Tax Rebate For Mortgage Interest Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

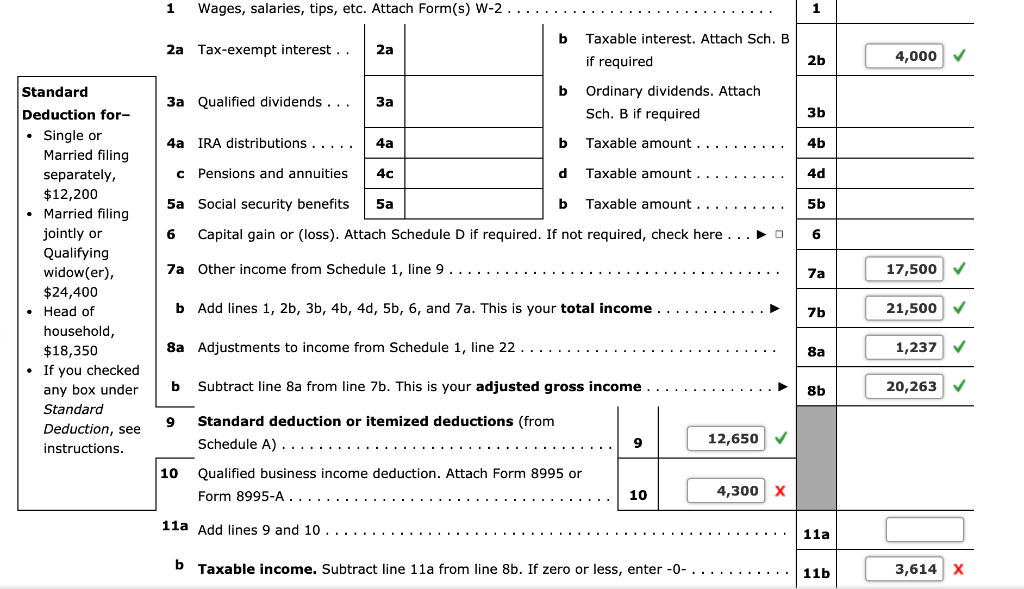

Web 19 janv 2023 nbsp 0183 32 The tax relief landlords get on a buy to let mortgage interest has now ended as of April 2020 Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you Web 1 sept 2023 nbsp 0183 32 The standard deduction for tax year 2023 is 13 850 for single filers and 27 700 for married taxpayers filing jointly That means

Tax Rebate For Mortgage Interest

Tax Rebate For Mortgage Interest

https://www.coursehero.com/qa/attachment/24027424/

FREE AFTER REBATE Tax Software Exp 2 28 14 Tax Software Free

https://i.pinimg.com/originals/24/5d/6b/245d6b42162db94f6bd6ed8c0340ea4f.jpg

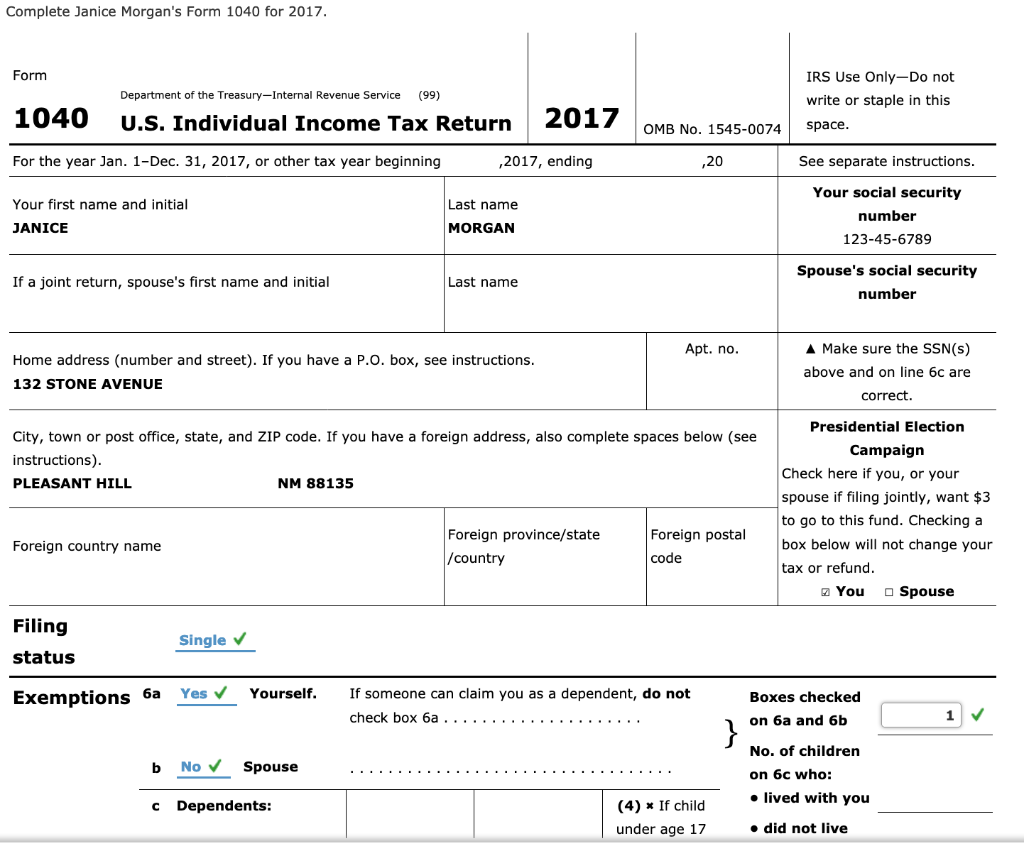

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/29e/29e60ea7-ac4f-41b4-b3e5-479b24bec3f3/phpYWR6IU

Web 22 juil 2021 nbsp 0183 32 Yes you can claim tax relief on mortgage interest However the changes over the past few years mean that you will be taxed on all your rental income and then be able to claim a limited amount of Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Web 9 janv 2023 nbsp 0183 32 Before 2017 The interest for your mortgage was 100 deductible Since most individual landlords have interest only mortgages you could basically claim all Web You cannot deduct the mortgage interest connected with your owner occupied home in your income tax return The tax advantages you do have can be found under I am living

Download Tax Rebate For Mortgage Interest

More picture related to Tax Rebate For Mortgage Interest

Home Loan EMI And Tax Deduction On It EMI Calculator

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

Web Mortgage Tax Rebate If your are an owner occupant of a property in the Netherlands you can get part of the financing costs refunded The rules for the refund are Web 20 juil 2016 nbsp 0183 32 The tax relief that landlords of residential properties get for finance costs is being restricted to the basic rate of Income Tax This is being phased in from 6 April

Web Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return You will get money Web 18 juil 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage

Pin By SoCal Dream Homes On Real Estate Being A Landlord Mortgage

https://i.pinimg.com/originals/c2/7f/ef/c27fefe44042ad59736899fc456c0d2e.jpg

Bank mortgage rebate comparison v2 Starpro Agency Limited

https://starpagency.com/wp-content/uploads/2016/05/bank-mortgage-rebate-comparison-v2.jpg

https://www.nerdwallet.com/article/taxes/mort…

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

https://www.which.co.uk/money/tax/income-ta…

Web 19 janv 2023 nbsp 0183 32 The tax relief landlords get on a buy to let mortgage interest has now ended as of April 2020 Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you

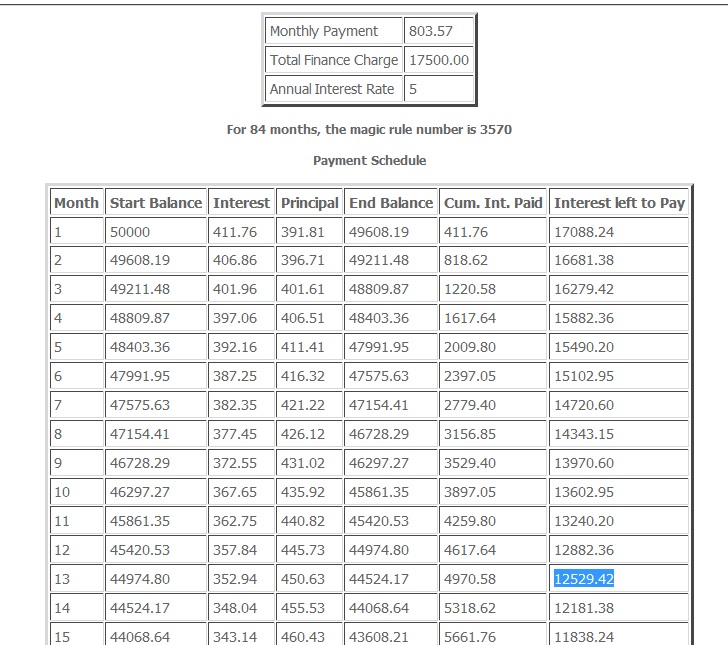

AkmalHussin Rule Of 78 What After One Year Payment Why My Loan

Pin By SoCal Dream Homes On Real Estate Being A Landlord Mortgage

Historical And Posted Canadian Mortgage Interest Rates Mississauga

Tax Law Flowchart Can You Deduct Your Mortgage Interest Mortgage

What Is Rebate On A Mortgage Loan

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Military Journal Nm State Rebate 2022 According To The Department

54 FORM FOR HOME MORTGAGE INTEREST DEDUCTION DEDUCTION HOME MORTGAGE

Is A 30 Year Mortgage Loan A Choice BNBA Org

Tax Rebate For Mortgage Interest - Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on