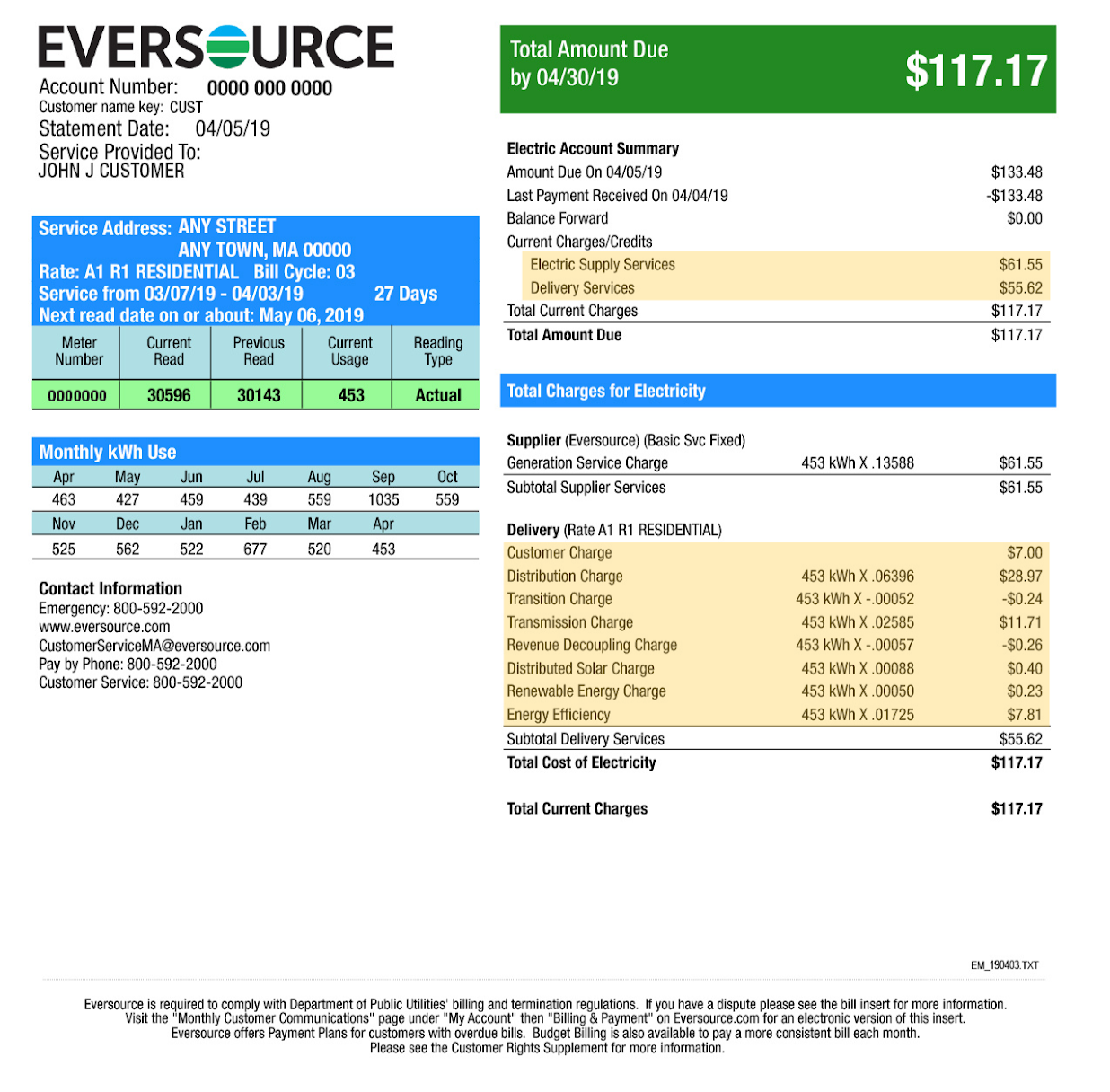

Can You Claim Electricity Bill On Taxes There are two ways to claim expenses either on your annual tax return if you file one or on a special form called a P87 which is available electronically via Government Gateway

Income and allowances to declare and the expenses you can claim a deduction for in your occupation or industry Find out which expenses you can claim as income tax How much can you claim for the home energy tax credits based on your energy efficient upgrades The table below lists qualifying purchases for both home

Can You Claim Electricity Bill On Taxes

Can You Claim Electricity Bill On Taxes

https://www.cleantechloops.com/wp-content/uploads/2021/08/tax-evasion.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

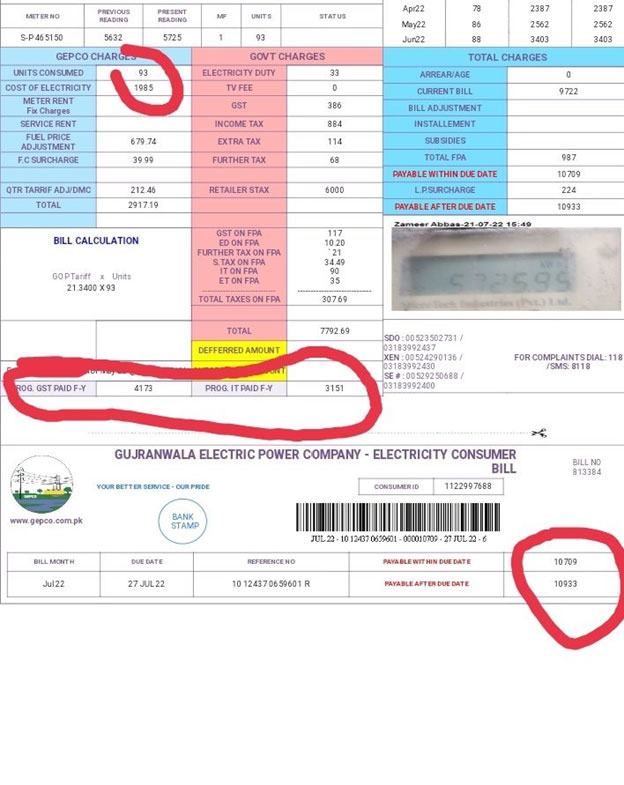

RETAILERS PROTEST AGAINST TAX IN POWER BILLS

https://arynews.tv/wp-content/uploads/2022/07/IESCO-2.jpg

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Claiming the home office tax deduction might lower your tax bill but to qualify you must use part of your home regularly and exclusively as your principal

The CBO measured the sizes of tax cuts by looking at the revenue effects of the bills as a percentage of gross domestic product in other words how much federal The document calls for the sacking of thousands of civil servants expanding the power of the president dismantling the Department of Education sweeping tax

Download Can You Claim Electricity Bill On Taxes

More picture related to Can You Claim Electricity Bill On Taxes

How To Claim Cell Phone Bill On Taxes CellularNews

https://cellularnews.com/wp-content/uploads/2023/10/how-to-claim-cell-phone-bill-on-taxes-1696307617.jpg

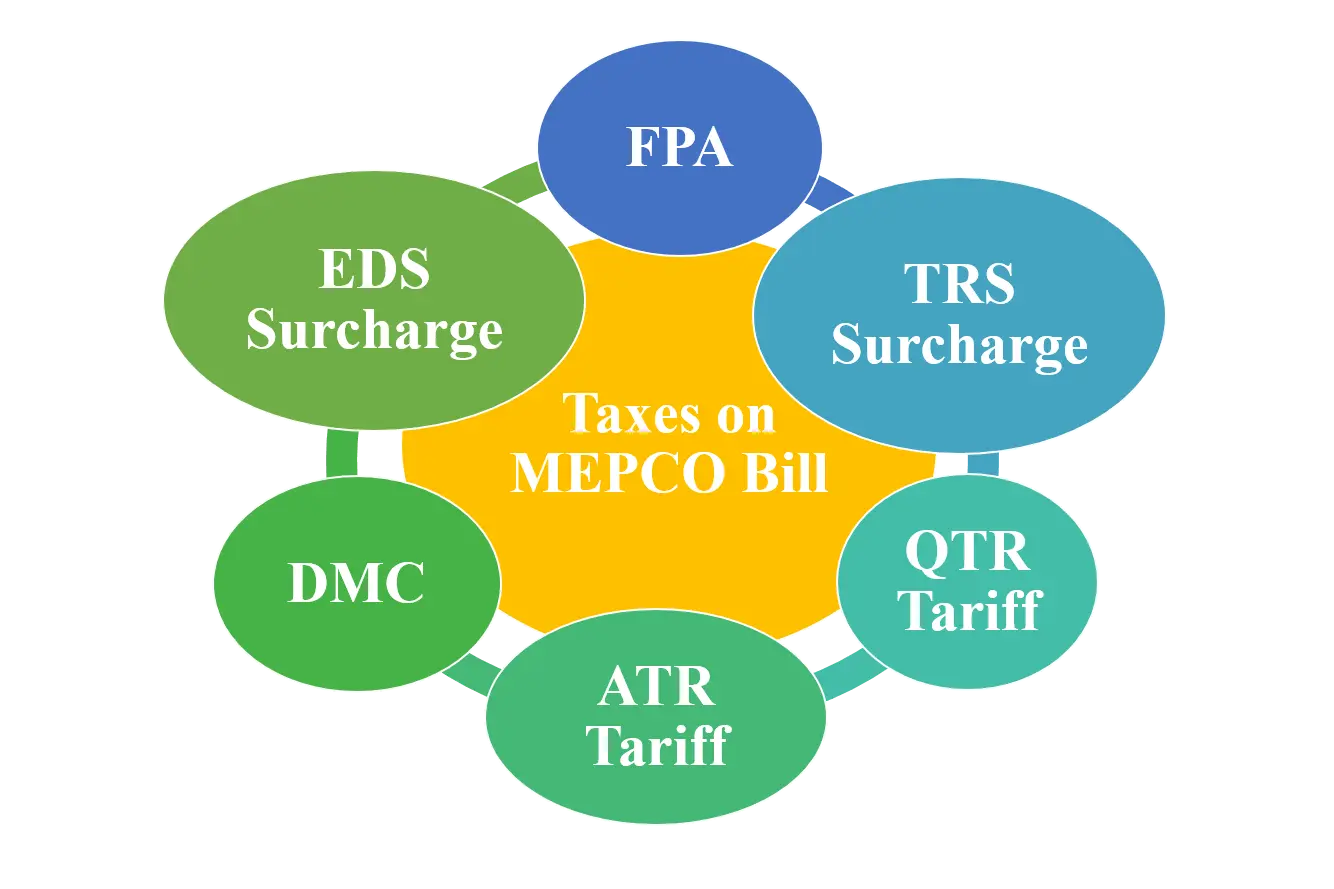

Taxes On Electricity Bill Highly Charged 8 Taxes

https://mepcobillcheck.com.pk/wp-content/uploads/2023/01/Taxes-on-MEPCO-Bill.webp

Tax Time Made Easier With These Tips The Origin Blog

https://www.originenergy.com.au/blog/wp-content/uploads/12588.Jun23.All_.OE-Tax-Time-2023-BLOG-BANNER-2048x1152px-FA01.jpg

Your electricity bill for the year is 400 Assuming all the rooms in your home use equal amounts of electricity you can claim 100 as allowable expenses 400 divided by 4 If an individual opts for the new concessional income tax regime for FY 2021 22 AY 2022 23 then the basic exemption limit will be Rs 2 5 lakh irrespective of the

Vice President Kamala Harris has backed the elimination of taxes on tips for hospitality and service workers endorsing a policy first offered by former President Trump announced a proposal to exclude tips from federal taxes on June 9 Harris announced a similar proposal on Aug 10 Details have been sparse Neither

The Deductions You Can Claim Hra Tax Vrogue

https://i.pinimg.com/originals/b7/f8/b4/b7f8b4bbd77f32ff39051e43daaba655.jpg

How To Check Electricity Bill Memberfeeling16

https://comparepower.com/wp-content/uploads/2022/03/How-to-read-electric-bill_Page_1-1091x2048.png

https://www.bbc.co.uk/news/business-5…

There are two ways to claim expenses either on your annual tax return if you file one or on a special form called a P87 which is available electronically via Government Gateway

https://www.ato.gov.au/.../deductions-you-can-claim

Income and allowances to declare and the expenses you can claim a deduction for in your occupation or industry Find out which expenses you can claim as income tax

Can I Claim The Cost Of My Loft Conversion In My Tax Return

The Deductions You Can Claim Hra Tax Vrogue

Lesson 6 What Expenses Can You Claim

Who Can You Claim As A Tax Dependent CBS News

Insurance 7 What Can You Claim For And How To Claim Insurance 7

Know Whether You Can Claim Input Tax Credit On Food

Know Whether You Can Claim Input Tax Credit On Food

Tax Bill Is Closer To Reality

Tax Investigation Archives IBISS CO

Wb Electricity Bill Order Discounts Save 61 Jlcatj gob mx

Can You Claim Electricity Bill On Taxes - If you want to claim a tax credit you ll likely need to fill out a form and submit it when you file taxes For example to claim the Residential Energy Efficient Credit