Can You Claim A Car Loan On Your Taxes If you are paying car finance you might be asking can I claim car finance on my tax return In this guide we ll outline the key HMRC criteria so you can better understand whether you might be able

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the

Can You Claim A Car Loan On Your Taxes

Can You Claim A Car Loan On Your Taxes

https://www.finnable.com/wp-content/uploads/2022/01/Instant-car-loan.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

What Happens If I Pay My Car Loan Off Early Bankrate

https://www.bankrate.com/2010/12/17222319/How-paying-off-a-car-loan-early-affects-your-credit-score.jpeg

If you use a vehicle as part of your business operations such as to deliver products or drive to worksites your company may be eligible for certain tax deductions But there are a few important details Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies

Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for In order to make the interest on your auto loan tax deductible it needs to qualify as a legitimate expense that can be itemized and written off when you file your

Download Can You Claim A Car Loan On Your Taxes

More picture related to Can You Claim A Car Loan On Your Taxes

Can You Claim Home Improvements On Your Taxes CountyOffice YouTube

https://i.ytimg.com/vi/Kt1oSzozBIc/maxresdefault.jpg

Denied A Car Loan Here s What To Do Bankrate

https://www.bankrate.com/2015/10/11222324/Denied-an-auto-loan-Heres-everything-you-need-to-know.jpeg

What Credit Score Is Used For Car Loans Self Credit Builder

https://images.ctfassets.net/90p5z8n8rnuv/PVrtXp8qVl8yobyAsuW2H/9be7a7267bfbfa11bf0a49dd7dc5e22b/What_Credit_Score_Is_Used_for_Car_Loans_Asset_-_02.jpeg

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax deductible Work out how to claim motor vehicle expenses depending on your business structure and the type of vehicle Cents per kilometre method Check how sole traders

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially improve Interest paid on personal loans car loans and credit cards is generally not tax deductible However you may be able to claim the interest you ve paid when you file

How Much Does A Car Loan Affect Your Credit Score Commons credit

https://i4.ytimg.com/vi/uViFyQ1hE4A/sddefault.jpg

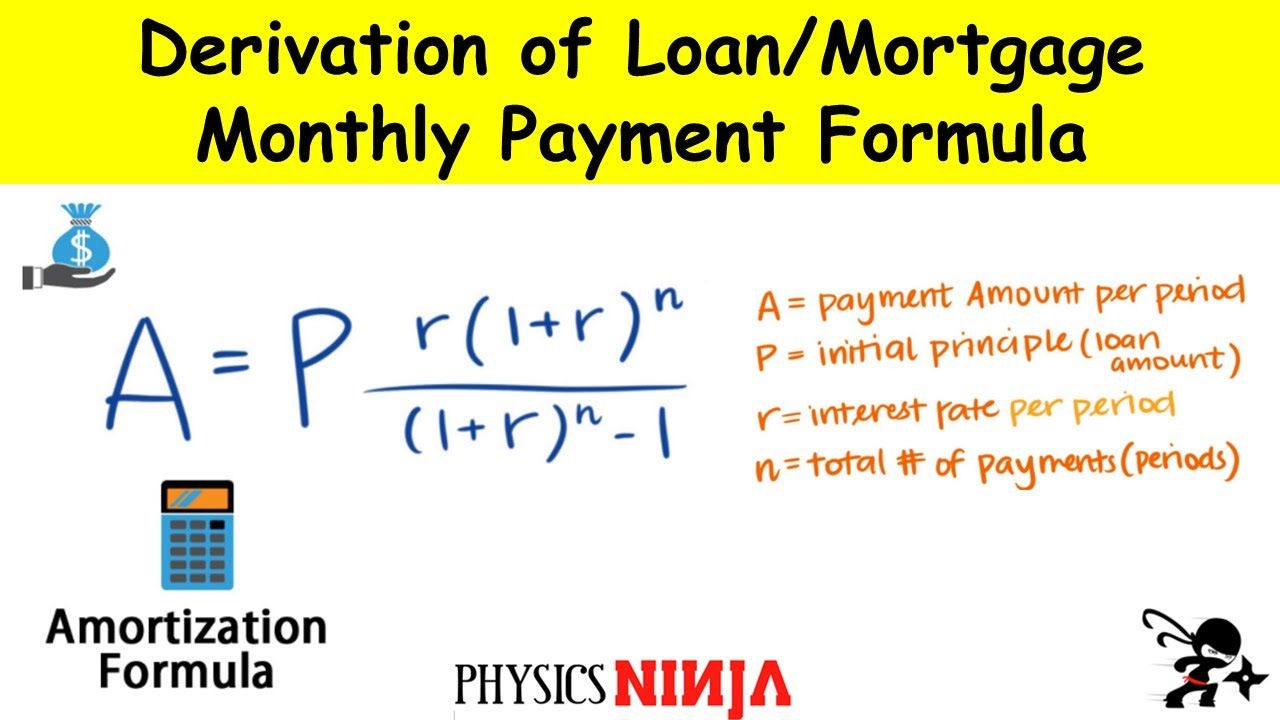

Derivation Of Loan Mortgage Monthly Payment Formula YouTube

https://i.ytimg.com/vi/iilFXMHKkZQ/maxresdefault.jpg

https://www.moneybarn.com/blog/your-…

If you are paying car finance you might be asking can I claim car finance on my tax return In this guide we ll outline the key HMRC criteria so you can better understand whether you might be able

https://www.hrblock.com/tax-center/filing/...

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car

Auto Loan Interest Rates The Key To Saving Thousands On Your Dream Car

How Much Does A Car Loan Affect Your Credit Score Commons credit

Claiming A Child As A Dependent When Parents Are Divorced Separated Or

Best Car Loans For Bad Credit My Car Community

5 Ways To Pay Off Your Car Loan Faster Self Credit Builder

How Auto Loan Refinancing Affects Your Credit Score Tresl Auto Finance

How Auto Loan Refinancing Affects Your Credit Score Tresl Auto Finance

Car Loan Apr Uk Tabitomo

Top 8 Car Loan Fair Credit In 2022 Blog H ng

When Can You Claim A Tax Deduction For Health Insurance

Can You Claim A Car Loan On Your Taxes - Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies