Can Students Get Vat Refund Uk Are you an international student seeking a VAT refund in the UK Here is a complete guide on international student VAT refund UK to learn more about how to file a VAT refund claim in the UK A VAT refund is the reimbursement of the VAT you paid as a non resident on items you bought in Europe

If you are a non EU resident who has been studying in the UK and you leave the UK and EU for 12 months or more then you can sometimes get VAT refunds on purchases you have made in the UK within the last 3 months The UK offers a tax refund scheme that allows tourists to reclaim the VAT paid on goods purchased during their visit provided certain conditions are met VAT amounts to 20 of the price paid so the refund could represent substantial savings

Can Students Get Vat Refund Uk

Can Students Get Vat Refund Uk

https://api.tourismthailand.org/upload/live/content_article/1124-20937.jpeg

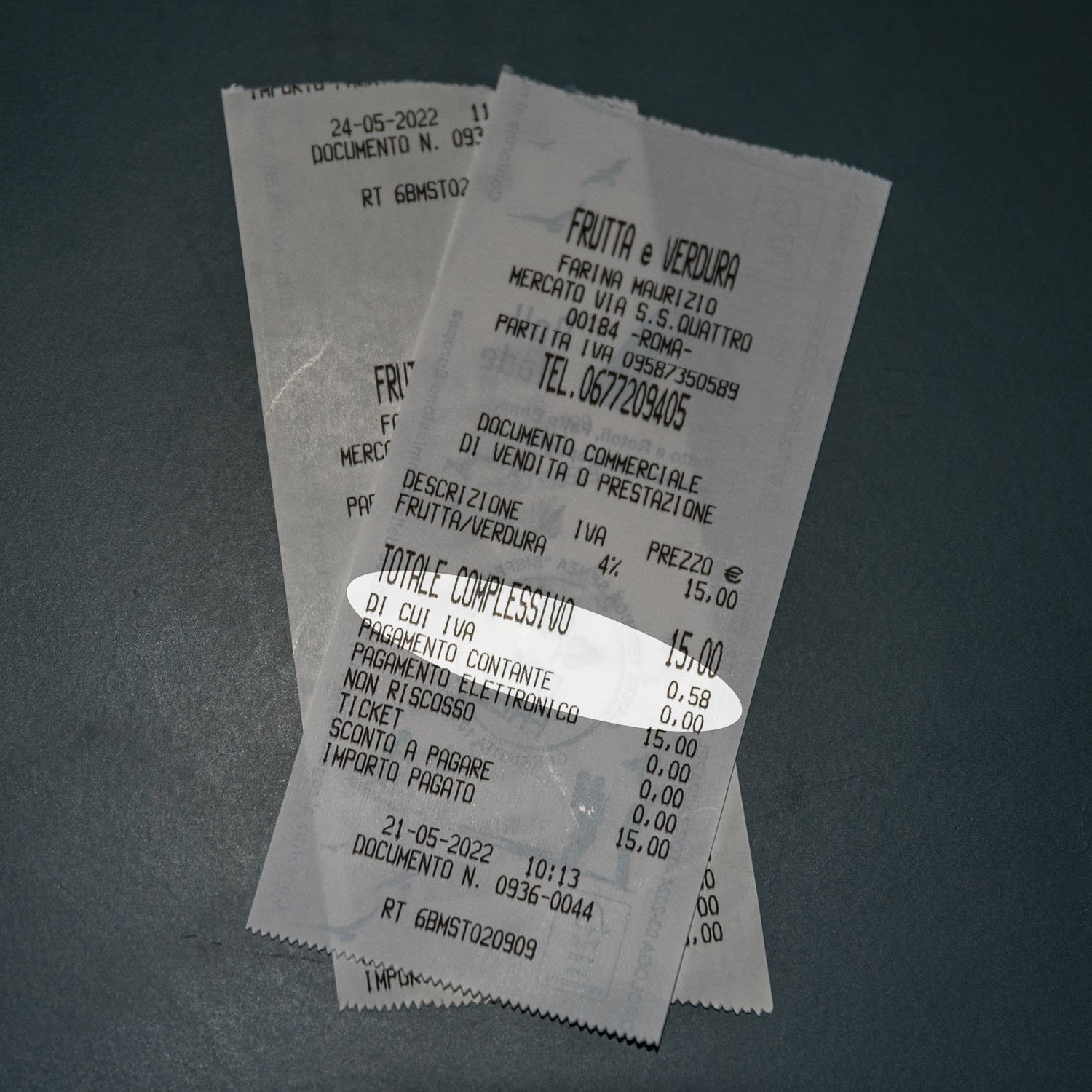

Know How To Get VAT Refund In Italy If It s Possible

http://static1.squarespace.com/static/626a3e2c3e96e84c4b6db2fb/t/628dded281abca76504d9c07/1653464786710/italy-VAT-IVA-1.jpg?format=1500w

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Foreign students usually do not pay UK tax on foreign income or gains as long as they re used for course fees or living costs like food rent bills study materials Learn how to claim a VAT refund in the UK if you re established outside the UK and meet certain conditions Find out what goods and services you can and cannot reclaim VAT on and how to

Learn how to get a VAT refund on goods bought in the UK if you are eligible and follow the steps Find out which goods are not eligible and what to do with the VAT 407 form This would enable non UK visitors to Great Britain to obtain a VAT refund on goods bought in the high street airports and other departure points and exported from the UK in their personal baggage The proposal is intended to provide a boost to the high street and create jobs in the retail and tourism sectors

Download Can Students Get Vat Refund Uk

More picture related to Can Students Get Vat Refund Uk

How To Claim A VAT Refund Everything You Need To Know

https://www.claimcompass.eu/blog/content/images/2020/05/How-to-Claim-a-VAT-Refund.png

UAE VAT Refund A Handy Guide For Businesses MBG

https://www.mbgcorp.com/ae/saseraf/2021/12/Blog-7-Image-how-to-get-vat-refund.jpg

How To Get VAT Refund In The UK YouTube

https://i.ytimg.com/vi/-lMQStIsPWc/maxresdefault.jpg

Learn how to claim VAT refunds on purchases made in London shops if you are eligible Find out that tax free sales at airports ports and Eurostar stations ended in 2021 If you have UK tax deducted at source in the tax year in which you leave the UK you might be due a tax refund

How Much Is VAT in the UK The VAT on most taxable goods in the UK is 20 percent since 2011 though the government can raise or lower the rate from time to time Some goods like Learn how to use the EU VAT refund system or the 13th Directive process to get VAT refunded in EU countries after the UK s departure from the EU Find out the eligibility criteria deadlines procedures and country specific conditions for different types of claimants

Taxes 2019 Why Is My Refund Smaller This Year

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

How Tourists Can Get VAT Refund In UAE Saif Chartered Accountants UAE

http://www.saifaudit.com/blog/wp-content/uploads/2018/07/uae-tourist-VAT-refund-system.jpg

https://www.getmyuni.com › uk › articles › complete...

Are you an international student seeking a VAT refund in the UK Here is a complete guide on international student VAT refund UK to learn more about how to file a VAT refund claim in the UK A VAT refund is the reimbursement of the VAT you paid as a non resident on items you bought in Europe

https://self-service.kcl.ac.uk › article › en-us

If you are a non EU resident who has been studying in the UK and you leave the UK and EU for 12 months or more then you can sometimes get VAT refunds on purchases you have made in the UK within the last 3 months

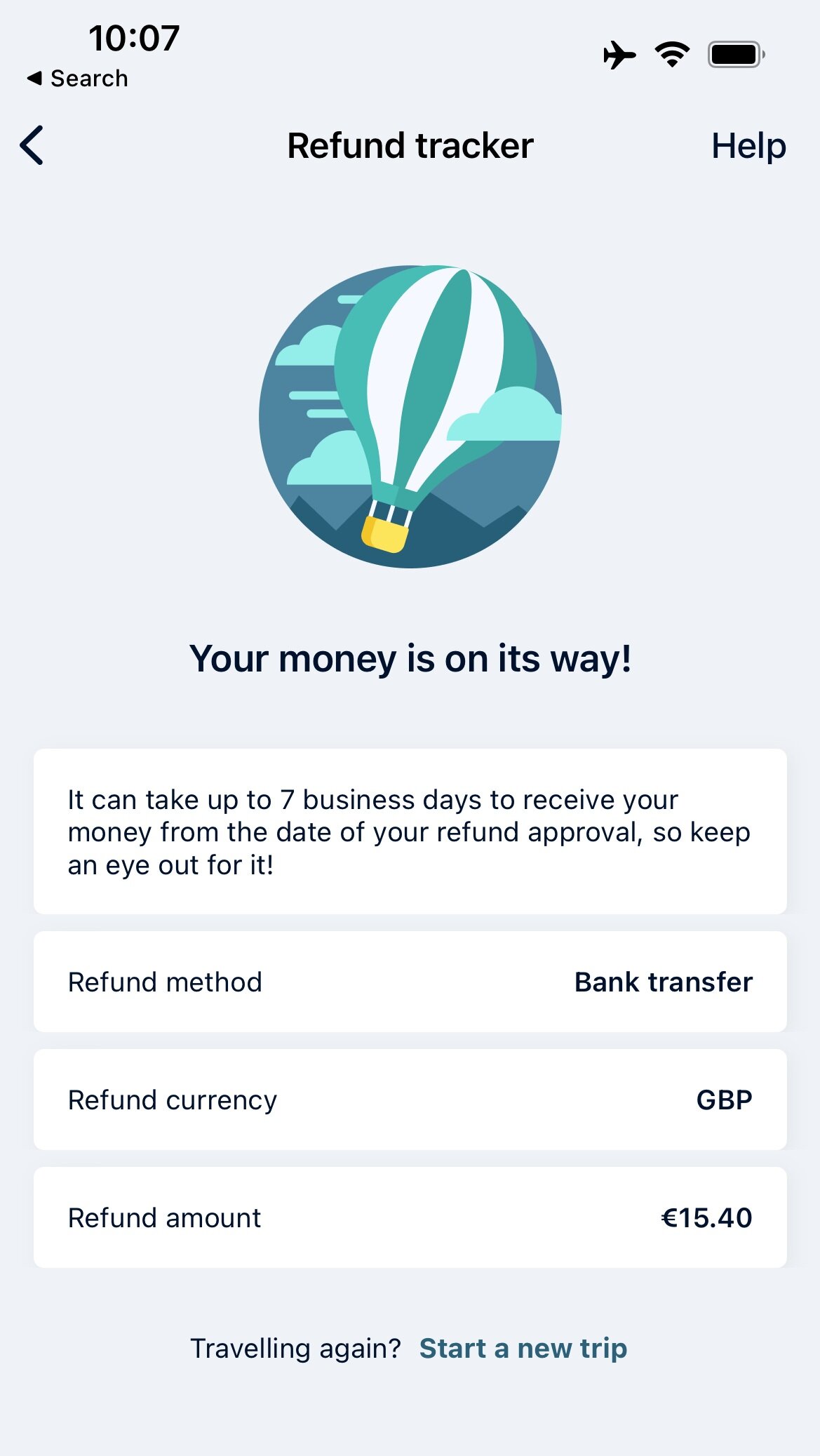

How To Get A VAT Refund In The UK With An App London Tips Travel

Taxes 2019 Why Is My Refund Smaller This Year

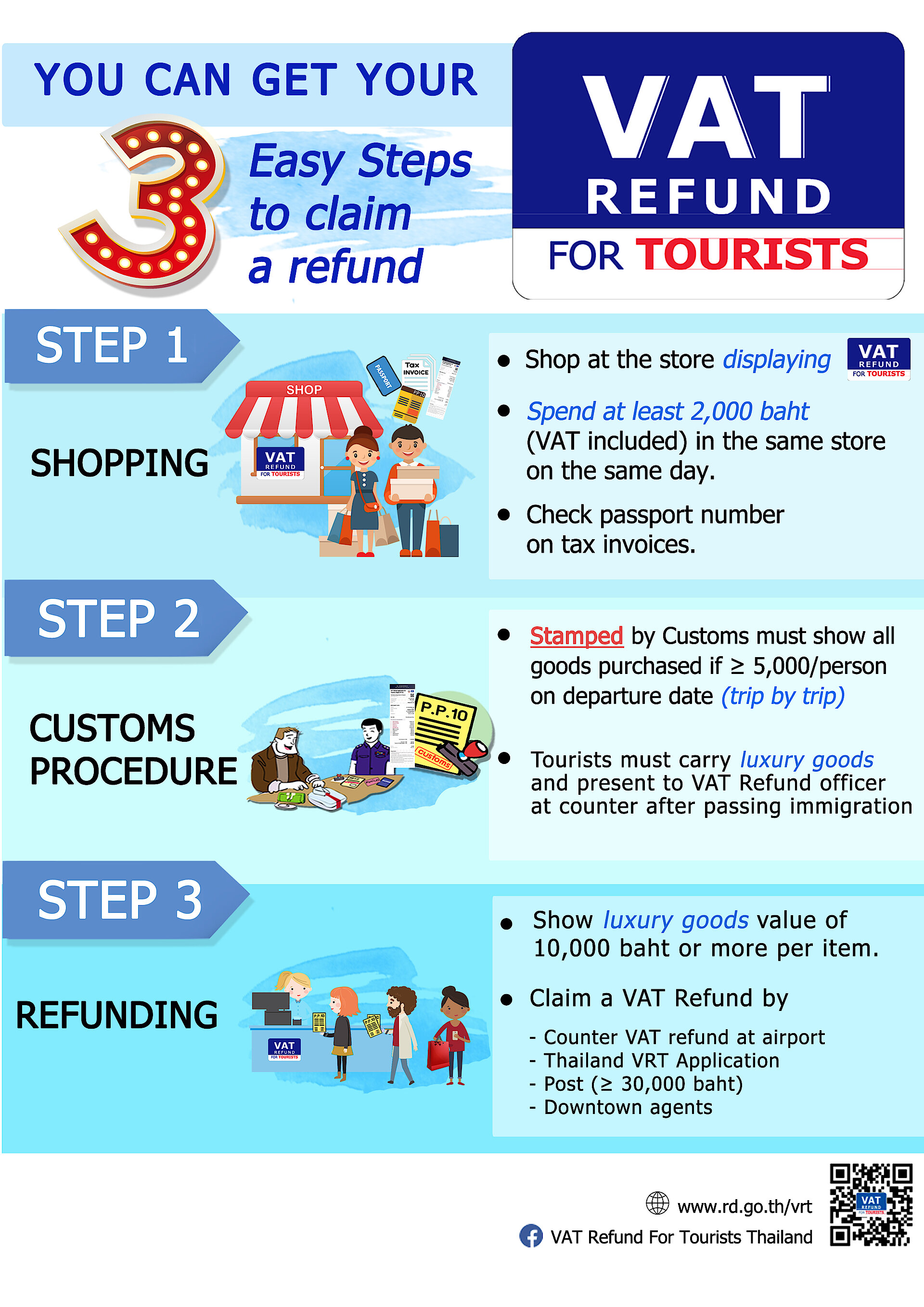

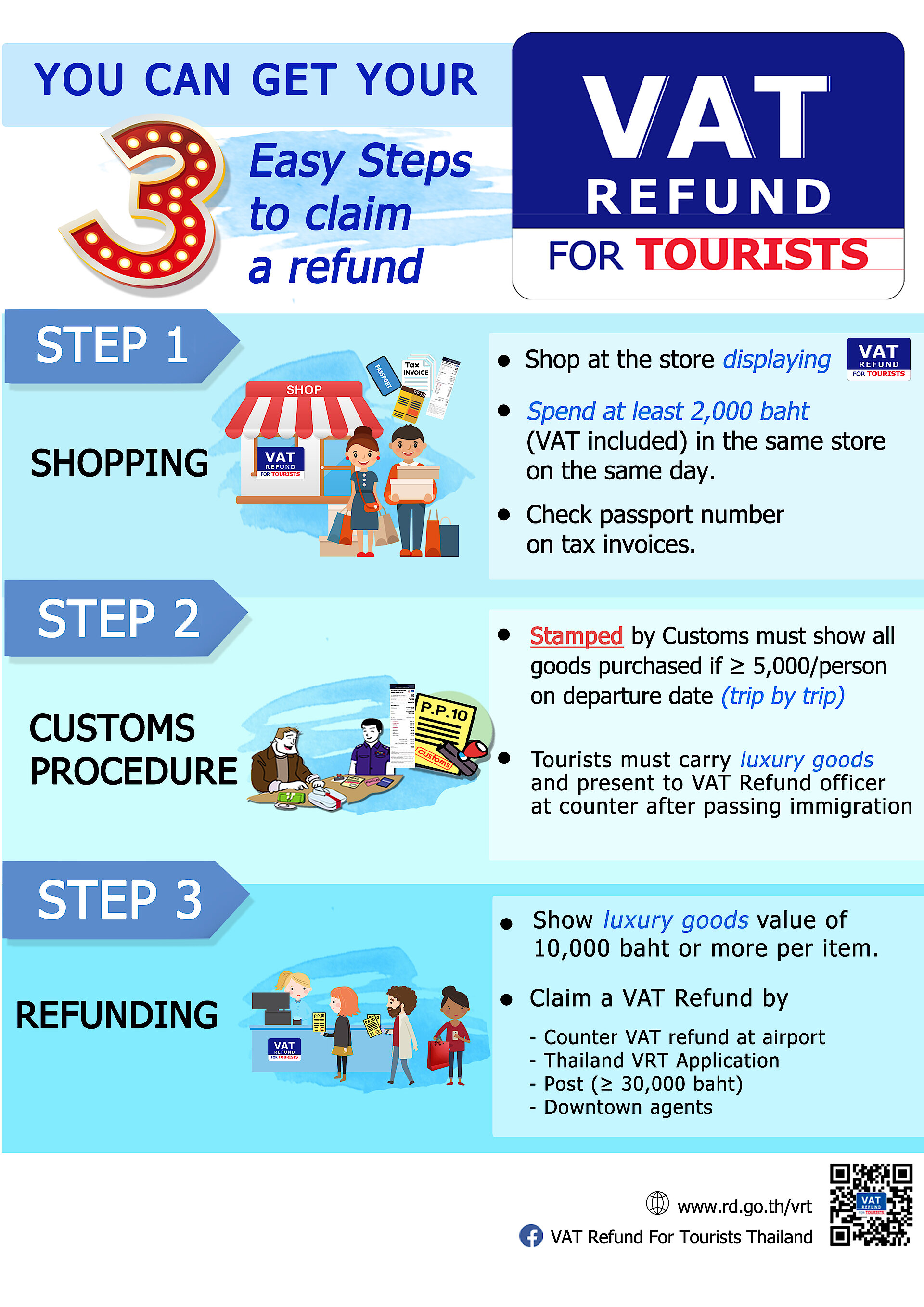

VAT Refund For Tourists Royal Thai Consulate General Vancouver

Who Is An Eligible Person For VAT Refund In Bahrain

How To Get Your VAT Refund In Paris Charles De Gaulle Airport France

VAT Refund Save Money In Europe Unseen Footprints

VAT Refund Save Money In Europe Unseen Footprints

How To Claim A VAT Refund UK VAT Calculator

How To Get A VAT Refund Travelsim

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

Can Students Get Vat Refund Uk - Learn how to get a VAT repayment if you ve charged less VAT than you ve paid and how to track it online Find out how long it takes how to change your payment details and what to do if