Can I Withdraw Money From My Hsa Debit Card In general you can withdraw money from an HSA by using the debit card that comes with most HSA accounts or writing yourself or your healthcare provider a check drawn on the

As a practical matter you are allowed to withdraw funds from your HSA at any time for any reason But if you aren t using the funds to cover a qualified medical expense then you ll be stuck paying a 9 rowsCards arrive within 7 10 days Transactions are reflected in your Available to Withdraw balance and are posted to your account within 5 business days Additional

Can I Withdraw Money From My Hsa Debit Card

Can I Withdraw Money From My Hsa Debit Card

https://i.ytimg.com/vi/O4B4d3sV6G8/maxresdefault.jpg

How To Withdraw Money From A PayPal Account Tips Tricks

https://www.freshbooks.com/wp-content/uploads/2021/10/how-to-withdraw-money-from-paypal.jpg

How To Withdraw Money From 1xBet YouTube

https://i.ytimg.com/vi/nR5cVPjDFQI/maxresdefault.jpg

Form 1099 SA reports all withdrawals including charges to your HSA debit card you have made from your HSA during the tax year You should report the withdrawal amounts How to withdraw funds from your HSA Most HSAs provide you with a debit card and some also supply checks which can be used to pay doctors pharmacies and vendors at the

Withdrawals from an HSA are tax free provided the money is used to pay for qualified medical expenses These expenses can include payments for dental and vision care which some medical Your HSA Bank Health Benefits Debit Card provides access to your HSA funds at point of sale with signature or PIN and at ATMs for withdrawals

Download Can I Withdraw Money From My Hsa Debit Card

More picture related to Can I Withdraw Money From My Hsa Debit Card

Can I Invest The Money In My HSA FSA Insurance Neighbor

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/11/HSA-Money-Medical-Health.jpg

Health Savings Account HSA Workest

https://www.zenefits.com/workest/wp-content/uploads/2022/12/HSA-e1677100040197.jpg

Can I Withdraw Money From My Optum HSA Account YouTube

https://i.ytimg.com/vi/8rU2vBKWJ_k/maxresdefault.jpg

You can also use your debit card to withdraw cash from an ATM to reimburse yourself for expenses you paid out of pocket a transaction fee may apply How can I check my Once you reach age 65 you can withdraw money from your HSA for any purpose without incurring a penalty

An HSA distribution is a withdrawal of money from your health savings account This could take the form of a debit card transaction a check or a direct transfer of funds from your Yes you can withdraw funds from your HSA at any time But please keep in mind that if you use your HSA funds for any reason other than to pay for a qualified medical expense

Authorisation Letter To Withdraw Cash From Bank Cash Withdrawal

https://i.ytimg.com/vi/wr_FGUtvU_Y/maxresdefault.jpg

What Can I Buy With My HSA Debit Card Health Savings Accounts For

https://www.texaseducatorshsa.com/wp-content/uploads/HSA-Card.jpg

https://money.stackexchange.com/questions/8172

In general you can withdraw money from an HSA by using the debit card that comes with most HSA accounts or writing yourself or your healthcare provider a check drawn on the

https://smartasset.com/insurance/hsa-withdr…

As a practical matter you are allowed to withdraw funds from your HSA at any time for any reason But if you aren t using the funds to cover a qualified medical expense then you ll be stuck paying a

Withdraw Money From A Permanently Limited PayPal Account

Authorisation Letter To Withdraw Cash From Bank Cash Withdrawal

How To Withdraw Money From A Capitec ATM Without A Card

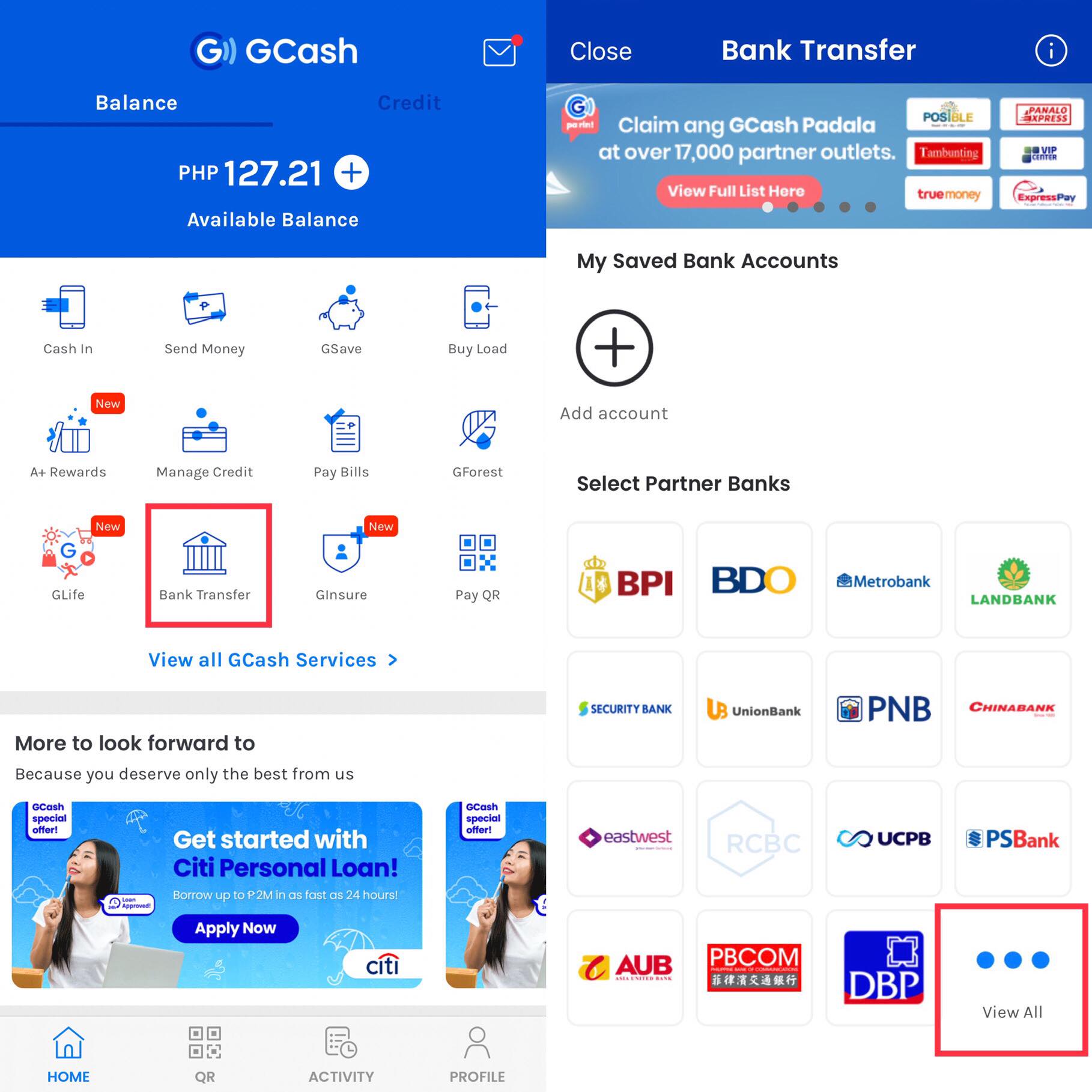

HOW TO CASH OUT IN GCASH 3 Easy Ways To Withdraw Money From Your GCASH

Can I Withdraw Money From My HSA YouTube

:max_bytes(150000):strip_icc()/GettyImages-75404663-5aa037f6eb97de00360f9398.jpg)

How To Use An ATM

:max_bytes(150000):strip_icc()/GettyImages-75404663-5aa037f6eb97de00360f9398.jpg)

How To Use An ATM

Request Letter For Cash Withdrawal From Bank Letter To Bank For Cash

How Do I Withdraw Money From Cash App Without Card IHSANPEDIA

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

Can I Withdraw Money From My Hsa Debit Card - Can I withdraw cash using my HSA debit card Yes you can use your Associated Bank HSA Debit Mastercard to withdraw cash to pay for eligible expenses or reimburse