Can I Get A Tax Credit For Buying A Hybrid Vehicle For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Can I Get A Tax Credit For Buying A Hybrid Vehicle

Can I Get A Tax Credit For Buying A Hybrid Vehicle

https://static.cargurus.com/images/article/2017/05/26/10/20/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-4169818146229685017-1600x1200.jpeg

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

https://i0.wp.com/juicedfrenzy.com/wp-content/uploads/2021/11/Depositphotos_131877390_S.jpg?fit=1000%2C751&ssl=1

2022 EV Tax Credit How To Get A Tax Refund On A New EV Or PHEV

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/41cce697d02567f472ac5922c1f0db93.jpg

If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D Any all electric vehicle EV plug in electric vehicle PHEV and fuel cell electric vehicle FCV purchased new in 2023 or later may be eligible for a federal income tax credit of

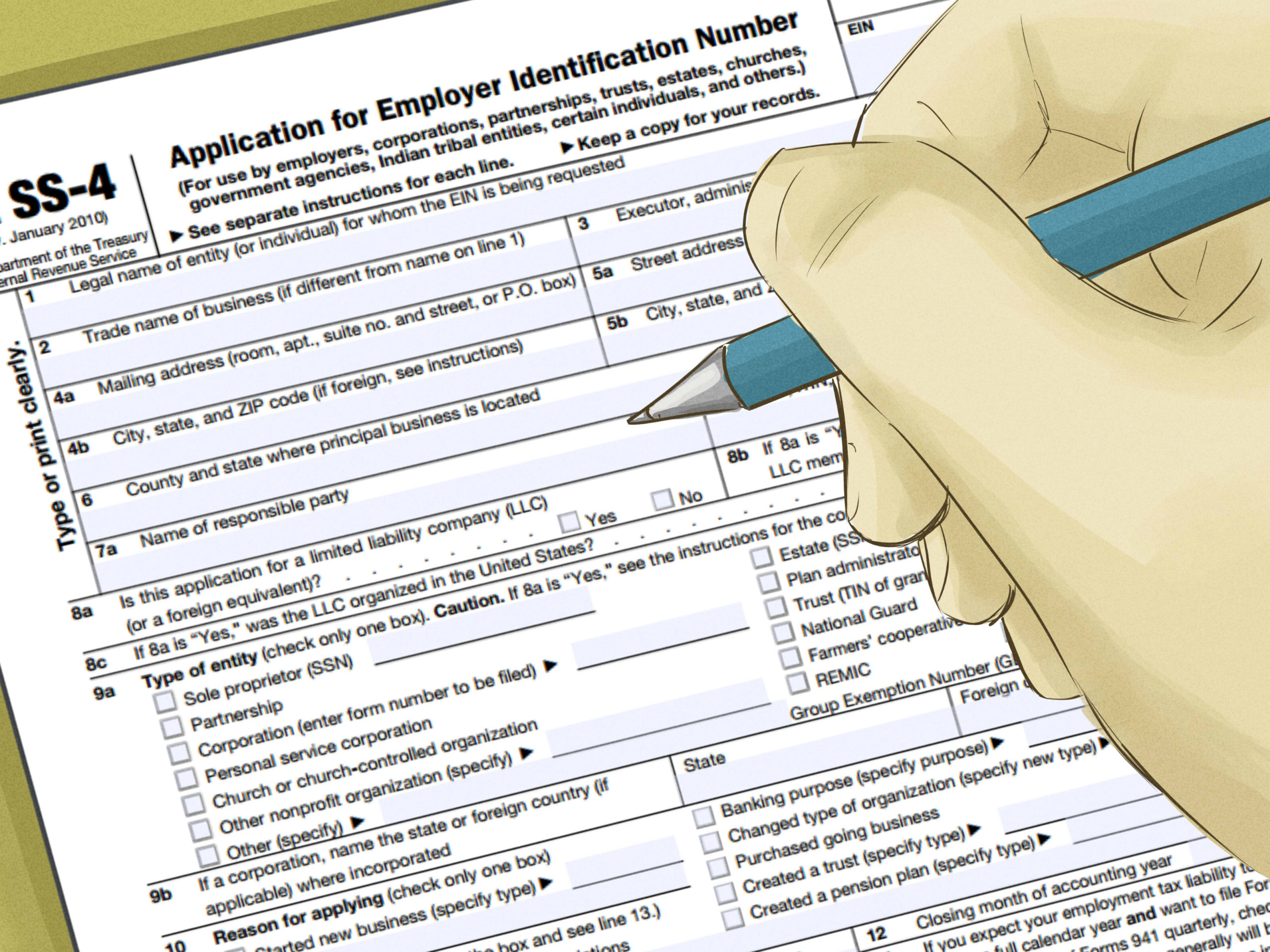

To claim the tax credit the buyer must file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles with All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based

Download Can I Get A Tax Credit For Buying A Hybrid Vehicle

More picture related to Can I Get A Tax Credit For Buying A Hybrid Vehicle

46 Terms To Know Before Buying A Hybrid Or Electric Vehicle Trust Auto

https://img.321ignition.io/321ignition-v4-prod-images/public/613bb2ed5ce9c8010acca31f/cms/tesla-model-x-1536x768.jpg

All You Need To Know About Electric Vehicle Tax Credits CarGurus

https://static.cargurus.com/images/article/2017/05/19/10/07/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-5583828754740272087-1600x1200.jpeg

EVs And Plug In Hybrids That Qualify For Tax Credits Consumer Reports

https://i.pinimg.com/originals/86/b7/bd/86b7bd3f4eb13684f847788f38a73b62.jpg

Plug in hybrid all electric and fuel cell electric vehicles purchased new in or after 2023 may be eligible for a federal income tax credit of up to 7 500 The amount and availability of Is there a tax credit for buying a hybrid car or electric vehicle Yes hybrid and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return

A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive The Inflation Reduction Act IRA of 2022 made a tax credit of up to 7 500 available to qualifying purchasers of certain EVs But restrictions on buyer income and where the car

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Tax Credit For Electric Vehicles Khou

https://media.khou.com/assets/KHOU/images/fda45742-0ba4-4512-b143-375cf49d3da4/fda45742-0ba4-4512-b143-375cf49d3da4_1920x1080.jpg

https://www.cars.com/articles/heres-which-hybrids...

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

https://www.irs.gov/newsroom/qualifying-clean...

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

How To Find Tax ID Number TIN Number

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Authorization Letter Tax Map PDF

Another Way To Save New Tax Credit For Plan Participants

Another Way To Save New Tax Credit For Plan Participants

2022 Taxes Due Deadlines Refunds Extensions And Credits This Year

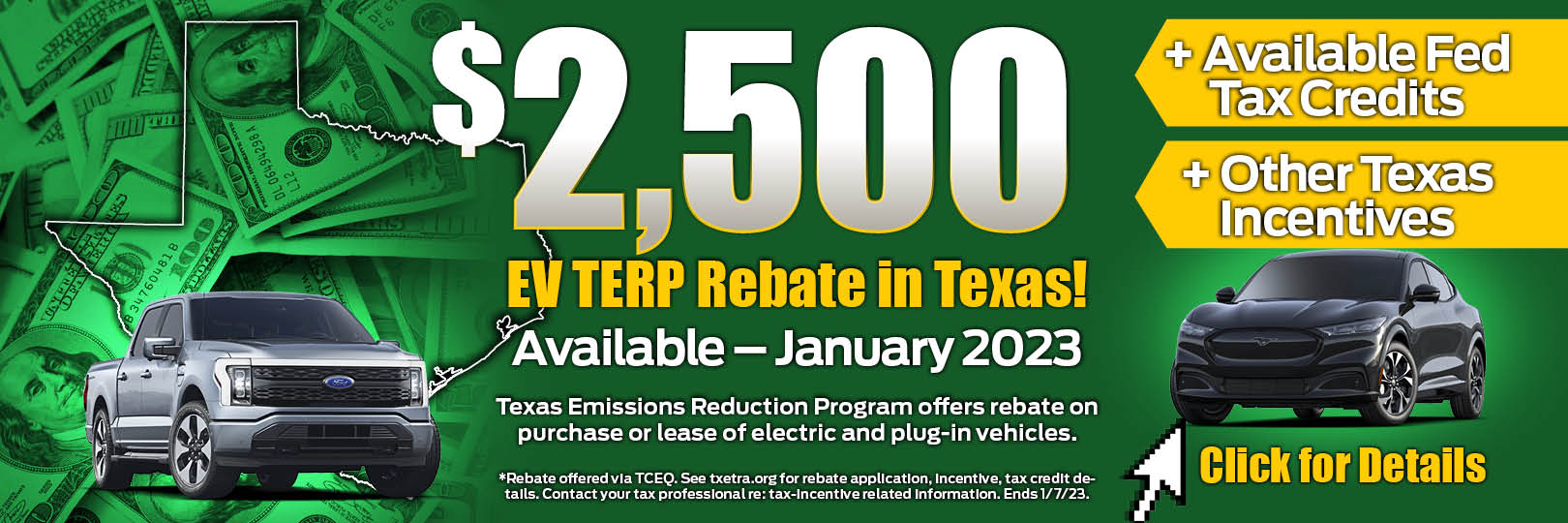

Planet Ford EV Plug in Hybrid Vehicle Rebate Program Randall Reed s

2023 2024 Child Tax Credit Schedule 8812 H R Block

Can I Get A Tax Credit For Buying A Hybrid Vehicle - Any all electric vehicle EV plug in electric vehicle PHEV and fuel cell electric vehicle FCV purchased new in 2023 or later may be eligible for a federal income tax credit of