Tax Relief For Mortgage Interest Verkko 22 syysk 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

Verkko 18 hein 228 k 2023 nbsp 0183 32 Homeowners can deduct mortgage interest from their income with the mortgage interest deduction Learn what qualifies for this deduction and how you can benefit Verkko 19 tammik 2023 nbsp 0183 32 The tax relief landlords get on a buy to let mortgage interest has now ended as of April 2020 Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you calculate its impact on your tax bill

Tax Relief For Mortgage Interest

Tax Relief For Mortgage Interest

https://www.carterjonas.co.uk/-/media/images/news-images-t08/residential/2018-resi-mortgage-interest-tax-relief-petition.ashx

Mortgage Interest Tax Changes How Will They Affect You

https://www.telegraph.co.uk/content/dam/property/Spark/directline/mortgage-interest-tax-relief-changes-xlarge.jpg?imwidth=1200

Landlords Tax Relief On Mortgage Interest Dixon Lewis

https://dixonlewis.co.uk/wp-content/uploads/2022/04/key.jpg

Verkko A mortgage interest tax credit or relief is a tax relief based on the amount of qualifying mortgage interest that you pay in a tax year for your home A new temporary mortgage interest tax credit was announced in Budget 2024 The previous scheme ended on Verkko 6 lokak 2022 nbsp 0183 32 This European Economy Economic Brief discusses the effects of mortgage interest tax relief and in particular EUROMOD simulations of a removal of the relief in 14 EU Member States The Fiscal and Distributional Effects of Removing Mortgage Interest Tax Relief in EU Member States European Commission

Verkko 4 tammik 2023 nbsp 0183 32 You can claim a tax deduction for the interest on the first 750 000 of your mortgage 375 000 if married filing separately HELOCs are no longer eligible for the deduction unless the proceeds are used to quot buy build or substantially improve quot a Verkko 30 jouluk 2022 nbsp 0183 32 In 2022 the standard deduction is 25 900 for married couples filing jointly and 12 950 for individuals The standard deduction is 19 400 for those filing as head of household The mortgage

Download Tax Relief For Mortgage Interest

More picture related to Tax Relief For Mortgage Interest

RELIEF FOR MORTGAGE INTEREST ON LET PROPERTIES Townends Accountants LLP

https://townends.com/wp-content/uploads/2023/02/Screenshot-2023-02-28-at-15.19.49.png

Mortgage Tax Relief

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2018/06/Mortgage-Tax-Relief.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://time.com/nextadvisor/wp-content/uploads/2021/03/na-mortgage-interest-tax-deduction-1000x630.jpg

Verkko The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate status the Verkko 14 jouluk 2023 nbsp 0183 32 The mortgage interest deduction is a tax incentive for homeowners This itemized deduction allows homeowners to subtract mortgage interest from their taxable income lowering the amount of taxes they owe This deduction can also be taken on loans for second homes as long as it stays within IRS limits See What You Qualify

Verkko 19 lokak 2010 nbsp 0183 32 Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home For tax years prior to 2018 the maximum amount of debt eligible for the deduction was 1 million Beginning in 2018 the maximum amount of debt is limited to 750 000 Verkko 4 tuntia sitten nbsp 0183 32 Taxback s Marian Ryan said there are a number of conditions relating to both the mortgage and the property that must be met in order to be eligible for the Mortgage Interest Tax Credit Firstly

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

Verkko 22 syysk 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

https://www.forbes.com/advisor/mortgages/mortgage-interest-

Verkko 18 hein 228 k 2023 nbsp 0183 32 Homeowners can deduct mortgage interest from their income with the mortgage interest deduction Learn what qualifies for this deduction and how you can benefit

Tax Relief Of Mortgage Interest Sigma Chartered Accountants

Understanding The Mortgage Interest Deduction With TaxSlayer

Claim Tax Relief Of Employing A Carer Home Care Matters

Tax Relief For Working From Home During The Pandemic Here s How To

Mortgage Interest And Tax Relief Accounting Firms

What Is Section 24 Common Questions About Mortgage Interest Tax Relief

What Is Section 24 Common Questions About Mortgage Interest Tax Relief

Interest Deductions Should I Buy Property Personally Or Via A Company

Tax Relief For Individuals With Disabilities

List Of Personal Tax Relief And Incentives In Malaysia 2023

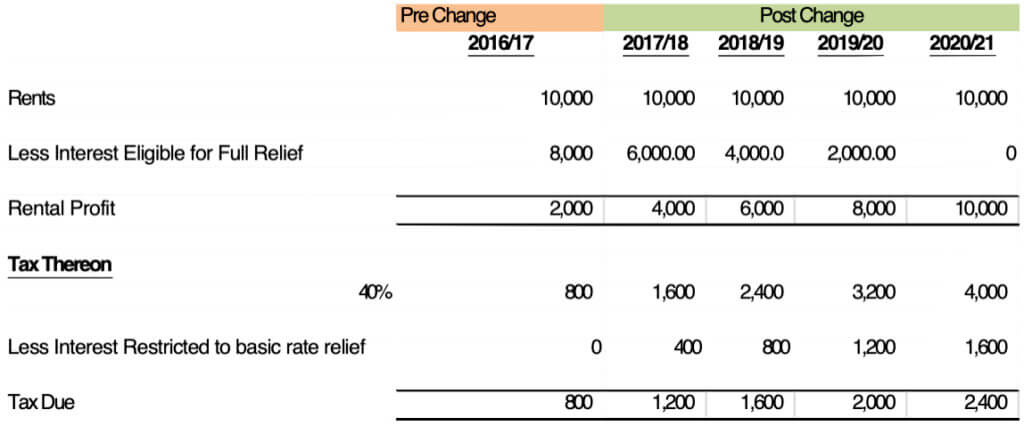

Tax Relief For Mortgage Interest - Verkko The government has decided to phase in the new rules over a four year period You ll see straight away the amount of mortgage interest tax relief steadily falling each year In the 2017 18 tax year you can claim 75 of your mortgage tax relief In the 2018 19 tax year you can claim 50 of your mortgage tax relief