Can I Write Off Mileage For Work Whether someone travels for work once a year or once a month figuring out travel expense tax write offs might seem confusing The IRS has information to help all

Learn how to deduct travel expenses for your business including mileage lodging meals and more Find out the rules for temporary and indefinite work If you use your own car for work purposes and are reimbursed by your employer for the related expenses the mileage reimbursement generally isn t taxable income if it s paid under an accountable plan

Can I Write Off Mileage For Work

Can I Write Off Mileage For Work

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7808a1a34e392da06a0_610f13719242da6fd79cc8b1_MileIQ-vs-paper-mileage-log-1.jpeg

Calculate Gas Mileage Reimbursement AntonioTavish

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Example Of Free 25 Printable Irs Mileage Tracking Templates Gofar

https://i.pinimg.com/originals/ef/80/33/ef80334d3a23f7799ac429aaf9a31cd4.jpg

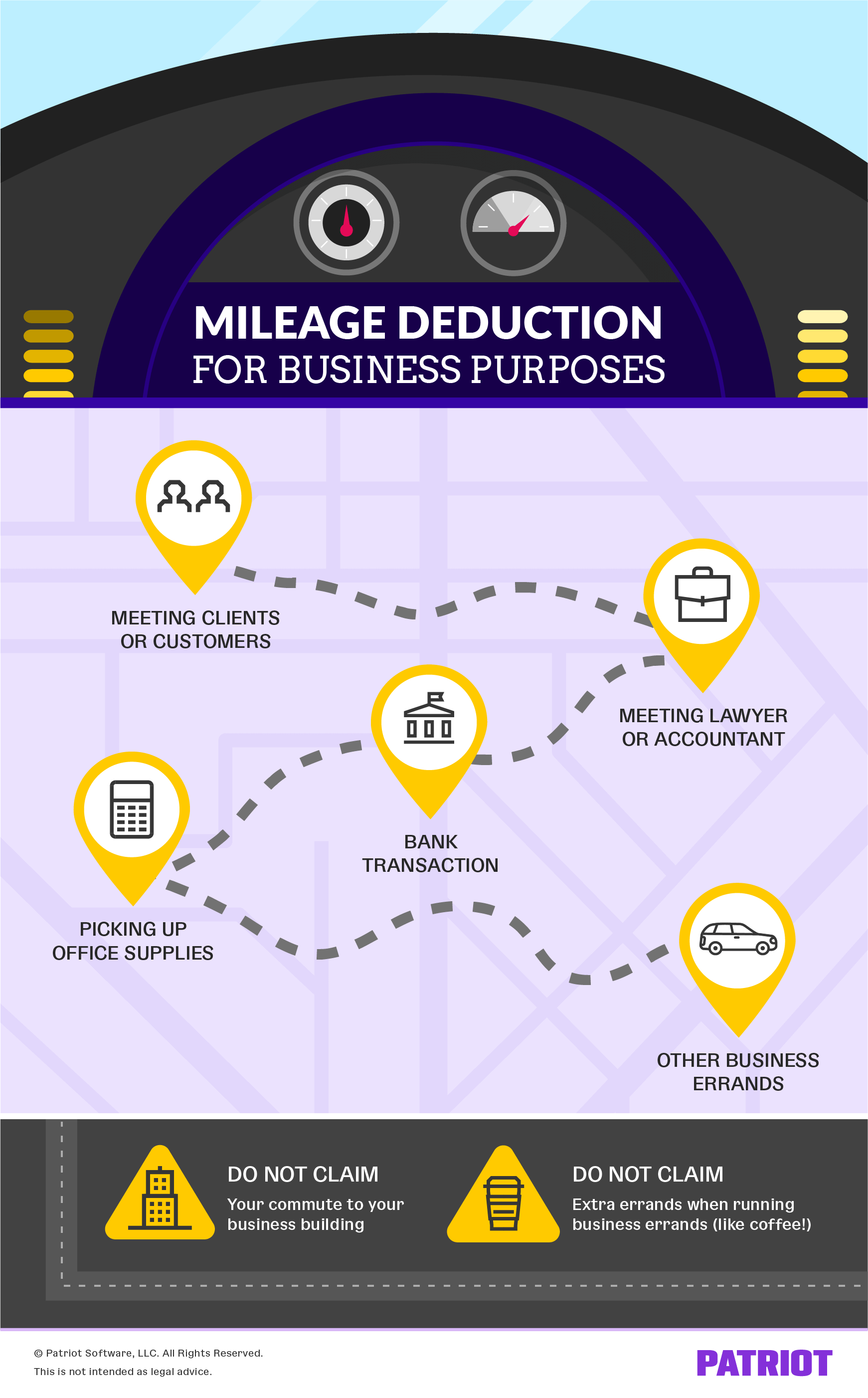

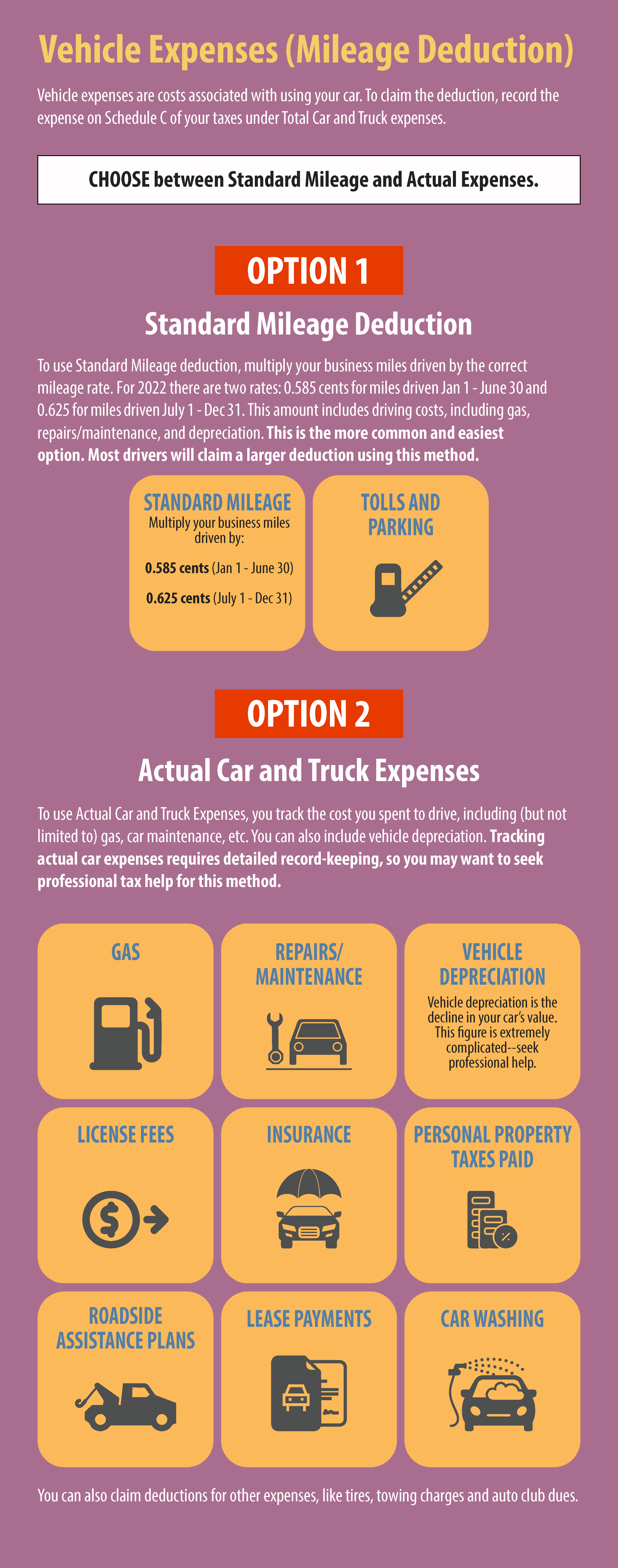

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also For 2024 the IRS standard mileage rates are 0 67 per mile for business 0 21 per mile for medical or moving and 0 14 per mile for charity If you drive for your business or plan to rack up

If you travel for work you may be able to deduct mileage expenses from your taxes Find out if you qualify and how to document it If you re self employed or a 1099 contractor you can claim the business travel tax deduction You don t have to be flying first class or staying at a fancy hotel Here s everything you can and can t write

Download Can I Write Off Mileage For Work

More picture related to Can I Write Off Mileage For Work

Free Printable Mileage Log Form Printable Forms Free Online

https://i1.wp.com/templatelab.com/wp-content/uploads/2015/11/Mileage-Log-05.jpg?w=640

Can You Write Off Mileage For An Unpaid Internship Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/199/30/511622433.jpg

You ll Never Forget To Use This Simple Mileage Log Money Saving Tips

https://i.pinimg.com/originals/11/ea/08/11ea08923db6bcb3a1330469152fe9b7.png

If you drive 36 000 miles a year with 18 000 miles dedicated to business use you can deduct 50 of your actual expenses If you qualify you can claim this deduction as an employee business expense Can you switch between standard mileage and actual expenses methods If you want to use the standard mileage rate method in any tax year you must do so in the first tax year you use your car for

As a self employed person or contractor you can deduct miles driven based on a per mile rate or you can deduct the full expenses as they relate to your If you have a dedicated vehicle that you only use for work purposes you can write off 100 of your mileage on your tax return If you have a personal vehicle that you sometimes

Can You Write Off Mileage For DoorDash Falcon Expenses Blog

https://falconexpenses.com/blog/wp-content/uploads/2022/01/can-you-write-off-mileage-for-doordash.png

![]()

25 Printable Irs Mileage Tracking Templates Gofar Self Employed Mileage

https://wssufoundation.org/wp-content/uploads/2020/11/25-printable-irs-mileage-tracking-templates-gofar-self-employed-mileage-log-template-example-scaled-1536x1087.jpg

https://www.irs.gov/newsroom/understanding-business-travel-deductions

Whether someone travels for work once a year or once a month figuring out travel expense tax write offs might seem confusing The IRS has information to help all

https://www.irs.gov/taxtopics/tc511

Learn how to deduct travel expenses for your business including mileage lodging meals and more Find out the rules for temporary and indefinite work

How To Claim The Standard Mileage Deduction Get It Back

Can You Write Off Mileage For DoorDash Falcon Expenses Blog

Tax Guide For Ambulance Company Owners Reality Paper

Example Of 25 Printable Irs Mileage Tracking Templates Gofar Mileage

Buy A Truck Or SUV Before Year End Get A Tax Break

50 Example Mileage Log For Taxes Ufreeonline Template Pertaining To

50 Example Mileage Log For Taxes Ufreeonline Template Pertaining To

:max_bytes(150000):strip_icc()/IRSSampleBusinessUseofCarLog-c0287e173350497e99732f429aae2305.jpg)

How To Keep A Mileage Log To Claim Vehicle Expenses

Mileage Claim Form Template

Can I Write Off Mileage If I Get A 1099 Leah Beachum s Template

Can I Write Off Mileage For Work - If you travel for work you may be able to deduct mileage expenses from your taxes Find out if you qualify and how to document it