Can You Claim Travel Allowance If The Vehicle Is Not On Your Name Web Vor 6 Tagen nbsp 0183 32 If your travel costs exceed the maximum amount for the commuting allowance of 4 500 you can claim your travel costs as business expenses even if

Web 9 Juli 2014 nbsp 0183 32 You can claim the deduction even though the car does not belong to you The point of the deduction is to show that the business travel is not taxable and Web 11 Juli 2019 nbsp 0183 32 However in certain circumstances employees who receive travel allowances can find themselves travelling with a vehicle that is not self owned for

Can You Claim Travel Allowance If The Vehicle Is Not On Your Name

Can You Claim Travel Allowance If The Vehicle Is Not On Your Name

https://businessbroadcaster.com.au/wp-content/uploads/2023/03/can-you-claim-travel-as-deduction-for-your-business-shorts-oxwRwn-iA3E-788x443.jpg

When Your Cars Vans Are Not Taxed Or Insured The Police Have The

https://i.pinimg.com/originals/00/51/2d/00512d64bfa894018a9d6e12dd0b7784.jpg

Car Allowance Letter Format Unpaid Nysc Allowance NYSC Nigeria

https://cdn.slidesharecdn.com/ss_thumbnails/allowances-polvehiclemaintenance-170507065120-thumbnail-4.jpg?cb=1494139954

Web You cannot claim for non business driving or travel costs fines travel between home and work You may be able to calculate your car van or motorcycle expenses using a flat Web 30 Nov 2021 nbsp 0183 32 The vehicle is usually owned by the recipient of the travel allowance but this is not a requirement In some instances recipients use a vehicle belonging to a

Web 9 Nov 2023 nbsp 0183 32 You can claim the cost of buying a van as an allowable business expense if you re self employed This will deduct some of the costs of your taxable profit but how Web 27 Nov 2023 nbsp 0183 32 HMRC s new published position HMRC have published an article that sets out initial guidance for employers and employees on reclaiming relevant NIC further

Download Can You Claim Travel Allowance If The Vehicle Is Not On Your Name

More picture related to Can You Claim Travel Allowance If The Vehicle Is Not On Your Name

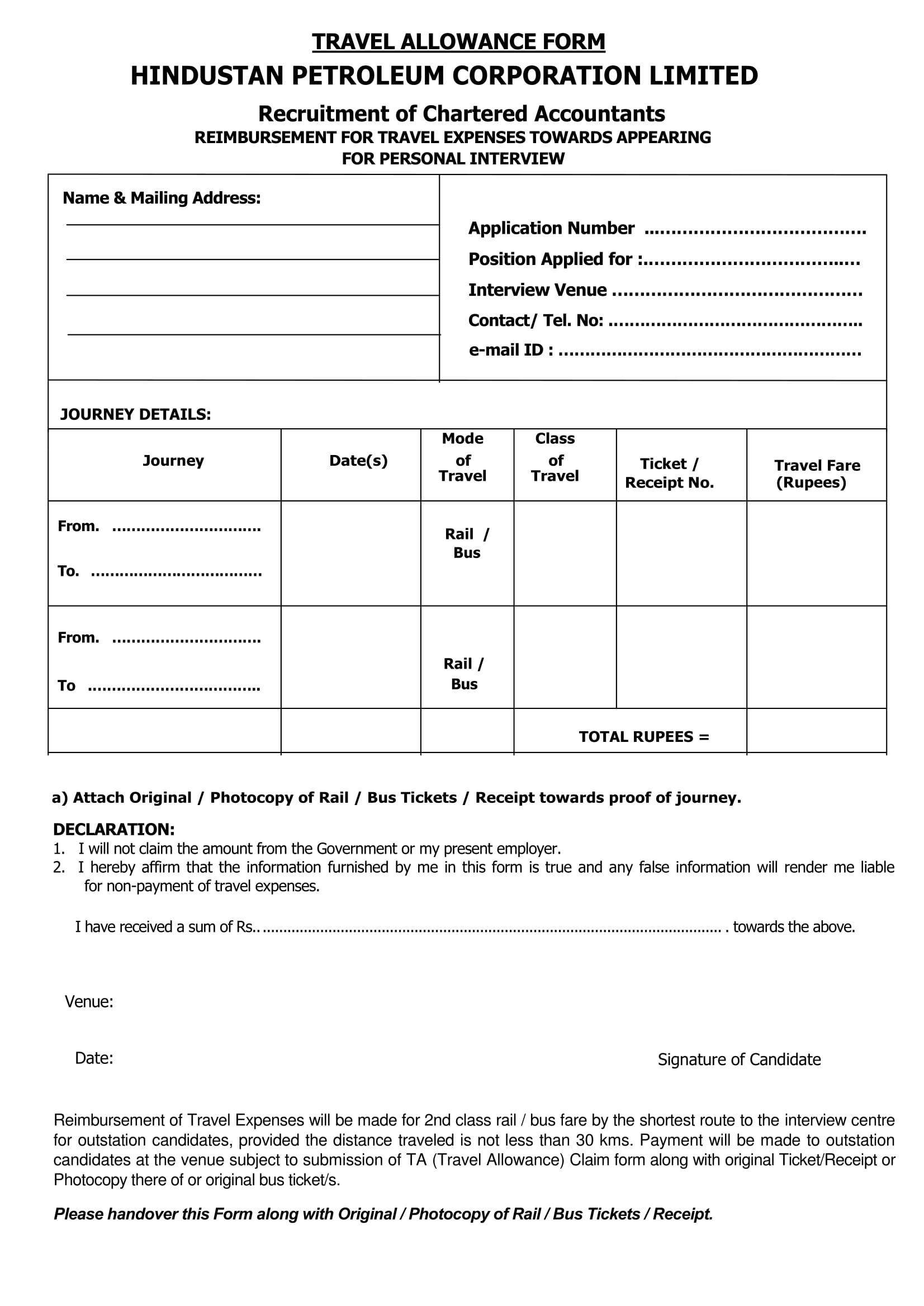

2023 Travelling Allowance Form Fillable Printable Pdf And Forms Porn

https://images.sampleforms.com/wp-content/uploads/2017/06/Travel-Allowance-Form-1.jpg

Conveyance Form

https://cdn.slidesharecdn.com/ss_thumbnails/conveyanceform-130421034918-phpapp02-thumbnail-4.jpg?cb=1366516199

How To Transfer Stata License Elsenturin

http://www.sampleletter1.com/wp-content/uploads/2015/06/LETTER-OF-AUTHORIZATION-TO-DRIVE-CAR.jpg

Web 23 Jan 2023 nbsp 0183 32 A reimbursive travel allowance that is deemed to be expended on business travelling that is one that complies with both criteria mentioned above is a non Web Vor 2 Tagen nbsp 0183 32 If you use a vehicle as part of your business you can claim tax relief for expenses such as petrol insurance and repairs Mileage allowance As a self employed

Web 25 Apr 2023 nbsp 0183 32 If you do this you will not pay any income tax on your travel allowance However if you spent more than your travel allowance on deductible travel allowance Web The following actual expenses can be claimed Fuel and oil Maintenance and repairs Insurance and license fees Wear and tear or Lease Payment Finance Charges

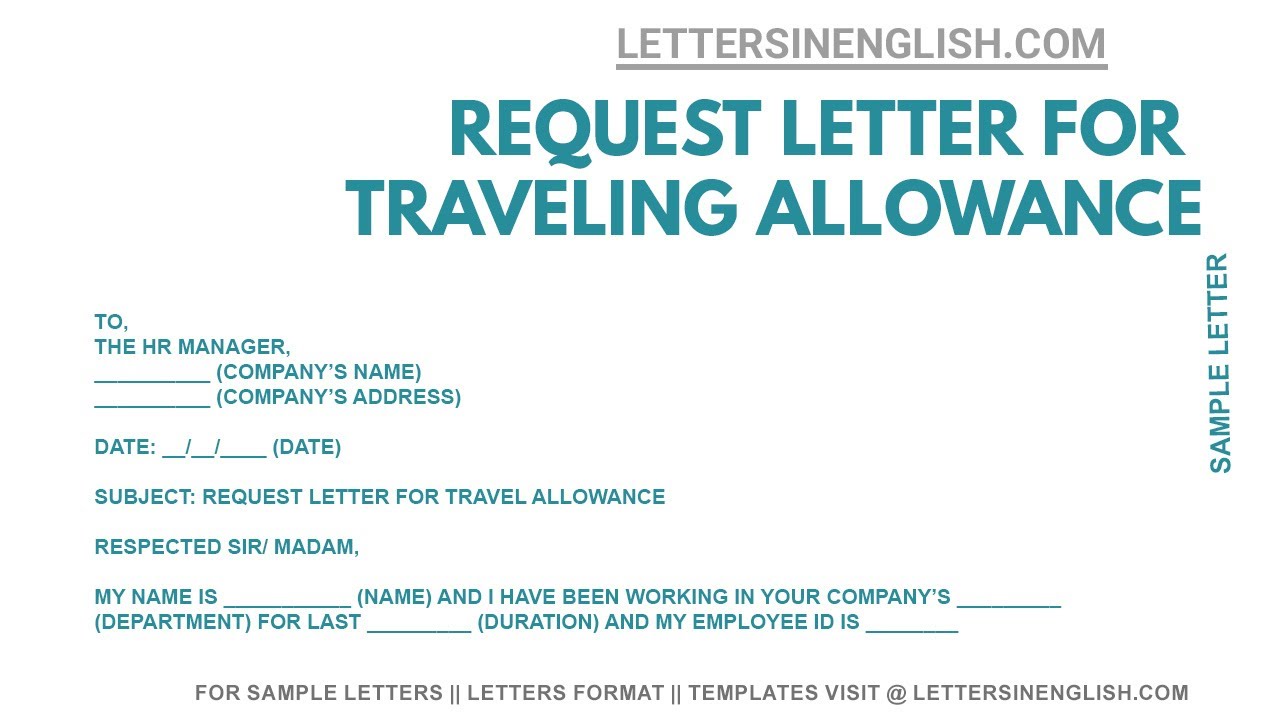

How To Write Request Letter For Travelling Allowance Letters In

https://i.ytimg.com/vi/__or-urd6Og/maxresdefault.jpg

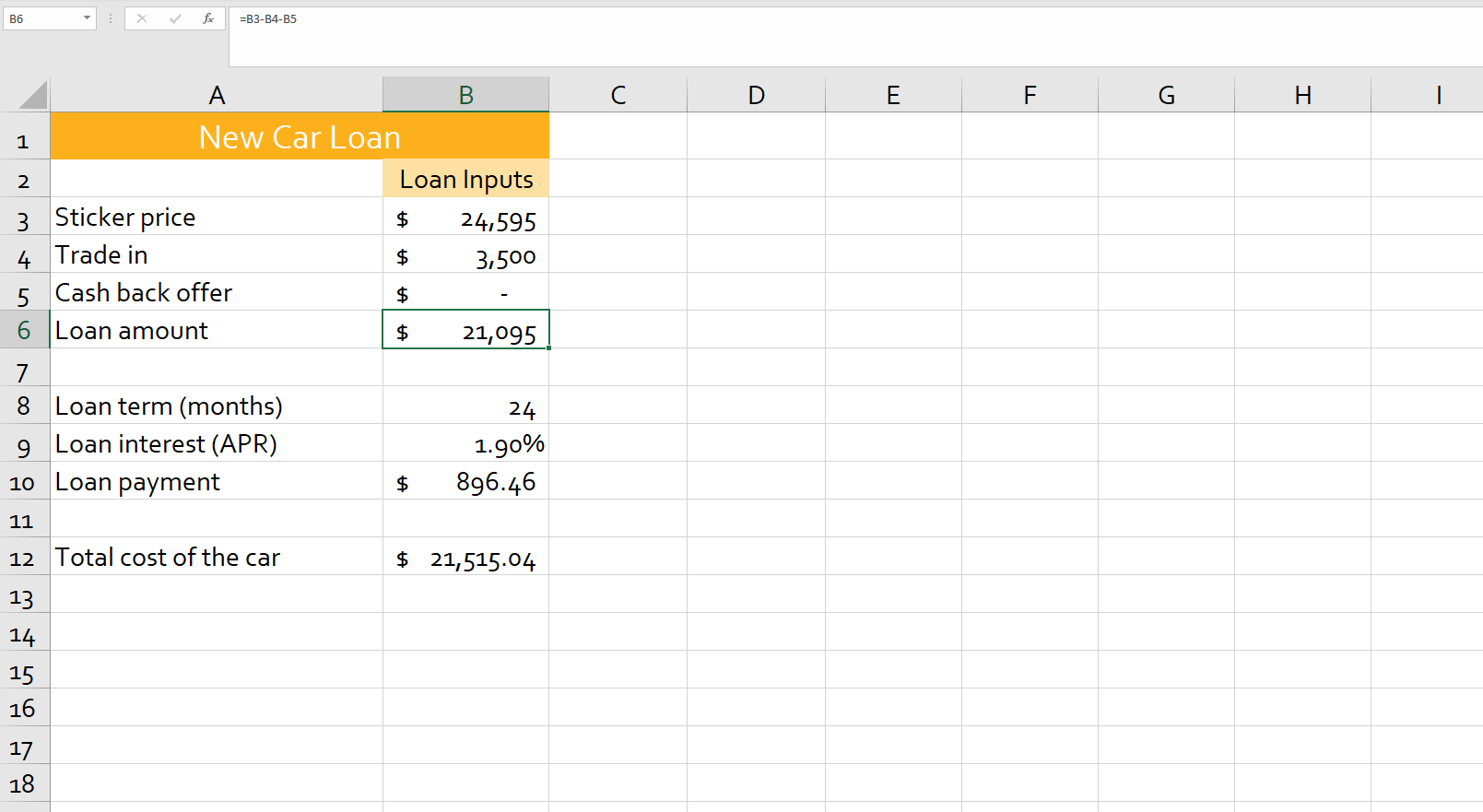

Solved 1 You Want To Purchase A New Car Your Current Car Chegg

https://media.cheggcdn.com/media/5db/5db712ed-e476-40e0-9a10-9d76e50995f6/phpyOG6tp

https://www.accountable.de/en/blog/travel-expenses-self-employed...

Web Vor 6 Tagen nbsp 0183 32 If your travel costs exceed the maximum amount for the commuting allowance of 4 500 you can claim your travel costs as business expenses even if

https://www.taxtim.com/za/answers/can-i-claim-travel-allowance-on-a...

Web 9 Juli 2014 nbsp 0183 32 You can claim the deduction even though the car does not belong to you The point of the deduction is to show that the business travel is not taxable and

Printable Form For Taking Over Payments On Recreational Vehicle

How To Write Request Letter For Travelling Allowance Letters In

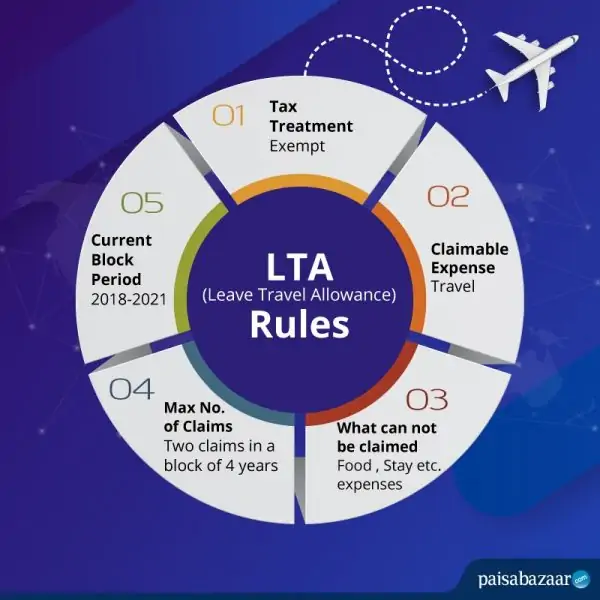

Leave Travel Allowance LTA Claim Rule Eligibility Tax Exemptions

How Can I Edit Inactivate Or Delete Vehicle Details School Software

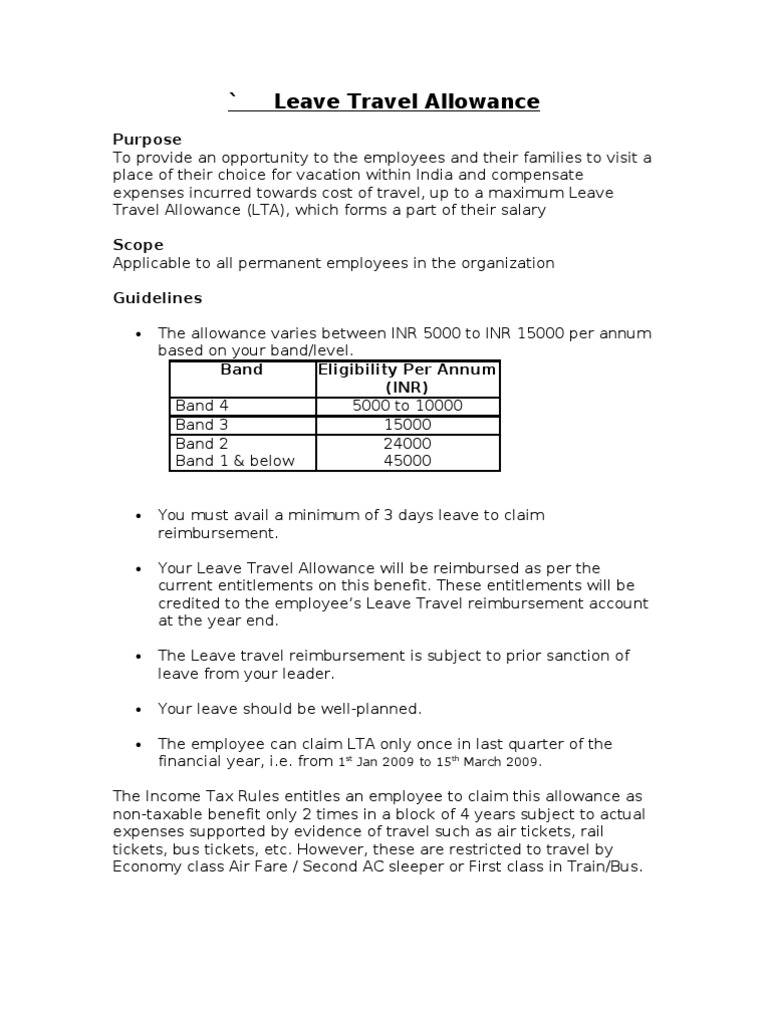

Leave Travel Allowance Employee Benefits Employment

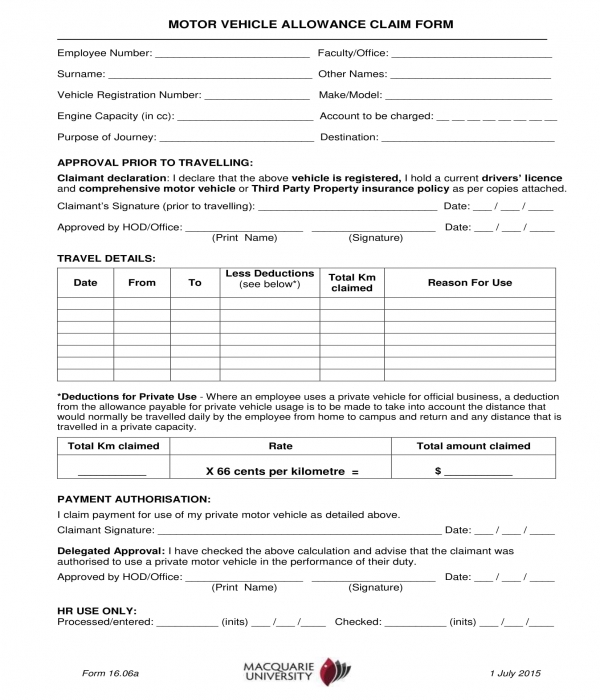

FREE 32 Allowance Forms In PDF MS Word Excel

FREE 32 Allowance Forms In PDF MS Word Excel

7th CPC Children Education Allowance Form Download Here Govtempdiary

Work Related Travel Expenses You Can Claim SMB Accounting

Vehicle Safety Within Last Mile Delivery ROUTD

Can You Claim Travel Allowance If The Vehicle Is Not On Your Name - Web You cannot claim for non business driving or travel costs fines travel between home and work You may be able to calculate your car van or motorcycle expenses using a flat