Can You Claim Health Insurance Copays On Taxes You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain criteria

Luckily medical insurance premiums co pays and uncovered medical expenses are deductible as itemized deductions on your tax return and that can help defray the costs But before you breathe a sigh of relief read on The deduction applies only to expenses not compensated by insurance or otherwise regardless of whether you receive the reimbursement directly or payment is made on your behalf to the doctor hospital or other medical provider

Can You Claim Health Insurance Copays On Taxes

Can You Claim Health Insurance Copays On Taxes

https://lh6.googleusercontent.com/proxy/JQryq77Brc8jNUCCgCrXO3u7PttNzZOxjNcp6j2V1fvw5WSIOHlUJVIMi1qOhO8CCtKbKJB3LO_hdwTDeSI3qhtIxUYyrZRTKVa5Hrt5Hyqnc5NjgzaHr211juLdoTsW5i_79g=w1200-h630-p-k-no-nu

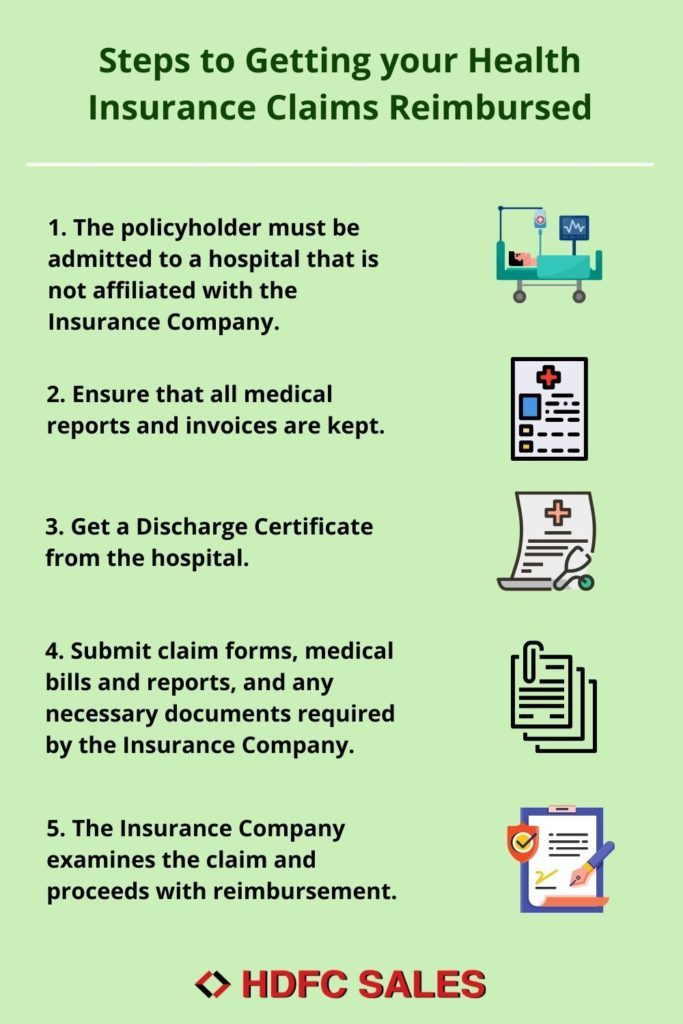

A Guide On Health Insurance Claim Process HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/health-insurance-reimbursement-process-683x1024.jpg

Canonprintermx410 25 Awesome Health Insurance Deductible Vs Copay

https://blog.cdphp.com/wp-content/uploads/2015/01/vignettes_copayment-1024x1024.jpg

To deduct unreimbursed out of pocket medical dental and vision costs on your federal return You must take the itemized deduction The expenses for you your jointly filing spouse and your dependent s must exceed 7 5 of your adjusted gross income AGI and Only the portion above and beyond 7 5 of your AGI is deductible You can include only the medical and dental expenses you paid in the current tax year It doesn t matter when you received the services The payment dates for expenses paid by the following methods are as follows Payment by

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction Generally you are allowed to deduct health insurance rates on your taxes if you itemize your deductions pay your health insurance premiums directly and your medical expenses totaled more than 7 5 of your income for the year

Download Can You Claim Health Insurance Copays On Taxes

More picture related to Can You Claim Health Insurance Copays On Taxes

What Conditions Qualify For Medical Card In California

https://www.greenworksflowersnyc.com/img/72ab42eac68c43d1aac4a58bb8a26925.jpg?22

Do You Need Copays On Your Ohio Health Insurance Plan YouTube

https://i.ytimg.com/vi/_dYcUDuue1o/maxresdefault.jpg

How Are Co insurance Copays And Deductible Different What Are Their

https://infolific.com/images/personal-finance/insurance-policy.png

Even with tax subsidies health insurance premiums are often costly You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed health insurance deduction allows you to deduct up to 100 of your premiums Some but not all health insurance premiums qualify for tax deductions When you itemize your deductions you typically can claim a deduction for the money you pay out of pocket toward health insurance premiums including traditional coverage COBRA and Medicare

Health Insurance Premiums Qualifying taxpayers can deduct the monthly premiums that they pay for insurance coverage These include expenses to HMOs long term care insurance and Medicaid payments Not all insurance will qualify for this tax deduction so make sure that your coverage does All 2021 taxpayers can claim certain medical expense deductions that exceed 7 5 of their AGI Learn which health expenses are deductible and which aren t

What Is Copay In Health Insurance A Comprehensive Guide The

https://www.lihpao.com/images/illustration/what-is-copay-in-health-insurance-3.jpg

Highmark Medicare Claims

https://www.bsneny.com/content/neny/member-services/tools/frequently-asked-questions/eob/_jcr_content/content/bootstraprow/bootstraprow_984258702/image.img.png/1615317784073.png

https://www.investopedia.com/are-health-insurance...

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain criteria

https://blog.turbotax.intuit.com/tax-tips/maximize...

Luckily medical insurance premiums co pays and uncovered medical expenses are deductible as itemized deductions on your tax return and that can help defray the costs But before you breathe a sigh of relief read on

Tax Deductions You Can Deduct What Napkin Finance

What Is Copay In Health Insurance A Comprehensive Guide The

Before After Microplastics II Microplastics A System Of Market Based

How To File An Insurance Claim And What To Expect

Can You Claim Health Insurance On Tax Return Are Diabetic Shoes Tax

The Car Expenses You Can Claim To Maximise Your Tax Return Fast Trak

The Car Expenses You Can Claim To Maximise Your Tax Return Fast Trak

What Is Copay In Health Insurance Coverfox Com YouTube

Rates And Insurance For TMS TMS Center Centennial

Streamline Collecting Copays And Deductibles From Patients

Can You Claim Health Insurance Copays On Taxes - Key Takeaways You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040