Can You Claim Tax Repayment Online Apply for a repayment online Apply for a repayment by post If you re claiming on behalf of someone else Print this page If you re registered for Self Assessment apply for a

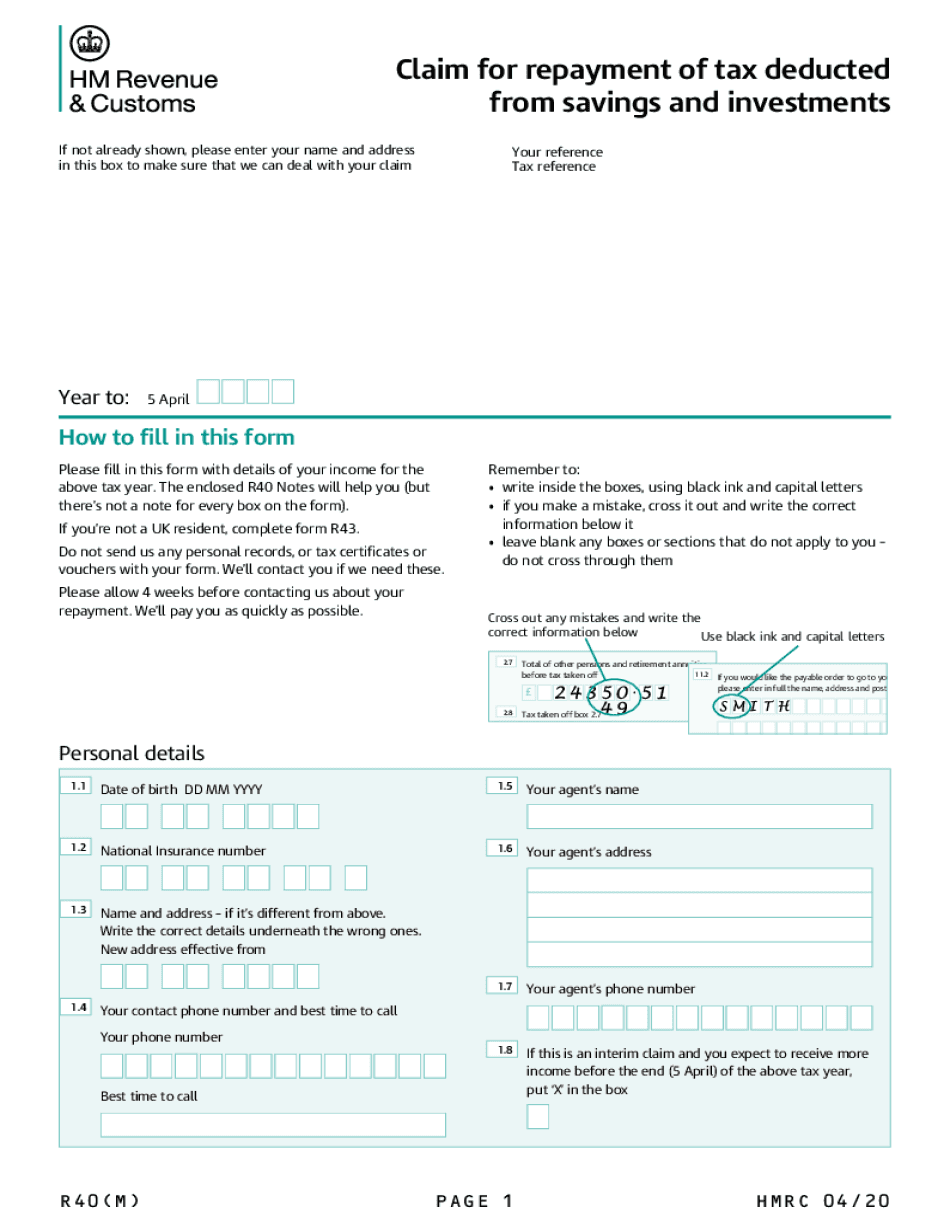

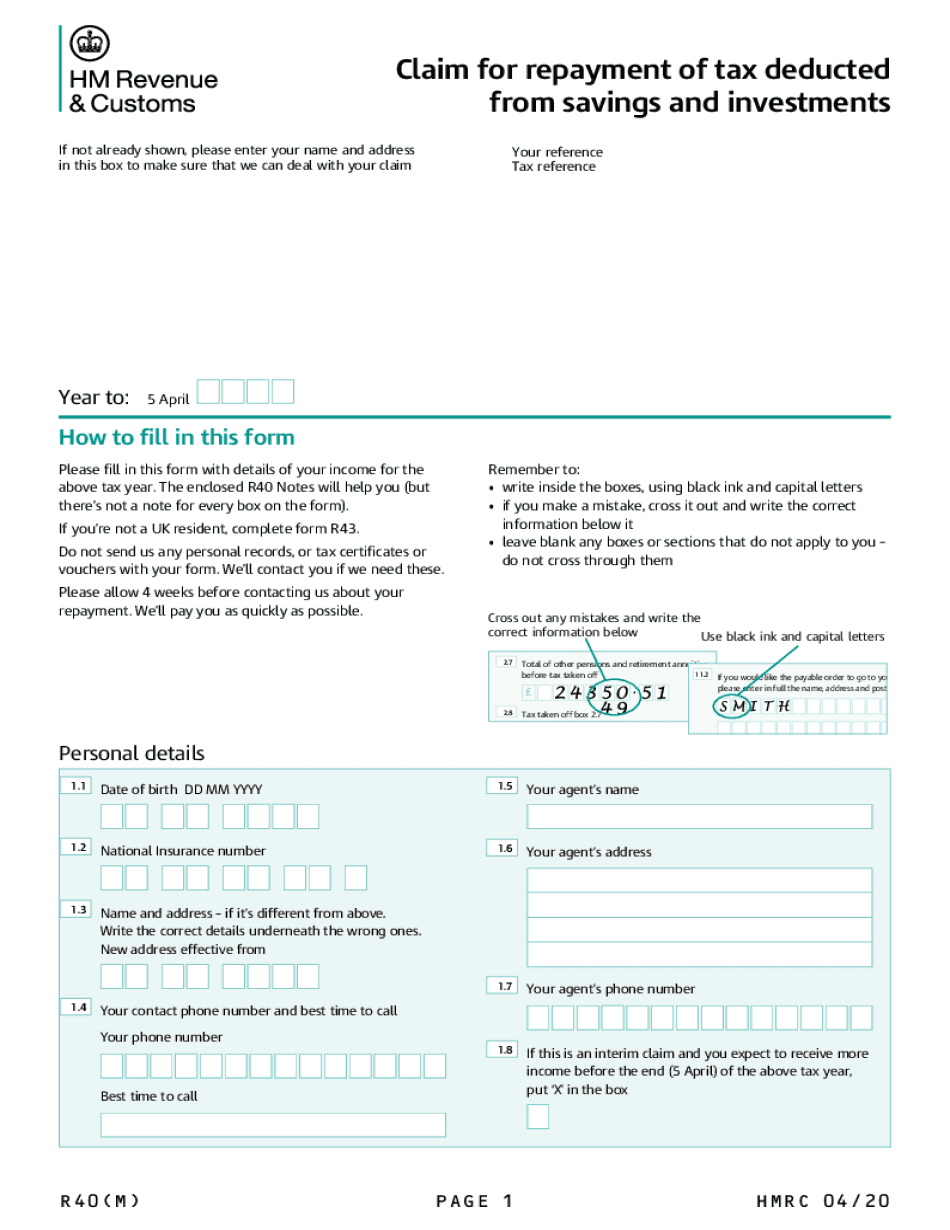

You can use this form to claim a refund if you ve overpaid tax nominate someone else to get the payment on your behalf You may be able to claim online There are also other Income Tax How do I use the HMRC app to claim a tax refund HMRCgovuk 73 2K subscribers Subscribed 624 181K views 1 year ago HMRC app This video looks at how you can view manage and update

Can You Claim Tax Repayment Online

Can You Claim Tax Repayment Online

https://www.signnow.com/preview/505/790/505790795/big.png

Can You Claim Tax Deductions For Working From Home

https://biz-com.co.za/wp-content/uploads/2021/08/Bizcom-Blog-Images-2-1.png

Can You Claim Tax Exemption For Tuition Fees Paid For Overseas

https://i.ytimg.com/vi/u7KjvGYWt54/maxresdefault.jpg

Key Takeaway What Is a Tax Refund A tax refund is money that s paid back to you by HMRC when you ve overpaid your tax bill It s how HMRC balances their own books A fail safe to keep the system as fair as possible A tax refund calculation is based on the tax you owe from all your income streams most commonly Salary from You can claim your tax refund online using the Government Gateway site The amount of tax refund you receive is based on several factors What is a tax refund Whether you ve been overtaxed on your personal income or are eligible for certain tax benefits that can be refunded you can get a tax refund or a rebate to get some of your money back

It s free to claim directly from HMRC While some people might prefer to opt for someone to make a claim on their behalf using a repayment agent to make a claim is unnecessary and can be costly A Which Money investigation in January 2022 found the fees charged by some third party companies are as much as half of the tax refund received Any refund you are owed from an amended Self Assessment will not be automatically paid back to you however and you will need to contact HMRC directly to claim your money back either by telephone or by logging onto your HMRC online services account and clicking request a repayment Can I claim if it s too late to amend my tax

Download Can You Claim Tax Repayment Online

More picture related to Can You Claim Tax Repayment Online

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

Can You Claim Tax Breaks For Capital Improvements On Your Home Andi

https://andidyer.com/wp-content/uploads/2021/05/Can-You-Claim-Tax-Breaks-for-Capital-Improvements-on-Your-Home-1024x1024.png

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Subcontractors Limited Companies only can offset any CIS repayments due against any amounts owed to HMRC in PAYE NI and CIS n b If they are also contractor then CIS may be owed to HMRC if they have subcontractors Example A business who is a contractor and a subcontractor has a PAYE NI liability of 5 000 A Claim of Right Repayment is a deduction you can take in the current tax year if you re required to pay back income in excess of 3 000 from a previous tax year that you thought you could keep You reported and paid taxes on the money not knowing you d have to pay it back

The general rule is that a refund or repayment cannot be claimed more than 4 years after the end of the relevant tax year For example if you are claiming a refund for the 2019 20 tax year you add 4 years to 2020 You must make your claim by 5 April 2024 When can HMRC use the extended time limits You must claim a tax refund within the 4 years after the year in which you made the overpayment To claim tax back you must make a tax return If you have paid too little tax you will owe Revenue the difference between what

Can I Claim Back Tax Paid In The US

https://static.wixstatic.com/media/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg/v1/fill/w_1000,h_667,al_c,q_90,usm_0.66_1.00_0.01/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg

P55 Repayment Claim Form For Tax Year 2021 22 CIPP

https://www.cipp.org.uk/static/uploaded/6aa294d3-ad0c-4fa6-bb06d93b1ab31b9f.jpg

https://www.gov.uk/guidance/claim-a-refund-of...

Apply for a repayment online Apply for a repayment by post If you re claiming on behalf of someone else Print this page If you re registered for Self Assessment apply for a

https://www.gov.uk/.../income-tax-tax-claim-r38

You can use this form to claim a refund if you ve overpaid tax nominate someone else to get the payment on your behalf You may be able to claim online There are also other Income Tax

The Deductions You Can Claim Hra Tax Vrogue

Can I Claim Back Tax Paid In The US

17 Things You Can t Claim In Your Tax Return Platinum Accounting

Settle Your IRS Tax Debt Step By Step

Doola On Twitter Are You Ready For Tax Season Join Us On 3 1 For

Are You Too Late To Claim A Tax Repayment Blog Torgersens

Are You Too Late To Claim A Tax Repayment Blog Torgersens

Can You Claim Tax Benefit On Both HRA And Home Loan Repayment USA

Does Pet Care Provide Tax Credit CelestialPets

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

Can You Claim Tax Repayment Online - Help on a low income Working and child tax credits Tax credits appeals Paying back a working or child tax credits overpayment This advice applies to England See advice for Northern Ireland Scotland Wales If you have a tax credits overpayment you must pay back you should deal with it as soon as possible