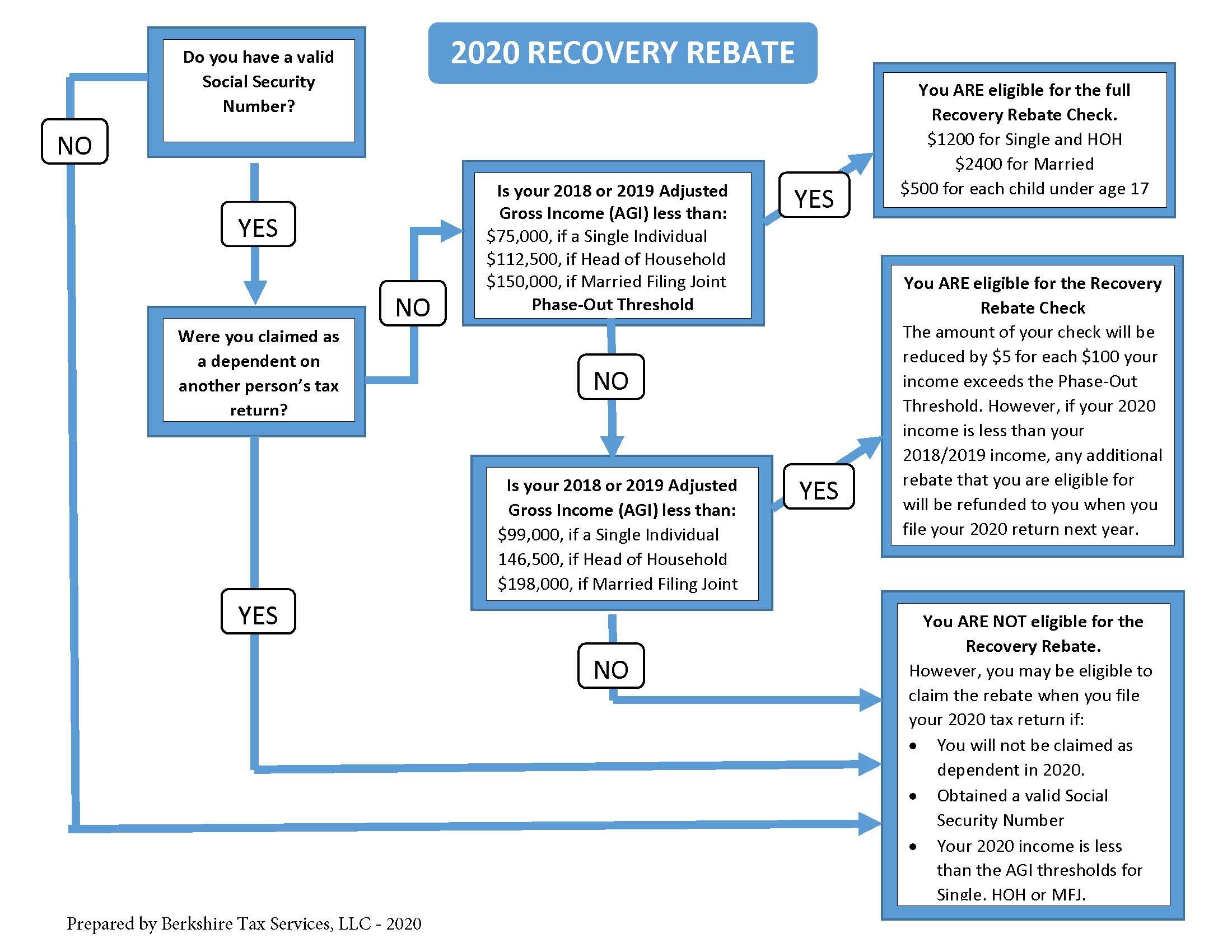

Can You Claim The Recovery Rebate Credit For A Deceased Person Also individuals who died prior to January 1 2020 are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return See IRS gov rrc or the Recovery Rebate Credit Worksheet available in the 2020 Form 1040 and Form 1040 SR instructions for more information

If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund In some cases yes If you re preparing a return for a deceased relative some individuals who passed away in 2020 or 2021 may qualify for the Recovery Rebate Credit if they didn t

Can You Claim The Recovery Rebate Credit For A Deceased Person

Can You Claim The Recovery Rebate Credit For A Deceased Person

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/le-cdn.hibuwebsites.com/6795e9d01eed4352a64d15f170ad49ae/dms3rep/multi/opt/Recovery+Rebate2020-1920w.jpeg

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

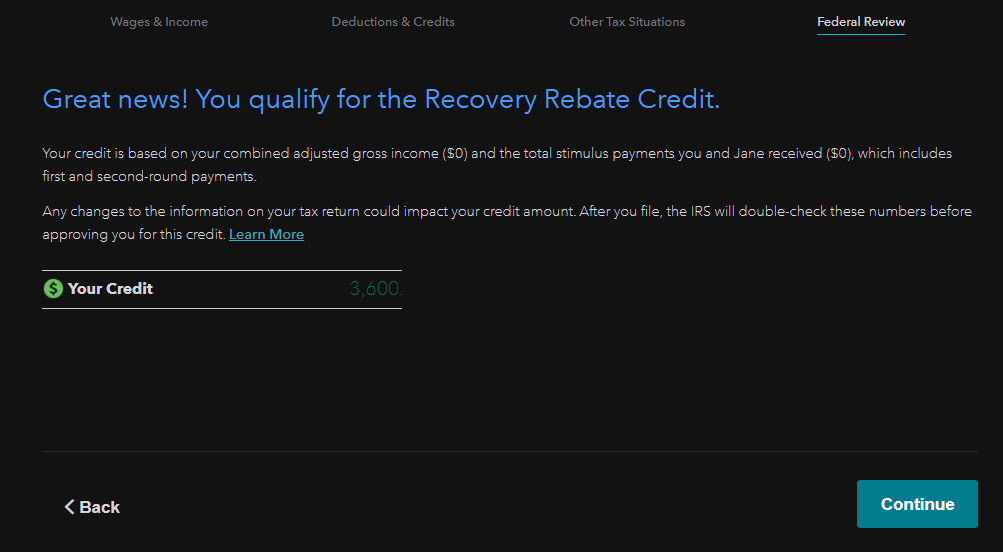

Your max tax refund is guaranteed Start Your Return Some people never received or didn t get their full stimulus payment amount in 2021 If this applies to you or if you gained any dependents in 2021 you might be able to claim the 2021 Recovery Rebate Credit even if you don t usually file taxes Sound familiar Luckily we can help close the stimulus gap You can rely on H R Block s expertise to help you claim any additional stimulus money you re due through a recovery rebate credit Don t leave money on the table File your taxes to claim any stimulus money you may have missed

Can heirs keep a Coronavirus Recovery Rebate that the Internal Revenue Service sent to a dead person If the decedent passed away this year the answer is yes If the tax filer died in 2018 or 2019 the answer is maybe maybe not Credits COVID 19 Advocacy Tax Relief Editor Valrie Chambers CPA Ph D Individuals who were eligible for an economic impact payment but did not receive one or were eligible for a larger payment than they received may be able to claim a recovery rebate credit when they file their income tax return for 2020

Download Can You Claim The Recovery Rebate Credit For A Deceased Person

More picture related to Can You Claim The Recovery Rebate Credit For A Deceased Person

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

How To Claim Stimulus Recovery Rebate Credit On TurboTax

https://www.irsofficesearch.org/wp-content/uploads/2021/02/recovery-rebate-credit.png

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

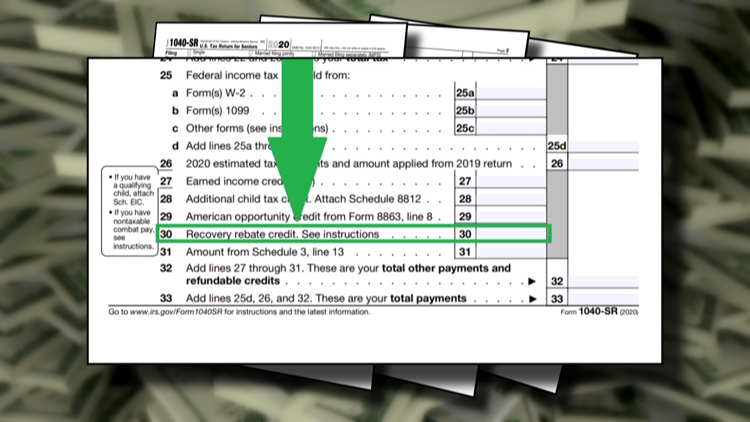

The Recovery Rebate Credit Worksheet calculates the credit amount based on filing status and income so in every case I have had an additional 600 credit calculate for the deceased spouse This doesn t seem correct especially since IRS only issued 600 by way of the second payment Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return

2021 Recovery Rebate Credit 2021 Economic Impact Payments 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors If you are eligible and did not receive either or both EIPs you now must claim them as the RRC on the 2020 Form 1040 Individual Income Tax or Form 1040 SR U S Tax Return for Seniors

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

https://media.cbs19.tv/assets/KYTX/images/81fe327c-4658-46bc-9bdb-03dd087512de/81fe327c-4658-46bc-9bdb-03dd087512de_1920x1080.jpg

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

https://www.irs.gov/newsroom/2020-recovery-rebate...

Also individuals who died prior to January 1 2020 are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return See IRS gov rrc or the Recovery Rebate Credit Worksheet available in the 2020 Form 1040 and Form 1040 SR instructions for more information

https://www.irs.gov/newsroom/2021-recovery-rebate...

If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund

2020 Recovery Rebate Berkshire Tax Services LLC

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Recovery Rebate Credit 2023

How To Calculate Recovery Rebate Credit 2022 Rebate2022 Recovery Rebate

TAS Tax Tip How Do I Find Out My Economic Impact Payment Amount s To

TAS Tax Tip How Do I Find Out My Economic Impact Payment Amount s To

2020 Recovery Rebate Credits Bayshore CPA s P A

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

2021 Recovery Rebate Credit DC Accounting

Can You Claim The Recovery Rebate Credit For A Deceased Person - OVERVIEW Many Americans may be eligible for the Recovery Rebate Credit commonly referred to as the COVID stimulus payment The credit is for the 2020 tax year even though the last payments came in 2021 for many recipients TABLE OF CONTENTS What is the 2020 Recovery Rebate Credit Who is eligible for the 2020