Federal Gas Rebate 2024 Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released additional guidance under President Biden s Inflation Reduction Act IRA to lower Americans energy bills by providing clarity on eligibility for incentives to install electric vehicle charging stations and other alternative fuel refueling stations The Department of Energy is also IR 2024 16 Jan 19 2024 WASHINGTON The Internal Revenue Service and the Department of the Treasury today issued Notice 2024 20 PDF to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit and to announce the intent to propose regulations for the credit The Inflation Reduction Act amended the credit for qualified alternative fuel

Federal Gas Rebate 2024

Federal Gas Rebate 2024

https://patabook.com/news/wp-content/uploads/2022/06/gas_prices_36292_c0-228-5472-3420_s1200x700.jpg

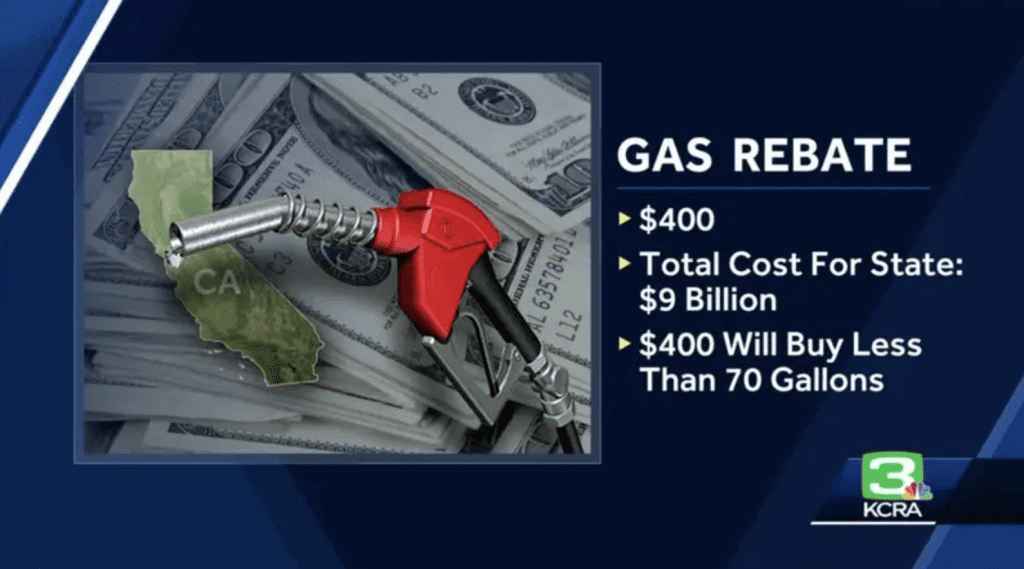

400 Per Taxpayer Gas Rebate Proposal To Be Announced By Assembly Dems On Thursday California

https://californiaglobe.com/wp-content/uploads/2022/03/IMG_0552-scaled.jpeg

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will Hurt Less Globalnews ca

https://globalnews.ca/wp-content/uploads/2019/05/infogfx_carbon_tax_comparison_1.jpg?quality=85&strip=all&w=1200

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase If you buy a qualified used EV or fuel cell vehicle from a licensed dealer at 25 000 or less that may be eligible for the used EV tax credit The credit is 30 percent of the sale price with a maximum credit

A used EV might be the way to go in 2024 Although the 7 500 federal tax credit has been or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a You ll get a 30 tax break for expenses related to qualified improvements that use alternative power like solar wind geothermal or biomass energy The tax credit had dropped to 26 in 2021 but

Download Federal Gas Rebate 2024

More picture related to Federal Gas Rebate 2024

New Federal Tax Brackets For 2023

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA16eFiq.img

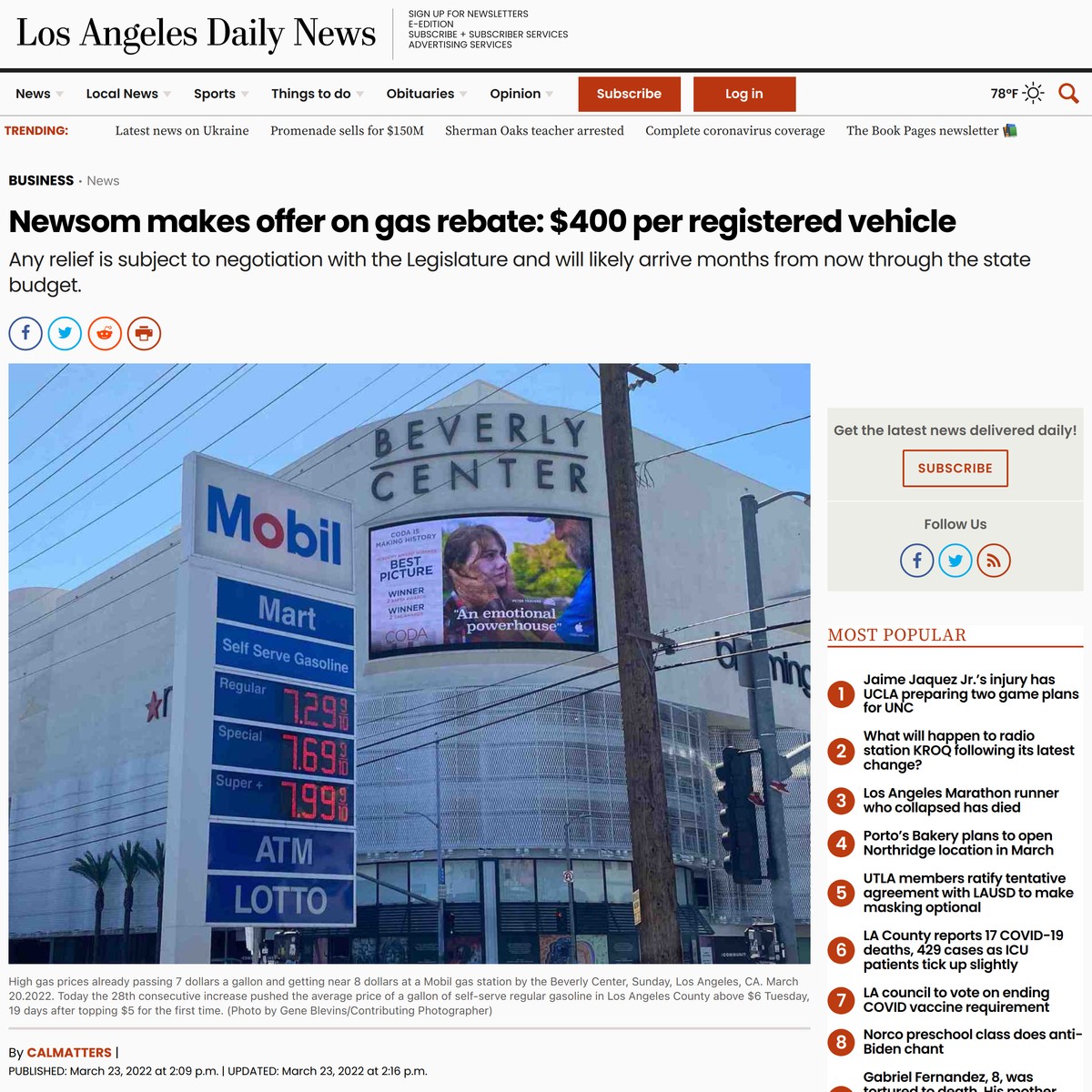

California Gas Rebate Here s How Much You ll Get CalMatters

https://calmatters.org/wp-content/uploads/2022/06/092922_GasStation_LV_CM_003.jpg

Mass Save PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

What to expect when buying a car in 2024 Dec 28 202303 11 Edmunds an online car shopping resource put the average price of a used EV at 50 000 as recently as December 2022 but now estimates Updated as of January 24 2024 metal or oxide fuel forms February 13 2024 Request for Federal Permitting Improvement Steering Council To support Tribal

Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance Rebates collectively the Home Energy Rebates The Home Energy Rebates together authorize 8 8 billion in funds for the benefit of U S households The Biden administration is trying to entice consumers to buy electric vehicles by offering tax credits of up to 7 500 per vehicle The federal government is also spending billions of dollars to

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

Gas Rebate Proposal Introduced In Congress The National Interest

https://nationalinterest.org/sites/default/files/styles/desktop__1260_/public/main_images/2022-03-09T110106Z_587906167_RC2TXS9L8HSP_RTRMADP_3_UKRAINE-CRISIS-BIDEN-OIL.JPG.jpg?itok=Auq9ksfX

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

https://home.treasury.gov/news/press-releases/jy2035

WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released additional guidance under President Biden s Inflation Reduction Act IRA to lower Americans energy bills by providing clarity on eligibility for incentives to install electric vehicle charging stations and other alternative fuel refueling stations The Department of Energy is also

Gas Rebate Card PrintableRebateForm

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Lensrebates Alcon Com

Will There Be A Gas Rebate Check The US Sun

PA Rent Rebate Form Printable Rebate Form

What You Need To Know Federal Carbon Tax Takes Effect In Ont Manitoba Sask And N B Today

What You Need To Know Federal Carbon Tax Takes Effect In Ont Manitoba Sask And N B Today

Gas Rebate Card Idea Complicated By Chip Shortage

Newsom Makes Offer On Gas Rebate 400 Per Registered Vehicle Are na

California Gas Rebates Coming This Month How Much Will You Get Green Energy Analysis

Federal Gas Rebate 2024 - The bill would increase a tax credit for caregivers from 2 000 to 2 100 per child in 2024 and 2025 the limited amount of credits available to be put to death by nitrogen gas as a form