Can You Claim Mileage To Work On Taxes If you re wondering whether you re eligible or how exactly to claim a mileage deduction on your tax return you re in the right place You ll learn how to track mileage which forms

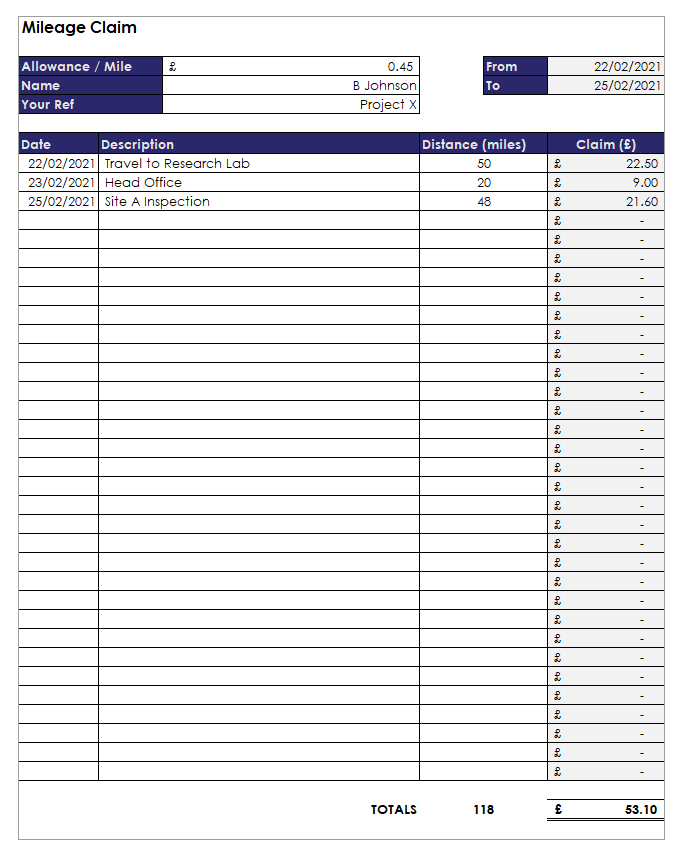

Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the mileage deduction If you use your own vehicle or vehicles for work you may be able to claim tax relief on the approved mileage rate This covers the cost of owning and running your vehicle

Can You Claim Mileage To Work On Taxes

Can You Claim Mileage To Work On Taxes

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7808a1a34e392da06a0_610f13719242da6fd79cc8b1_MileIQ-vs-paper-mileage-log-1.jpeg

![]()

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

https://wssufoundation.org/wp-content/uploads/2020/11/editable-25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-word-scaled-2048x1449.jpg

![]()

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes

https://wssufoundation.org/wp-content/uploads/2020/11/25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-excel-768x543.jpg

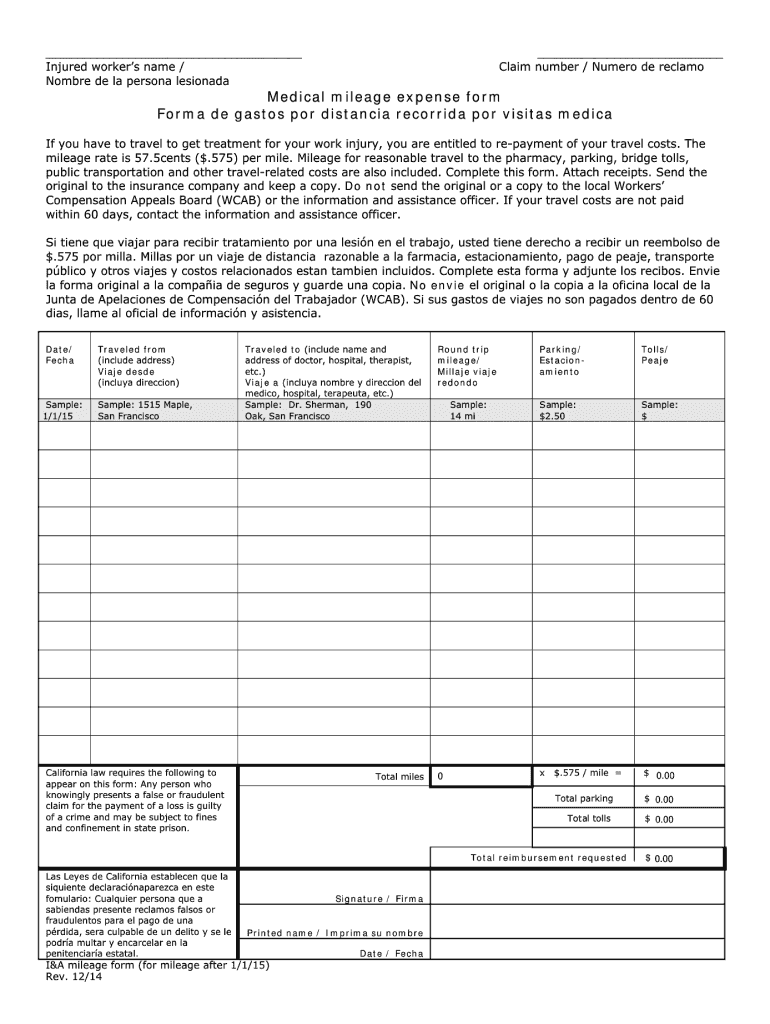

And if a mileage reimbursement is treated as taxable income can you claim a tax deduction for it That s a separate question that depends on the type of job you hold In most Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons A taxpayer is

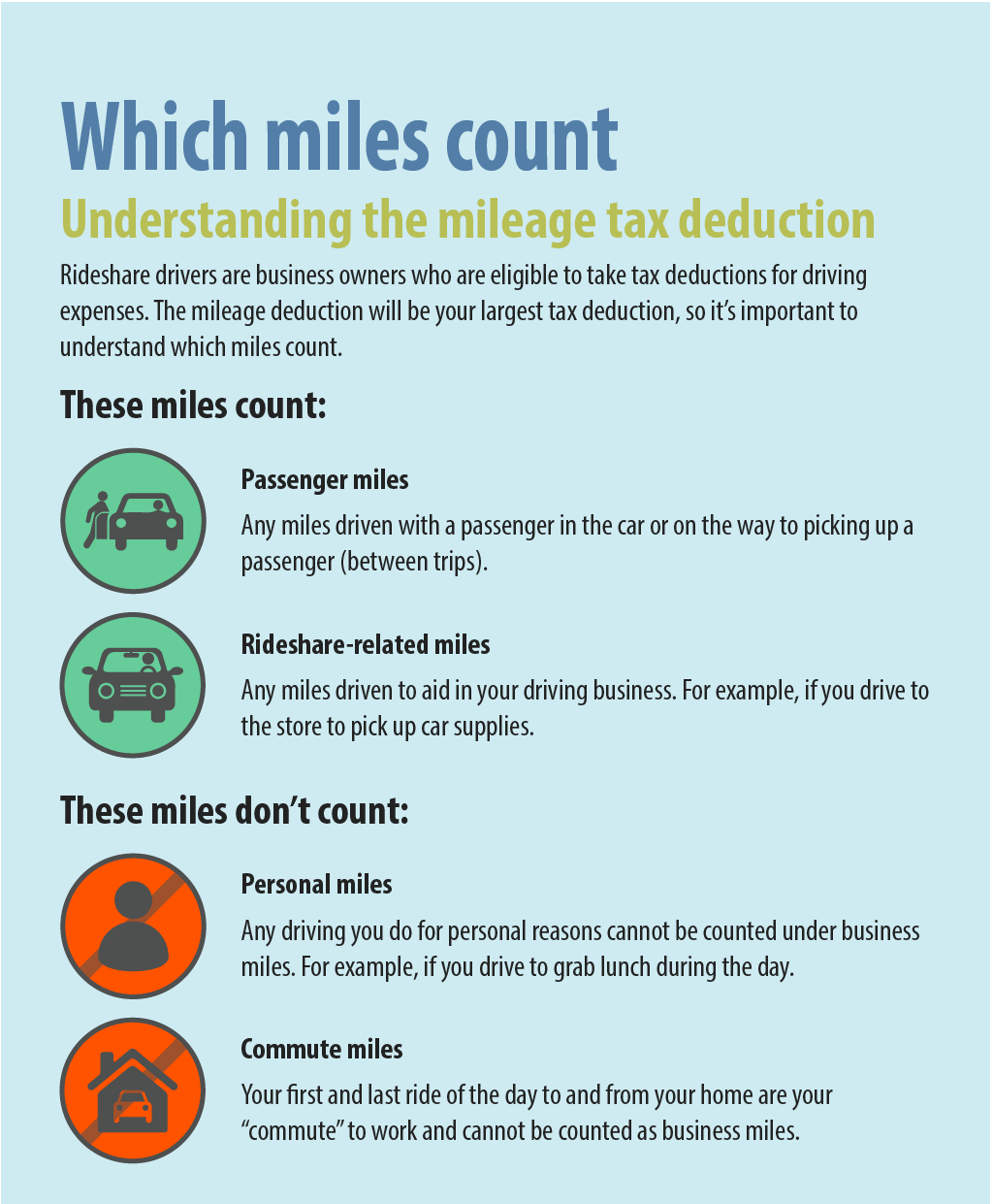

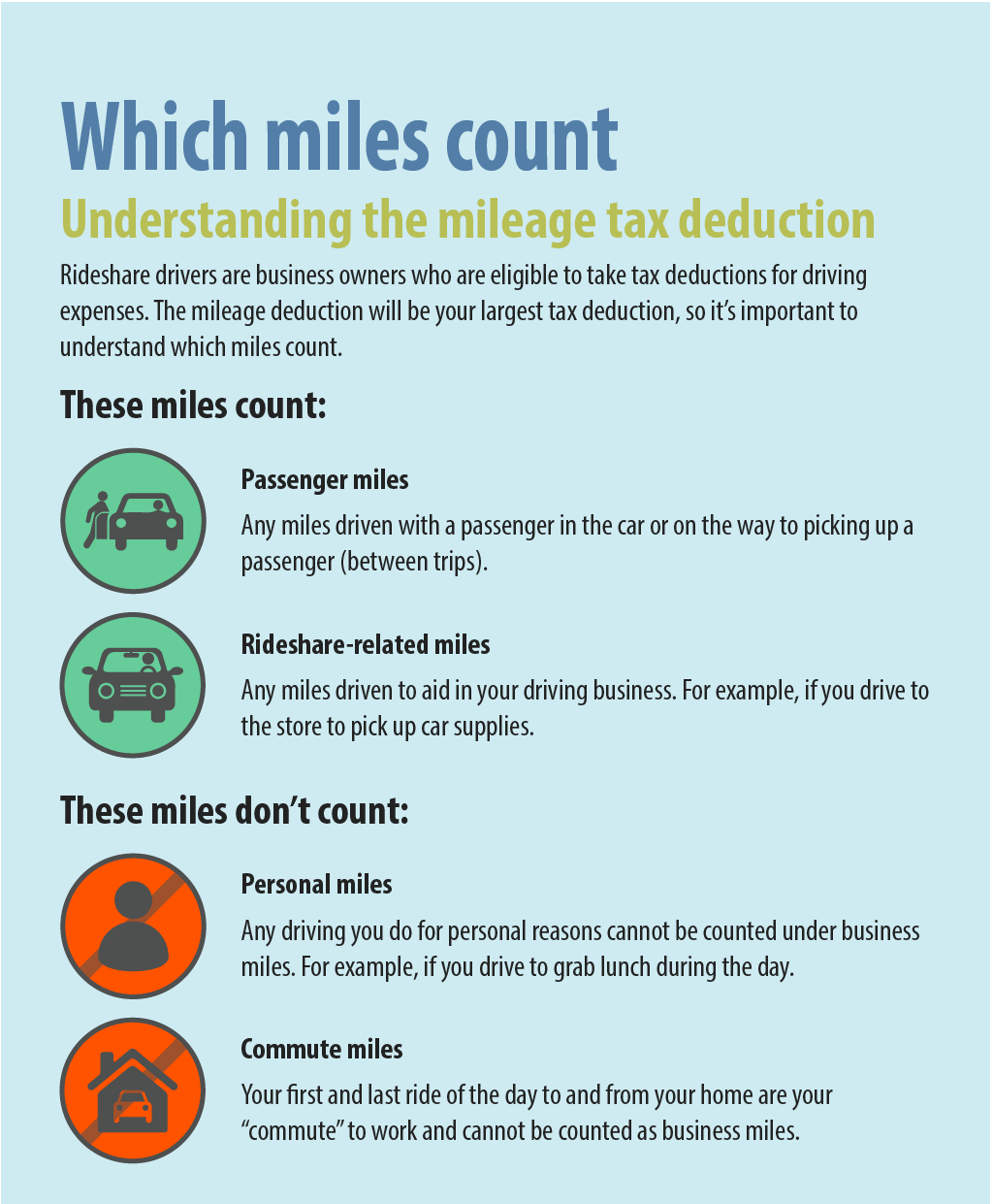

You can t claim business mileage deductions for your commuting expenses between your home and your regular place of work Your employer may reimburse you for some job related travel such as if Step 1 Choose your method of calculation Step 2 Gather your mileage records Step 3 Calculate your mileage claim Step 4 Fill out the correct tax form Step

Download Can You Claim Mileage To Work On Taxes

More picture related to Can You Claim Mileage To Work On Taxes

Simple Expense Reimbursement Form 1 Excelxo

https://excelxo.com/wp-content/uploads/2018/02/simple-expense-reimbursement-form-1-601x466.png

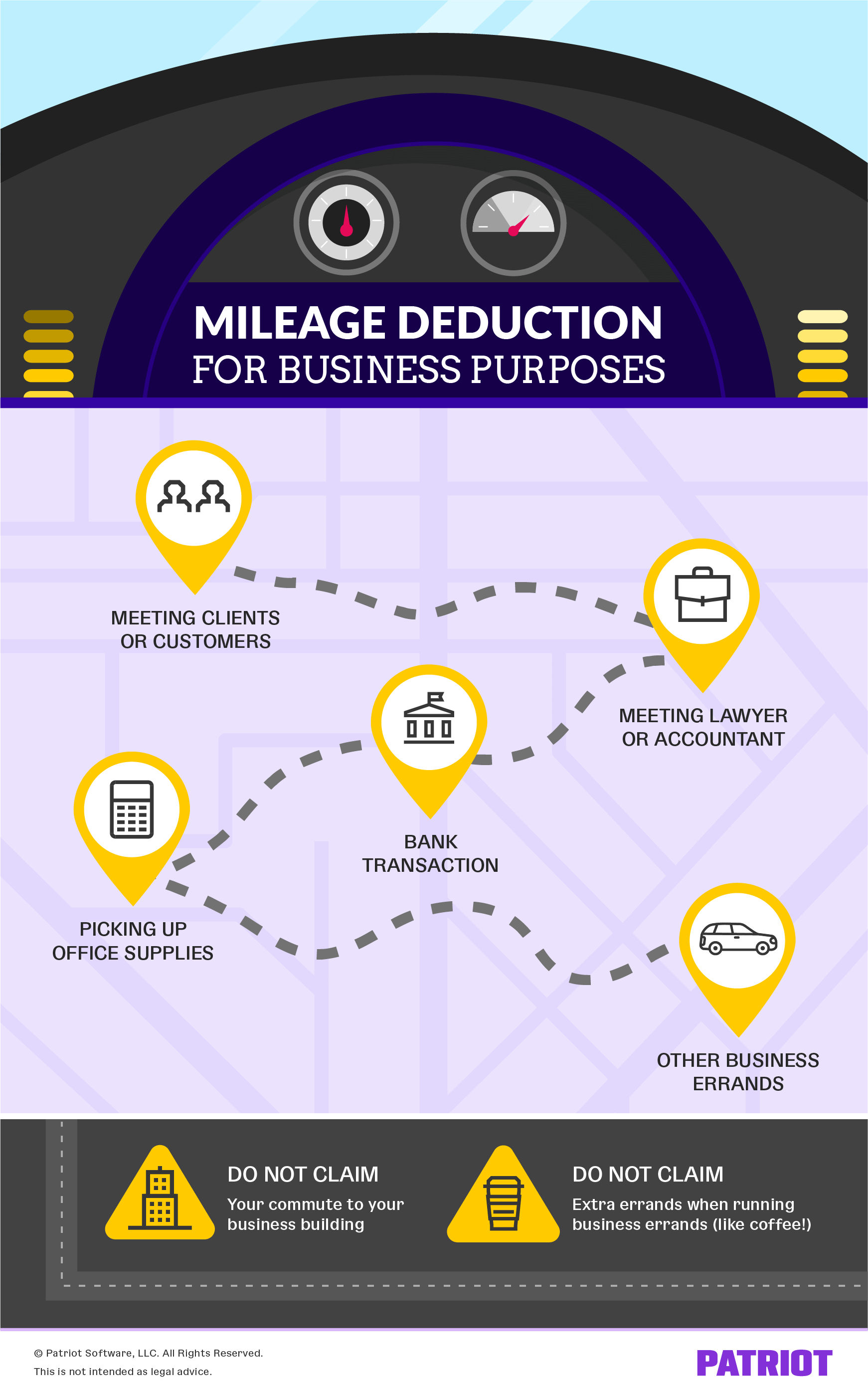

Calculate Gas Mileage Reimbursement AntonioTavish

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Example Of Free 25 Printable Irs Mileage Tracking Templates Gofar

https://i.pinimg.com/originals/ef/80/33/ef80334d3a23f7799ac429aaf9a31cd4.jpg

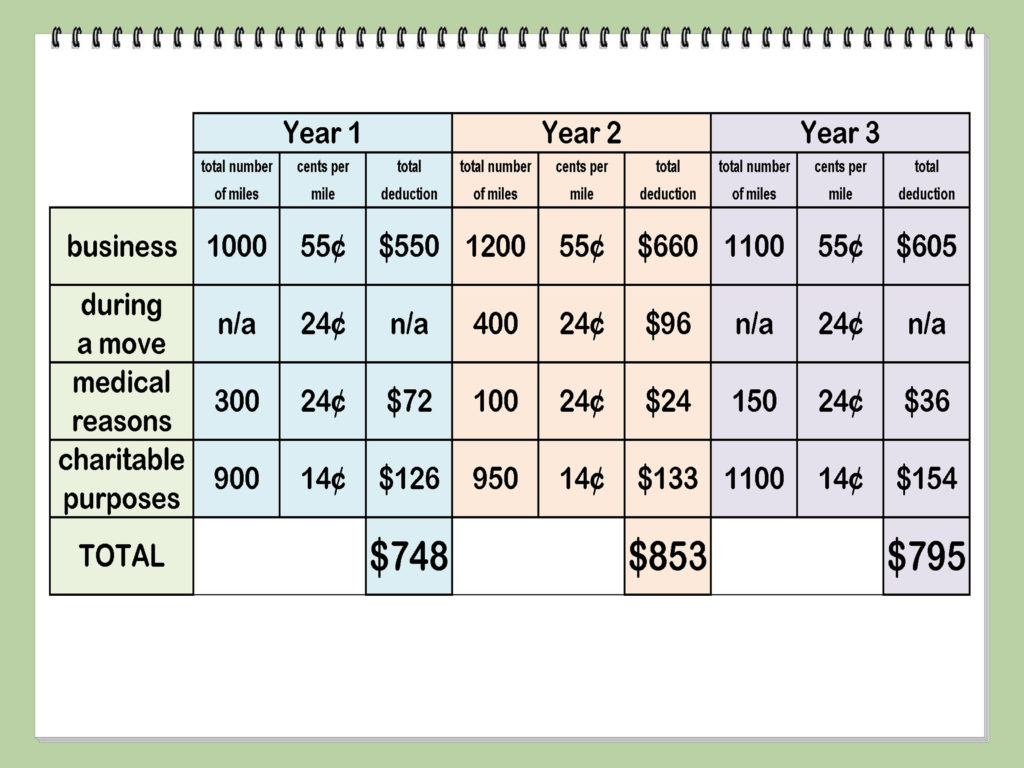

If you qualify you can claim mileage or vehicle expenses on your tax return Your choice depends on how often and how far you drive for business medical The IRS has not set a limit or cap on the amount of deductible miles you can claim You cannot deduct mileage expenses as a W 2 employee because miscellaneous unreimbursed employee

You can deduct actual expenses or the standard mileage rate as well as business related tolls and parking fees If you rent a car you can deduct only the You can claim a section 179 deduction and use a depreciation method other than straight line only if you don t use the standard mileage rate to figure your business related car

You ll Never Forget To Use This Simple Mileage Log Money Saving Tips

https://i.pinimg.com/originals/11/ea/08/11ea08923db6bcb3a1330469152fe9b7.png

Mileage Form 2021 IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/tax-forms-for-mileage-claims-fill-out-and-sign-printable-5.png

https://mileiq.com/mileage-guide/how-to-claim...

If you re wondering whether you re eligible or how exactly to claim a mileage deduction on your tax return you re in the right place You ll learn how to track mileage which forms

https://www.hrblock.com/tax-center/filing/...

Luckily you can claim a tax write off for mileage in specific circumstances While not everyone qualifies it s worth the time to check into the rules as the mileage deduction

Business Spreadsheet Tools Custom Software Development Working Data

You ll Never Forget To Use This Simple Mileage Log Money Saving Tips

Download The Business Mileage Tracking Log From Vertex42 Business

Government Mileage Calculator IRS Mileage Rate 2021

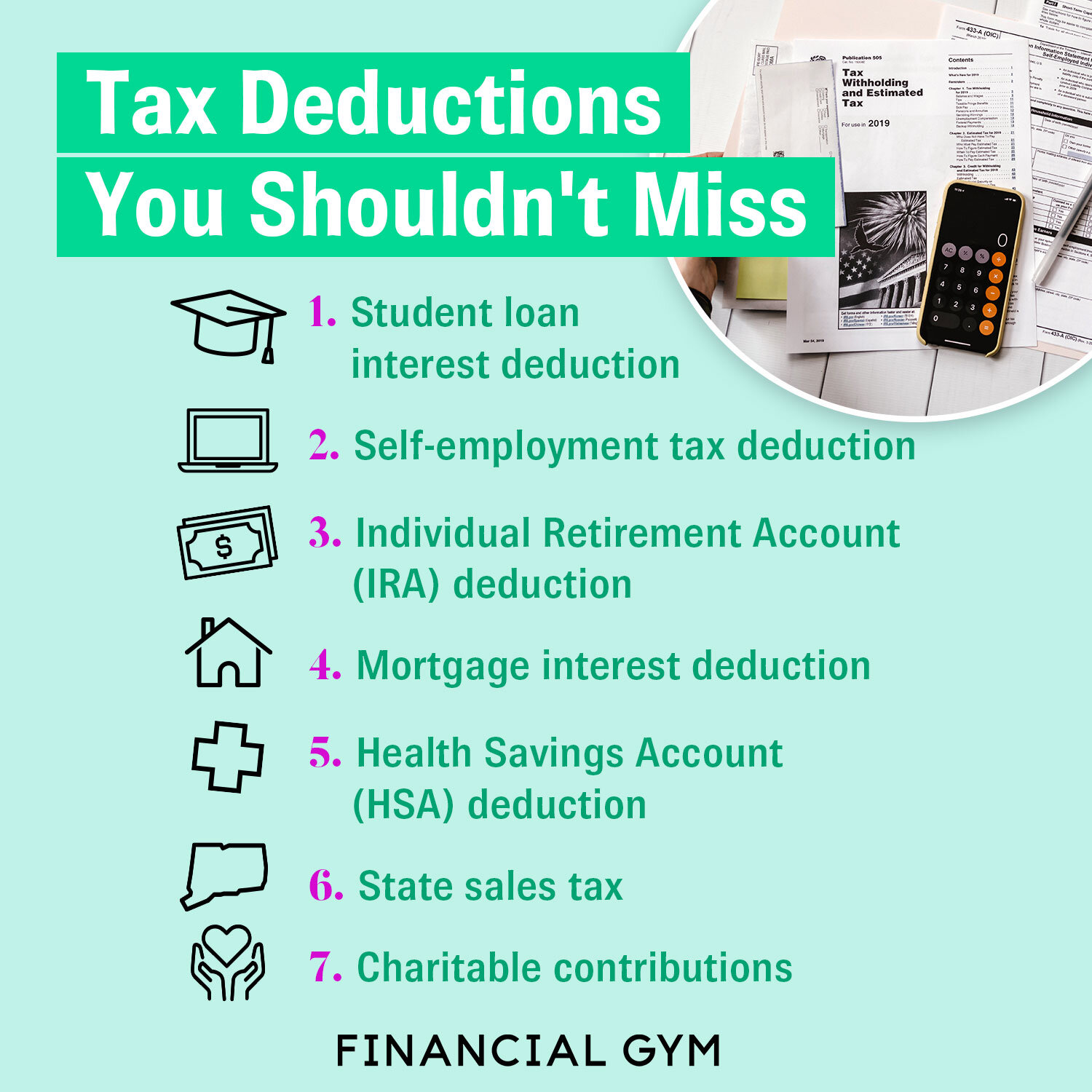

Tax Deductions Write Offs To Save You Money Financial Gym

24 Vehicle Lease Mileage Tracker Sample Excel Templates

24 Vehicle Lease Mileage Tracker Sample Excel Templates

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Tax Deduction For Mileage To Second Job Sapling

Printable Tax Deduction Cheat Sheet

Can You Claim Mileage To Work On Taxes - The IRS business standard mileage rate cannot be used to claim an itemized deduction for unreimbursed employee travel expenses under the Tax Cuts