Can Married Filing Separately Claim Child Tax Credit If you re married filing separately the child tax credit amount qualify for is reduced from what you would receive if you had filed jointly Couples that are married filing separately receive a reduced credit that is equal to half of the typical credit amount

Generally you may not take this credit if your filing status is married filing separately However see What s Your Filing Status in Publication 503 Child and Dependent Care Expenses which describes an exception for certain taxpayers living apart from their spouse and meeting other requirements The amount of the credit is a If you re married filing separately you can still claim the child tax credit but there are some restrictions The credit is reduced to 1 000 per qualifying child and it s phased out at lower income levels than if you were married filing jointly

Can Married Filing Separately Claim Child Tax Credit

Can Married Filing Separately Claim Child Tax Credit

https://crossborderplanner.com/wp-content/uploads/2020/09/how-marriage-impacts-irs-tax-return.jpg

How Married Filing Separate Works In Texas Plano Tax Prep

https://planotaxprep.com/wp-content/uploads/2016/06/How-Married-Separate-Filings-Work-in-Texas.jpg

Married Filing Separately For Student Loans How Your Taxes Are

https://static.twentyoverten.com/5cc0c4b3364724490e40a13f/RDQIPOE4e/Married-Filing-Separately-for-Student-Loans-Blog-Post-Header.png

However if the parents have a qualifying agreement for the noncustodial parent to claim the child the noncustodial parent who claims the child as a dependent is eligible to claim the Child Tax Credit A parent can claim the CTC or ACTC if their filing status is Married Filing Separately Getting help claiming the Child Tax Credit If you claim the credit and your filing status is married filing separately you are required to show you meet the special requirements listed later under Married Persons Filing Separately by checking the checkbox located on line A above Part I on Form 2441 See Line A later for more information Purpose of Form

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to A child can only be claimed as a dependent on one tax return each tax year If the child s parents file separate tax returns the situation can get messy when both parents try to claim the same child

Download Can Married Filing Separately Claim Child Tax Credit

More picture related to Can Married Filing Separately Claim Child Tax Credit

Should I File Jointly Or Separately Expat US Tax

https://www.expatustax.com/wp-content/uploads/2022/09/Filing-Jointly-Vs-Separately.jpg

Consequences Of Filing Married Separately

https://static.wixstatic.com/media/ad4a76_2968b20eedac470cb89ccd4d3e01370a~mv2.png/v1/fill/w_1000,h_300,al_c,usm_0.66_1.00_0.01/ad4a76_2968b20eedac470cb89ccd4d3e01370a~mv2.png

Should Married Couples File Taxes Separately Or Jointly

https://i.ytimg.com/vi/JvHh-jmiyYA/maxresdefault.jpg

To claim the child tax credit a parent must have a qualifying dependent child younger than 17 at the end of 2023 However only one divorced parent is allowed to claim a child as a Answer the following true false questions about the limits on the amount of credit a taxpayer can receive for the child tax credit by clicking on the correct answer To assess your answers click the Check My Answers button at the bottom of the page

[desc-10] [desc-11]

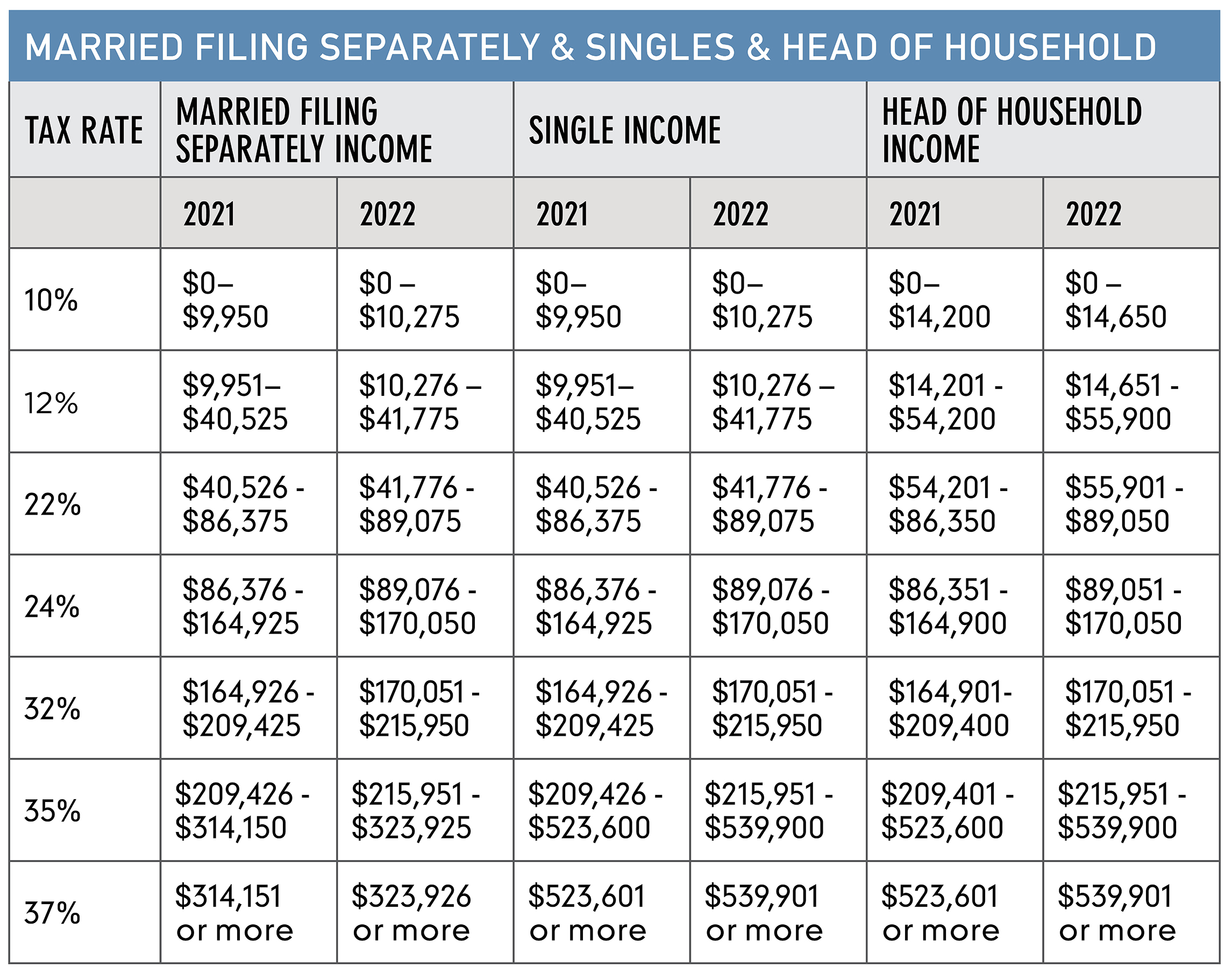

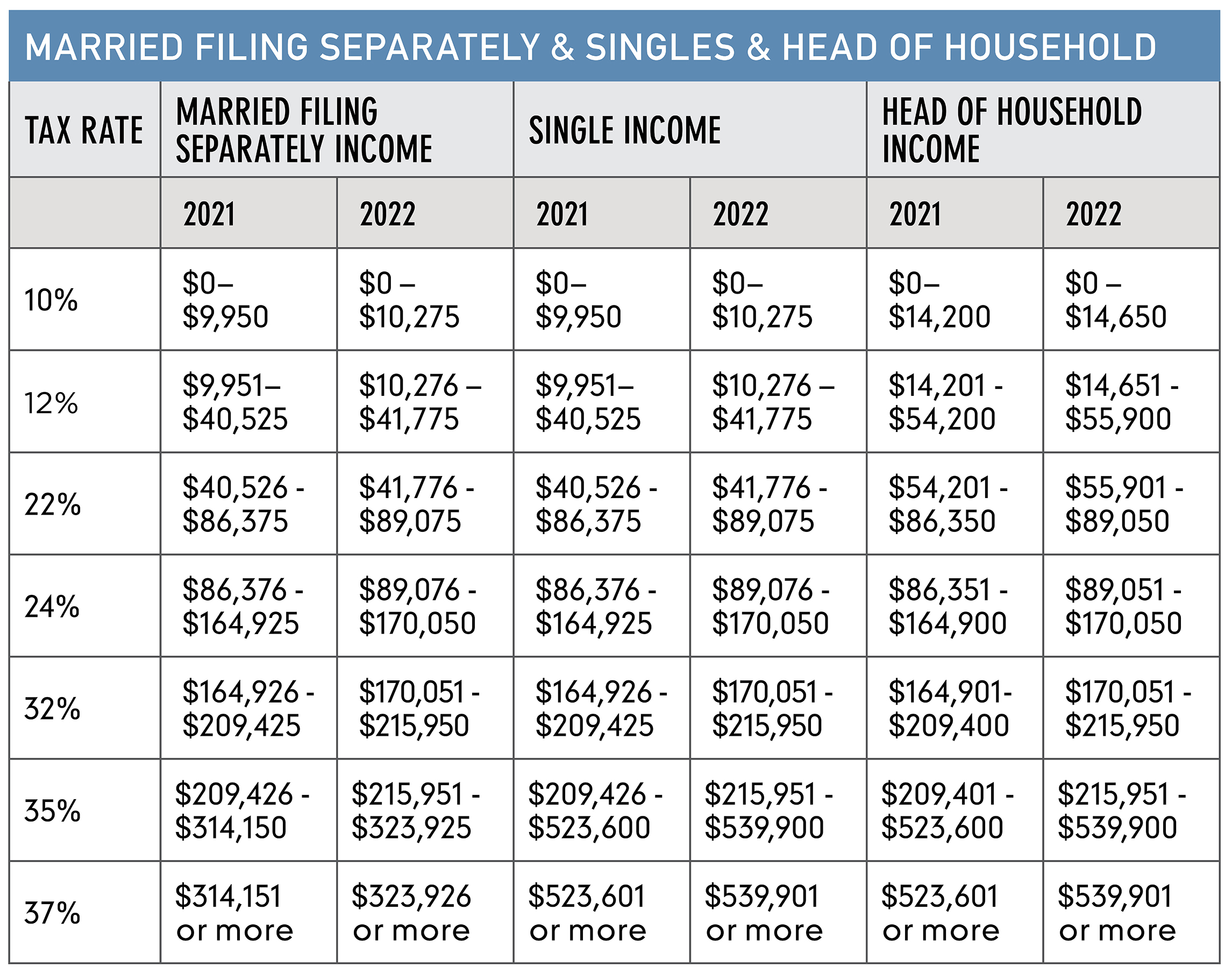

Stern Kory Sreden Morgan s Tax Planning Guide 2022 Tax Planning

https://cdn.ltmclientmarketing.com/WEBTPG/articles/2022TPG/Chart-Married_Filing_Separately_and_Singles_Head_of_Household.jpg

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

https://corvee.com/blog/child-and-dependent-tax-credit-for-married...

If you re married filing separately the child tax credit amount qualify for is reduced from what you would receive if you had filed jointly Couples that are married filing separately receive a reduced credit that is equal to half of the typical credit amount

https://www.irs.gov/taxtopics/tc602

Generally you may not take this credit if your filing status is married filing separately However see What s Your Filing Status in Publication 503 Child and Dependent Care Expenses which describes an exception for certain taxpayers living apart from their spouse and meeting other requirements The amount of the credit is a

Tax Filing 2022 Usa Latest News Update

Stern Kory Sreden Morgan s Tax Planning Guide 2022 Tax Planning

How To Fill Out IRS Form W 4 2020 Married Filing Jointly YouTube

Married Filing Jointly Vs Married Filing Separately Jarrar CPA

Married Filing Taxes Jointly Vs Married Filing Separately King5

/https://blogs-images.forbes.com/learnvest/files/2015/03/531887071-1940x1295.jpg)

Married Filing Jointly Vs Separately A CPA Weighs In

/https://blogs-images.forbes.com/learnvest/files/2015/03/531887071-1940x1295.jpg)

Married Filing Jointly Vs Separately A CPA Weighs In

What Is The Child And Dependent Care Credit 2020 2021 Children

Can Married Couples File Taxes As Single VERIFY Wcnc

How To Do Your Own Taxes A Beginners Guide

Can Married Filing Separately Claim Child Tax Credit - However if the parents have a qualifying agreement for the noncustodial parent to claim the child the noncustodial parent who claims the child as a dependent is eligible to claim the Child Tax Credit A parent can claim the CTC or ACTC if their filing status is Married Filing Separately Getting help claiming the Child Tax Credit