Can We Claim Tax Benefit For Under Construction Property Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only after the construction is completed

You can claim tax benefits on a Home Loan availed of to purchase an under construction property Familiarising yourself with the tax exemptions available As per the income tax laws tax benefits on loan for an under construction property can be claimed in 5 equal installments starting from the financial year in which the homebuyer gets

Can We Claim Tax Benefit For Under Construction Property

Can We Claim Tax Benefit For Under Construction Property

https://thumbor.forbes.com/thumbor/fit-in/x/https://www.forbes.com/advisor/au/wp-content/uploads/2022/11/TaxDeductionsInvestmentProperty-e1669189015120.jpg

Can We Claim Tax Benefits While Availing A Personal Loan Fibe

https://altcont.fibe.in/wp-content/uploads/2020/07/shutterstock_553347184.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

As per the current income tax rules you cannot claim any tax benefits for the home loan till you get possession of the house i e during the pre construction In this guide we will explain how a buyer who has invested in an under construction property can claim tax benefit against home loan interest payment for a property in a pre construction stage

As far as tax benefits are concerned you will not get any benefit during the construction period for servicing the home loan Tax benefits for interest and loan repayments begin only from Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till

Download Can We Claim Tax Benefit For Under Construction Property

More picture related to Can We Claim Tax Benefit For Under Construction Property

How To Claim Income Tax Deductions BusinessToday

https://akm-img-a-in.tosshub.com/businesstoday/images/story/201302/tax-benefits_505_012913031006_020113040452.jpg?size=948:533

Your Guide To The Tax Benefit On Multiple Home Loans Homeonline

https://cloudimage.homeonline.com/855x451/public/uploads/gallery/articles/your-guide-to-the-tax-benefit-on-multiple-home-loans.jpg

Section 54F Benefit For Under construction Flats

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/06/17/837748-property-investment-istock-052119.jpg

6 Min Read In a move that could foster greater investment in the commercial real estate sector the Supreme Court on Thursday October 3 provided relief to the A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid in a year and up to 1 5 lakhs for principal paid under Section 80C of the Income Tax Act

5min read The Supreme Court recently delivered a crucial ruling on the question of whether input tax credit ITC can be claimed for transactions concerning Can I get income tax benefit on under construction property Yes you get income tax benefits for an under construction property under Sections 24 and 80C of the

Can We Claim Tax Exemption On The Leave Encashment Fishbowl

https://files.getfishbowl.com/content_preview_images/can-we-claim-tax-exemption-on-the-leave-encashment-received-after-resigning-the-company-i-received-it-in-the-full-and-final.png

Self employed Individuals Are Allowed To Take A Tax Deduction For Their

http://static1.squarespace.com/static/601c437c854ffc4d9f0aead9/6033c36413e8d937c4d9d497/636d52be324d854ed57020d6/1668797535403/Self+employed+medicare+premium+tax+deduction+.jpg?format=1500w

https://cleartax.in/s/case-study-deduction-fo…

Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only after the construction is completed

https://www.bajajhousingfinance.in/resources/claim...

You can claim tax benefits on a Home Loan availed of to purchase an under construction property Familiarising yourself with the tax exemptions available

How To Claim Tax Benefit On Home Loan For Under Construction Property

Can We Claim Tax Exemption On The Leave Encashment Fishbowl

How To Claim Tax Benefits On More Than One Home Loan

Buying Ready To Move In Or Under Construction Properties

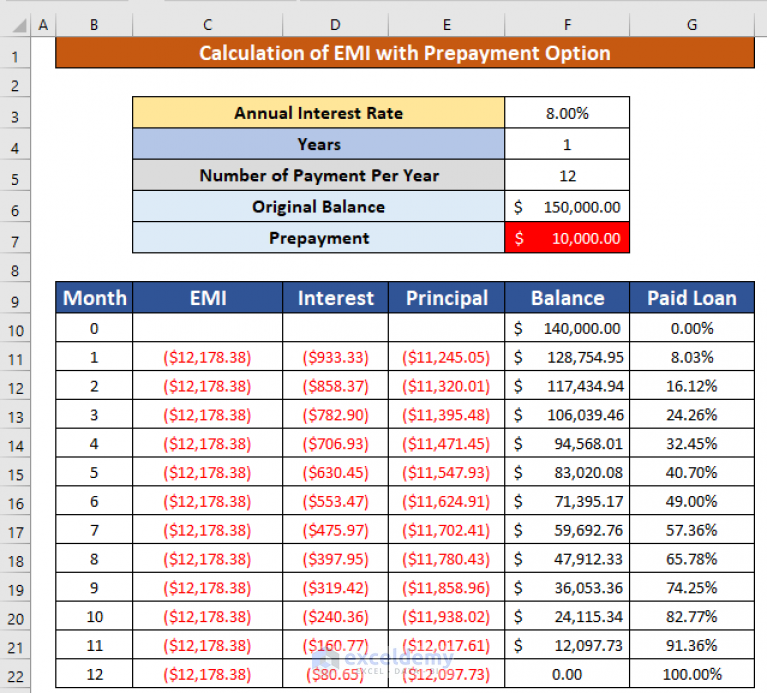

EMI Calculator With Prepayment Option In Excel Sheet with Easy Steps

How To Get Tax Benefit On Under Construction Property Stroymaster

How To Get Tax Benefit On Under Construction Property Stroymaster

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

How Service Tax And VAT Is Calculated On Under Construction Property

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

Can We Claim Tax Benefit For Under Construction Property - If you get the possession before March 2020 ends you can claim tax benefits You can request for Construction completion and Possession certificates from