Can You Claim Solar Tax Credit On Second Home Y ou can claim the Residential Energy Efficiency Property Credit for solar wind and geothermal equipment in both your principal residence and a second home But fuel cell

Due to the principal residence requirement a taxpayer may not claim the credit for a home energy audit of the taxpayer s second home The credit is never available for homes The federal solar tax credit can also be claimed on a second home as long as the solar energy system meets the eligibility requirements The tax credit works the same whether

Can You Claim Solar Tax Credit On Second Home

Can You Claim Solar Tax Credit On Second Home

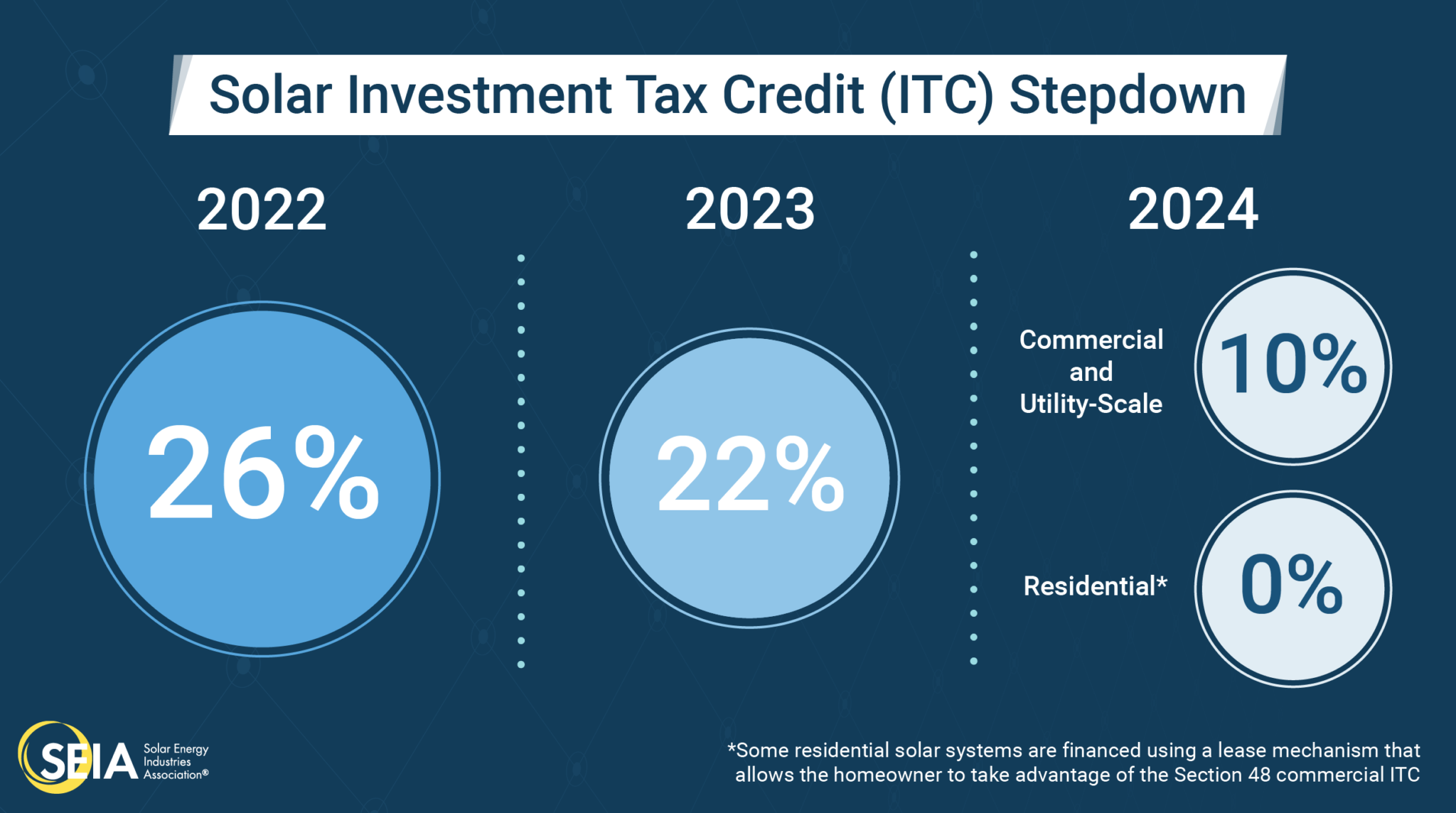

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

How Many Years Can I Claim Solar Tax Credit YouTube

https://i.ytimg.com/vi/NWOSYlRLgc4/maxresdefault.jpg

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

It s also possible for homeowners to claim the solar tax credit for systems installed on both a primary residence and a second home provided they are qualifying residences Am I eligible to claim the federal solar tax credit You might be eligible for this tax credit if you meet all of the following criteria Your solar PV system was installed between January 1

The short answer is yes you can take a solar credit on your second home just like you would on your primary residence There are several benefits to taking advantage of the solar credit on a second home Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or renovation of an

Download Can You Claim Solar Tax Credit On Second Home

More picture related to Can You Claim Solar Tax Credit On Second Home

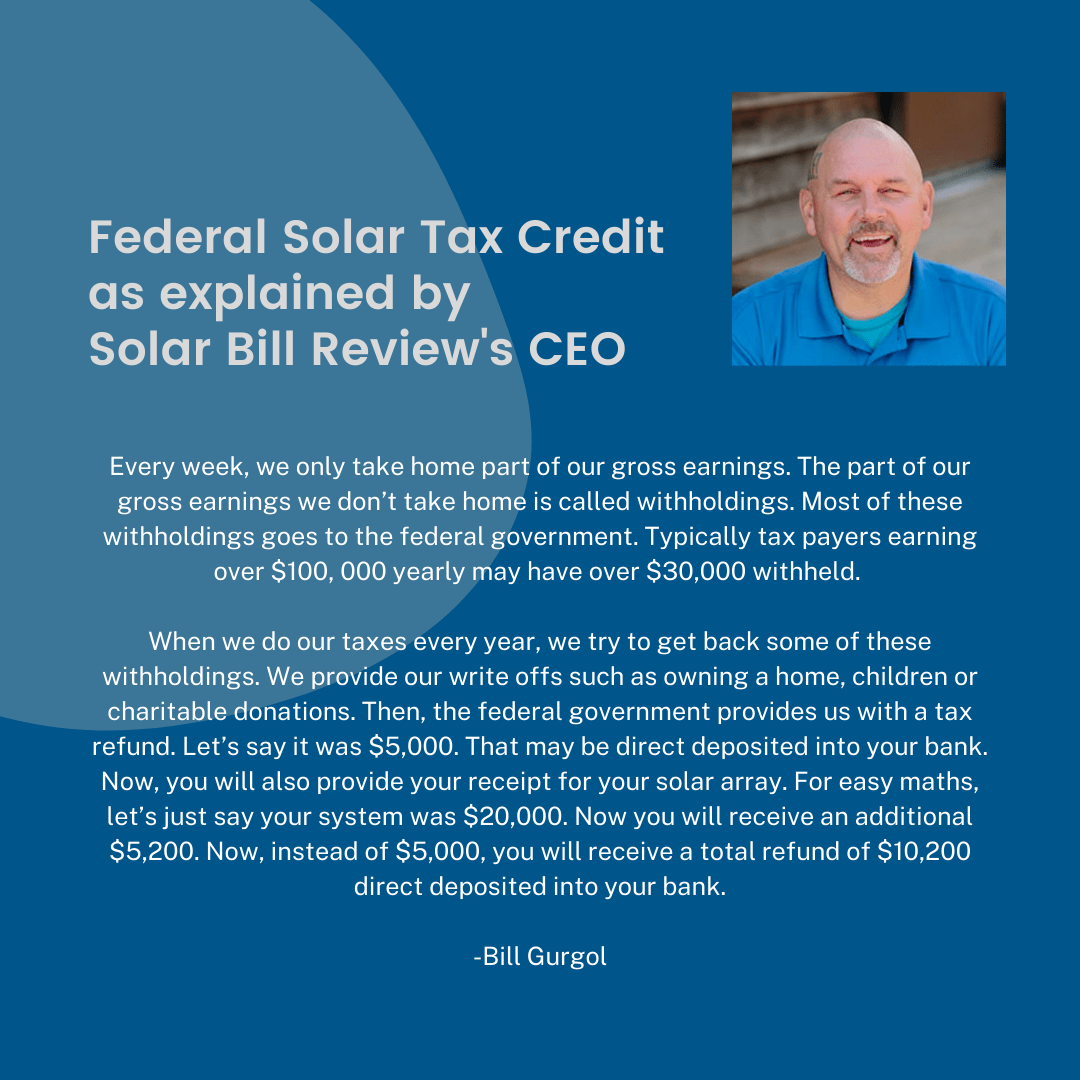

Your Guide To Solar Federal Tax Credit

https://solarbillreview.com/wp-content/uploads/2021/10/ITC-Explanation-v3.png

How Does The Solar Tax Credit Work Advanced Solar

https://cdn.advancedsolarllc.com/wp-content/uploads/advanced-solar-tax-blog.jpg

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023.png

No you cannot claim a solar credit on the second home The credit can only be taken on your Main Home IRS Form 5695 Residential Energy Credits As a homeowner you can claim a federal solar tax credit for the amount of money that you pay towards installing solar and reduce the amount you owe when you file your yearly federal tax return The solar tax credit does

Yes Solar photovoltaic systems do not necessarily have to be installed on your primary residence for you to claim the tax credit You might be eligible for this tax credit if you Can you claim the solar tax credit more than once Yes You can claim the solar tax credit every year that you complete a qualifying solar project for your home so long as the credit is still

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

The Federal Solar Tax Credit What You Need To Know 2022

https://sandbarsc.com/wp-content/uploads/2017/07/solar-tax-credit.jpg

https://ttlc.intuit.com › community › tax-credits...

Y ou can claim the Residential Energy Efficiency Property Credit for solar wind and geothermal equipment in both your principal residence and a second home But fuel cell

https://www.irs.gov › credits-deductions › frequently...

Due to the principal residence requirement a taxpayer may not claim the credit for a home energy audit of the taxpayer s second home The credit is never available for homes

Solar Tax Credit Calculator NikiZsombor

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Pin By 360 Realtors LLP On Article Ambiguity Tax Credits Old Things

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Colorado Government Solar Tax Credit Big History Blogger Photography

Solar Tax Credit

Solar Tax Credit

Solar Tax Credit In 2020 Solar Pool Solar Panels Solar Pool

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Solar TAX CREDIT In 2023 Solar Panels Solar Panel Installation

Can You Claim Solar Tax Credit On Second Home - For example is the credit available for expenditures for a home rented by the taxpayer or for a second home added Jan 17 2025 A1 A taxpayer claiming the credit for