Can We Withdraw Hsa Money Withdrawals from an HSA are tax free provided the money is used to pay for qualified medical expenses These expenses can include payments for dental and vision care which some medical

HSA rules for withdrawals If you withdraw money from an HSA for any reason other than to cover eligible medical expenses you will be subject to a 20 penalty on the amount There are two different penalties that can result when people withdraw money from an HSA Which penalty you face depends on what you use the money for

Can We Withdraw Hsa Money

Can We Withdraw Hsa Money

https://images.contentful.com/6j8y907dne6i/4ASMR4GJB8EGJoXPtGWqLj/d6a2d0cf2f363b57abaa037e62026a55/Infographic_Money_Out_HORIZ.png

Health Savings Account HSA Workest

https://www.zenefits.com/workest/wp-content/uploads/2022/12/HSA-e1677100040197.jpg

The Best Health Savings Accounts HSA Providers Fidelity And Lively

https://www.mymoneyblog.com/wordpress/wp-content/uploads/2021/11/hsa_better.jpg

When can I withdraw my HSA money without penalty You can withdraw your HSA money penalty free any time before or during retirement to pay for qualified medical expenses You can withdraw HSA funds for any reason once you re 65 without penalty though you ll owe taxes on non medical distributions

A health savings account HSA has potential financial benefits for now and later Not only can you save pre tax dollars in this account to pay for qualified medical expenses but HSA withdrawal rules You can receive tax free HSA distributions to pay for qualified medical expenses as defined by the IRS

Download Can We Withdraw Hsa Money

More picture related to Can We Withdraw Hsa Money

Can I Withdraw Money From My Optum HSA Account YouTube

https://i.ytimg.com/vi/8rU2vBKWJ_k/maxresdefault.jpg

How Do I Withdraw Cash Using My HSA Card YouTube

https://i.ytimg.com/vi/Jo6RT53iolo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgZigRMA8=&rs=AOn4CLDgPCfWdnkRF3FfsXi6SmCY_vSfsg

Can I Invest The Money In My HSA FSA Insurance Neighbor

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/11/HSA-Money-Medical-Health.jpg

HSA funds can also be withdrawn to cover costs that Medicare often does not cover Examples dental and vision care Withdrawals for qualified healthcare expenses are tax free However in order to be eligible to open an HSA you need to be enrolled in a high deductible health plan For 2024 the

Once you turn 65 you may withdraw money from your HSA for any reason without facing the 20 penalty for non medical withdrawals However only the money HSAs are individual tax advantaged accounts that help people save and pay for qualified medical expenses Benefits include Contributions are pre tax or tax deductible

Authorisation Letter To Withdraw Cash From Bank Cash Withdrawal

https://i.ytimg.com/vi/wr_FGUtvU_Y/maxresdefault.jpg

Now Withdraw Money From ATM Without Using Debit ATM Cards

https://www.paisabazaar.com/wp-content/uploads/2022/05/feature-image-2.jpg

https://www.investopedia.com/articles/…

Withdrawals from an HSA are tax free provided the money is used to pay for qualified medical expenses These expenses can include payments for dental and vision care which some medical

https://www.fool.com/retirement/plans/hsa/rules

HSA rules for withdrawals If you withdraw money from an HSA for any reason other than to cover eligible medical expenses you will be subject to a 20 penalty on the amount

Can I Withdraw Money From My HSA At An ATM YouTube

Authorisation Letter To Withdraw Cash From Bank Cash Withdrawal

Withdraw Money From A Permanently Limited PayPal Account

How To Withdraw Money From Tradersway YouTube

Why Can t I Withdraw Cash From My HSA YouTube

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

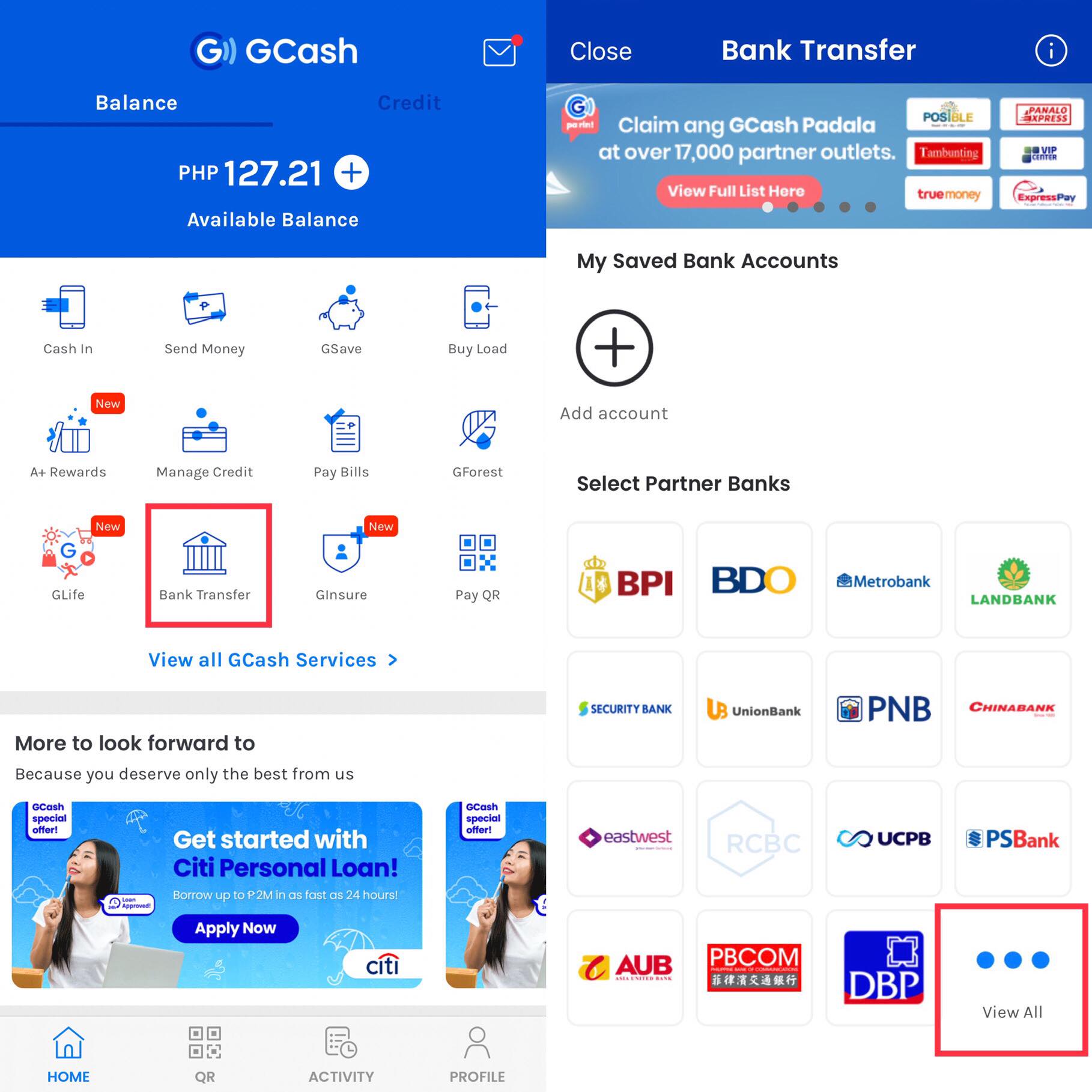

HOW TO CASH OUT IN GCASH 3 Easy Ways To Withdraw Money From Your GCASH

How Can We Withdraw Funds From GoFundMe TechCult

Can I Withdraw Money From My HSA YouTube

Can We Withdraw Hsa Money - When can I withdraw my HSA money without penalty You can withdraw your HSA money penalty free any time before or during retirement to pay for qualified medical expenses