Can You Claim High Efficiency Furnace On Taxes Will these energy efficiency tax credits make home improvements more cost effective Generally yes Not only can energy efficiency home improvements

There are tax credits for an efficient building 22a water boiler 22b or air circulating fan in a furnace 22c Use Line 22b for a Qualified IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements

Can You Claim High Efficiency Furnace On Taxes

Can You Claim High Efficiency Furnace On Taxes

https://www.webmountindia.in/webmount-common/img/holi.gif

Why You Should Get Maintenance Service For Your Oil Furnace Supreme Energy

https://supremeenergy.com/wp-content/uploads/2023/02/Oil-Furnace-Maintenance-980x653.png

Home Repairs That Will Save Energy This Winter

https://www.genuine-comfort.com/wp-content/uploads/2019/11/high-efficiency-furnace-scaled-1024x684.jpg

Federal Tax Credits For Energy Efficiency Furnaces Natural Gas Oil Tax Credits This tax credit is effective for products purchased and installed between January 1 2023 A high efficiency furnace could save you 150 in tax liability In an attempt to spur higher energy efficiency the Energy Policy Act of 2005 first established tax credits for

Furnaces This article provides an overview of the credits available for specific HVAC system home improvements which improvements qualify and how to A new home furnace can be eligible for a federal tax credit When you install a new furnace in your home it may prove more than an efficient heating system If

Download Can You Claim High Efficiency Furnace On Taxes

More picture related to Can You Claim High Efficiency Furnace On Taxes

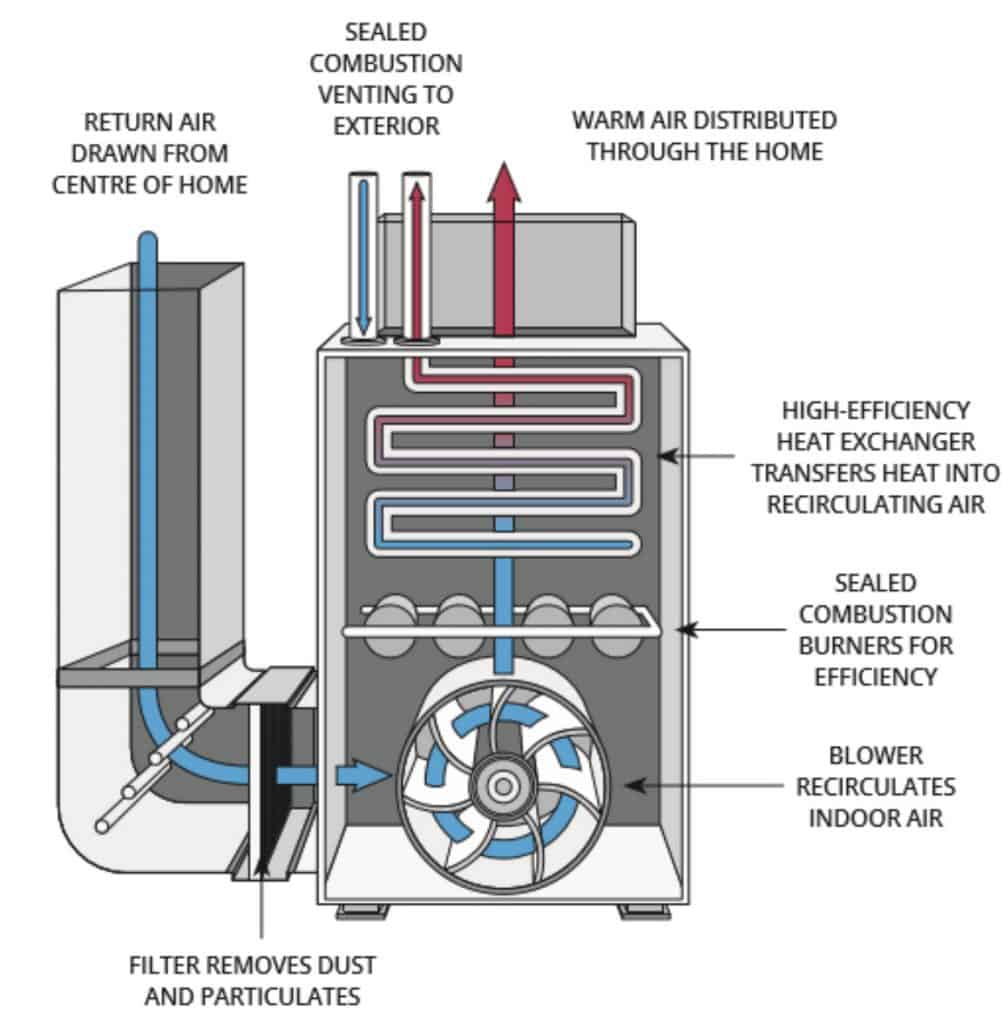

High Efficiency Furnaces Come With Their Own Set Of Advantages And

https://i.pinimg.com/originals/dc/60/5e/dc605edaf458652f33f745bcb8b415f3.jpg

Can You Claim Clothing As A Business Expense CRUX Award Winning

http://static1.squarespace.com/static/5b4c14fe9f8770f26424fa47/t/632cd8e82db81d3724879b35/1663883498196/unsplash-image-b34E1vh1tYU.jpg?format=1500w

How Much Does It Cost To Install A New Furnace Syndication Cloud

https://hvacservicecost.com/wp-content/uploads/2021/09/HVAC-Buying-Guide-1-1024x1017.jpg

You may be eligible for the maximum credit every year you make qualifying improvements until 2032 to be claimed by 2033 tax season Upgrading to a high Complete lines 17a through 30 of a separate Form 5695 for each main home Figure the amount to be entered on line 30 of both forms and enter the combined amount on

The energy efficient home improvement credit is subject to the following limitations Sec 25C b as amended by the act Annual overall limitation The credit You could also claim the credit for 100 of the costs associated with installing certain energy efficient water heaters heat pumps central air conditioning

Benefits Of The Goodman 96 AFUE 40k BTU Single Stage Gas Furnace

https://i.pinimg.com/originals/05/e7/5f/05e75f52c0b58348a8fe60b7909b1e9a.jpg

High Efficiency Furnace Shop Authentic Save 67 Jlcatj gob mx

https://hvac-boss.com/wp-content/uploads/2021/02/High-efficiency-furnace-heat-exchange-1003x1024.jpg

https:// turbotax.intuit.com /tax-tips/home...

Will these energy efficiency tax credits make home improvements more cost effective Generally yes Not only can energy efficiency home improvements

https:// thelawdictionary.org /article/ho…

There are tax credits for an efficient building 22a water boiler 22b or air circulating fan in a furnace 22c Use Line 22b for a Qualified

.png)

General 1 EC ACCOUNTING SOLUTIONS CPA

Benefits Of The Goodman 96 AFUE 40k BTU Single Stage Gas Furnace

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

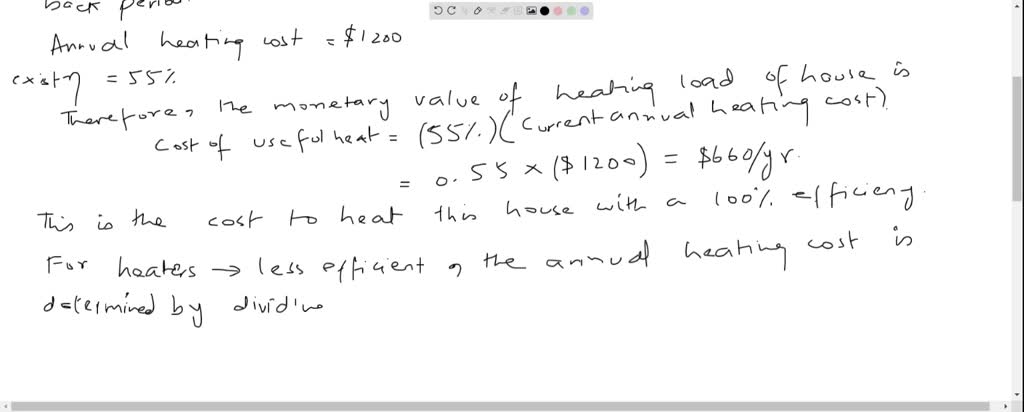

SOLVED Consider A Homeowner Who Is Replacing His 25 yearold Natural

Hvac Repair Ductwork High Efficiency Furnace And Air Conditioner

The Advantages Of High Efficiency Furnaces For Lower Heating Costs

The Advantages Of High Efficiency Furnaces For Lower Heating Costs

Calgary Alberta Canada Sep 21 2020 A Home Goodman High Efficiency

Is Your Furnace As Efficient As You Think Here s How To Find Out Blog

Furnace Efficiency What Do The Numbers Mean SWAN Plumbing

Can You Claim High Efficiency Furnace On Taxes - A high efficiency furnace could save you 150 in tax liability In an attempt to spur higher energy efficiency the Energy Policy Act of 2005 first established tax credits for