Can We Claim Nps Deduction In New Tax Regime If individuals choose the new tax regime they can avail of a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This deduction from the

Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the NPS on your behalf which is exempt from tax Under the new tax regime a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS can be availed This deduction from gross total income can be claimed if the

Can We Claim Nps Deduction In New Tax Regime

Can We Claim Nps Deduction In New Tax Regime

http://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

https://i.ytimg.com/vi/rYJYpL_AjkM/maxresdefault.jpg

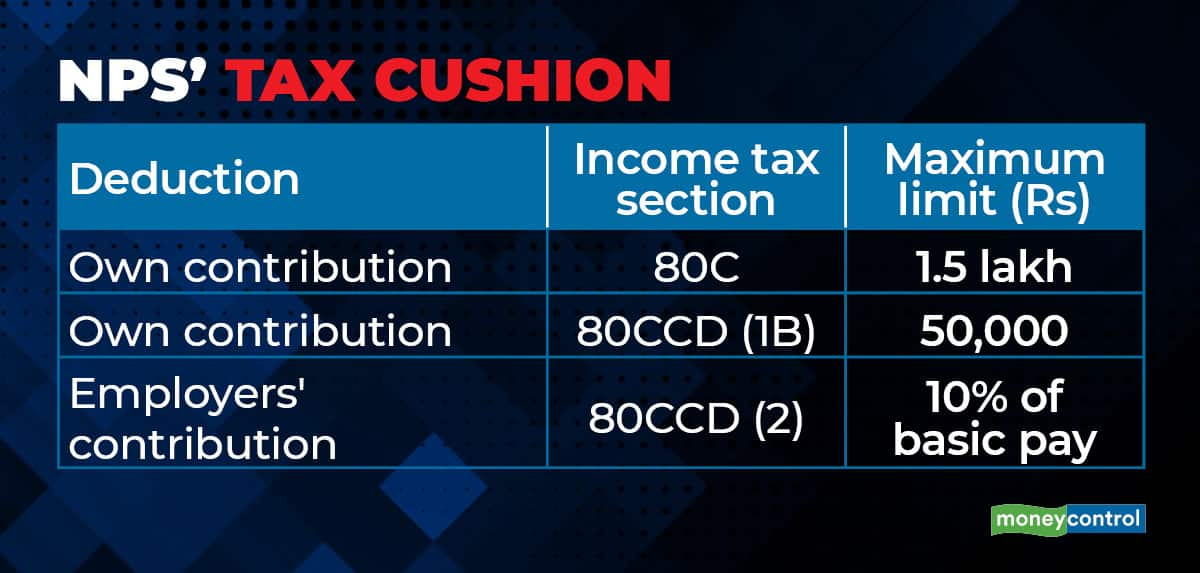

Taxpayers going with the Old Tax Regime can claim tax deductions against NPS under three sections of the Income tax Act 1961 Sections 80CCD 1 80CCD Here s how one can claim tax deductions for NPS under old and new income tax regimes New Tax Regime The NPS related deduction under Section 80CCD 2 of the Income tax Act 1961 was

Under the new tax regime the contribution made by employer towards Tier 1 NPS account is eligible for tax deduction under section 80CCD 2 of Income Tax Act 1961 without any limit The deduction of employer s contribution to NPS account i e under Section 80CCD 2 is allowed under New Regime There was a limit of 10 of employer s

Download Can We Claim Nps Deduction In New Tax Regime

More picture related to Can We Claim Nps Deduction In New Tax Regime

Creating NPS Deduction Pay Head For Employees Payroll

https://help.tallysolutions.com/docs/te9rel53/Payroll/Images/1_NPS_Employee_Deduction1.gif

NPS Tax Deduction Wealth Caf Financial Advisors

https://i2.wp.com/financial.wealthcafe.in/wp-content/uploads/2021/12/Article-Headers-9.png?fit=3000%2C1055&ssl=1

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

If you plan to choose the new tax regime you can deduct the employer s contribution from your NPS account The new tax regime has higher slabs and lower rates But the new tax regime takes away around Can you claim Income Tax Deduction on NPS contribution under New Tax Regime Are there any tax deductions under NPS Tier 2 account Under what sections of the IT act NPS investments can be

Contribution towards NPS by the taxpayer himself allows deduction from the Gross Total Income of an individual in three different sections of the Income tax Act 1961 viz Sec 80CCD 1 80CCD 1B and will be While the new tax regime offers the NPS benefit only under Section 80CCD 2 the old tax regime allows three deductions under Sections 80CCD 1 1 5 lakh

How Should You Manage Your NPS Tier 1 Account Under The New Tax Regime

https://www.livemint.com/lm-img/img/2023/04/06/600x338/H364LA44_1641746284136_1680788732333_1680788732333.jpg

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

https://economictimes.indiatimes.com › wealth › tax › ...

If individuals choose the new tax regime they can avail of a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This deduction from the

https://timesofindia.indiatimes.com › busi…

Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the NPS on your behalf which is exempt from tax

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

How Should You Manage Your NPS Tier 1 Account Under The New Tax Regime

Income Tax Slabs For FY 2022 2023 AY 2023 2024 Akrivia HCM

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

NPS Investment Proof How To Claim Income Tax Deduction Mint

Changes In New Tax Regime All You Need To Know

Changes In New Tax Regime All You Need To Know

Deduction Under Section 80CCD 2 For Employer s Contribution To

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

NPS Tax Queries Can You Claim Deduction For NPS Contribution Made By

Can We Claim Nps Deduction In New Tax Regime - Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD