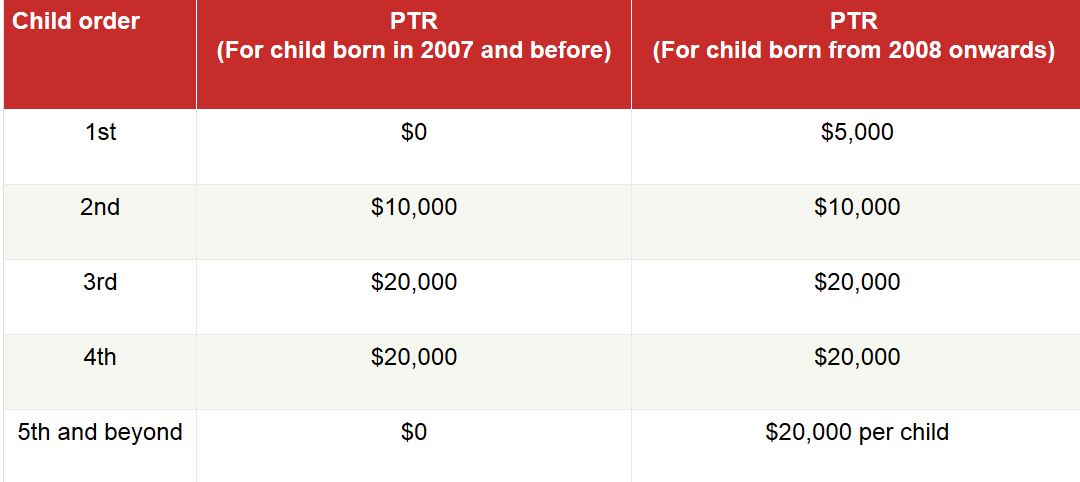

Parenthood Tax Rebate Eligibility Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per

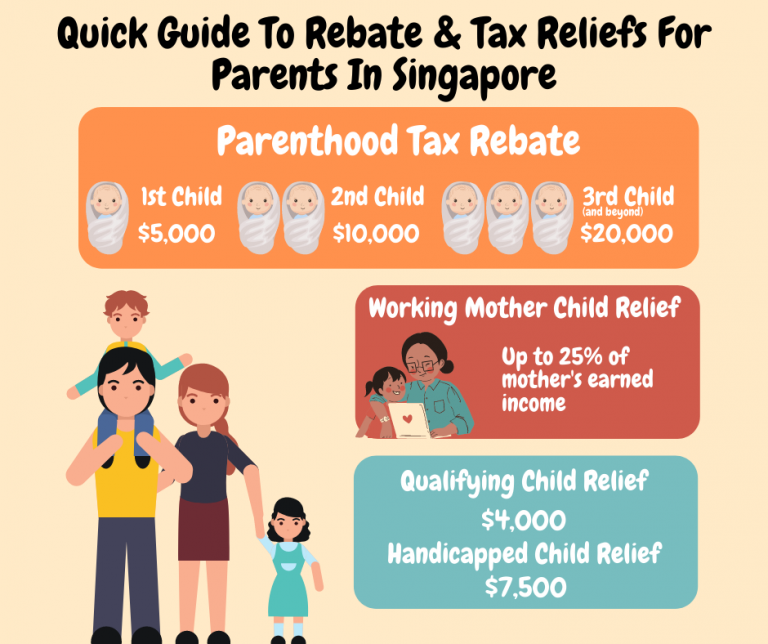

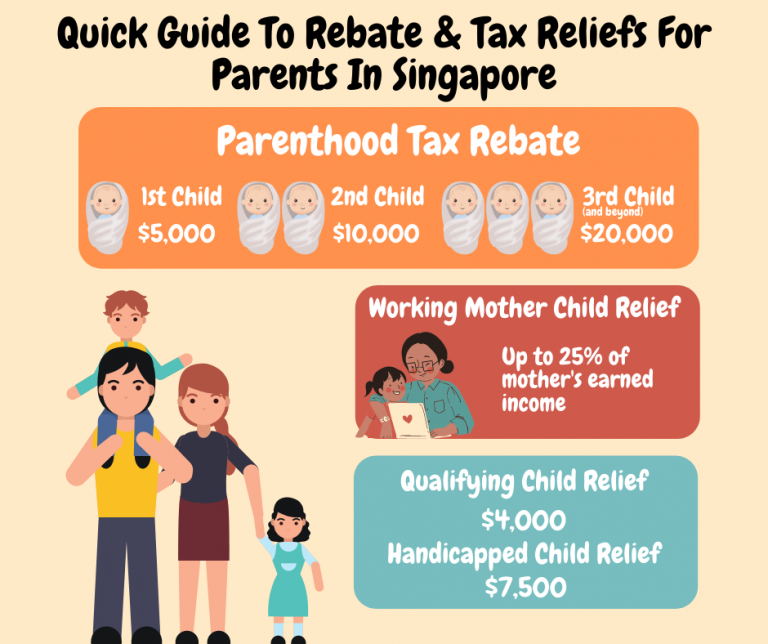

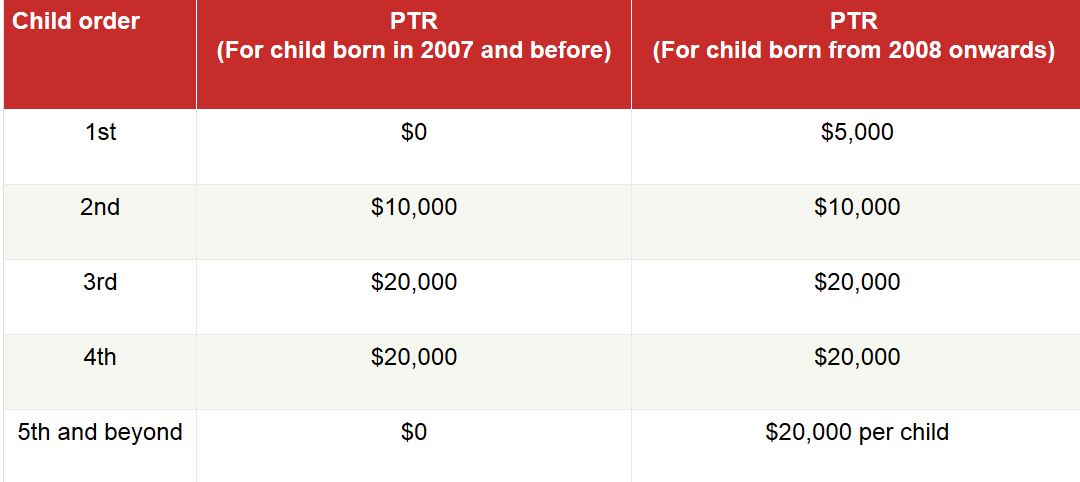

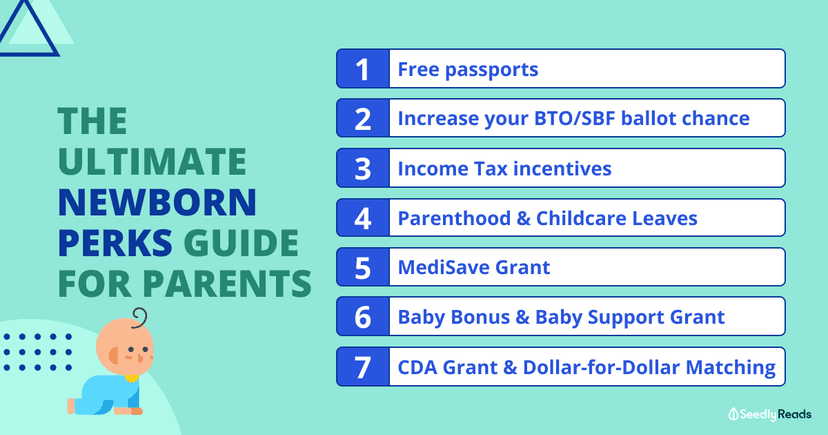

Web Please refer to the link below on how to claim the rebate You are not eligible to claim PTR Date of birth of your child dd mmm yyyy You are eligible for PTR of 5 000 if you are a Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and

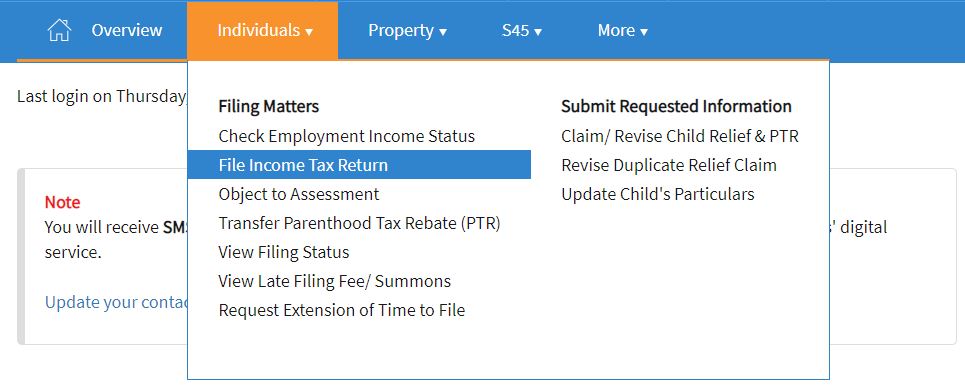

Parenthood Tax Rebate Eligibility

Parenthood Tax Rebate Eligibility

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-768x644.png

https://www.xinjiapo.news/image/a767a095880f5a7e35fa41114c0aff7d173d1296.jpeg

Web Click here for a simple eligibility tool How much money you save Parents receive a 5 000 offset for their first child an additional 10 000 for their second child and 20 000 Web a a child born to you and your spouse ex spouse in 2016 and you are married to your spouse ex spouse at the time or b a child born to you and your spouse ex spouse

Web 29 juil 2021 nbsp 0183 32 You may claim 15 of your earned income for your first child 20 for your second child and 25 for your third and subsequent child The total amount claimable is capped at 100 of Web 3 f 233 vr 2022 nbsp 0183 32 Parents who have not saved up to the co matching cap can continue to contribute to the Post Secondary Education Account and receive the matching

Download Parenthood Tax Rebate Eligibility

More picture related to Parenthood Tax Rebate Eligibility

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2016/04/table.jpg?fit=654%2C320&ssl=1

Parenthood Tax Rebate Guide For Singapore Parents

https://raisingangels.sg/wp-content/uploads/2021/11/PTR2.jpg

Parenthood Tax Rebate Rocks SimplyJesMe

https://4.bp.blogspot.com/-9c515_YMS7A/Wy8VH0SC9tI/AAAAAAAAEFk/GVdpND0QU6MV0-ks1zhFYidSsBlitIwdACLcBGAs/s640/1.JPG

Web Qualifying for relief Legally separated spouses Divorced spouses Qualifying for relief You may claim Spouse Relief in the Year of Assessment 2023 if you have supported your Web To claim Parent Relief Handicapped Parent Relief for Year of Assessment 2023 you must satisfy all these conditions in 2022 Parent Relief Handicapped Parent Relief may be

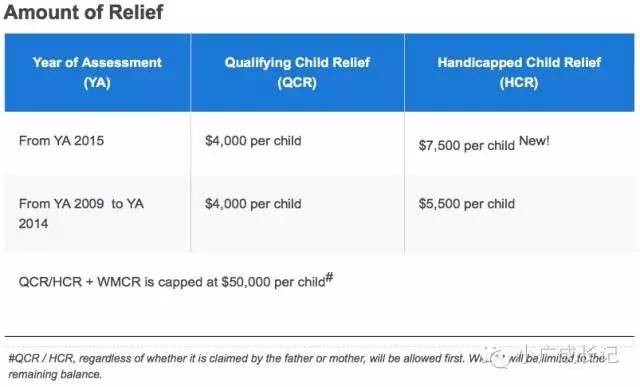

Web Qualifying for relief You may claim Qualifying Child Relief QCR Handicapped Child Relief HCR for the Year of Assessment 2023 if you are a parent maintaining an unmarried Web 2 mars 2016 nbsp 0183 32 If you are a new parent you will be entitled to 5 000 parenthood tax rebate for your first kid This rebate can be shared between parents and utilised slowly over the

10 Things All Working Mums Should Know

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2781915438586529

https://parentology.sg/complete-guide-to-the-parenthood-tax-rebate-ptr

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per

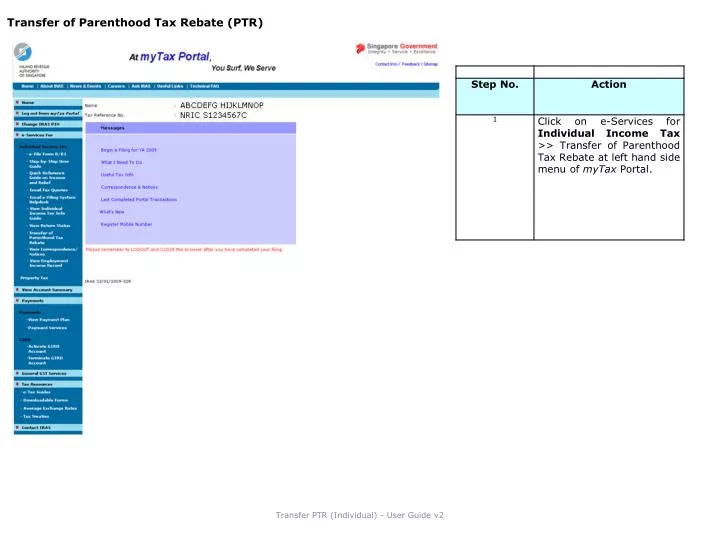

https://www.iras.gov.sg/docs/default-source/i…

Web Please refer to the link below on how to claim the rebate You are not eligible to claim PTR Date of birth of your child dd mmm yyyy You are eligible for PTR of 5 000 if you are a

IRAS Tax Savings For Married Couples And Families

10 Things All Working Mums Should Know

Parenthood Tax Rebate Rocks SimplyJesMe

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

.png?sfvrsn=d0aa2658_3)

IRAS Parent Relief Handicapped Parent Relief 2022

All About The Parenthood Tax Rebate In Singapore

All About The Parenthood Tax Rebate In Singapore

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

PPT Transfer Of Parenthood Tax Rebate PTR PowerPoint Presentation

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

Parenthood Tax Rebate Eligibility - Web March 31 2021 183 The Parenthood Tax Rebate and Qualifying Child Relief Handicapped Child Relief are available to all eligible parents Claim these reliefs when filing your taxes