Tax Credit Rebate Solar If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Afficher plus

Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Tax Credit Rebate Solar

Tax Credit Rebate Solar

https://www.solarproguide.com/wp-content/uploads/the-solar-tax-credit-explained-solalt.png

Texas Solar Power For Your House Rebates Tax Credits Savings

https://i.pinimg.com/originals/14/05/ef/1405ef205102ec2392f7c34907bb980e.png

Congress Gets Renewable Tax Credit Extension Right Institute For

https://ilsr.org/wp-content/uploads/2016/01/federal-solar-tax-credit-phase-out-ILSR-2015-1024x768.jpeg

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy

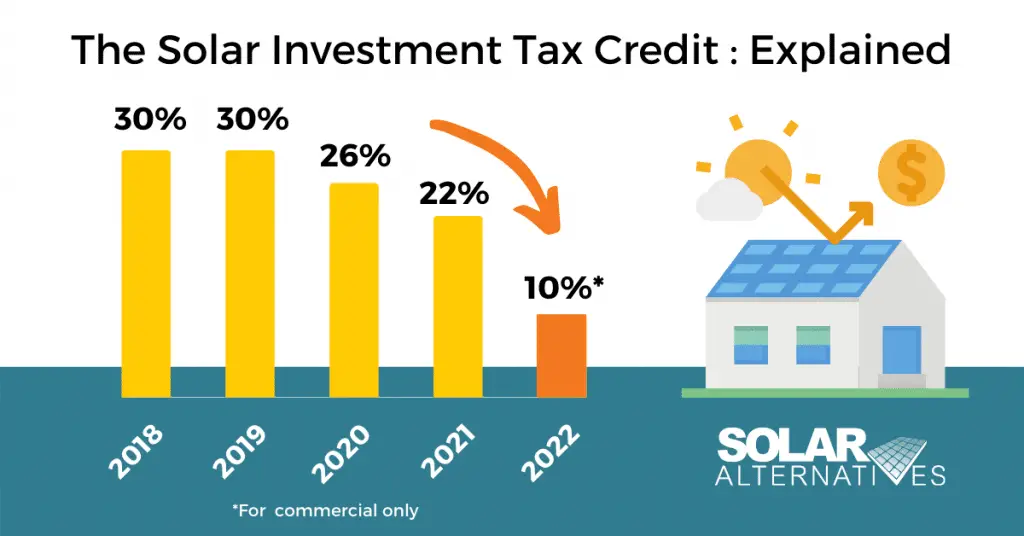

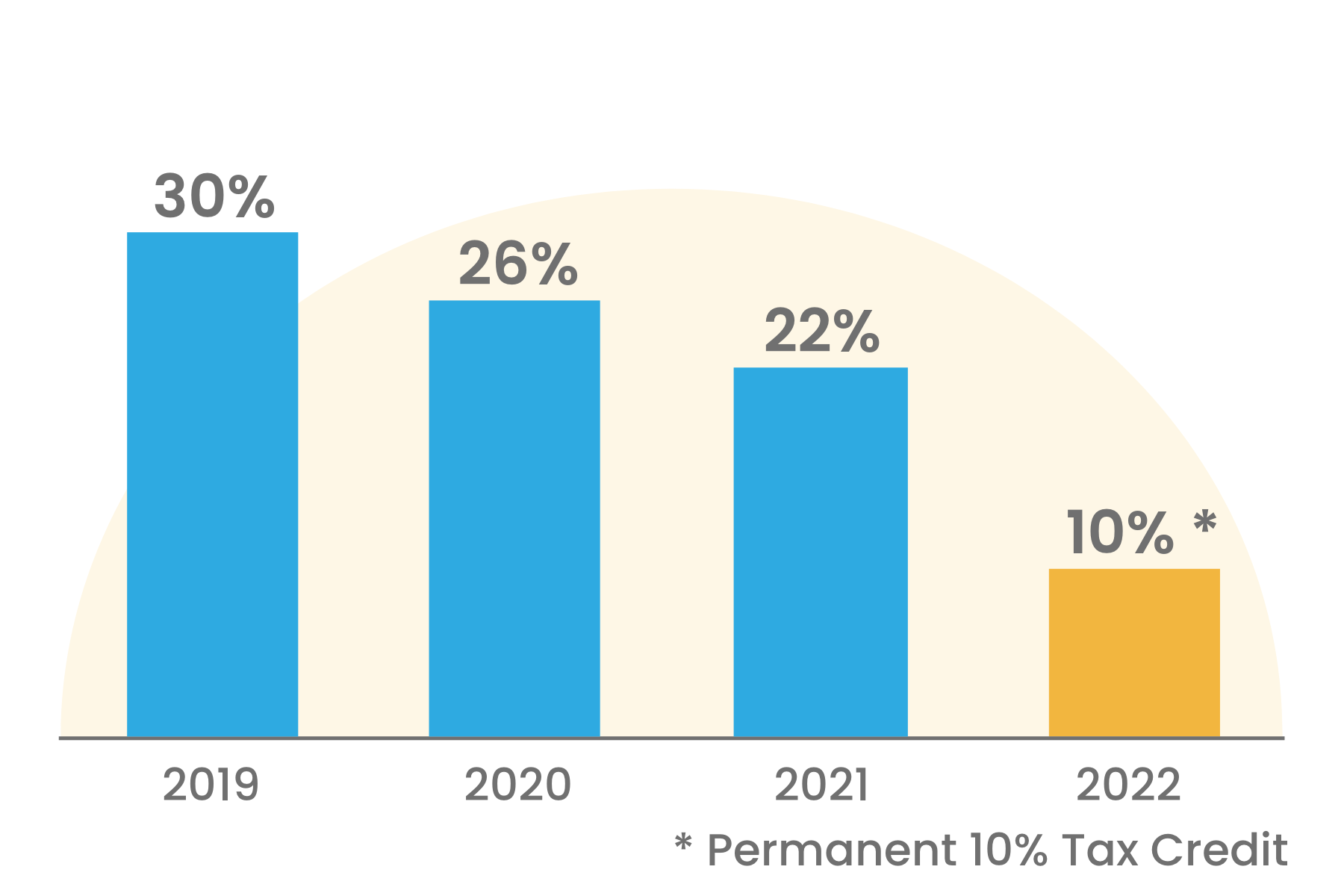

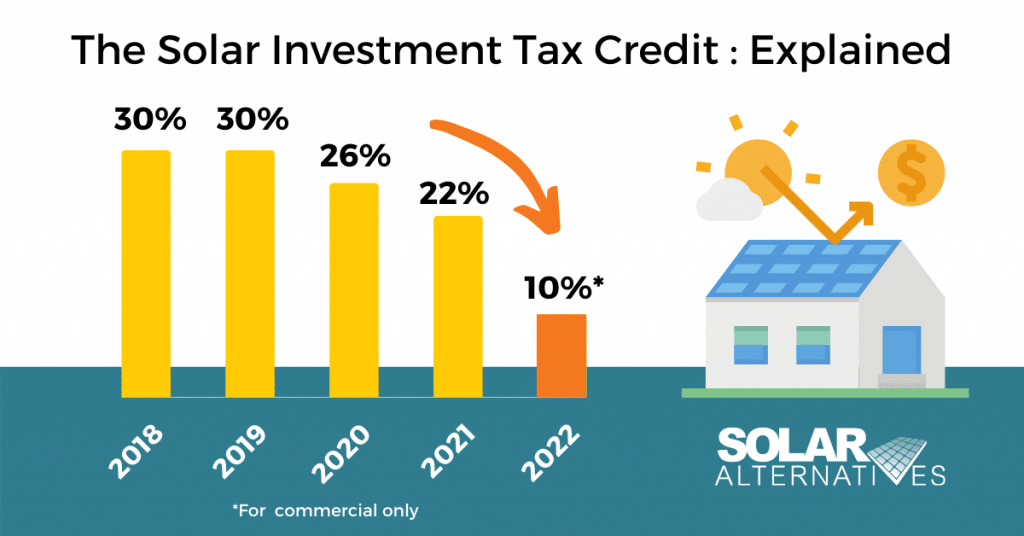

Web 14 mars 2023 nbsp 0183 32 The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system Web 8 sept 2022 nbsp 0183 32 Solar Investment Tax Credit What Changed President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of

Download Tax Credit Rebate Solar

More picture related to Tax Credit Rebate Solar

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2019/01/tax-credit-change-.jpg

Solar Tax Credits By State SolarDailyDigest

https://www.solardailydigest.com/wp-content/uploads/credit-file-solar-tax-credits-by-state.jpeg

Minnesota Solar Power For Your House Rebates Tax Credits Savings

https://i.pinimg.com/originals/f0/5a/d4/f05ad428174c29968441de8b94bc2bab.png

Web 7 ao 251 t 2023 nbsp 0183 32 Solar Tax Credit Extension The Solar Investment Tax Credit has offered tax reduction incentives for homeowners who choose to go solar On August 16 Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit

Web 9 ao 251 t 2023 nbsp 0183 32 To claim the federal solar tax credit follow these steps Download IRS Form 5695 as part of your tax return This residential energy tax credit form can be downloaded straight from the IRS Calculate the Web 16 ao 251 t 2023 nbsp 0183 32 The solar credit is just one of the tax credit and rebate programs in the Inflation Reduction Act The legislation s incentives can also save you money on electric

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/images/pages/solar-tax-credit/commercial-bar.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Afficher plus

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

2018 Guide To West Virginia Home Solar Incentives Rebates And Tax

Solar Tax Credits Rebates Missouri Arkansas

Oregon Solar Power For Your House Rebates Tax Credits Savings Tax

Calculate Your Federal Solar Tax Credit 2021 Solar

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Do I Qualify For Solar Tax Credit SolarProGuide

Do I Qualify For Solar Tax Credit SolarProGuide

Alternate Energy Hawaii

Solar In California Ultimate Guide Solar Panels In California How You

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Tax Credit Rebate Solar - Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing