Can I Get Tax Benefit On Two Home Loans However now an individual can claim tax benefits on two Home Loans Prior to the financial year 2019 20 an individual owning two houses could claim income tax benefits with respect to the

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5 The income tax benefits in respect of interest on home loans for self occupied house property ies as well as for repayment of principal repayment are available only if you opt

Can I Get Tax Benefit On Two Home Loans

Can I Get Tax Benefit On Two Home Loans

https://dp5zphk8udxg9.cloudfront.net/wp-content/uploads/2019/08/shutterstock_7366563461.png

What Are The Tax Benefit On Home Loan FY 2020 2021

https://www.nitsotech.com/wp-content/uploads/Tax-Benefit-on-Home-Loan.jpg

If I Take A Second Home Loan Can I Get Tax Benefit On Both Loans

https://www.outlookindia.com/outlookmoney/public/uploads/article/gallery/53b37956df658282cfd9d204bf0b6fd8.gif

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available in case of your second house you can enjoy tax benefits A Second Home Loan comes with limited tax benefits which depend on the use of the loan and the current income tax law It s prudent to know your home loan eligibility and use an EMI

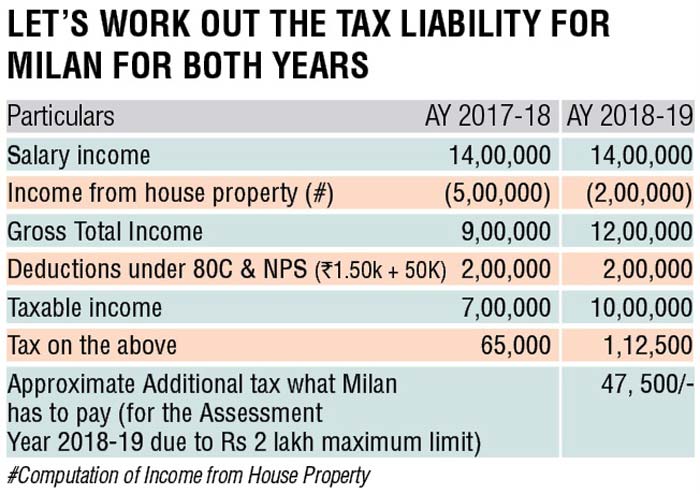

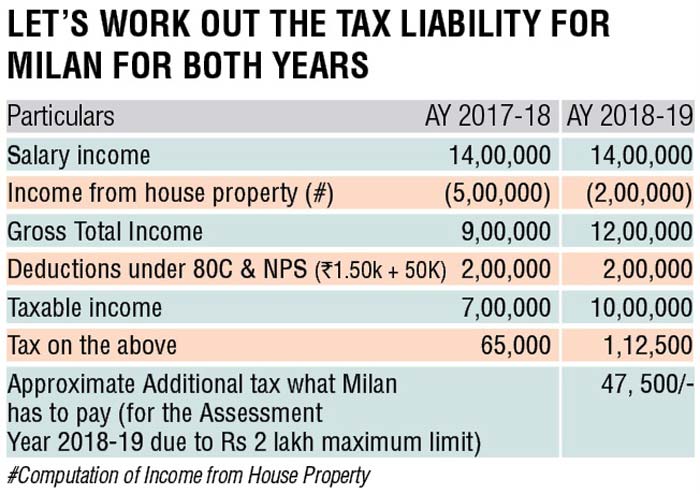

So you will be able to claim a deduction for interest payable under Section 24 b for both loans up to 2 lakh in case the property is self occupied Tax benefits on second Home Loan You can get the above tax benefits if you take a second home loan to buy another property however the aggregate amount of deductions is subject to the respective caps mentioned above As per the

Download Can I Get Tax Benefit On Two Home Loans

More picture related to Can I Get Tax Benefit On Two Home Loans

![]()

Section 24 Income Tax Benefit Of A Housing Loan OneMint

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_580/http://www.onemint.com/wp-content/uploads/2011/11/Tax-Benefit-of-Home-Loan-Repayment.png

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Income Tax Benefits On Housing Loan Interest And Principal House Poster

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/01/Home-Loan-Benefits.png

Yes it is possible to get tax benefit on the second home loan in the same financial year The tax benefit on two home loans taken for the purchase of two self occupied properties Combining two home loans can help in saving money and also helps in boosting credit score You can merge the two home loans by following a few simple steps Income Tax deductions can also be claimed on the interest

Can I claim tax exemption for home loans taken from friends Deduction under Section 24 b for interest paid can be claimed even if the money is borrowed financing The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

https://www.icicibank.com › blogs › home-loan › tax...

However now an individual can claim tax benefits on two Home Loans Prior to the financial year 2019 20 an individual owning two houses could claim income tax benefits with respect to the

https://taxguru.in › income-tax › income-tax-benefits...

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5

Income Tax Benefits On Housing Loan Interest And Principal House Poster

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

20151209 Tax Benefits On A Home Loan Personal Finance Plan

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Income Tax Benefits On Housing Loan In India

Understanding The Tax Benefit Of Home Loan Interest

Understanding The Tax Benefit Of Home Loan Interest

Here Is The Tax Benefit On Personal Loans That You Can Avail

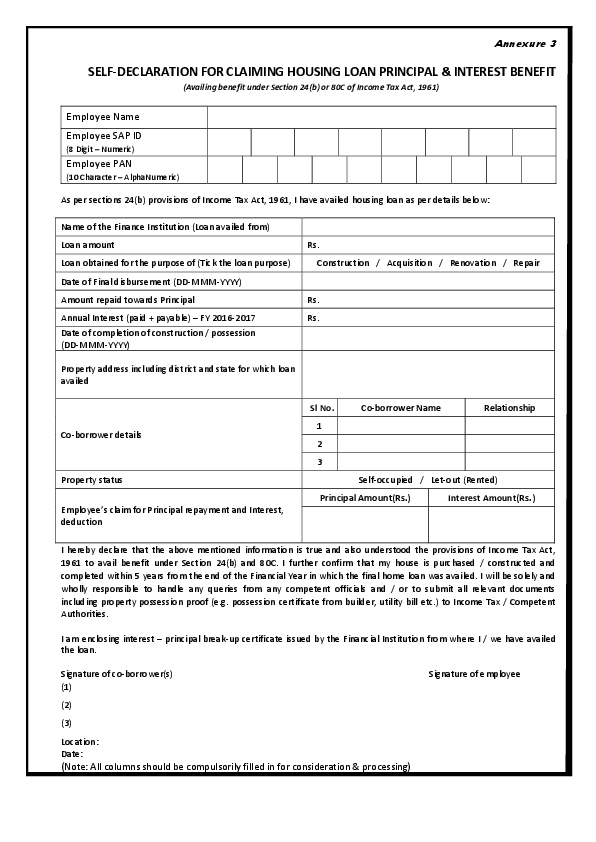

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

The Importance Of Benefits Management Ntegra

Can I Get Tax Benefit On Two Home Loans - Tax benefits on second Home Loan You can get the above tax benefits if you take a second home loan to buy another property however the aggregate amount of deductions is subject to the respective caps mentioned above As per the