Can I Deduct Rent Payments On My Taxes Whether you qualify for tax deductions as a renter depends on the nature of your work how you plan to file your taxes and where you live Here s a breakdown of

Deducting rent on taxes is not permitted by the IRS However if you use the property for your trade or business you may be able to deduct a portion of the rent from your taxes Taxpayers cannot deduct residential rent payments on your federal income taxes But depending on where you live you might be able to deduct a portion of rent from your state income

Can I Deduct Rent Payments On My Taxes

Can I Deduct Rent Payments On My Taxes

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Can I Deduct Rent On My Taxes

https://s.yimg.com/ny/api/res/1.2/m44FOD.Uxb2L3ExR71Cjiw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTYzOA--/https://media.zenfs.com/en/smartasset_475/c29bf0361efc785c83a1db226515e305

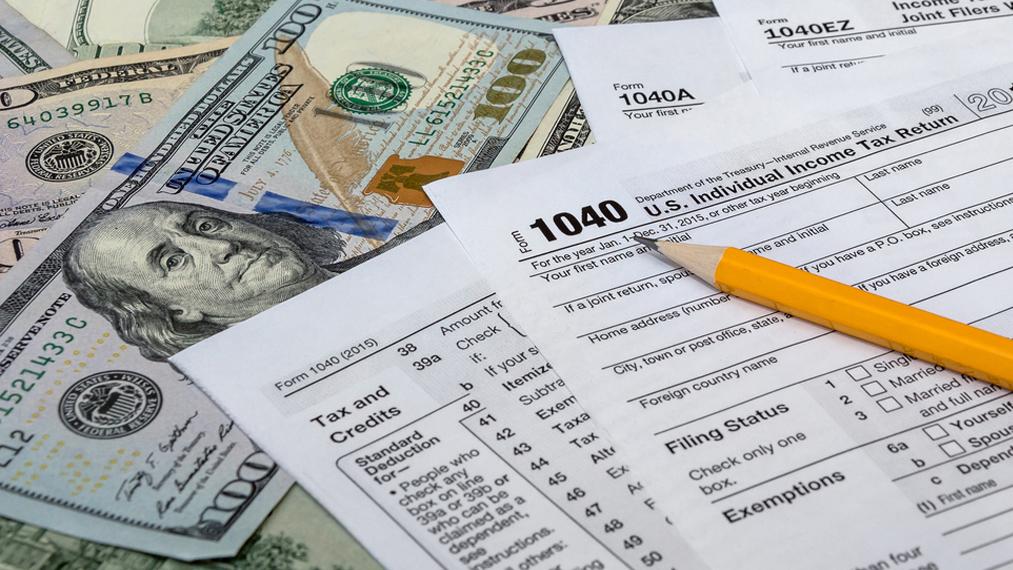

Individual Tax Deductions

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/8654/images/dGtNNfyFRc2jd72ieCJV_Blog_graphics_10.png

Similar to the OTB only one person per household can claim the renter s tax credit Unlike the OTB if you share accommodations with roommates only one of Rent paid for a business is usually deductible in the year it is paid If a business pays rent in advance it can deduct only the amount that applies to the use of the rented property

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may The nine most common rental property tax deductions are 1 Mortgage Interest Most homeowners use a mortgage to purchase their own home and the same goes for rental properties Landlords with a

Download Can I Deduct Rent Payments On My Taxes

More picture related to Can I Deduct Rent Payments On My Taxes

Can I Deduct Dental Implants On My Taxes Dental News Network

https://sandiegoinvisaligndentist.org/wp-content/uploads/2022/06/Can-i-deduct-dental-implants-on-my-taxes-scaled.jpeg

I Bought A Rental Apartment What Expenses Can I Deduct Nj

https://www.nj.com/resizer/66HzwPdSXa_sfQyuJAzghen1lbc=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/Q7G7CTULGRCL7EERJL2PL746GQ.jpg

Can I Deduct Rent On My Taxes

https://s.yimg.com/ny/api/res/1.2/dkl11.kB8FUEIAyVGf7iLQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTQyNw--/https://media.zenfs.com/en/smartasset_475/60e415b00cbed700fe942c12868ca906

Unfortunately you generally cannot deduct the cost of rent on your taxes But there s one related tax break you may be able to take advantage of Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can

The IRS lets you deduct ordinary and necessary expenses required to manage conserve or maintain property that you rent to others You re allowed to So to deduct unpaid rent you must report unpaid rent as income on your tax return for the year the rent was due In other words you d have to adopt an

What Can I Deduct From My Taxes Hylen CPA Inc

https://hylencpa.com/wp-content/uploads/2018/01/Hylen_Blog_TaxDeductions.jpg

Can I Deduct Rent On My Taxes

https://s.yimg.com/ny/api/res/1.2/fAa.Pv5c_OvbuC5ctFr3eQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0MA--/https://media.zenfs.com/en/smartasset_475/4bb0e0f5fbea15e17baeb61404ef2ac0

https://www.realtor.com/advice/rent/tax-deductions-for-renters

Whether you qualify for tax deductions as a renter depends on the nature of your work how you plan to file your taxes and where you live Here s a breakdown of

https://www.hrblock.com/.../deducting-rent-on-taxes

Deducting rent on taxes is not permitted by the IRS However if you use the property for your trade or business you may be able to deduct a portion of the rent from your taxes

Can I Deduct Coaching As A Job Search Expense Official Site Dan Miller

What Can I Deduct From My Taxes Hylen CPA Inc

Report Rent Payments Landlord Credit Bureau

Can I Deduct My Tax prep Fees Fox Business

How To Deduct Your Car And Rent On Your Tax Return YouTube

Understanding Tax Deductions And Maximizing Your Refunds Investors

Understanding Tax Deductions And Maximizing Your Refunds Investors

Deductible Business Expenses For Independent Contractors Financial

Can My Employer Deduct Money From My Wages Hall Payne Lawyers

Credit Note To Customer And Then Payment Received Page 2 Manager Forum

Can I Deduct Rent Payments On My Taxes - Rent paid for a business is usually deductible in the year it is paid If a business pays rent in advance it can deduct only the amount that applies to the use of the rented property