Can You Claim Health Insurance On Your Tax Return Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the money you paid toward your monthly premiums can be taken as a tax deduction

If you are enrolled in an employer sponsored health insurance plan your premiums may already be tax free If your premiums are made through a payroll deduction plan they are likely made If your premium tax credits cover 60 of your premiums you won t be able to deduct that portion But if you pay the remaining 40 out of pocket you ll be able to deduct that amount on your tax return Additionally you cannot take the self employed health insurance deduction for the credit amount

Can You Claim Health Insurance On Your Tax Return

Can You Claim Health Insurance On Your Tax Return

https://img-4.linternaute.com/KltbLvPNMMwvgtnPtt2VFikZLHQ=/1500x/smart/2347a444b7dc4e6aa215ee5bc33b93ff/ccmcms-linternaute/34932014.jpg

How Can You Claim Health Insurance On Taxes HowFlux

http://www.howflux.com/wp-content/uploads/2016/03/How-To-Claim-Health-Insurance-on-taxes.jpg

Health Insurance Claims Without Hospitalization Bajaj Allianz

https://www.bajajallianz.com/blog/wp-content/uploads/2021/12/claiming-health-insurance-without-hospitalization.jpg

This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your spouse and dependents Taxpayers who are preparing to file their tax returns may receive multiple health care information forms that they can use to complete their return The forms are Form 1095 A Health Insurance Marketplace Statement Form 1095 B Health Coverage Form 1095 C Employer Provided Health Insurance Offer and Coverage

If you pay for health insurance after taxes are taken out of your paycheck you might qualify for the medical expense deduction If you paid the premiums for a policy you obtained yourself your health insurance premium is deductible when they are out of pocket costs Beginning after 2018 there s no longer a federal tax penalty for not having health insurance If you obtain your health insurance from the Health Insurance Marketplace you may be eligible to receive a tax credit to offset some of your premium payments

Download Can You Claim Health Insurance On Your Tax Return

More picture related to Can You Claim Health Insurance On Your Tax Return

/Tax-form-56a0d5af3df78cafdaa57849.jpg)

Business Travel Tax Deductions

https://www.tripsavvy.com/thmb/IteNxEW8QfH_iYKm5GSnBrx6j18=/4230x2914/filters:fill(auto,1)/Tax-form-56a0d5af3df78cafdaa57849.jpg

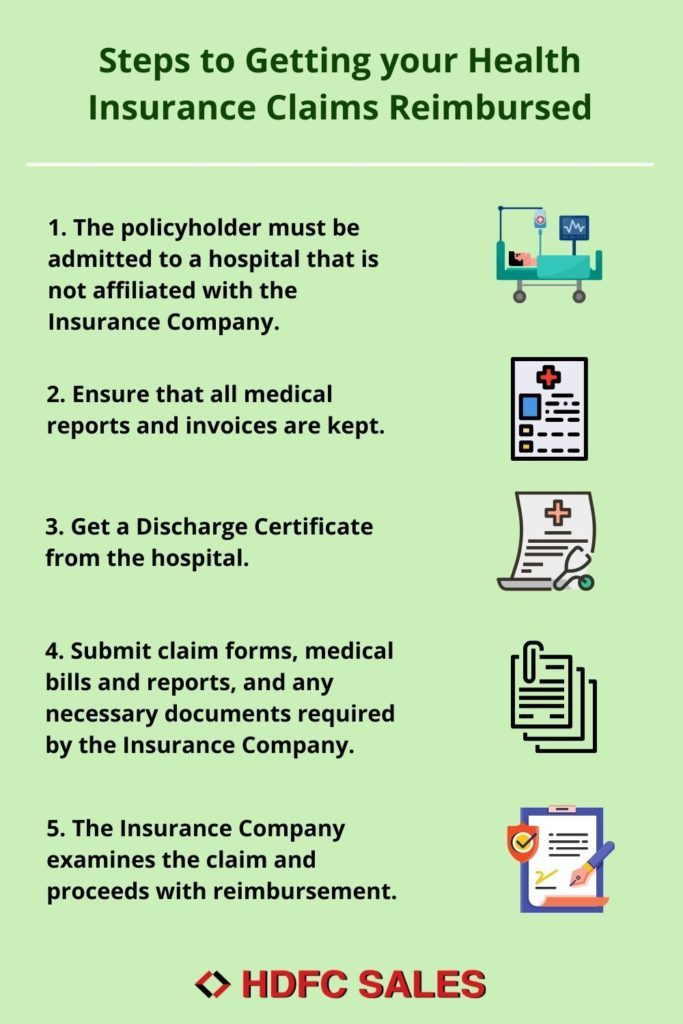

A Guide On Health Insurance Claim Process HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/health-insurance-reimbursement-process-683x1024.jpg

How To Claim Health Insurance On Your 2014 Taxes Everyday Health

https://images.everydayhealth.com/images/healthy-living/2014-taxes-and-health-insurance-penalties-722x406.jpg?sfvrsn=19db2076_0

Your health insurance premiums can be tax deductible if you have income from self employment and you aren t eligible to participate in a health plan offered by an employer or your spouse s You must file a tax return if enrolled in Health Insurance Marketplace plan Get details on tax forms you need to file

Generally you are allowed to deduct health insurance rates on your taxes if you itemize your deductions pay your health insurance premiums directly and your medical expenses totaled more than 7 5 of your income for the year For tax years other than 2020 if APTC is made on behalf of you or an individual in your family and you do not file a tax return you will not be eligible for APTC to help pay for your Marketplace health insurance coverage in future years

Can You Claim Health Insurance On Tax Return Are Diabetic Shoes Tax

https://i.pinimg.com/originals/51/2c/52/512c5260a24b61d12840696f3061282e.jpg

Hecht Group The Exception To Property Taxes

https://img.hechtgroup.com/1664848931412.png

https://blog.turbotax.intuit.com/health-care/when...

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the money you paid toward your monthly premiums can be taken as a tax deduction

https://www.investopedia.com/are-health-insurance...

If you are enrolled in an employer sponsored health insurance plan your premiums may already be tax free If your premiums are made through a payroll deduction plan they are likely made

Tax Return Are All Government Payments And Allowances Taxable Income

Can You Claim Health Insurance On Tax Return Are Diabetic Shoes Tax

Don t Forget The Healthy Homes Tax Credit Safe Home

Do You Need An Accountant For Your Tax Return

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

You Can Claim Your Parents As Dependents On Your Tax Return

You Can Claim Your Parents As Dependents On Your Tax Return

Get Your Tax Return Prepared For Free The Washington Post

10 Mistakes On Your Tax Return That Will Get You In Trouble With The IRS

Your Income Tax Return Made Simple Visual ly

Can You Claim Health Insurance On Your Tax Return - Taxpayers who are preparing to file their tax returns may receive multiple health care information forms that they can use to complete their return The forms are Form 1095 A Health Insurance Marketplace Statement Form 1095 B Health Coverage Form 1095 C Employer Provided Health Insurance Offer and Coverage