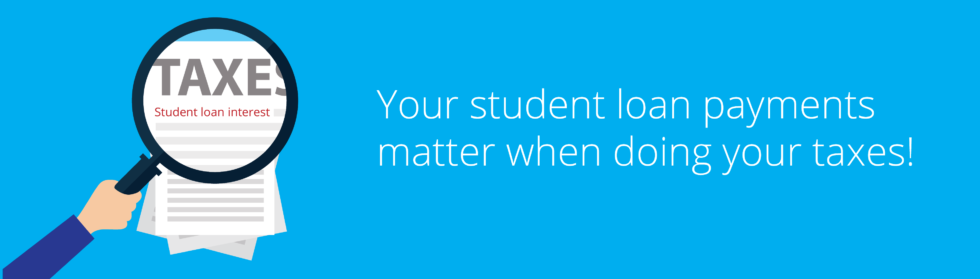

Can You Claim School Loan Interest On Taxes You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know Reducing the deduction you can claim by 180 means you can deduct 720 on your taxes Remember your total tax savings is based on your income tax bracket To figure your student loan interest

Can You Claim School Loan Interest On Taxes

Can You Claim School Loan Interest On Taxes

https://www.cleantechloops.com/wp-content/uploads/2021/08/tax-evasion.jpg

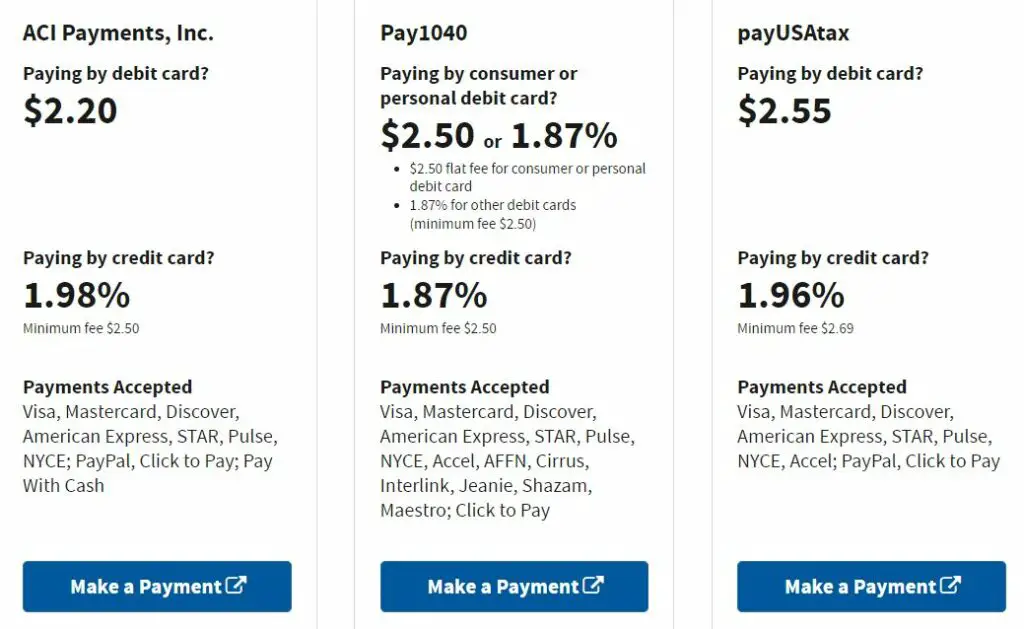

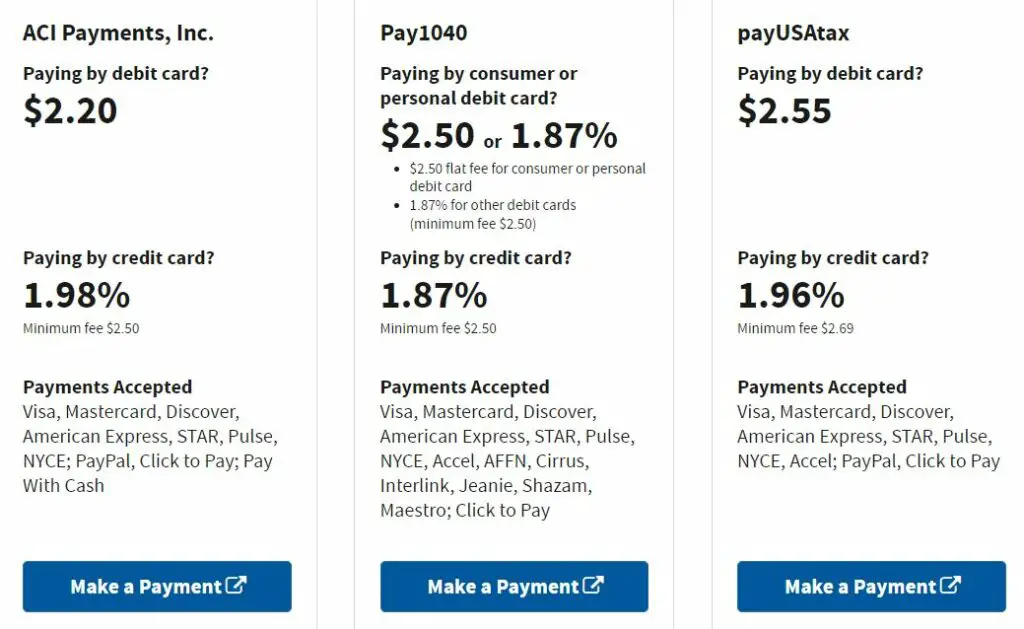

How To Make Tax Payments With Credit Card And Profit Navigating

https://mymoneyplanet.com/wp-content/uploads/2021/08/IRS-Pay-with-credit-card-1024x629.jpg

Working From Home What Can You Claim And How Do You Claim It Public

https://www.publicaccountant.com.au/images/tax_consultant_.jpeg

You may be eligible for a tax reduction based on your student loan interest Key Takeaways If you took out an educational loan for yourself your spouse or your dependent you may be able to ITA home This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic income information Your adjusted gross income Educational expenses paid with nontaxable funds

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student You can claim the student loan interest deduction even if you take the standard deduction Qualified education expenses and institutions The student loan interest deduction

Download Can You Claim School Loan Interest On Taxes

More picture related to Can You Claim School Loan Interest On Taxes

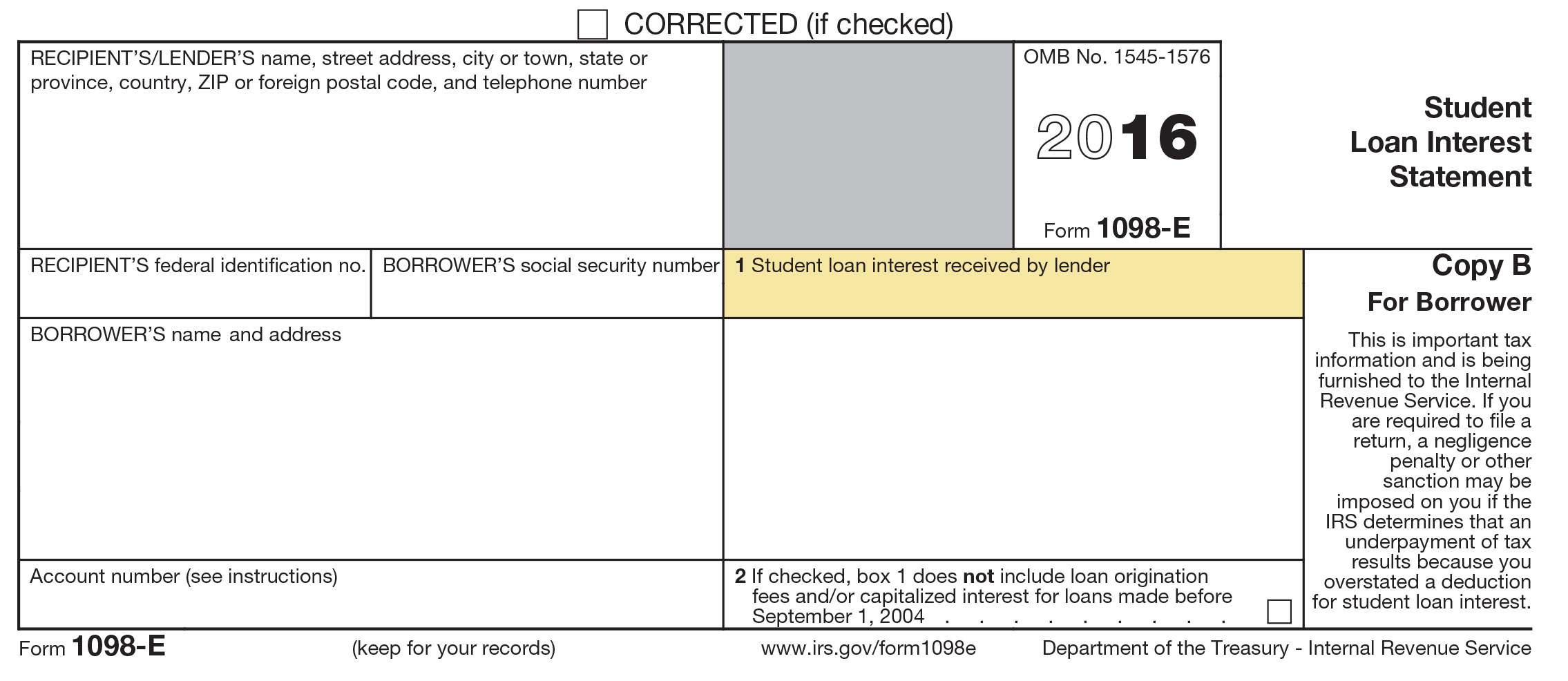

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

https://s28637.pcdn.co/wp-content/uploads/2017/01/2016-1098-E.jpg

Can You Claim Tax Benefit On Home Loan And HRA At The Same Time When

https://i.ytimg.com/vi/MXhuys9iE2o/maxresdefault.jpg

How Many Uears Of Tax Teturs For Home Loan

https://www.manishanilgupta.com/public/assets/upload/blog/5f6af0338d718_Income Tax.jpeg

You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan If you pay the expenses with money from a loan you take the credit for the year you pay the expenses not the year you get the loan or the year you repay the loan It allows you to deduct up to 2 500 in interest paid from your taxable income Payments on federal student loans were paused from March 2020 until October 2023 If you didn t make any

You can deduct some or all of your student loan interest payments on your federal tax return that s due on April 15 2024 if you meet the following criteria for the 2023 tax year You When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits A tax deduction is also available for the interest payments you make when you start repaying your qualified education loans

Can You Claim Previous Year s Tax Returns SARS In South Africa

https://wasomiajira.com/wp-content/uploads/2023/02/Can-You-Claim-Previous-Years-Tax-Returns-SARS-in-South-Africa-1024x1024.jpg

Education Loan Interest Calculator JasdeepAfrahim

https://i.pinimg.com/originals/1b/cc/67/1bcc67408a4e90ad1369ee8585bf4934.jpg

https://www.irs.gov/taxtopics/tc456

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and

https://smartasset.com/taxes/student-lo…

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

Can You Claim The Employee Retention Credit MichaelTritthart

Can You Claim Previous Year s Tax Returns SARS In South Africa

The Deductions You Can Claim Hra Tax Vrogue

Can You Claim Clothing As A Business Expense NH Associates

Who Can Claim The Education Tax Credit Commons credit portal

AARP Can You Claim Social Security On Your Spouse s

AARP Can You Claim Social Security On Your Spouse s

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

Insurance 7 What Can You Claim For And How To Claim Insurance 7

Lesson 6 What Expenses Can You Claim

Can You Claim School Loan Interest On Taxes - Key Takeaways If you include student loan interest in you tax deductions you can lower your tax bill Up to 2 500 of student loan interest can be tax deductible each