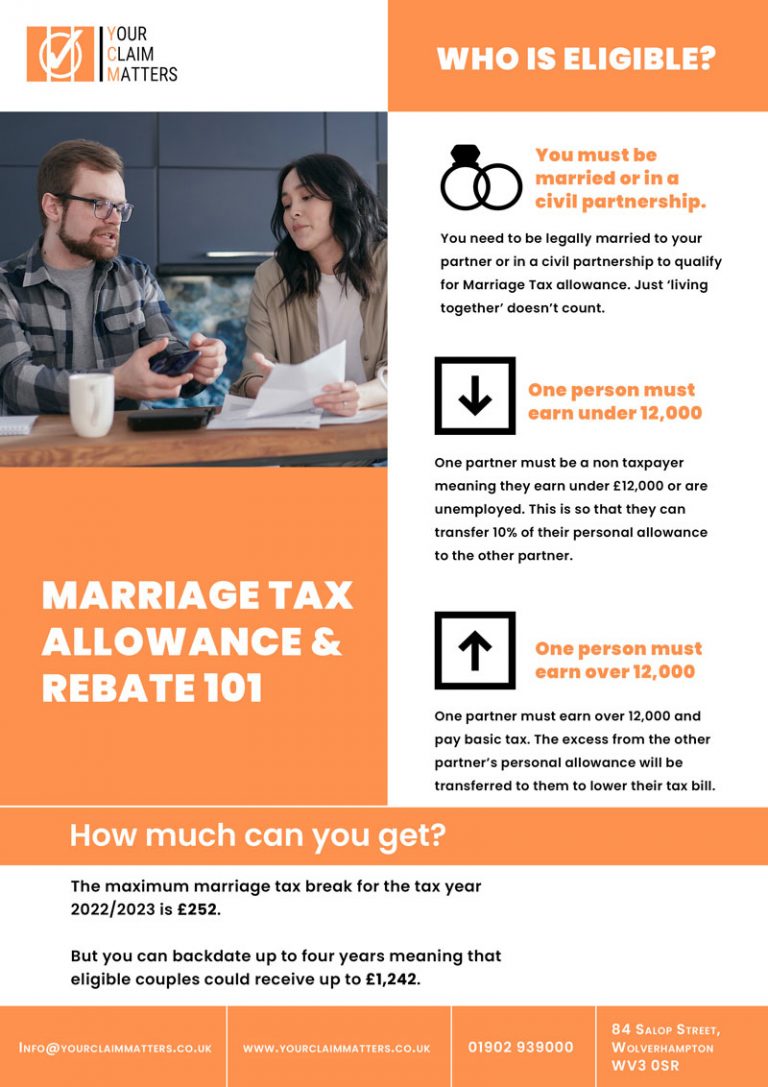

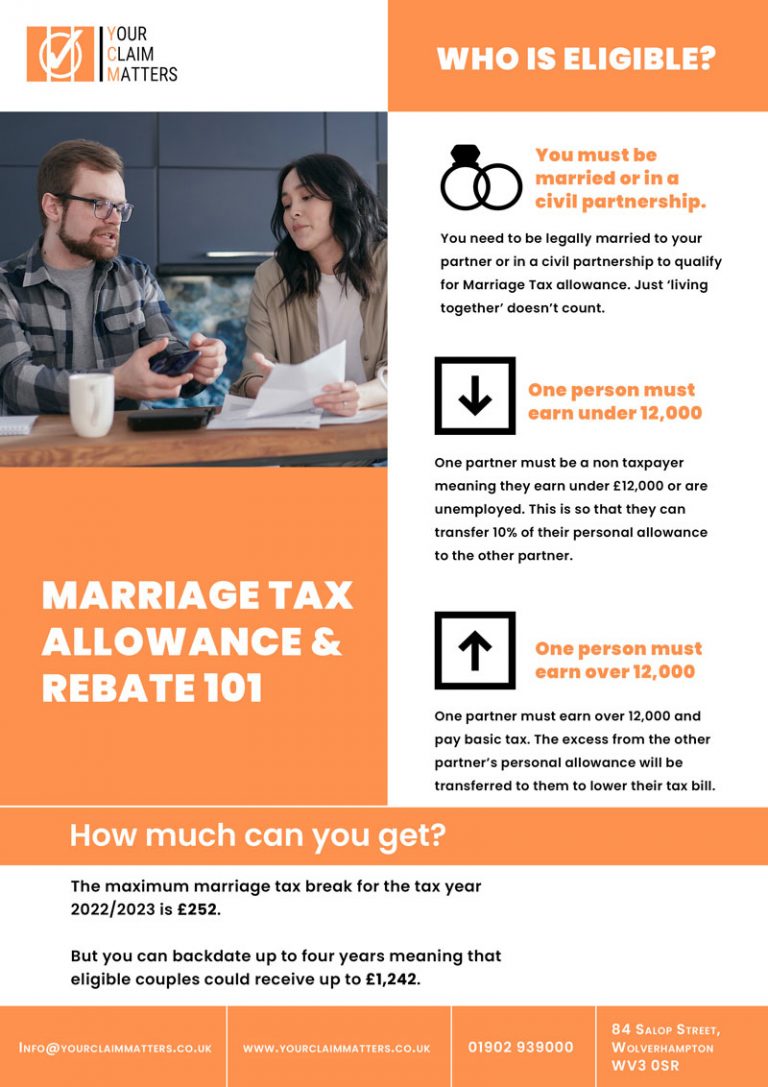

Marriage Tax Rebate Review Web 11 sept 2023 nbsp 0183 32 Marriage allowance is a tax perk available to couples who are married or in a civil partnership where one low earner can transfer 163 1 260 of their personal allowance to their partner The higher earning

Web 14 juil 2023 nbsp 0183 32 Samantha Partington Updated July 14 2023 If you are married or in a civil partnership where one partner earns less than 163 12 570 a year and the other is a basic rate taxpayer you may be able to Web 8 juin 2020 nbsp 0183 32 Which has heard from a number of people who ve unwittingly lost out on almost half of their marriage allowance claim to a tax refund company called Marriage

Marriage Tax Rebate Review

Marriage Tax Rebate Review

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

Can A Married Couple File Single They Can Contribute To A Roth Ira As

https://www.thetaxadviser.com/content/dam/tta/issues/2019/jun/yurko-ex-2.JPG

Marriage Tax Rebates

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=308508013002387

Web Marriage Tax Allowance There are many things to love about being married honestly but one that s often overlooked is Marriage Tax Allowance which could reduce your tax bill or mean that you re eligible Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Web 14 f 233 vr 2023 nbsp 0183 32 The marriage allowance reclaim for the tax year 2022 23 is 163 252 This can be increased to a tax rebate amount of 163 1 241 This is possible by back dating your Web Overview Married Couple s Allowance could reduce your tax bill by between 163 401 and 163 1 037 50 a year You can claim Married Couple s Allowance if all the following apply

Download Marriage Tax Rebate Review

More picture related to Marriage Tax Rebate Review

Gorilla Tax Rebates Reviews Read Customer Service Reviews Of

https://share.trustpilot.com/images/company-rating?locale=en-US&businessUnitId=63e11ec85561b076c2c636cd&preset=consumersite

Tax Claimer Marriage Allowance Tax Rebate

https://taxclaimer.com/wp-content/uploads/2022/01/GettyImages-498799284-2000-1536x1024.jpg

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/work-2-2048x2048.png

Web 11 janv 2021 nbsp 0183 32 Some married couples can make a saving on the amount of income tax that they pay For example John has an annual income of 44 300 in 2020 As a single individual he would be due to pay 7 360 in Web For the 2023 to 2024 tax year it could cut your tax bill by between 163 401 and 163 1 037 50 a year Use the Married Couple s Allowance calculator to work out what you could get If

Web 30 sept 2013 nbsp 0183 32 The Prime Minister David Cameron has announced how the Government proposes to recognise some marriages and civil partnerships in the income tax system Web Glyn Nevatte 3 days ago Easy to do Easy to do william 3 days ago Quick and efficient Quick and efficient Steven Huckstepp 3 days ago Marriage Refund Great and easy to

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance-768x1087.jpg

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

https://www.which.co.uk/money/tax/income-ta…

Web 11 sept 2023 nbsp 0183 32 Marriage allowance is a tax perk available to couples who are married or in a civil partnership where one low earner can transfer 163 1 260 of their personal allowance to their partner The higher earning

https://www.thetimes.co.uk/money-mentor/arti…

Web 14 juil 2023 nbsp 0183 32 Samantha Partington Updated July 14 2023 If you are married or in a civil partnership where one partner earns less than 163 12 570 a year and the other is a basic rate taxpayer you may be able to

Tax Steps To Add To Your Wedding Checklist Wedding Checklist

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Allowance Tax Rebate In UK EmployeeTax

Can A Married Couple File Single They Can Contribute To A Roth Ira As

Marriage Allowance Claim Your 252 Tax Rebate

Marriage Tax Allowance Tax Rebate Online

Marriage Tax Allowance Tax Rebate Online

Home Tax Rebate Online

What Is The Marriage Tax Allowance A Million Couples Missing Out On

Marriage Family Irish Tax Rebates

Marriage Tax Rebate Review - Web 14 mai 2022 nbsp 0183 32 A bigger tax bill can come from a few different sources for higher earners For 2022 the top federal rate of 37 kicks in at taxable income of 539 901 for single filers