Can I Use Medical Expenses As A Tax Deduction You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related

This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

Can I Use Medical Expenses As A Tax Deduction

Can I Use Medical Expenses As A Tax Deduction

https://images.squarespace-cdn.com/content/v1/5976a036bf629ac6f2a7bfdc/1566955219012-D81E0R00F6Y7YB1PJKUE/Tax+deductions.jpg

Hair Salon Monthly Expenses Google Search Tax Deductions Tax

https://i.pinimg.com/originals/59/a8/f5/59a8f5c21289277936f1e4c5ed2b0d42.png

Understanding The Basics Of Tax On Superannuation CHN Partners

https://www.chnpartners.com.au/wp-content/uploads/2022/03/6jVDH772nyzhIqDUIHxQRO-pexels-dave-colman-7105019.jpg

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10 Your medical expenses may be tax deductible under certain circumstances If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may

You can deduct medical expenses on your taxes but only under certain circumstances Learn all the rules and exceptions around deducting medical expenses Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your total medical expenses

Download Can I Use Medical Expenses As A Tax Deduction

More picture related to Can I Use Medical Expenses As A Tax Deduction

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

7 Home Improvement Tax Deductions INFOGRAPHIC Tax Deductions

https://i.pinimg.com/originals/bb/c7/4e/bbc74ee927d067f43bbaf4252e12eb28.jpg

How Do Tax Deductions Really Work

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/BB1iMU4S.img?w=1920&h=1282&m=4&q=79

You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible Yes the medical expense deduction lets you recoup some of the cost of unreimbursed expenses from doctor visits prescriptions and other medical expenses on your tax

If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your adjusted gross Key Takeaways The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191025/a893d00e6a764d2f9dbbb7838baa295d.jpg

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_1588xN.3985544266_82sm.jpg

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related

https://www.irs.gov/help/ita/can-i-deduct-my...

This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in

Qualified Business Income Deduction And The Self Employed The CPA Journal

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

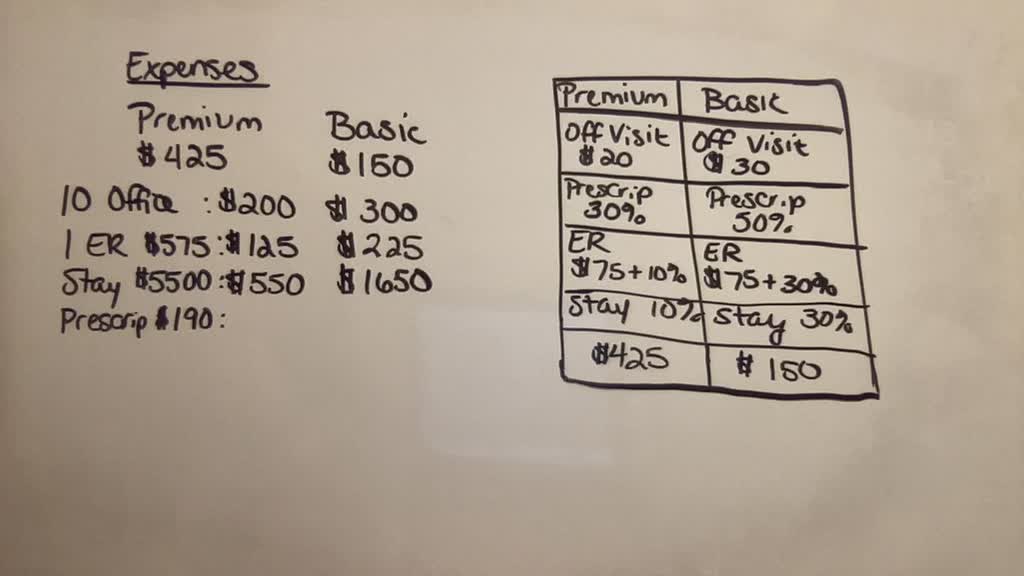

SOLVED Use Computational And Algebraic Tools To Quantify The Total

Printable Itemized Deductions Worksheet

Tax Deduction Planning Concept Expenses Account VAT Income Tax And

1099 Expense Report Template

1099 Expense Report Template

6 Dog Related Tax Deductions You May Be Eligible To Claim Tax

EXCEL Of Income And Expense Statement Chart xlsx WPS Free Templates

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How To Calculate Cost Of Goods Sold In Accounting Haiper

Can I Use Medical Expenses As A Tax Deduction - For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10