Invite to Our blog, a space where inquisitiveness satisfies information, and where day-to-day subjects end up being interesting conversations. Whether you're looking for understandings on lifestyle, innovation, or a little every little thing in between, you have actually landed in the right location. Join us on this exploration as we study the worlds of the average and amazing, making sense of the world one article at a time. Your trip into the fascinating and varied landscape of our Can You Claim Home Office Deduction If You Rent begins below. Check out the fascinating content that awaits in our Can You Claim Home Office Deduction If You Rent, where we untangle the ins and outs of different subjects.

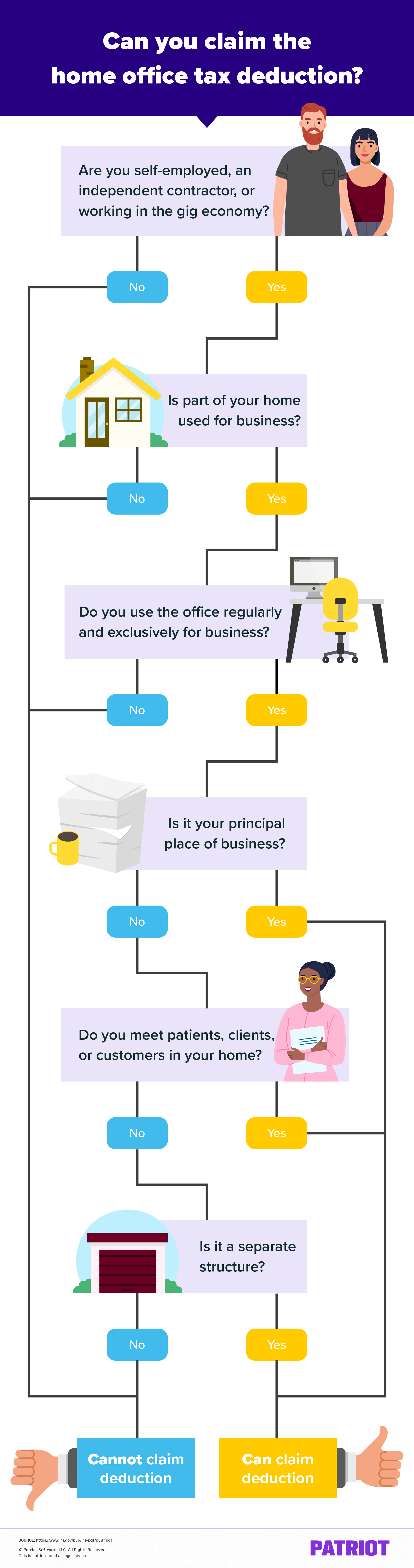

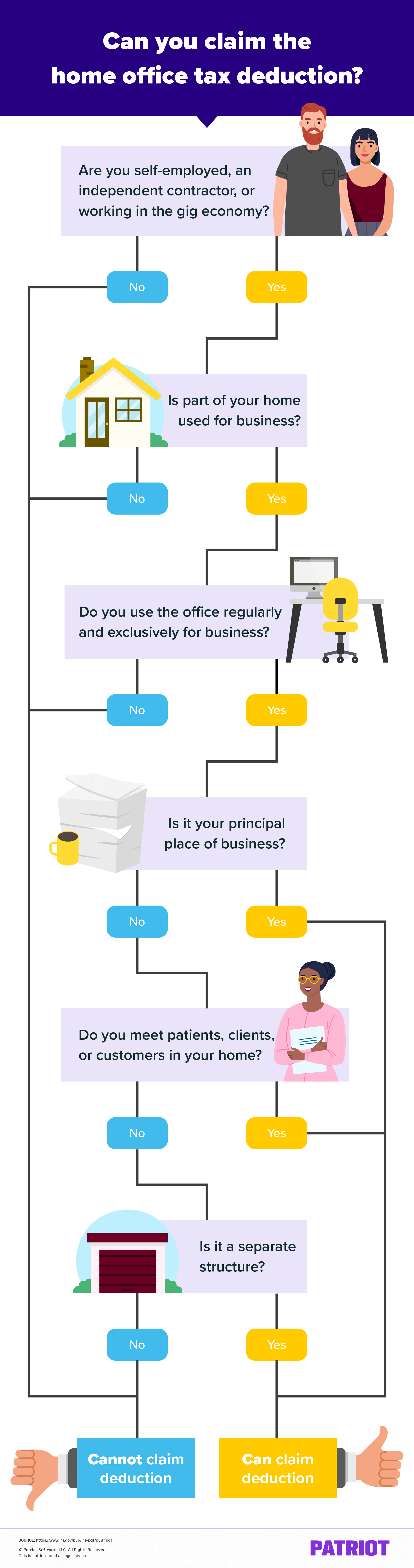

Can You Claim Home Office Deduction If You Rent

Can You Claim Home Office Deduction If You Rent

ERC Credits What Is It And How Can You Claim It

ERC Credits What Is It And How Can You Claim It

Can You Claim Home Office If You Work From Home

Can You Claim Home Office If You Work From Home

Gallery Image for Can You Claim Home Office Deduction If You Rent

10 Creative But Legal Tax Deductions Howstuffworks

Common Tax Deductions For Homeowners MileIQ

The Deductions You Can Claim Hra Tax Vrogue

Can You Take The Home Office Deduction

How To Claim Home Office Deduction As A Corporate Owner

Home Office Tax Deduction What Is It And How Can Help You

Home Office Tax Deduction What Is It And How Can Help You

Home Office Deduction If You Operate As A Corporation Henningfield

Thank you for choosing to explore our internet site. We truly wish your experience exceeds your expectations, and that you uncover all the info and resources about Can You Claim Home Office Deduction If You Rent that you are looking for. Our dedication is to supply an easy to use and interesting platform, so do not hesitate to navigate through our web pages with ease.