Can I Submit My Own Company Tax Return You file your accounts with Companies House and your Company Tax Return with HM Revenue and Customs HMRC You may be able to file them together if you have a

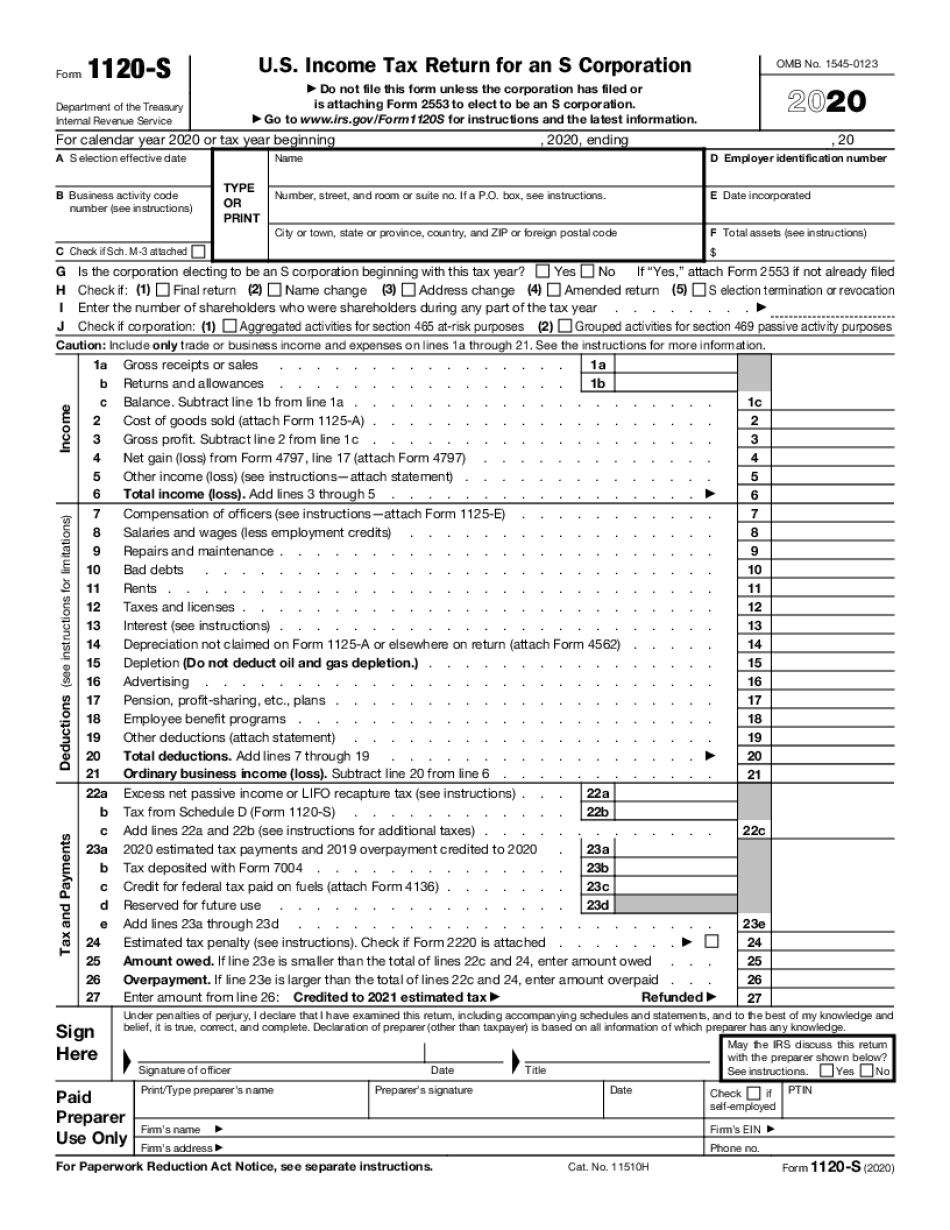

There are different requirements for Corporation Tax and Company Tax Returns with HMRC Your company is called dormant by Companies House if it s had Whether you are coming to the end of your Company s first year of trading or have been trading for several years at the end of each year you need to file a Corporation Tax Return with HMRC and pay any

Can I Submit My Own Company Tax Return

Can I Submit My Own Company Tax Return

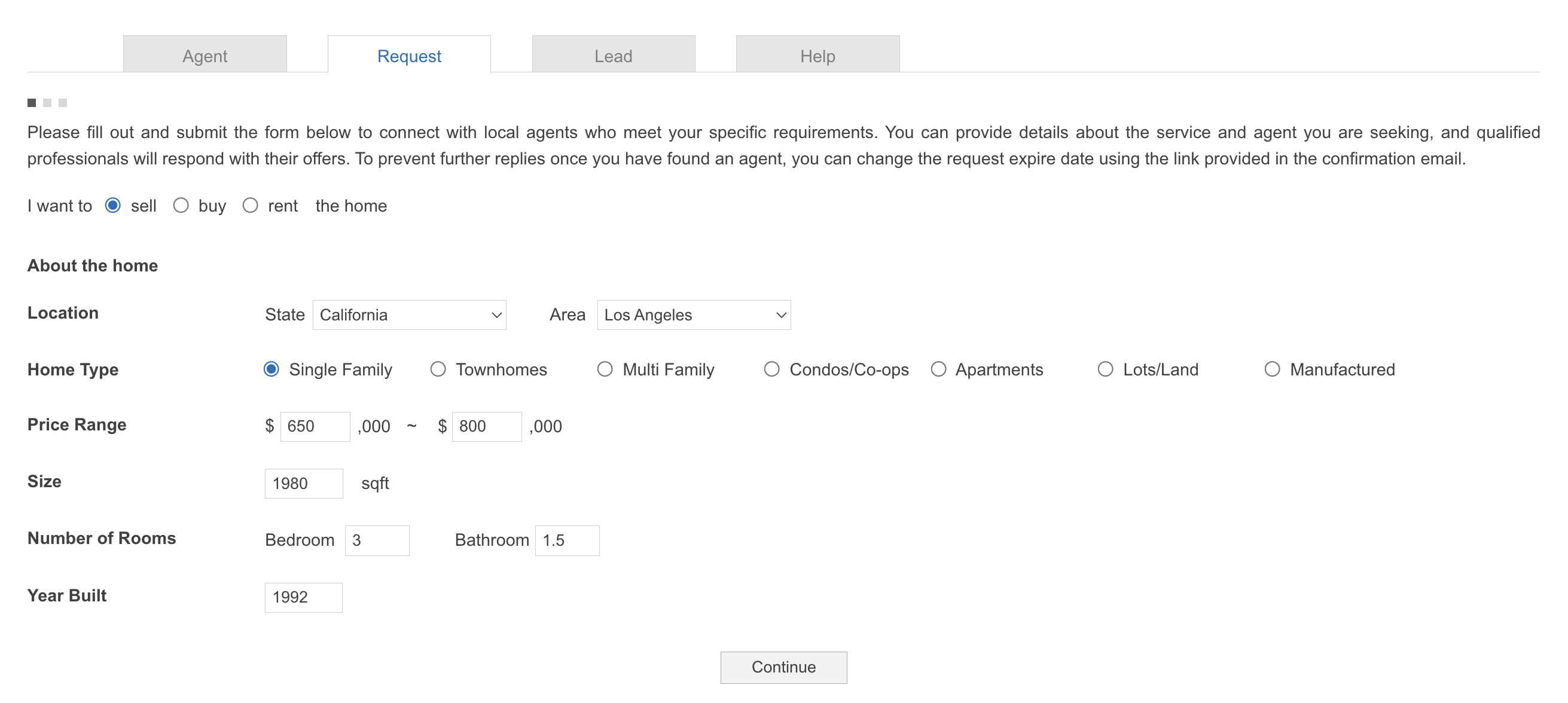

https://www.meet-agent.com/ma_help_img/request-tab.png

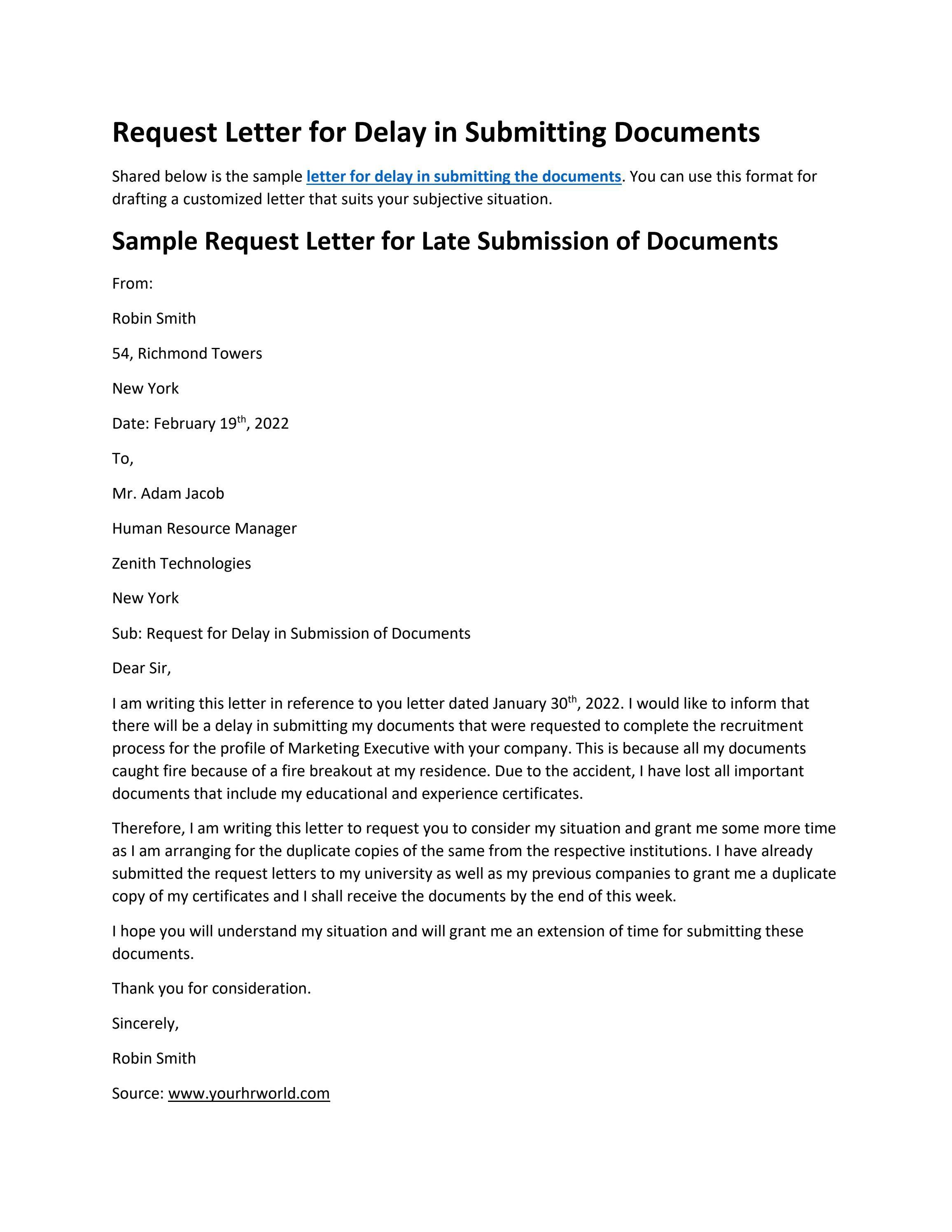

Request Letter For Late Or Delay In Submitting Of Documents By Your HR

https://image.isu.pub/220219085450-ed0921151b587de0e0e7aa873486de1f/jpg/page_1.jpg

I Thought I d Submit My Own Murder R ComedyNecrophilia

https://external-preview.redd.it/-jl4dlNbqIHB7EWf8NAycoLaVR83gHBgg-bXBrrhD08.jpg?auto=webp&s=decf1f44e214b9d6ef74a4180b133f839d25cfa7

If you are a sole trader partnership trust or company you have a choice in how to lodge your tax return How do you lodge your tax return You can lodge through A company tax return is used to report your spending profits and corporation tax due to HMRC It involves completing a CT600 form and submitting a financial report

You can prepare and file your own Company Tax Return However unless you feel completely confident in completing the return yourself then it may be advisable to employ the services of an accountant Select File or amend a return This is under Payments refunds and returns Select your Companies income tax return IR4 Follow the prompts to complete your return Select

Download Can I Submit My Own Company Tax Return

More picture related to Can I Submit My Own Company Tax Return

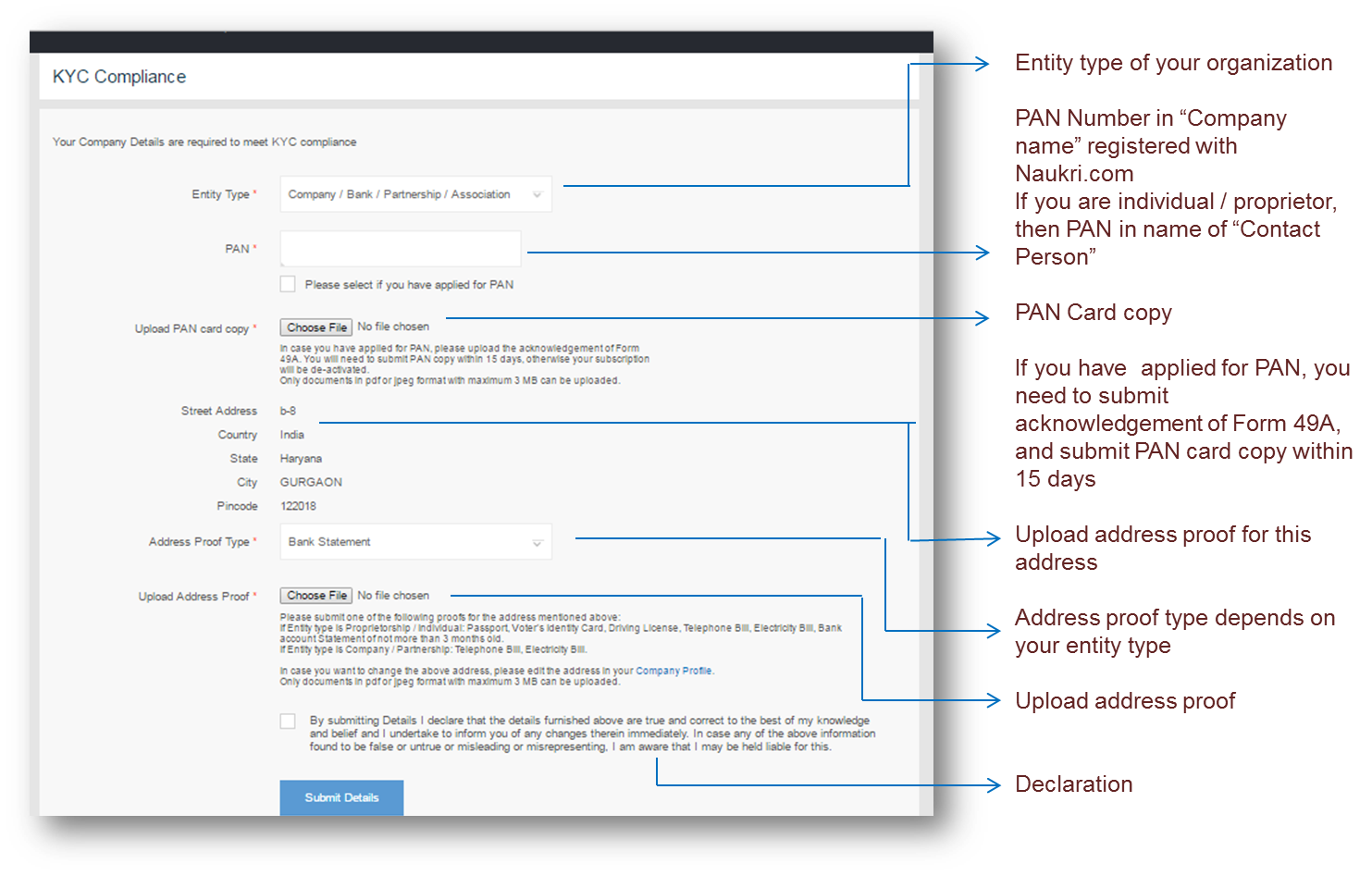

Account ManagementRecruiter FAQ

https://recruiterfaq.naukri.com/wp-content/uploads/sites/29/2016/12/KYC_fill-details.png

After Years Of Marraige I Submit My Own Marraige Advice Grandad Meme Guy

https://memeguy.com/photos/images/after-years-of-marraige-i-submit-my-own-marraige-advice-grandad-51289.png

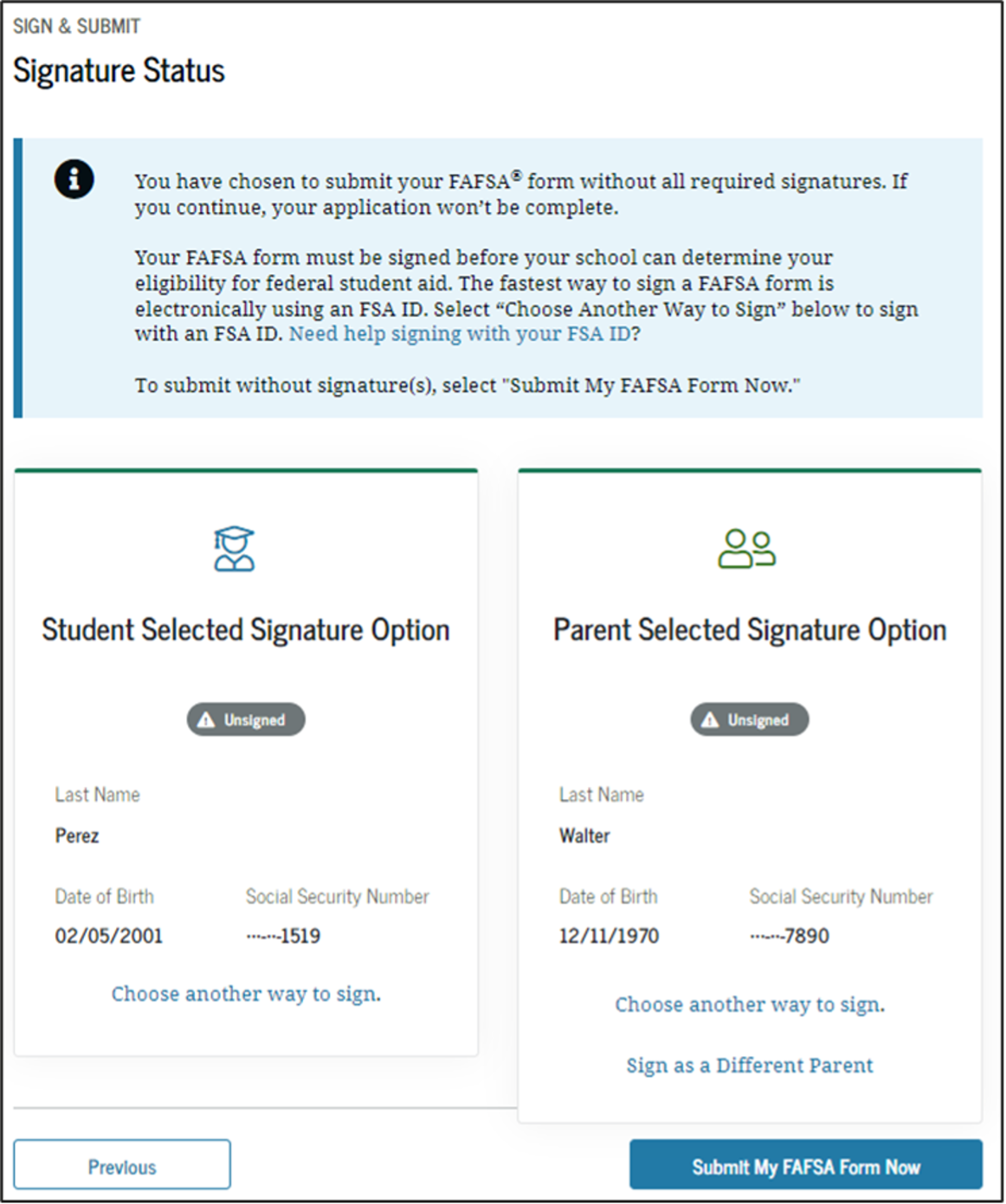

How To Complete The 2023 2024 FAFSA Application

https://www.nitrocollege.com/hubfs/2023-2024 online FAFSA/S8/S8s18.png

No you don t legally need an accountant you can choose to complete your own accounts which can include preparing and filing your accounts your company tax You can use the HMRC online service to file your Company Tax Return with HMRC and accounts with Companies House at the same time if your company s

Corporation income tax return All resident corporations except tax exempt Crown corporations Hutterite colonies and registered charities have to file a corporation You can absolutely create a company tax return in Xero John have a look at this article for more info

One Does Not Simply Submit Their Timesheet One Does Not Simply Make

https://media.makeameme.org/created/one-does-not-29401873b9.jpg

Tax Return Clipboard Image

http://www.picpedia.org/clipboard/images/tax-return.jpg

https://www.gov.uk/.../file-your-accounts-and-company-tax-return

You file your accounts with Companies House and your Company Tax Return with HM Revenue and Customs HMRC You may be able to file them together if you have a

https://companieshouse.blog.gov.uk/2021/09/07/when...

There are different requirements for Corporation Tax and Company Tax Returns with HMRC Your company is called dormant by Companies House if it s had

Publication Details

One Does Not Simply Submit Their Timesheet One Does Not Simply Make

Tax Return Bank2home

Submit Your Music For Infrequent Exposure

SARS EFiling How To Submit Your ITR12 YouTube

Do I Need To Submit A Tax Return 2018 YouTube

Do I Need To Submit A Tax Return 2018 YouTube

Signing Tax Documents For Verification UCF Office Of Student

Should You Do Your Own Company Tax Return Tax Return Take Money

How To File Sales Tax Return Submit Your Sales Tax Return Online YouTube

Can I Submit My Own Company Tax Return - Steps to follow to bring your dormant company up to date with SARS Check with the Companies and Intellectual Property Commission CIPC to see which