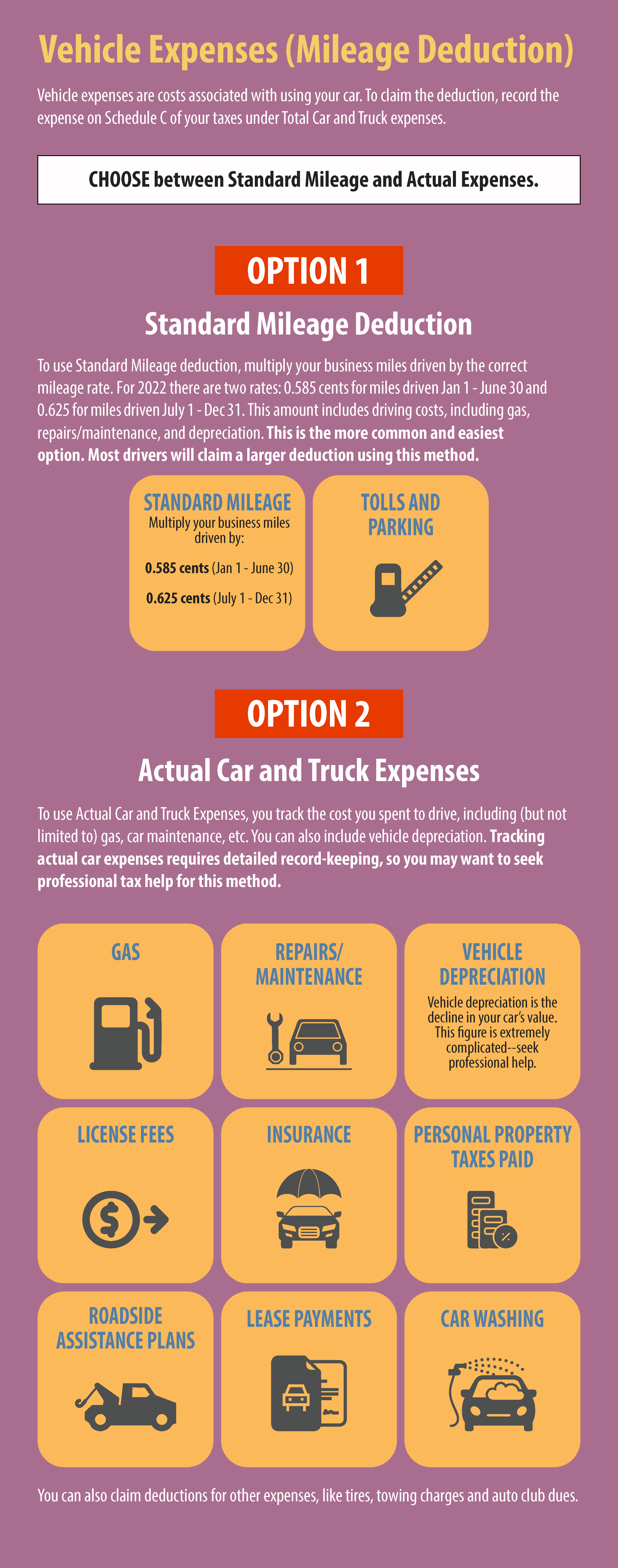

Can You Claim Gas Mileage On Taxes How to claim gasoline on your taxes There are two ways to write off car related expenses on your tax return the actual expense method and the standard mileage method You ll have to pick the former

You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the mileage deduction can add up to significant tax

Can You Claim Gas Mileage On Taxes

Can You Claim Gas Mileage On Taxes

https://image.isu.pub/221101165611-598d17bd7fbf01f76f627d521e6f458b/jpg/page_1.jpg

Mileage Log For Taxes Requirements And Process Explained MileIQ

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7808a1a34e392da06a0_610f13719242da6fd79cc8b1_MileIQ-vs-paper-mileage-log-1.jpeg

How The Self Employed Claim Mileage On Their Taxes

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cabad516a1f1ceea16e1_60d8c67933840b4f5f836616_claim-mileage-deduction-canada.jpeg

If you re self employed you typically can deduct expenses for the miles you drive or for the actual automobile costs for business purposes You can calculate your driving deduction by adding up your Can you claim gasoline and mileage on taxes In short the answer is no The type of deduction method you choose will determine whether or not you can claim gasoline or

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also Find out if you can claim gas expenses on your taxes with the tax experts at H R Block See if you are eligible for the standard mileage deduction

Download Can You Claim Gas Mileage On Taxes

More picture related to Can You Claim Gas Mileage On Taxes

Can I Claim Gas On My Taxes For Driving To Work Rules Explained

https://media.marketrealist.com/brand-img/rD-1GrxJg/1024x536/gas-business-expense-taxes-1667227937446.jpg

Can You Claim Gas On Your Taxes The Oasis Firm Credit Repair

https://www.theoasisfirm.com/wp-content/uploads/2022/04/Can-You-Claim-Gas-On-Your-Taxes.png

Watch Biden Claim Gas Was 5 A Gallon When He Took Office Not The Bee

https://media.notthebee.com/articles/635bc85b2c51b635bc85b2c51c.jpg

Step 1 Choose your method of calculation Step 2 Gather your mileage records Step 3 Calculate your mileage claim Step 4 Fill out the correct tax form Step 5 Retain your records Eligibility for Certain taxpayers can deduct mileage from vehicle use related to business charity medical or moving purposes To take the deduction taxpayers must meet use requirements and may have to

If you use your car whether you own or lease it for transportation to school you can deduct your actual expenses or use the standard mileage rate to figure the amount you If you don t want to keep a log by hand mileage and expense tracking apps can help you keep an accurate tally of this all important deduction When you use the

Calculate Gas Mileage Reimbursement AntonioTavish

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Example Of Free 25 Printable Irs Mileage Tracking Templates Gofar

https://i.pinimg.com/originals/ef/80/33/ef80334d3a23f7799ac429aaf9a31cd4.jpg

https://www.keepertax.com/posts/is-ga…

How to claim gasoline on your taxes There are two ways to write off car related expenses on your tax return the actual expense method and the standard mileage method You ll have to pick the former

https://www.gov.uk/tax-relief-for-employees/...

You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel

Can I Claim Gas Mileage To School On My Taxes School Walls

Calculate Gas Mileage Reimbursement AntonioTavish

What Expenses Can An Executor Claim List Actionable Advice Atticus

How Many Kids Can You Claim On Taxes Hanfincal

How To Claim The Standard Mileage Deduction Get It Back

Mileage Form 2021 IRS Mileage Rate 2021

Mileage Form 2021 IRS Mileage Rate 2021

Can I Claim Gas On My Taxes For Driving To Work Rules Explained

How To Deduct Mileage On Taxes Asbakku

How Much Does Probate Cost Who Pays Good Advice Atticus Magazine

Can You Claim Gas Mileage On Taxes - If you re wondering whether you re eligible or how exactly to claim a mileage deduction on your tax return you re in the right place You ll learn how to track mileage which forms