get Into

https://www.privateschoolconsultant.net/img/44b873636dc5d98c274da60b1bb6a08a.jpg?01

.jpg)

Tuition And Fees Edgewood Campus School

https://www.edgewoodk8.org/editoruploads/images/285250839_390588799756551_4636519693207824460_n(2).jpg

Can I Deduct College Tuition And Fees YouTube

https://i.ytimg.com/vi/D4RciqdSY3Y/maxresdefault.jpg

Some states do offer families tax relief for K 12 private school expenses Alabama Illinois Indiana Iowa Louisiana Minnesota Ohio South Carolina and Wisconsin offer private school choice programs known as Private school tuition isn t a direct deduction that you can take on your taxes Here are other related ways you could lower your tax liability

The IRS offers two types of education tax credits to offset tuition and fees you have paid You can claim either the American opportunity tax credit or the lifetime learning credit Information about Form 8917 Tuition and Fees Deduction including recent updates related forms and instructions on how to file Form 8917 is used to figure and take

Is Private School Tuition Tax Deductible Not Always And Here s Why

https://media.marketrealist.com/brand-img/yEWNcx8db/1280x670/private-school-tuition-taxes-1666812809602.jpg

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

https://www.forbes.com/sites/robertfarrington/2021/...

Withdrawals made for private school tuition are tax free on a federal level but you should note that states actually oversee 529 plans

https://www.sofi.com/learn/content/tuitio…

Have you been asking yourself is private school tuition tax deductible The good news is that it may be possible to lower education costs by using tuition tax breaks Even if the money comes out of your pocket at first

Teachers Can Now Deduct More On Taxes For Buying School Supplies After

Is Private School Tuition Tax Deductible Not Always And Here s Why

Is Private School Tuition Tax Deductible Not Always And Here s Why

I Was In School This Year Can I Deduct Those Expenses File It Inc

Can I Deduct My Child s College Tuition Cost JacAnswers

Back To School Myths You Can Deduct Private School Tuition On Your Taxes

Back To School Myths You Can Deduct Private School Tuition On Your Taxes

Tuition Wiseowl Academy

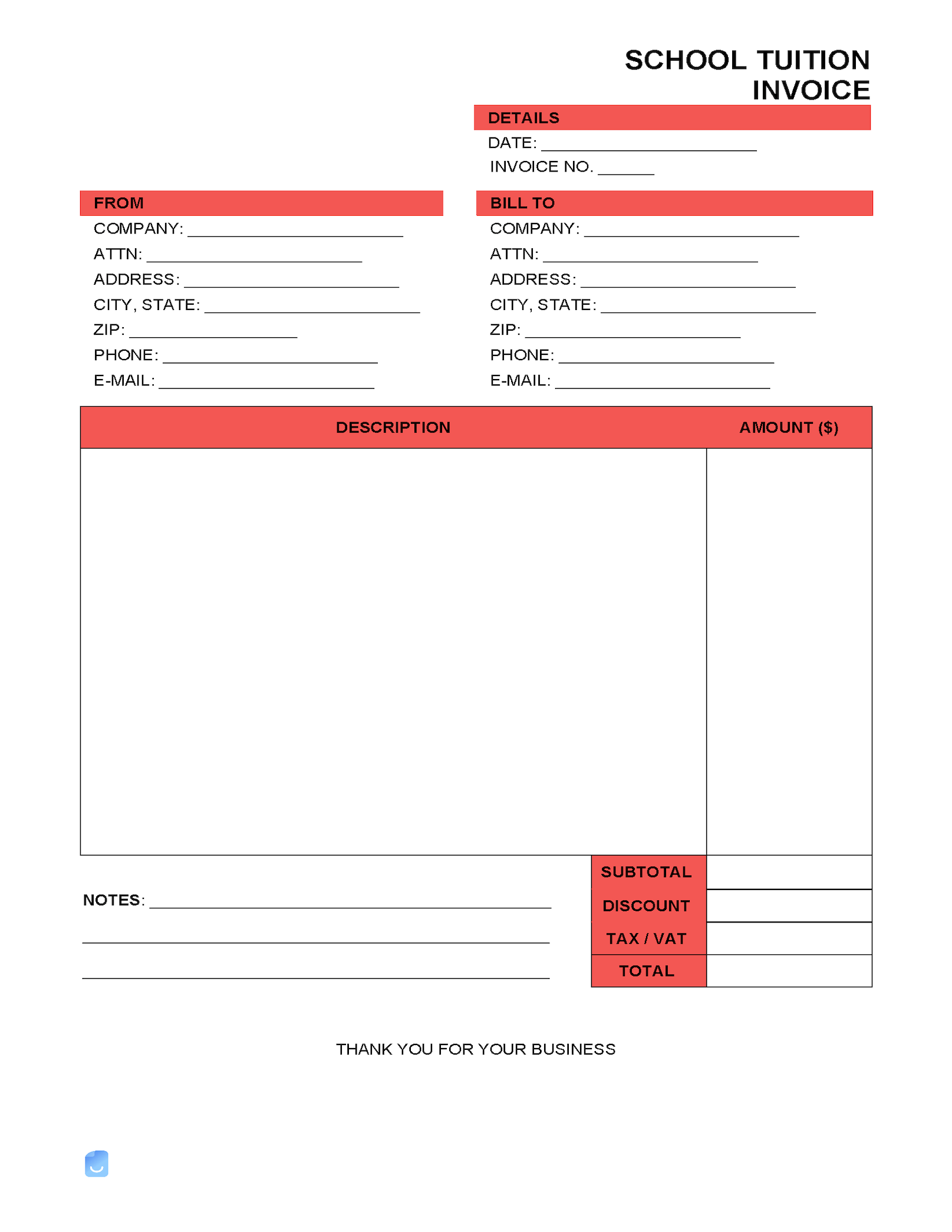

School Tuition Invoice Template Invoice Maker

Can I Deduct Private School Tuition

Can I Deduct Private School Tuition Paid For My Child - Private school tuition is not deductible for federal income tax purposes tax breaks for private and parochial school may be available on a state by state basis